by Calculated Risk on 3/17/2009 01:18:00 PM

Tuesday, March 17, 2009

DataQuick: SoCal Home Sales Up, Foreclosure Resales 56.4% of Market

Note: I ignore the median price data because it is skewed by the mix of homes sold. A repeat sales index like Case-Shiller is a better indicator of price changes.

From DataQuick: Southland home sales outpace last year again; median price steady

Southland home sales stayed above year-ago levels for the eighth consecutive month in February ... Market activity was dominated by bargain-hunting in affordable neighborhoods while buying and selling in more expensive established areas remained largely on hold ...Sales are up because of foreclosure resales in less expensive neighborhoods. Meanwhile, sales in "more expensive established areas" have slowed to a trickle. This build up in supply will eventually lead to more price declines in the expensive areas ...

A total of 15,231 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was essentially unchanged from 15,227 for January, and up 41.3 percent from 10,777 for February 2008, according to MDA DataQuick of San Diego.

...

Regionwide, foreclosure resales accounted for 56.4 percent of February’s resales activity, which was the same as the revised January figure and up from 36.2 percent in February 2008.

Credit Crisis Indicators

by Calculated Risk on 3/17/2009 10:58:00 AM

Here is a quick look at a few credit indicators:

First, the British Bankers' Association reported that the three-month dollar Libor rates were fixed at 1.30%, down from 1.31% on Monday. This has been a slight improvement over the last week. Click on table for larger image in new window.

Click on table for larger image in new window.

The first graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

There has been some increase in the spread the last few weeks, but the spread is still way below the recent peak. The spreads are still very high, even for higher rated paper, but especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

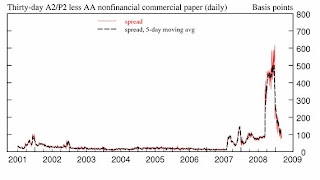

There has been improvement in the A2P2 spread. This has declined to 0.84. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

There has been improvement in the A2P2 spread. This has declined to 0.84. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread has decreased a little over the last week, and is now at 107.5. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.The recent surge in this index was a cause for alarm, but the index appears to have stabilized over the last week.

All of these indicators are still too high, but at least none of them are increasing this week.

Housing Starts Rebound

by Calculated Risk on 3/17/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 583 thousand (SAAR) in February, well off the record low of 477 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 357 thousand in February; just above the record low in January (353 thousand).

Permits for single-family units increased in February to 373 thousand, suggesting single-family starts could increase in March.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building permits increased slightly:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 547,000. This is 3.0 percent (±3.5%)* above the revised January rate of 531,000, but is 44.2 percent (±1.2%) below the revised February 2008 estimate of 981,000.On housing starts:

Single-family authorizations in February were at a rate of 373,000; this is 11.0 percent (±2.1%) above the January figure of 336,000.

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 583,000. This is 22.2 percent (±13.8%) above the revised January estimate of 477,000, but is 47.3 percent (±5.3%) below the revised February2008 rate of 1,107,000.And on completions:

Single-family housing starts in February were at a rate of 357,000; this is 1.1 percent (±11.0%)* above the January figure of 353,000.

Privately-owned housing completions in February were at a seasonally adjusted annual rate of 785,000. This is 2.3 percent (±14.8%)* above the revised January estimate of 767,000, but is 37.3 percent (±7.7%) below the revised February 2008 rate of 1,251,000.Note that single-family completions are still significantly higher than single-family starts. This is important because residential construction employment tends to follow completions, and completions will probably decline further.

Single-family housing completions in February were at a rate of 505,000; this is 8.2 percent (±11.8%)* below the January figure of 550,000.

One month does not make a trend - and the graph shows this is just a slight increase in total starts (and single family starts are basically flat with the record low). However I do expect housing starts to bottom sometime in 2009.

Monday, March 16, 2009

Obama Administration Hoping to Avoid Auto Bankruptcies

by Calculated Risk on 3/16/2009 09:58:00 PM

From the WSJ: Obama Seeks to Avoid Auto Bankruptcies

The leaders of President Barack Obama's auto task force are focused on restructuring General Motors Corp. and Chrysler LLC outside of bankruptcy court ...Meanwhile: Chrysler Presses Request for Loans. Just another $5 billion by the end of the month ...

...

"It sometimes becomes a necessary place for some companies, but it's certainly not a desired place and it is certainly not our goal to see these companies in bankruptcy, particularly considering the consumer-facing nature of their businesses," [Steven Rattner, a private-equity executive leading the team] said in an interview.

...

By the end of the month, the government plans to lay out its view on the companies' viability and what the industry should look like in future years, Mr. Rattner said.

Credit Card Defaults at 20 Year-High

by Calculated Risk on 3/16/2009 07:56:00 PM

From Reuters: U.S. credit card defaults rise to 20 year-high

U.S. credit card defaults rose in February to their highest level in at least 20 years, with losses particularly severe at American Express ... and Citigroup ...The Treasury and Federal Reserve haven't publicly released the indicative loss rates for various asset classes associated with the two stress test economic scenarios (baseline and more adverse), but these numbers are probably approaching the "more adverse" scenario range for credit cards.

AmEx ... said its net charge-off rate ... rose to 8.70 percent in February from 8.30 percent in January.

... Citigroup Inc (C.N) ... default rate soared to 9.33 percent in February, from 6.95 percent a month earlier ...

...

Chase ... reported its charge-off rate rose to 6.35 percent in February from 5.94 percent in January. ...

Capital One Financial Corp's ... default rate increased to 8.06 percent in February from 7.82 percent in January.

...

Analysts estimate credit card chargeoffs could climb to between 9 and 10 percent this year from 6 to 7 percent at the end of 2008.

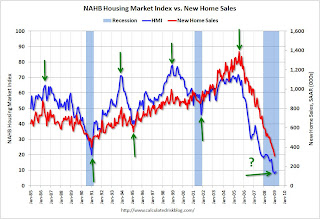

Comparing the NAHB Housing Market Index and New Home Sales

by Calculated Risk on 3/16/2009 06:06:00 PM

Here is a comparison of the National Association of Home Builders (NAHB) Housing Market Index and new home sales from the Census Bureau. Since new home sales are released with a lag, the NAHB index provides a possible leading indicator for sales.

Note: the NAHB index released this morning was for a March survey. New Home sales for February will be released on March 25th - so the NAHB is released almost 6 weeks ahead of the corresponding sales numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that major tops and bottoms (green arrows) for the two series line up pretty well (usually within 1 month). However both series are noisy month to month, and there are plenty of head fakes in between the significant peaks and troughs. Also the new home sales data is revised significantly (this graph uses revised data).

Just something to watch going forward ...

FASB to Propose Changes to Mark-to-Market

by Calculated Risk on 3/16/2009 03:46:00 PM

From Bloomberg: FASB Moves Toward Giving Banks More Flexibility on Fair-Value (ht Justin)

The Financial Accounting Standards Board, pressured by lawmakers to change the fair-value rule blamed for worsening the financial crisis, proposed permitting companies to use “significant judgment” in valuing assets.From the American Bankers Association: Breaking News: FASB to Propose Improvements to Mark-to-Market, OTTI

Companies would be able to apply the revised rule to their first-quarter financial statements, FASB Chairman Robert Herz said today during a meeting at the U.S. accounting rulemaker’s Norwalk, Connecticut, headquarters. The board is set to vote on the proposal April 2, after a 15-day public comment period. ...

Mark-to-Market. The proposal for estimating market values will take into consideration whether there is an active market (such as the number of recent transactions, whether price quotes are based on current information, whether price quotes vary substantially, etc.). If there is not an active market, then the quoted price is a distressed transaction unless certain other conditions exist. For distressed transaction prices, “Level 3” techniques (such as present values of future cash flows) are used instead of the distressed prices and should reflect an orderly transaction between market participants, including a reasonable profit margin for uncertainty in a non-distressed situation.

Other-Than-Temporary-Impairment. FASB will also propose that the full market loss continue to be reported through earnings (and capital) only if the entity intends to sell or will be required to sell the security prior to its recovery. For all other OTTI, the amount of market loss will be split between the credit portion of the loss, which will be reported in earnings, and the remainder of the loss, which will be reported in “other comprehensive income.”

Report: Mortgage Fraud Increased in 2008

by Calculated Risk on 3/16/2009 03:21:00 PM

Update: Housing Wire has more: Mortgage Fraud at All-Time High: Report

This report appears to deal with Fraud for Housing, and not Fraud for Profit (what most people think of as mortgage fraud).

From Dina ElBoghdady at the WaPo: Mortgage Fraud Rises Even as Loans Decline

Mortgage fraud rose last year even though fewer loans were issued nationwide ... Fraud jumped by 26 percent in 2008 from the previous year, the study concluded, based on data collected from roughly 70 percent of the nation's lenders as well as mortgage insurance companies and mortgage investors. The study was prepared by the Mortgage Asset Research Institute, an arm of LexisNexis, for the Mortgage Bankers Association.Historically there have been two types of mortgage fraud: fraud for housing, and fraud for profit. The MBA/MARI report focuses on fraud for housing (and that probably includes refinance fraud because borrowers are desperate).

...

"With fewer loan originations today, the data suggest that the economic downturn may have created more desperation, causing more people than ever before to try to commit mortgage fraud," said Denise James, one of the study's authors.

The most common type of fraud continues to be application misrepresentation, which includes falsifying a borrower's income. That kind of fraud represented about 61 percent of all the reported cases last year, followed by fraud on tax returns and financial statements. The volume of reported fraud related to credit reports dropped from 9 percent to 4 percent in the past year.

...

The study noted that the spike in fraudulent activity cases can be partially attributed to more vigorous reporting and investigations.

Tanta explained this well: Unwinding the Fraud for Bubbles

There is a tradition in the mortgage business of distinguishing between two major types of mortgage fraud, called “Fraud for Housing” and “Fraud for Profit.” The former is the borrower-initiated fraud—inflating income or assets, lying about employment, etc.—that is motivated by the borrower’s desire to get housing (not the same thing as “real estate”), by means of getting a loan he or she doesn’t actually qualify for. It may require some collusion by the loan originator or appraiser, but it may not. It is usually the least expensive kind of fraud to lenders and investors, since the goal is getting (and keeping) the property, so the borrower is at least usually motivated to make the payments. The problems come about, of course, because these borrowers failed to qualify honestly for a reason. Borrower-initiated fraud loans may be considered “self-underwritten,” and such loans do have a much higher failure rate than the “lender-underwritten” ones. Their only saving grace is that the lender tends to recover more in a foreclosure than in a fraud for profit case. Penalties to the borrower rarely ever come in the form of prosecution; losing the home and becoming a subprime borrower for the next four to seven years—with the credit costs that implies—are the borrower's punishment.As Tanta noted, during the housing bubble, these two frauds merged, and that is probably not happening now. I suspect most of the fraud today is "fraud for housing" by homeowners desperate to refinance.

Fraud for profit is simply someone trying to extract cash—not housing—out of the transaction somewhere. If it is borrower-initiated fraud, it’s not a borrower who wants a house; it’s a borrower who wants to flip a piece of real estate or launder money or in some other way grab the cash and leave the lender holding the bag. Most of it, however, is initiated by a seller, real estate broker, lender, or closing agent (or all of them in collusion). It generally requires additional collusion by bribable appraisers, although it can certainly be initiated by a corrupt appraiser looking for a kickback, or can merely take advantage of a trainee or gullible appraiser. This is the flip scam, straw borrower, equity skimming, misappropriation of payoff funds, identity theft kind of fraud. It may not be as common as fraud for housing, at least in some markets, but it’s much, much more expensive to the bagholder. At minimum, the fraud-for-housing borrower wants to take clear, merchantable title to the property and maintain it at an acceptable level. That’s either unnecessary expense or (in the case of title) a hurdle to be gotten over by the fraud-for-profit participant.

NAHB Housing Market Index Still Near Record Low

by Calculated Risk on 3/16/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was flat at 9 in March (same as February). The record low was 8 set in January.

This is the fifth month in a row at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB: Builder Sentiment Unchanged In March

Builder confidence in the market for newly built single-family homes remained unchanged in March as economic woes continued to take their toll on potential buyers, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI held steady at 9 in March, marking a fifth consecutive month of single-digit readings.

“Home builders are hopeful that the recent economic stimulus package, and particularly the first-time home buyer tax credit that it included, will have a positive impact on consumer behavior and home sales as the prime home buying season gets underway,” said NAHB Chairman Joe Robson, a home builder from Tulsa, Okla. “But it’s still too soon to tell how much of an impact that will be, especially as builders find potential buyers are reluctant because of uncertainty about their future job security and the overall economic outlook.”

“The economy continues to be the main drag on home sales activity right now, in terms of consumer confidence across most of the country,” acknowledged NAHB Chief Economist David Crowe. “What’s more, home builders report that tight credit conditions are posing a further hurdle, especially for potential first-time buyers, while potential trade-up buyers are finding it very tough to sell their existing homes so they can make a move.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Two out of three of the HMI’s component indexes were unchanged in March, with the index gauging current sales conditions holding at 7 and the index gauging sales expectations in the next six months holding at a record-low 15. Meanwhile, the index gauging traffic of prospective buyers declined two points to 9.

Three out of four regions saw no change in their HMI reading in March. The Midwest, South and West each held at near-record lows of 8, 12, and 5, respectively. The Northeast rose a single point from a record low of 8 in February to 9 in March.

Industrial Production and Capacity Utilization: Cliff Diving

by Calculated Risk on 3/16/2009 09:22:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Federal Reserve reported that industrial production fell 1.4% in February, and output in February was 11.2% below February 2008. The capacity utilization rate for total industry fell to 70.9%, matching the historical low set in December 1982.

This is a very sharp decline in industrial output. Industrial production is a key to the depth of the economic slowdown. Up until late last Summer the decline in industrial production had been mild. Now, with the global economy slowing sharply, industrial production and capacity utilization are falling off a cliff.

The significant decline in capacity utilization suggests less investment in non-residential structures for some time.

Empire State Manufacturing Survey: "conditions deteriorated significantly"

by Calculated Risk on 3/16/2009 09:15:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated significantly in March. The general business conditions index fell to a fresh low of -38.2. The new orders and shipments indexes also dropped sharply to new record lows, and the inventories index declined to its lowest level since 2001. The indexes for both prices paid and prices received remained negative for a fourth consecutive month. Employment indexes remained close to their recent lows. Future indexes were somewhat higher than in February, but the six-month outlook continued to be very subdued, with capital spending and technology spending indexes falling to record lows.More record lows ...

Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002), so all these record lows aren't that significant.

Sunday, March 15, 2009

Sunday Night Futures

by Calculated Risk on 3/15/2009 11:59:00 PM

AIG released (pdf) a list of counterparties.

Bernanke was on 60 Minutes.

Hamilton asked "What will recovery look like?"

And CNBC reported Obama Plan for Bad Bank Assets Could Come This Week

Just another Sunday ... here is an open thread, a few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

AIG Discloses Counterparties

by Calculated Risk on 3/15/2009 08:53:00 PM

AIG released a list of Counterparties to CDS, GIA and Securities Lending Transactions (PDF) (ht David)

And from the Financial Times: AIG publishes counterparty list (ht Dwight)

AIG caved in to political pressure Sunday and released a list of some of the financial counterparties that benefited from its $160bn US government rescue, including some of Europe’s largest banks.

...

IG paid out $22.4bn of collateral related to credit default swaps, $27.1bn to help cancel swaps and another $43.7bn to satisfy the obligations of its securities lending operation. The payments were made between September 16 and the end of last year.

Goldman Sachs, which has also accepted US government support, received payments worth $12.9bn. Three European banks – France’s Société Générale, Germany’s Deutsche Bank and the UK’s Barclays – were paid the next-largest amounts. SocGen received $11.9bn; Deutsche $11.8bn; and Barclays $7.9bn.

Bernanke: The End is Near

by Calculated Risk on 3/15/2009 07:48:00 PM

Fed Chairman Ben Bernanke was interviewed on 60 Minutes tonight.

Fed Chairman Ben Bernanke was interviewed on 60 Minutes tonight.

Here is a picture of Bernanke from his college days ... his forecasting skills weren't much better then (Ok, slightly edited!)

From CBS 60 Minutes: Ben Bernanke's Greatest Challenge

"Mr. Chairman, I'm gonna start with a question that everyone wants me to ask: when does this end?" 60 Minutes correspondent Scott Pelley asked Bernanke.The transcript is available at 60 minutes.

"It depends a lot on the financial system," he replied. "The lesson of history is that you do not get a sustained economic recovery as long as the financial system is in crisis. We've seen some progress in the financial markets, absolutely. But until we get that stabilized and working normally, we're not gonna see recovery. But we do have a plan. We're working on it. And I do think that we will get it stabilized, and we'll see the recession coming to an end probably this year. We'll see recovery beginning next year. And it will pick up steam over time."

Here is the interview:

Hamilton: "What will recovery look like?"

by Calculated Risk on 3/15/2009 06:10:00 PM

Professor Hamilton provides a number of graphs on the temporal order of a recovery: What will recovery look like?

This adds to my post: Business Cycle: Temporal Order

Here is the table I provided of a simplified temporal order for emerging from a recession. The table shows when each area typically starts to recovery relative to the end of the recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

And this graph from Professor Hamilton shows the average pattern for all the recessions since 1947.

And here is what the current recession looks like. The record slump in RI has changed the scale of the graph, but the order appears the same.

For recovery, we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

Unfortunately there are reasons that RI (excess supply) and PCE (too much debt) won't rebound quickly, but they are still the areas to watch.

And here is an excerpt from a research note by Jan Hatzius, Chief Economist at Goldman Sachs, sent out this afternoon:

"Although we still think real GDP will fall by about 7% annualized in Q1 and the labor market numbers remain awful, the good news is that the weakness is shifting from more leading to more lagging sectors."(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Domestic Oil Investment to Decline Sharply in 2009

by Calculated Risk on 3/15/2009 12:18:00 PM

Here is another area of domestic non-residential investment that will slump in 2009.

From the NY Times: As Oil and Gas Prices Plunge, Drilling Frenzy Ends

The great American drilling boom is over.The following graph compares real domestic investment in petroleum and natural gas with real gasoline prices.

The number of oil and gas rigs deployed to tap new energy supplies across the country has plunged to less than 1,200 from 2,400 last summer, and energy executives say the drop is accelerating further.

Click on graph for larger image in new window.

Click on graph for larger image in new window.After the oil shock of 1973, oil exploration investment (real dollars) has tracked real gasoline prices pretty closely.

This graph shows oil investment in 2000 dollars. Investment in 2008 was $138 billion in nominal dollars.

The recent rapid decline in gasoline prices suggests investment in petroleum and natural gas exploration and wells could decline by 1/3 or more in 2009 from the $138 billion invested in 2008. This is another area of non-residential structure investment that will decline sharply in 2009 - along with investment in offices, malls and hotels.

Note: Real gasoline prices are annual prior to 1980. The gasoline data is from the EIA.

FSA urges Global Crackdown on Shadow Banking System

by Calculated Risk on 3/15/2009 10:22:00 AM

From The Times: Lord Turner demands global crackdown on bank excess

A BLUEPRINT for international financial regulation will be unveiled this week, leading the way for a global crackdown on the shadow banking system and high-risk trading strategies.

Lord Turner, chairman of the Financial Services Authority (FSA), will publish a paper on Wednesday outlining the regulator’s responses to the global financial crisis.

The proposals are expected to form the cornerstone of international efforts to overhaul the global regulatory system ... [Turner] wants more co-ordination between regulators and central banks to spot signs that economies are overheating.

He will launch a clampdown on the shadow-banking system — including the off-balance-sheet funding vehicles set up by banks in tax havens.

Further regulation of hedge funds is expected ...

Banks that offer big bonuses to traders who deal in risky assets could be obliged to hold more capital. Retail banks, which hold savers’ money, could also face restrictions on the investments they make through their treasury operations.

...

“You are going to see a massive change in the supervisory system. It’s going to include tax havens and institutions where it didn’t before,” [Prime Minister Gordon Brown] said.

Saturday, March 14, 2009

Roubini: "Reflections on the latest sucker’s rally"

by Calculated Risk on 3/14/2009 09:45:00 PM

The linked post is very long ... long even by Roubini standards! This is actually a short excerpt ...

From Nouriel Roubini: Reflections on the latest dead cat bounce or bear market sucker’s rally

It is déjà vu all over again. We have already seen this Groundhog Day movie at least six times over and over again in the last year or so: the market starts to rally – this time around about 8% in a week - and the chorus of optimists starts to say that this is the bottom of the economic and financial crisis and that we are at the beginning of a sustained stock market rally that signals the true end of this bear market.Next Roubini outlines what he sees as the arguments of the optimists:

[H]ere are the arguments of the optimists:My main interest is in point #1 - economic activity - and Roubini quotes a post he wrote on March 2nd. (See Roubini's post for his discussion of the other 3 points.

1. While the first derivative of economic activity is still negative the second derivative is becoming positive around the world: i.e. output, employment, demand etc. are still contracting but they are – or will soon be - contracting at a slower rate than in Q4 of 2008. As long as the second derivative is positive rather than negative economic activity will bottom out some time in H2 of 2009 and the recession will be over sooner rather than later.

2. The policy stimulus, both monetary but especially fiscal, in the US, China and the rest of the world is starting to have traction and will contribution to the slowdown in the rate of economic decline and eventually –sooner rather than later – contribute to the economic recovery

3. Stock markets have already fallen in the US and globally by over 50% and are now way oversold. Earnings have fallen a lot but will recover soon as economic activity will soon stabilize. And since stock markets are forward looking and bottom out 6 to 9 months before the end of the recession we must be now at the bottom if the economy will recover by H2 or, at the latest, by year end.

4. Banks and financial stocks are way oversold; Citi, JP Morgan, Bank of America and other banks are now saying that they will be profitable this year and that they will not need any further injection of capital by the government. The financial system is solvent and the undershooting of banks’ equity prices was way too excessive.

Let us explain again – as we discussed most of these points here before – and flesh out in more detail why each of these optimistic arguments is incorrect or, at least, too early and exaggerated.

"For those who argue that the second derivative of economic activity is turning positive (i.e. economies are contracting but a slower rate than in Q4 of 2008) the latest data don’t confirm this relative optimism. In Q4 of 2008 GDP fell by about 6% in the US, 6% in the Eurozone, by 8% in Germany, by 12% in Japan, by 16% in Singapore and by 20% in South Korea. So things are even more awful in Europe and Asia than the US ...As usual Professor Roubini makes some strong arguments. And I agree that economic activity is contracting in Q1 2009 at about the same pace as in Q4 2008. However, I think the composition of the contraction is different in Q1 (and following the normal business cycle). Most of the real GDP decline in Q1 will be from slumping investment and an inventory correction, whereas in Q4, declines in personal consumption (PCE) were an important contributor to the economic slump.

First, note that most indicators suggest that the second derivative of economic activity is still sharply negative in Europe and Japan and close to negative in the US and China: some signals that the second derivative was turning positive for US and China (a stabilizing ISM and PMI, credit growing in January in China, commodity prices stabilizing, retail sales up in the US in January) turned out to be fake starts. For the US, the Empire State and Philly Fed index of manufacturing are still in free fall; initial claims for unemployment benefits are up to scary levels suggesting accelerating job losses; the sales increases in January is a fluke (more of a rebound from a very depressed December after aggressive post-holiday sales than a sustainable recovery).

For China the growth of credit in China is only driven by firms borrowing cheap to invest in higher returning deposits not to invest; and steel prices in China have resumed their sharp fall. The more scary data are those for trade flows in Asia with exports falling by about 40 to 50% in Japan, Taiwan, Korea for example. Even correcting for the effect of the new Chinese Year exports and imports are sharply down in China with imports falling (-40%) more than exports. This is a scary signal as Chinese imports are mostly raw materials and intermediate inputs; so while Chinese exports have fallen so far less than the rest of Asia they may fall much more sharply in the months ahead as signaled by the free fall in imports.

With economic activity contracting in Q1 at the same rate as in Q4 a nasty U-shaped recession could turn into a more severe L-shaped near-depression (or stag-deflation) as I argued for a while (most recently in my Sunday New York Times op-ed). The scale and speed of syncronized global economic contraction is really unprecedented (at least since the Great Depression) with a free fall of GDP, income, consumption, industrial production, employment, exports, imports, residential investment and, more ominously, capex spending around the world. And now many emerging market economies – as argued here for a while- are on the verge of a fully fledged financial crisis starting with Emerging Europe."

Maybe PCE will start cliff diving again, but so far the recession (no matter how severe) is still following the normal temporal pattern. Note: Even the Great Depression followed the normal pattern - just more so! Although there are still severe economic problems ahead, I think the shift in the composition is a potential positive. (See: Business Cycle: Temporal Order)

It is still way to early to call the bottom - and even after the economy bottoms, I think the recovery will be very sluggish for some time - but I am watching for the signs (see Looking for the Sun). Roubini concludes:

So, in conclusion and caveat emptor for investors: Dear investors, do enjoy this dead cat bounce and bear market sucker’s rally ... don’t wait too long until you jump ship while the financial Titanic hits the next financial iceberg: you may get squeezed and crashed in the rush to the lifeboats.

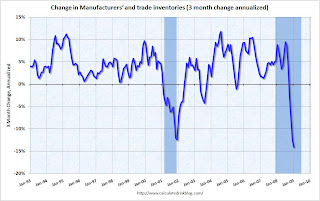

Inventory Correction

by Calculated Risk on 3/14/2009 05:35:00 PM

The recent data suggests there is a significant inventory correction in progress. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph is based on the Manufacturing and Trade Inventories and Sales report from the Census Bureau.

This shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in this recession, but inventories are now declining sharply.

This change in inventories will probably have a significant impact on GDP for the next few quarters. This is common in a recession. The contribution of changes in inventory to GDP have been pretty wild at times - in the early '80s there were a few quarters where the change in inventory subtracted more than 5% from GDP (annualized) in just one quarter! Something like that could happen in Q1 or Q2 too - and this is difficult to predict - and that could contribute to a horrible GDP number in Q1.

This inventory correction is probably also impacting imports and could be part of the reason import traffic has fallen off a cliff (see LA Port Import Traffic Collapses in February)

The good news is a significant inventory correction will help with GDP later in the year. Even with some evidence of stabilization in personal consumption, I expect a horrible GDP number for Q1 due to this inventory correction and also because of the sharp decline in all categories of investment (especially non-residential investment).

G20: Key is Value of Assets on Banks’ Balance Sheets

by Calculated Risk on 3/14/2009 03:22:00 PM

Here is the G20 statement. Excerpt:

Our key priority now is to restore lending by tackling, where needed, problems in the financial system head on, through continued liquidity support, bank recapitalisation and dealing with impaired assets, through a common framework (attached). We reaffirm our commitment to take all necessary actions to ensure the soundness of systemically important institutions.And from the "common framework":

We, the G20 Finance Ministers and Central Bank Governors, agreed the need to continue working together to maintain and support lending in our financial systems. We are committed to taking decisive action, where needed, and to use all available tools to restore the full functioning of financial markets, and in particular to underpin the flow of credit, both domestically and globally.The rest is general, but it keeps coming back to how to value the toxic assets on the banks' balance sheets.

Actions to achieve this may include where necessary:providing liquidity support, including through government guarantees to financial institutions’ liabilities; injecting capital into financial institutions; protecting savings and deposits; and, strengthening banks’ balance sheets, including through dealing with impaired assets.

Our key priority now is to address the uncertainties around the value of assets held on banks’ balance sheets, which are significantly constraining banks’ lending. This uncertainty, and the extent to which banks are holding capital to protect themselves from further potential extreme losses, is preventing them from restoring lending to business and households, with damaging consequences to our economies.

emphasis added