by Calculated Risk on 4/02/2009 12:40:00 AM

Thursday, April 02, 2009

LA Times on Jim the Realtor

From Peter Hong at the LA Times: The Hunter S. Thompson of real estate

Real estate salesman Jim Klinge ... has become a notorious Internet chronicler of the real estate crash in north San Diego County, where he has lived and worked for decades.Here is one of my favorites - Jim the Realtor showcases an investment opportunity in San Diego - enjoy!

Rather than downplay the greed and excess that caused the region's travails, he revels in exposing them.

He surveys the wreckage with a pocket video camera, shooting footage of vacant, once-pricey houses turned into eyesores, voiced over with his deadpan narration. Then he posts them on his website, at www.bubbleinfo.com.

They're shaky, noisy clips full of coarse images and language.

More from the LA Times:

In one clip, the camera pans across the kitchen of a million-dollar fixer near Interstate 5. He pointedly notes the house's proximity to the freeway, which he calls the "De-troit river." There's mold under the sink and a foot-sized hole in the drywall just above the floor.I really enjoy Jim's videos ... Here is a compilation video Jim posted today:

"December 2006 this house sold for a million dollars," he says. "Nineteen hundred square feet, built in '78, right across the freeway. One million."

...

His wife, Donna, who helps manage the family brokerage, was nervous. "He was really pushing the envelope with the blog, taking people on, naming names," she said. "I took deep breaths. I didn't know how it would turn out."

She said she was shocked one day to see a photo on the blog of two young men sitting on the floor of a house with their wrists bound like prisoners. They had been squatting in a foreclosed house Jim was selling, and he had sneaked up on them as they slept and tied them up with plastic zip ties in a brazen citizen’s arrest.

Wednesday, April 01, 2009

NPR: Anatomy Of A Bank Takeover

by Calculated Risk on 4/01/2009 10:59:00 PM

From NPR (with Chicago Public Radio: This American Life), here is a story about the FDIC takeover of Bank of Clark County: Anatomy Of A Bank Takeover (ht Ted)

Here is the audio from NPR.

Here is the FDIC announcement from January: Umpqua Bank Acquires the Insured Deposits of Bank of Clark County, Vancouver, WA

| At least they get free ice cream! Click on photo for larger image in new window. Photo Credit: Otishertz, January 2009 |

Auto Sales: Ray of Sunshine?

by Calculated Risk on 4/01/2009 08:25:00 PM

In Looking for the Sun, I suggested there might be three areas to look for "rays of sunshine in a very dark season": housing starts, new home sales, and auto sales.

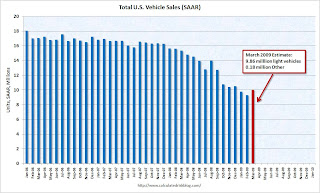

Just like for housing starts and new home sales, it is way too early to call a bottom for auto sales - but it does look like vehicle sales increased in March on a seasonally adjusted annual rate (SAAR) basis. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical vehicle sales from the BEA (blue) and an estimate for March (light vehicle sales of 9.86 million SAAR from AutoData Corp).

Note: this graph includes a small number of heavy vehicle sales to compare to the BEA.

From the WSJ: Auto Makers See a Ray of Hope

The annualized sales pace ... came in at 9.86 million vehicles, well below the 16 million or more the industry typically logged a few years ago, but up from February's pace of 9.12 million.Even if this is the bottom for auto sales (way too early to call), the pickup will probably be very sluggish - especially considering the grim unemployment news and continuing financial crisis.

"I believe we are in a bottoming process for the industry," Bob Carter, a group vice president at Toyota Motor Corp., said in a conference call. ...

Michael DiGiovanni, the top sales analyst at General Motors Corp., said he expects a "very, very gradual pickup" in vehicle sales in the second quarter. He cited "the first signs of brightening" in the market. ...

Moody's Warns of Worst Corporate Default Rate since WWII

by Calculated Risk on 4/01/2009 06:09:00 PM

From Reuters: Moody's downgraded $1.76 trln U.S. corp debt in Q1

... Moody's Investors Service downgrading an estimated $1.76 trillion of debt, a record high ...Hopefully the bank stress tests have all these defaults factored in ...

The downgrades included a record number to the lowest rating categories, signaling the approach of the worst defaults since at least World War Two ...

"The most prominent new driving force behind credit rating reductions would be deterioration of commercial real estate," [Moody's chief economist John Lonski] said. ...

Moody's has forecast that the U.S. default rate will peak around 14.5 percent in November.

emphasis added

Moody's: Record High Credit Card Charge-Offs

by Calculated Risk on 4/01/2009 05:57:00 PM

From Reuters: Credit card charge-offs hit record high -Moody's (ht Brad)

Credit card write-downs soared to record levels in February, representing an all-time high in the 20-year history of the Moody's Credit Card Index ....Moody's reported the charge-off rate at 5.59% in February 2008, and 4.51% in February 2007.

Credit card charge-offs, the write-down of uncollectable debt, advanced decisively to 8.82 percent in February, marking the sixth consecutive month of increases. The level, is more than 300 basis points higher than a year ago.

...

[Moody's] predicts the charge-off rate index will peak at about 10.5 percent in the first half of 2010, assuming a coincident unemployment rate peak at 10 percent.

Case Shiller House Prices Seasonal Pattern

by Calculated Risk on 4/01/2009 04:04:00 PM

First, the market graph from Doug ... Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

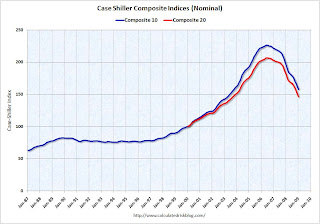

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. This graph shows the seasonal pattern for the Case-Shiller Composite 10 house price index.

This graph shows the seasonal pattern for the Case-Shiller Composite 10 house price index.

The percentage change is the month-to-month change annualized.

It is important to remember this clear seasonal pattern when looking at the Case-Shiller data.

Wile E. Coyote Indicator

by Calculated Risk on 4/01/2009 03:03:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Posted with permission.

Credit: Buzz Potamkin in Animation World Magazine

See: The Macro Economy's Impact on Animation: Will Wile E. Coyote Dodge the Anvil?

"Economists and commentators are increasingly citing Wile E. Coyote to explain the macro economy, with Nobel-laureate Paul Krugman first hoisting the anvil in 2007. Cartoon image courtesy of Warner Bros. Animation. Graphs courtesy of Project X."

Ford U.S. March sales fall 40.9%

by Calculated Risk on 4/01/2009 12:04:00 PM

Update2: Toyota sales off 36.6%. GM Sales off 47%. Chrysler off 39%. From MarketWatch:

Chrysler LLC on Wednesday reported a 39% drop in March U.S. sales to 101,001 cars and trucks from 166,386 a year earlier.Update: from MarketWatch: Ford U.S. March sales drop 40.9%

Ford Motor Co. said Wednesday that U.S. March sales fell 40.9% ... At the end of March, Ford said that Ford, Lincoln and Mercury inventories totaled 408,000 units, about 27% lower than a year ago.This is reported as Year-over-year (March 2009 vs. March 2008)

Last month (February) Ford sales were off 46.3% YoY

And in January Ford sales were off 42.1%

December: 32.4%

November: 31%

Ford's numbers will probably be better than GM or Chrysler!

Thornburg Mortgage to file BK

by Calculated Risk on 4/01/2009 11:50:00 AM

From Bloomberg: Thornburg Mortgage to File for Bankruptcy, Liquidate

Thornburg Mortgage Inc., the “jumbo” residential loan specialist battling a slump in home sales and the collapse of mortgage markets, plans to file for bankruptcy protection and shut down.Thornburg specialized in prime Jumbos.

...

Thornburg specialized in mortgages of more than $417,000, typically used to buy more expensive homes.

It was an early report of Thornburg's problems that prompted Tanta to famously exclaim: "We're all subprime now!"

Construction Spending Declines in February

by Calculated Risk on 4/01/2009 10:00:00 AM

Residential construction spending is 59.3% below the peak of early 2006.

Non-residential construction spending is 8.5% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is now slightly negative on a year-over-year basis, and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

These are two key stories for 2009: the collapse in private non-residential construction, and the probably bottom for residential construction spending.

From the Census Bureau: February 2009 Construction at $967.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $665.9 billion, 1.6 percent (±1.1%) below the revised January estimate of $676.9 billion. Residential construction was at a seasonally adjusted annual rate of $275.1 billion in February, 4.3 percent (±1.3%) below the revised January estimate of $287.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $390.7 billion in February, 0.3 percent (±1.1%)* above the revised January estimate of $389.5 billion.

Pending Home Sales Index

by Calculated Risk on 4/01/2009 09:59:00 AM

From the NAR: Gain Seen In Pending Home Sales, Housing Affordability Sets New Record

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in February, rose 2.1 percent to 82.1 from a reading of 80.4 in January, but is 1.4 percent below February 2008 when it was 83.3.This suggests a possible slight increase in existing home sales from March to April (February was the most recent report).

Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the February report suggests existing home sales will increase slightly from March to April.

Note: Ignore all the affordability nonsense. That just tells you interest rates are low.

ADP: Private Sector Loses 742,000 Jobs

by Calculated Risk on 4/01/2009 09:06:00 AM

I don't have much confidence in the ADP report in predicting the BLS employment number, but this is pretty ugly ...

From ADP:

Nonfarm private employment decreased 742,000 from February to March 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®.

...

March’s ADP Report estimates nonfarm private employment in the service-providing sector fell by 415,000. Employment in the goods-producing sector declined 327,000, the twenty-seventh consecutive monthly decline. Employment in the manufacturing sector declined 206,000, its thirty-seventh consecutive decline.

...

In March, construction employment dropped 118,000. This was its twenty-sixth consecutive monthly decline, and brings the total decline in construction jobs since the peak in January 2007 to 1,135,000.

Tuesday, March 31, 2009

Evening Summary and Open Thread

by Calculated Risk on 3/31/2009 10:59:00 PM

Here is an open thread for discussion.

Case-Shiller reported house prices fell sharply in January.

The Philly Fed State indexes showed all 50 states in recession (check out the map!).

The Restaurant Performance Index showed continued contraction.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

Report: Obama believes automaker BK appears inevitable

by Calculated Risk on 3/31/2009 09:06:00 PM

Update from Reuters: Obama thinking on GM, Chrysler unchanged -official

"Nothing has changed on this," the official said when asked about a Bloomberg report that the president has determined that a prepackaged bankruptcy is the best way for GM to restructure and become competitive. "This report is not accurate."From Bloomberg: Obama Said to Conclude Bankruptcy Best Option for GM, Chrysler

President Barack Obama has determined that a prepackaged bankruptcy is the best way for General Motors Corp. to restructure ...This seems like the end for Chrysler. Hopefully GM will emerge as an efficient and competitive (and smaller) automaker.

Obama also is prepared to let Chrysler LLC go bankrupt ...

“quick and surgical” bankruptcy ... appears to be inevitable ...

Comparison: OECD and "More Adverse" Scenarios

by Calculated Risk on 3/31/2009 06:50:00 PM

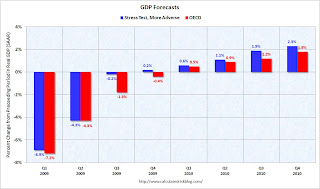

The Organisation for Economic Co-operation and Development (OECD) released an Interim Economic Outlook today. I thought it would be interesting to compare their forecast with the "more adverse" scenario from the Stress Test.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph compares the quarterly OECD U.S. GDP forecast with the quarterly stress test scenario (more adverse).

Clearly the OECD is more pessimistic than the more severe stress test scenario for the U.S. banks. The second graph compares the OECD unemployment rate forecast with the more severe scenario.

The second graph compares the OECD unemployment rate forecast with the more severe scenario.

Once again, the OECD is slightly more pessimistic.

Earlier I compared both the baseline stress test scenario and the more adverse scenario with forecasts from Northern Trust and Goldman Sachs. At this point I think we can just ignore the old baseline scenario.

The "more adverse" scenario is the new baseline.

Market and Misc

by Calculated Risk on 3/31/2009 04:16:00 PM

First, the graph from Doug ... Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And a few misc notes ...

Almost a 'Half Off' sale (the auction has closed): Hancock Tower sells for $660m at auction

The John Hancock Tower was sold today for $660.6 million at a foreclosure auction in New York City. ... the Hancock's previous owner, Broadway Partners of New York, defaulted on some of the loans it used to buy property for $1.3 billion in late 2006.More Vegas disaster: Riviera misses interest payment, warns of possible bankruptcy (ht Howard)

"The deteriorating trends in revenue and earnings experienced during the first three quarters of 2008 continued as evidenced by our fourth quarter results and accelerated during the first quarter of 2009. We expect this situation to continue as long as competitors in the Las Vegas market follow a strategy of sacrificing ADR (average daily room rate) to maximize room occupancy and the decline in convention business is unabated."Yeah, blame your competitors for cutting prices!

And from an analyst on Case-Shiller and housing:

The acceleration in the rate of decline in the US Case-Shiller 20-city house price index is a bit disappointing given that other evidence suggested conditions in the housing market may have stabilised since the turn of the year. The annual growth rate fell from 18.6% in December to a new record low of 19.0% in January. Although the monthly data need to be treated with a great deal of caution (this series is not seasonally adjusted) ...I forgot to mention CS is not seasonally adjusted (an important point), but I think the first sentence is incorrect. There will probably be two bottoms for housing - the first for single family starts and new home sales, and the 2nd - later, perhaps much later - for existing home prices. The Case-Shiller price declines are not "disappointing" with regards to the other data. Even if starts bottom sometime this year, I expect house prices to continue to fall. See More on Housing Bottoms.

Tiered House Price Indices

by Calculated Risk on 3/31/2009 02:52:00 PM

The following graph is based on the Case-Shiller Tiered Price Indices for San Francisco. Case-Shiller has data for all 20 cities in the Composite 20 index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that prices increased faster for lower priced homes than higher priced homes. And prices have also fallen faster too.

It now appears mid-to-high priced homes are overpriced compared to lower priced homes - although prices will probably continue to fall for all three tiers.

Distressed properties - foreclosures and short sales - have dominated sales in the lower priced areas. This has pushed the prices down quicker than in the higher priced areas.

As an example, DataQuick reported this month:

[F]oreclosure resales last month ranged from 12.1 percent of resales in San Francisco to 69.5 percent in Solano County.With so many foreclosures, prices have fallen quicker in Solano County than in San Francisco.

But over time, prices will probably equilibrate between the low and high priced areas. It will take longer for prices to fall in San Francisco, and I expect the lower priced areas to bottom (especially in real terms) before the higher priced areas.

March Economic Summary in Graphs

by Calculated Risk on 3/31/2009 01:30:00 PM

Here is a collection of 20 real estate and economic graphs for data released in March ...

New Home Sales in February

New Home Sales in FebruaryThe first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2009. This is the lowest sales for February since the Census Bureau started tracking sales in 1963. (NSA, 27 thousand new homes were sold in February 2009; the previous low was 29 thousand in February 1982).

From: New Home Sales: Just above Record Low

Housing Starts in February

Housing Starts in FebruaryTotal housing starts were at 583 thousand (SAAR) in February, well off the record low of 477 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 357 thousand in February; just above the record low in January (353 thousand).

Permits for single-family units increased in February to 373 thousand, suggesting single-family starts could increase in March.

From: Housing Starts Rebound

Construction Spending in January

Construction Spending in JanuaryThis graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years.

From: Construction Spending: Non-Residential Cliff Diving

February Employment Report

February Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 651,000 in February. The economy has lost almost 2.6 million jobs over the last 4 months!

The unemployment rate rose to 8.1 percent; the highest level since June 1983.

From: Employment Report: 651K Jobs Lost, 8.1% Unemployment Rate

February Retail Sales

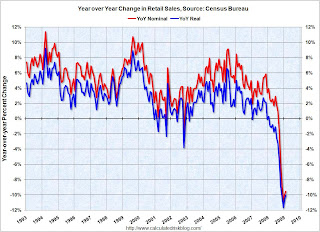

February Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

On a monthly basis, retail sales decreased slightly from January to February (seasonally adjusted), but sales are off 9.5% from February 2008 (retail and food services decreased 8.6%). Automobile and parts sales decline sharply 4.3% in February (compared to January), but excluding autos, all other sales climbed 0.7%.

From: Retail Sales: Some Possible Stabilization

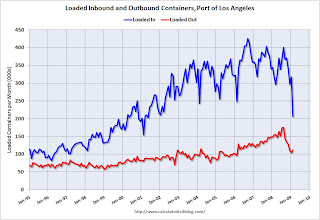

LA Port Traffic in February

LA Port Traffic in FebruaryThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 35% below last February and 35% below last month.

From: LA Port Import Traffic Collapses in February

U.S. Imports and Exports Through January

U.S. Imports and Exports Through JanuaryThis graph shows the monthly U.S. exports and imports in dollars through January 2009. The recent rapid decline in foreign trade continued in January. Note that a large portion of the decline in imports is related to the fall in oil prices - but not all.

The graph includes both goods and services. The import and export of services has held up pretty well; most of the collapse in trade has been in goods. Imports of goods has declined by one third from the peak of last July!

From: U.S. Trade: Exports and Imports Decline Sharply in January

February Capacity Utilization

February Capacity UtilizationThe Federal Reserve reported that industrial production fell 1.4% in February, and output in February was 11.2% below February 2008. The capacity utilization rate for total industry fell to 70.9%, matching the historical low set in December 1982.

This is a very sharp decline in industrial output.

From: Industrial Production and Capacity Utilization: Cliff Diving

NAHB Builder Confidence Index in March

NAHB Builder Confidence Index in MarchThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was flat at 9 in March (same as February). The record low was 8 set in January.

This is the fifth month in a row at either 8 or 9.

From: NAHB Housing Market Index Still Near Record Low

Architecture Billings Index for February

Architecture Billings Index for February"Following another historic low score in January, the Architecture Billings Index (ABI) was up two points in February. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI rating was 35.3, up from the 33.3 mark in January, but still pointing to a general lack of demand for design services (any score above 50 indicates an increase in billings)."

From: Architecture Billings Index Near Record Low

Vehicle Miles driven in January

Vehicle Miles driven in JanuaryBy this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis.

As the DOT noted, miles driven in January 2009 were 3.1% less than January 2008.

From: DOT: U.S. Vehicle Miles Off 3.1% in January

Existing Home Sales in February

Existing Home Sales in February This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2009 (4.72 million SAAR) were 5.1% higher than last month, and were 4.6% lower than January 2008 (4.95 million SAAR).

It's important to note that about 45% of these sales were foreclosure resales or short sales. Although these are real transactions, this means activity (ex-distressed sales) is under 3 million units SAAR.

From: Existing Home Sales Increase Slightly in February

Existing Home Inventory February

Existing Home Inventory FebruaryThis graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 3.8 million in February. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Usually most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs - this is possible, but not confirmed.

From: Existing Home Sales Increase Slightly in February

Case Shiller House Prices for January

Case Shiller House Prices for JanuaryThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.2% from the peak, and off 2.5% in January.

The Composite 20 index is off 29.1% from the peak, and off 2.8% in January.

From: Case-Shiller: Prices Fall Sharply in January

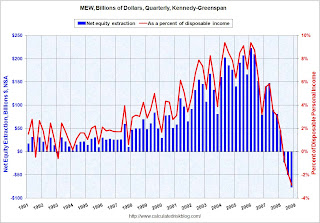

Mortgage Equity Extraction for Q4

Mortgage Equity Extraction for Q4Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

For Q4 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $77 billion, or negative 2.9% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

From: Q4 Mortgage Equity Extraction Strongly Negative

Unemployment Claims

Unemployment ClaimsThe first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 649,000.

Continued claims are now at 5.56 million - the all time record.

From: Unemployment Insurance: Continued Claims Over 5.5 Million

Restaurant Performance Index for February

Restaurant Performance Index for February"Restaurant industry performance remained soft in February, as the National Restaurant Association’s comprehensive index of restaurant activity stood below 100 for the 16th consecutive month. The Association’s Restaurant Performance Index (RPI) ... stood at 97.5 in February, up 0.1 percent from its January level."

From: Restaurant Peformance Index: 16th Consecutive Month of Contraction

New Home Sales: February

New Home Sales: FebruaryThis graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in February 2009 were at a seasonally adjusted annual rate of 337,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.From: New Home Sales: Just above Record Low

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

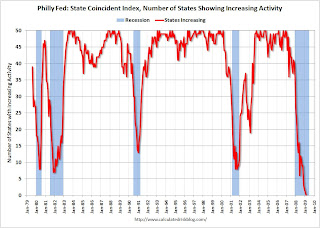

Philly Fed State Indexes February

Philly Fed State Indexes FebruaryHere is a map of the three month change in the Philly Fed state coincident indicators. All 50 states are showing declining activity.

This is the new definition of "Red states".

This is what a widespread recession looks like based on the Philly Fed states indexes.

From: Philly Fed State Indexes: We're all Red States now!

New Home Months of Supply: February

New Home Months of Supply: FebruaryThere were 12.2 months of supply in February - just below the all time record of 12.9 months of supply set in January.

The seasonally adjusted estimate of new houses for sale at the end of February was 330,000. This represents a supply of 12.2 months at the current sales rate.From: New Home Sales: Just above Record Low

Restaurant Peformance Index: 16th Consecutive Month of Contraction

by Calculated Risk on 3/31/2009 11:55:00 AM

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remains Uncertain as Restaurant Performance Index Stood Below 100 for 16th Consecutive Month

Restaurant industry performance remained soft in February, as the National Restaurant Association’s comprehensive index of restaurant activity stood below 100 for the 16th consecutive month. The Association’s Restaurant Performance Index (RPI) ... stood at 97.5 in February, up 0.1 percent from its January level.

“Although the index registered its second consecutive monthly gain, each of the RPI’s eight indicators stood below 100 in February, which signifies continued contraction,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “A majority of restaurant operators reported negative same-store sales and customer traffic levels in February, and their outlook for sales growth in the months ahead remains uncertain.”

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007.

Philly Fed State Indexes: We're all Red States now!

by Calculated Risk on 3/31/2009 11:00:00 AM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. All 50 states are showing declining activity.

This is the new definition of "Red states".

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in all 50 states in February. Here is the Philadelphia Fed state coincident index release for February.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2009. The indexes decreased in all 50 states both for the month and for the past three months (one-month and three-month diffusion indexes of -100).

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.All states showed declining activity. A widespread recession ...