by Calculated Risk on 12/08/2008 01:52:00 PM

Monday, December 08, 2008

Tribune Co. files for bankruptcy

WSJ Headline: Tribune filed for Chapter 11 bankruptcy protection, pressured by high debts. From an earlier story:

Tribune has been on wobbly footing since last December, when real-estate mogul Samuel Zell led a debt-backed deal to take the company private. Tribune has stayed ahead of its $12 billion in borrowings with the help of asset sales. Now, however, shrinking profits are tightening the noose.The corporate default rate will be rising ...

This, That, and Tanta

by Calculated Risk on 12/08/2008 12:50:00 PM

I've add Tanta: In Memoriam to the menu bar above. This page includes several family photos, tributes to Tanta, and links to Tanta's writings and articles about her. Check it out.

Women on the Web had a story on Tanta this morning: Four Financial Horsewomen Who Warned of the Apocalypse

And Krugman mentions Tanta in a Salon interview: Paul Krugman's depression economics

Yeah, the "confidence game" goes bad pretty quickly if there aren't genuine substantive reasons for confidence. I wrote early in 2008 that Fed/Treasury policy was based on the "slap in the face" theory; the late, much-lamented Tanta at Calculated Risk even worked it into one of her Mortgage Pig entries. The answer, again, is institutions and regulations to secure that confidence. And if necessary, you deal with the problem of market panic by restricting the market: temporary capital controls, temporary nationalization of banks.Also - the WaPo has an article on mass transit this morning: New Ridership Record Shows U.S. Still Lured to Mass Transit

Americans rode subways, buses and commuter railroads in record numbers in the third quarter of this year, even as gas prices dropped and unemployment rose. The 6.5 percent jump in transit ridership over the same period last year marks the largest quarterly increase in public transportation ridership in 25 years, according to a survey to be released today by the American Public Transportation Association.However gasoline prices didn't started falling sharply until October, so it will be interesting to see if mass transit ridership falls off with gasoline prices. This fits my post yesterday, Thoughts on oil. I touched on several oil related topics including estimating that the decline in oil prices is providing a stimulus of about $15 billion per month to the U.S. economy compared to July.

Dugan: High Re-Default Rates

by Calculated Risk on 12/08/2008 11:34:00 AM

Comptroller of the Currency John C. Dugan spoke today about the high re-default rates on modified loans. From the press release:

Comptroller of the Currency John C. Dugan said today that new data shows that more than half of loans modified in the first quarter of 2008 fell delinquent within six months.

“After three months, nearly 36 percent of the borrowers had re-defaulted by being more than 30 days past due. After six months, the rate was nearly 53 percent, and after eight months, 58 percent,” the Comptroller said in remarks at the Office of Thrift Supervision’s National Housing Forum today.

...

A key question, Mr. Dugan said, is why is the number of re-defaults so high? “Is it because the modifications did not reduce monthly payments enough to be truly affordable to the borrowers? Is it because consumers replaced lower mortgage payments with increased credit card debt? Is it because the mortgages were so badly underwritten that the borrowers simply could not afford them, even with reduced monthly payments? Or is it a combination of these and other factors?”

Click on photo for larger image in a new window.

Click on photo for larger image in a new window.This graph shows the re-default rate by month for loans modified in Q1 and Q2 2008.

For loans modified in Q2 2008, over half are already in default.

Here is Dugan's speech.

In general, the third quarter report will show many of the same disturbing trends as other recent mortgage reports. Credit quality continued to decline across the board, with delinquencies increasing for subprime, alt-A, and prime mortgages – and the greatest increase in percentage terms was in prime mortgages. Similarly, total foreclosures in process increased, as did foreclosure sales, just as they had done in the previous quarter.The only good news is foreclosure starts are down (as reported by the MBA too), but the reason is modifications have increased - and a very large percentage of modified loans re-default very quickly. Also note the comment on prime loans - we're all subprime now!

Not all the news is bad, however. Foreclosure starts actually decreased in the third quarter, by 2.6 percent. And not coincidentally, mortgage modifications increased: the total in the third quarter was nearly double what it was in the first quarter.

Of course, it stands to reason that the more mortgages that are modified, the fewer should result in foreclosure starts. But how true is that statement? In an attempt to shed light on this question, we collected a new data element in our Mortgage Metrics for the third quarter. Specifically, we asked our servicers to track the extent to which mortgage modifications earlier in the year were successful, in this sense: what percentage of borrowers re-defaulted on their mortgages after the modification was completed, and how quickly did they do so?

The results, I confess, were somewhat surprising, and not in a good way. Take the loans that were modified in the first quarter of this year. After three months, nearly 36 percent of the borrowers had re-defaulted by being more than 30 days past due. After six months, the rate was nearly 53 percent, and after eight months, 58 percent. The data is similar for mortgages modified in the second quarter: the re-default rate after three months was 39 percent, and after six months, 51 percent.

emphasis added

Auto Bailout may be "introduced tomorrow"

by Calculated Risk on 12/08/2008 10:00:00 AM

It sounds like something will be introduced tomorrow ...

From Bloomberg: Congress, White House Work to Forge Auto Aid Accord

U.S. lawmakers are working to reach an agreement today on automaker aid as they decide conditions such as when to name a so-called “car czar” and whether to replace executives.

Congress is considering loans for at least the $14 billion General Motors Corp. and Chrysler LLC say they need to keep operating through March 31. The legislation may be introduced tomorrow ...

Volcker Warns of Tough Times Ahead

by Calculated Risk on 12/08/2008 02:09:00 AM

From the LA Times: Paul Volcker is back, and he warns of tough times ahead

In speeches, interviews, public policy reports and congressional testimony, Volcker, 81, has laid out a fairly clear outline of what he thinks is wrong with the present-day financial system and the government's management of the economy.This article is mostly a compilation of various Volcker speeches and testimony. The article concludes:

His concerns go to the very core of how America lives and how Wall Street operates. A child of the Great Depression and a man of legendary personal thrift, Volcker thinks Americans have been living above their means for too long.

...

Bringing consumption back in line with income would not only crimp individuals and families, but also require major readjustments in the global economy, which has relied on the U.S. as consumer of last resort.

...

Volcker has become a skeptic of modern Wall Street, worried that the nation's entire financial system has evolved to a point that the government no longer has effective control over all of its important components. And the financial industry has become beholden to complex financial engineering that clouds the picture.

"The market was being run by mathematicians who didn't know financial markets," he said this year after the crisis struck.

Clearly, he wants tough new regulations on securities markets, including oversight of hedge funds, in order to avoid the need for a bailout effort by the Fed ever again. It seems likely that he will advise Obama that the growth of U.S. consumption -- everything from government spending to household outlays -- should not be financed by selling ever larger amounts of debt to foreign interests.

But he warns people not to expect an easy ride. "It's going to be a tough period," Volcker said in a speech at the Urban Land Institute in late October. "But when we dealt with inflation, it laid the groundwork for 20 years of growth. I'd like to see that happen this time."

"The only reason I sleep at night," said a longtime friend and business partner of Volcker's, speaking on background, "is that Paul Volcker will have the president's ear."

In Memoriam: Doris "Tanta" Dungey

by Calculated Risk on 12/08/2008 12:43:00 AM

From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices. In 2006, Tanta was diagnosed with late stage cancer, and she took an extended medical leave while undergoing treatment. While on medical leave she wrote for this blog, and her writings received widespread attention and acclaim.

| Click on photo for larger image in a new window. Tanta playing guitar in 2002 (photo credit: family) A few obituaries: CR writes: Sad News: Tanta Passes Away NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47 WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis |

| For some reader remembrances, emails from Tanta and more, see Remembering Tanta Here is piece from reader sdtfs: She will always be Tanta to me, just as Mark Twain and George Orwell are real, and not merely pseudonyms of Samuel Clemens and Eric Blair. She thought she was just another anonymous pen on the internet, but no one with her talent at writing and complete honesty could be a shallow pale ghost; she was as alive to me as my other literary heroes. |  Dance, Tanta, dance! (Photo credit: family) Dance, Tanta, dance! (Photo credit: family) |

Funny, intelligent, and compassionate, how could you not like her? I don’t know if we could ever be friends, (she awed me so much with her knowledge and wit), but in a very real sense I adored her. I am so thankful for the writings she left behind and yet feel cheated, as we might feel cheated by only having the Great Pyramids of Egypt left behind and none of the other Seven Wonders of the World to gaze upon.

Her blog posts were carefully crafted masterpieces and worthy of attention, but her follow up answers to questions really showed her acumen. I hesitate to say it, but her real abilities showed up best in response to people who annoyed her by their persistent inability to argue the facts and clung to their prejudices or misbehaved. She could skewer a commenter who was misrepresenting himself and take him apart point by point in the blink of an eye, or issue a perfectly balanced warning to someone who was clumsily interrupting her conversation with us, her readers. Most of us have thought of the perfect thing to say an hour, or a day after the conversation is long dead, but on-line, she had immediate and total command of her wit and the conversation.

And really, if she had a blind spot, it was she had no idea of the tremendous impact she had on her readers. Any casual mention of her likes and dislikes was seared into my memory, Van Morrison? Check. Jackson Browne? Check. ABBA? Check. “Zen and the Art of Motorcycle Maintenance”? Check. Marianne Moore? Check. Ann Taylor Stores? Ha! For someone who engaged in as many and extended wide-ranging conversations with us all as she did, how could we not know her?

I didn’t even care about mortgages when I stumbled across her writing, and to tell you the truth, the only reason I care now was because it gave me a chance to read her writing. Some might have kidded about the length of her posts, in part because she was so thorough, but there are still a large number of us who thought them, if not too short (because she was always complete), at least over too soon. She could have written about anything and I would have read it. But she was careful to stay in the areas where she felt her expertise was needed.

I felt proud whenever I managed to catch one of her literary allusions and only wish that she could know how much we appreciated them,…Just as I wish that her friends and family could know how much she meant to us, her internet pen pals.

| Tanta in Iowa 2000 (photo credit: family) |

From the Boston Globe:

Calculated Risk quickly developed a cult following for its sophisticated analysis of economic data, for rapidly crunching numbers into readable graphs, and for the knowledgeable posts of Tanta, a guest blogger with razor-sharp prose and an almost limitless enthusiasm for exposing the inner workings of the mortgage industry. Tanta had worked as a mortgage banker, and the blog created an instant platform for this one thoughtful - and worried - insider. Today, her posts have become legendary as a prescient warning cry about the current financial meltdown.

|  |

| Left: Tanta on Christmas Eve, 2002. Above: Tanta's Driver License 2004 (photo credit: family) |

UPDATE: Here are the details on The Doris "Tanta" Dungey Scholarship Fund

Here are 13 articles on the mortgage industry that Tanta called "The Compleat UberNerd"

Here is a Compendium of Tanta's Posts

Sunday, December 07, 2008

Boston Globe on "Econobloggers"

by Calculated Risk on 12/07/2008 07:30:00 PM

From Stephen Mihm at the Boston Globe: So, you want to save the economy?

First a correction, I'm not a "veteran of Wall Street" - please don't tar and feather me! (I retired as a senior executive and board member of a public company)

Here is a nice comment:

Calculated Risk quickly developed a cult following for its sophisticated analysis of economic data, for rapidly crunching numbers into readable graphs, and for the knowledgeable posts of Tanta, a guest blogger with razor-sharp prose and an almost limitless enthusiasm for exposing the inner workings of the mortgage industry. Tanta had worked as a mortgage banker, and the blog created an instant platform for this one thoughtful - and worried - insider. Today, her posts have become legendary as a prescient warning cry about the current financial meltdown.On timing - I started this blog at the beginning of 2005 just to figure out what a "blog" was. Of course I needed something to write about, and I chose the obvious housing bubble and inevitable bust. Tanta started by commenting on some of my early posts as we were both trying to figure out who the eventual bagholders would be; suspecting all along that it would probably be all of us - the taxpayers.

...

Last week, the author of Calculated Risk announced that his co-blogger Tanta had died of ovarian cancer at age 47. The news flashed from blog to blog, eliciting tributes by everyone from ordinary readers to the Nobel Prize-winning economist Paul Krugman. Tanta had a graduate degree in English, it turned out; her name was Doris Dungey, and her formidable financial expertise came from a job inside the mortgage industry coupled with deep curiosity about a complex problem. Her obituary ran in the New York Times, and when it did, it was the first time most of her devoted readers had seen her real name.

I've always loved Tanta's discussion of stated income and the term "bagholder", from What's Really Wrong With Stated Income

We use the term "bagholder" all the time, and it seems to me we've forgotten where that metaphor comes from. It didn't used to be considered acceptable to find some naive rube you could manipulate into holding the bag when the cops showed up, while the seasoned robbers scarpered. I'm really amazed by all these self-employed folks who keep popping up in our comments to defend stated income lending. It is a way for you to get a loan on terms that mean you potentially face prosecution if something goes wrong. Your enthusiasm for taking this risk is making a lot of marginal lenders happy, because you're helping them hide the true risk in their loan portfolios from auditors, examiners, and counterparties. You aren't getting those stated income loans because lenders like to do business with entrepreneurs, "the backbone of America." You're not getting an "exception" from a lender who puts it in writing and takes the responsibility for its own decision. You're getting stated income loans because you're willing to be the bagholder.Also on timing, here are some of Tanta's comments to a post I wrote in June 2005 - notice she was complaining about stated income then too.

Thoughts on Oil

by Calculated Risk on 12/07/2008 03:07:00 PM

All year we have been discussing the potential for significant demand destruction with regards to oil - the weaker economy and higher prices leading to less consumption in the U.S. and elsewhere, the demand impact of the Chinese stockpiling oil before the Olympics (and subsequently reducing demand after the Olympics), other Asian countries reducing their subsidies - all leading to a significant decline in oil prices in the 2nd half of 2008.

Now that oil prices have fallen sharply to around $40 per barrel, here are some further thoughts ...

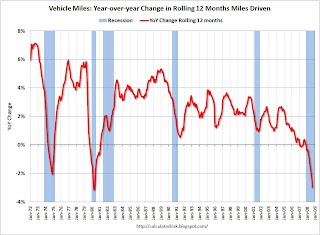

First, I think it will be interesting to see if U.S. vehicle miles driven increases with gasoline prices now below $2 per gallon. Or will households just save the difference? Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven through September (from DOT). The number of U.S. vehicle miles driven has fallen off a cliff with high gasoline prices, rising unemployment and an overall weaker economy. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.0% YoY, and the decline in miles driven is worse than during the early '70s oil crisis - and about the same as the 1979-1980 declines. As the DOT noted, miles in September 2008 were 4.4% less than September 2007, so the YoY change in the rolling average will probably get worse. The second graph shows the weekly U.S. gasoline prices from the EIA through Dec 1st. This shows that gasoline prices really declined in October - but prices in September were still over $3.50 per gallon. So we will have to wait for the October and November vehicle mile reports to see the impact of sharply lower gasoline prices.

The second graph shows the weekly U.S. gasoline prices from the EIA through Dec 1st. This shows that gasoline prices really declined in October - but prices in September were still over $3.50 per gallon. So we will have to wait for the October and November vehicle mile reports to see the impact of sharply lower gasoline prices.

I expect vehicle miles to start increasing again - or at least stop declining. I think the impact of price declines on driving behavior will more than offset higher unemployment and the weaker economy. And gasoline prices are still falling in December!

How much will the decline in oil prices cushion the U.S. recession? That is another key question.

The following graph shows the monthly personal consumption expenditures (PCE through October) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly through November, December estimated at $41 per barrel). At current oil prices, it appears oil related PCE will fall to $250 to $300 billion SAAR, from close to $500 billion SAAR in July. This is a savings of over $15 billion per month compared to July. And that would be very helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

At current oil prices, it appears oil related PCE will fall to $250 to $300 billion SAAR, from close to $500 billion SAAR in July. This is a savings of over $15 billion per month compared to July. And that would be very helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

Data sources: PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117. Oil prices from EIA U.S. Spot Prices.

And this leads to the potential impact on oil producing countries and U.S. interest rates. Rachel Ziemba (filling in for Brad Setser) at RGE Monitor in March discussed how petrodollars are being spent by the GCC (Gulf Cooperation Council) countries in Petrodollars: How to Spend It. When I saw the following graph, my first thought was: What happens if oil prices fall? Rachel Ziemba writes:

Rachel Ziemba writes:

2007 was the first year that spending growth outstripped revenues [growth] in the GCC and many other oil exporters. 2008 budget plans imply even higher current (especially wages and subsidies) and capital expenditures. Even countries that have traditionally saved more (Kuwait) are ramping up spending especially on capital projects and in some cases transfers to the population or pension funds. ... With megaprojects in the works in a variety of sectors including energy and other infrastructure, capital spending will likely continue to rise.With oil prices at $40 per barrel, and government spending at $50 per barrel, the math doesn't work!

And once again I'd like to recommend (again) this paper from Dr. Krugman: The Energy Crisis Revisited

The fact that oil is an exhaustible resource means that not extracting it is a form of investment. And it is an investment that might look attractive to a national government when oil prices are high. If a country does not want to spend all of the massive flow of cash generated by a sudden price increase on consumption, it must do one of three things: engage in real investment at home, which is subject to diminishing returns; invest abroad; or "invest" by cutting oil extraction, and hence reducing supply.

Krugman: Figure 1.

Krugman: Figure 1.So there is a definite possibility that over some range higher oil prices will lead to lower output. And given highly inelastic demand, as Cremer et al showed, that means that you can have multiple equilibria. Figure 1 illustrates the point: given the backward-bending supply curve and a steep demand curve, there are stable equilibria at both the low price PL and the high price PH.And my comment from back in March:

So there is a possibility that what has looked like peak oil to some observers (something I believe is coming), was actually GCC countries investing by not extracting oil. If oil prices start to fall, and with rising expenditures (see first graph again), the GCC countries might increase production - causing prices to fall further.Now that oil prices are below the level needed to support government expenditure in the GCC, I think OPEC's talk of production cuts is mostly just talk.

And finally, I've been writing about how China might cut back on buying dollar denominated assets as they try to stimulate their domestic economy. However Dr. Brad Setser has argued several times that he views this is unlikely, and he recently highlighted this report from David Dollar and Louis Kuijs World Bank China Quarterly:

The last thing anyone needs to worry about is fall in Chinese demand for US treasuries.That is a good argument for China not cutting their purchases of U.S. assets, but what about oil producing countries? That has the same impact on demand for dollar denominated assets (just further down the chain).

...

The World Bank forecasts that China’s current account surplus will RISE not fall in 2009, going from an estimated $385 billion to $425 billion. How is that possible if real imports are forecast to grow faster than real exports? Easy – the terms of trade moved in China’s favor. The price of the raw materials China imports will fall faster than the value of China’s exports. China’s oil and iron bill will fall dramatically.

This touches on a number of related topics, and hopefully provides some food for thought on a Sunday. Best to all.

Great Moment in Journalism: "Thud"

by Calculated Risk on 12/07/2008 01:28:00 PM

Charlie Rose interviews Nassim Taleb (author of the "The Black Swan"). This short clip (1 min 14 secs) features Taleb suggesting Roubini is an optimist! (hat tip bobn for sending this to me). The entire interview is here.

Saturday, December 06, 2008

Frank Rich Mention of Tanta

by Calculated Risk on 12/06/2008 11:03:00 PM

From Frank Rich at the NY Times: The Brightest Are Not Always the Best (hat tip Kevin)

In our current financial quagmire, there have also been those who had the wisdom to sound alarms before Rubin, Summers or Geithner did. Among them were not just economists like Joseph Stiglitz and Nouriel Roubini but also Doris Dungey, a 47-year-old financial blogger known as Tanta, who died of cancer in Upper Marlboro, Md., last Sunday. As the Times obituary observed, “her first post, in December 2006, took issue with an optimistic Citigroup report that maintained that the mortgage industry would ‘rationalize’ in 2007, to the benefit of larger players like, well, Citigroup.” It was months before the others publicly echoed her judgment.Tanta's first post is worth rereading: Let Slip the Dogs of Hell. Of course Tanta had been a commenter for almost two years before she started writing for CR. Here are some comments from June 2005 (yes, 2005!):

Regarding those bagholders . . . I've worked in the mortgage industry for two booms now. The problem with the "why are the lenders stupid" question is not that they aren't stupid, but that the bag is too dispersed to be held by any one particular idiot. The lenders keep making 100% CLTV interest-only loans to borrowers with a 50% debt-to-income ratio on a grossly overpriced property because Fannie Mae will buy the first mortgage and GreenPoint will buy the second mortgage and Radian will write pool insurance for it. Your average bank or S&L believes it is successfully laying off the risk on the Real Deep Pockets who are Too Big To Fail. It has also been my personal experience over the years that the OCC and OTS are not enforcing the old requirements that the people who approve credit policy be insulated from the people who make override bonuses on production volumes. Last thrift I worked for (ending 2005) had a chief credit officer reporting to the national sales manager. Then you look at who the powerful executives are at lending institutions: these are people who take themselves to be exceptions to the rule that The Market Can Bite You, and they want to make loans to borrowers who are like them, because they think people like them are not credit risks. Overleveraged speculators buying McMansions with a 401(k)loan are the demographic equivalent of the mortgage managerial class. The really interesting question in my mind is when the first mortgage insurance company will burst into flames. The MIs have already backed off a great deal on the toxic stuff, which is why you're seeing all the 80/20 or 80/15 loans, and so they might save themselves. In that case, look at the HELOC lenders. The only advice I ever have regarding the stock market is, "short the HELOC lenders."And more:

Tanta | 06.27.05 - 9:51 am

I have been spending the morning working on an anti-mortgage-fraud protocol for a bank client. Realist is on the money about the hidden speculator/flipper loans, but it's even worse when you add the fraud levels and all the "Stated Income" loans. People lie about their incomes without compunction because they believe that they will be making that much money in X years, just as they believe that they will be moving in X years and so need an ARM, or that they can sell in X years if rates go up. The mortgage industry is qualifying a whole bunch of borrowers based on "conventional wisdom" about how the future will be just like the past except it will have bigger kitchens and another half-bath.And more:

The other elephant in the room is refinances. The other link between interest rates and prices goes like this: rates go down, people refinance, refinances mean the property is reappraised, the reappraisal sets the next sales price. Most appraisal fraud (besides the sleazy flip scheme stuff) comes in when someone needs cash and the appraiser is leaned upon to provide sufficient value. Once that new value goes into the databases . . .

Prices aren't just a matter of what buyers will pay. They're also a matter of what lenders will lend.

Tanta | 06.27.05 - 2:17 pm |

CR, I just read the Business Week piece. Frankly, whenever I see David Duncan being quoted, I surf to the next item.

"Yet in spite of the profit pressures, Duncan told BusinessWeek that he believes lenders on the whole are behaving responsibly. One reason: If lenders resell a mortgage into the secondary market and then the borrower defaults, they can sometimes be forced to buy the loan back, eating the loss. He says he's not worried that the industry is setting itself up for a wave of defaults."

Right. Repurchase warranties prevent moral hazards. These people make my head hurt.

Since the secondary market players can put (some) loans back onto the original lender (sometimes), the SMP have an incentive to write lots of latitude into their credit guidelines. Then the lenders use "secondary market guidelines" to prove to their nervous credit policy people that their own loan policies are "respectable."

Lenders believe they'll end up repurchasing loans like homebuyers believe they'll sell at a loss next year.

Tanta | 06.27.05 - 6:02 pm |

Obama Releases Some Details on Economic Stimulus Package

by Calculated Risk on 12/06/2008 04:52:00 PM

President-elect Obama released some more details of his economic stimulus proposals today. As I noted last week, there aren't anywhere near enough "shovel ready" projects to offset the decline in private non-residential structure investment that I expect in 2009. Obama has added several more key areas in addition to roads and bridges; he is also proposing to invest in energy efficiency for public buildings, upgrade school buildings, and expanding broadband to all schools, libraries and hospitals.

Here is an excerpt:

[W]e need action – and action now. ...

Today, I am announcing a few key parts of my plan. First, we will launch a massive effort to make public buildings more energy-efficient. Our government now pays the highest energy bill in the world. We need to change that. We need to upgrade our federal buildings by replacing old heating systems and installing efficient light bulbs. That won’t just save you, the American taxpayer, billions of dollars each year. It will put people back to work.

Second, we will create millions of jobs by making the single largest new investment in our national infrastructure since the creation of the federal highway system in the 1950s. We’ll invest your precious tax dollars in new and smarter ways, and we’ll set a simple rule – use it or lose it. If a state doesn’t act quickly to invest in roads and bridges in their communities, they’ll lose the money.

Third, my economic recovery plan will launch the most sweeping effort to modernize and upgrade school buildings that this country has ever seen. We will repair broken schools, make them energy-efficient, and put new computers in our classrooms. Because to help our children compete in a 21st century economy, we need to send them to 21st century schools.

As we renew our schools and highways, we’ll also renew our information superhighway. It is unacceptable that the United States ranks 15th in the world in broadband adoption. Here, in the country that invented the internet, every child should have the chance to get online, and they’ll get that chance when I’m President – because that’s how we’ll strengthen America’s competitiveness in the world.

In addition to connecting our libraries and schools to the internet, we must also ensure that our hospitals are connected to each other through the internet. That is why the economic recovery plan I’m proposing will help modernize our health care system – and that won’t just save jobs, it will save lives. We will make sure that every doctor’s office and hospital in this country is using cutting edge technology and electronic medical records so that we can cut red tape, prevent medical mistakes, and help save billions of dollars each year.

These are a few parts of the economic recovery plan that I will be rolling out in the coming weeks.

Tanta's Mortgage Pig Wear for Charity

by Calculated Risk on 12/06/2008 11:48:00 AM

Update: Repeating this ... makes a great Holiday gift for the UberNerd in your family! And the proceeds go to fight cancer ...

From Cathy (Tanta' sister):

Back in October, after Tanta came home from the hospital and agreed to come to Ohio with me, we had an idea to create Mortgage Pig Wear and donate the proceeds from the sales to the UMMS Greenebaum Cancer Center.

We have friends in Springboro, OH who own a small, local embroidery company called Image Mark-it that is owned and staffed by the type of caring folks who would want to be involved in a project like this. Jumped at the chance, is more like it.

We enlisted her 16 year-old nephew (my son) to handle the shipping and for that he would receive $1.00 per item in his college fund. Tanta would provide the "quality control" or lovingly ride herd on him. She couldn't wait.

Over the past 4 weeks we have "digitized" the pig for the embroidery on sweatshirts and polos and created high quality photo transfers for T-shirts and sweatshirts. Tanta lived long enough to see the samples but not to see the items go into production and be offered for sale. I still can't believe it.

I worried about what to do with this on Saturday so I simply asked Tanta. She wanted us to proceed. My son and my husband both asked her as well - and both got the same answer "Please go ahead with The Mortgage Pig Wear".

In the last day or so as I read the various tributes to her, I saw references to cure vs care. So we've made a small change - we're offering the embroidered pig items with proceeds donated to the Ovarian Cancer Research Fund (www.ocrf.org) and the photo-transfer items split between UMMS Greenebaum and OSUMC James Cancer Centers.

I hope you enjoy wearing these as much as the folks at Image Mark-it and I have enjoyed creating them. We are planning to work very hard to keep up with demand - and for all of us it's a labor of love.

From CR: I believe these are the larger images:

| Holiday |

|

| Click on the Mortgage Pig™ for a larger image in new window. |

| Slap it |

|

| Convexity |

|

Saturday Rock Blogging: Reminiscing

by Calculated Risk on 12/06/2008 08:00:00 AM

Saturday Rock Blogging was a Tanta feature for most of 2007. Just once more for the memories ...

First some advice from Tanta:

Advice for all you UberNerds: if your PC is already acting squirrelly, and your dsl connection is slower than usual, it is not a good time to decide to download a giant MIRS dataset from the Federal Housing Finance Board, because three hours later after you've finally restored your system and rebooted in normal mode and retrieved the fragments of your damaged spreadsheet, you will have forgotten what the hell you needed that data for.And in a post in August 2007, Tanta presented this gem from our very own central_scrutinizer: "Dead Cat On The Rise": (CR note: good call by central_scrutinizer!)

I see trouble on the way

I see copper thieves obligin'

I see more flat screens on Ebay

Don't go long tonight

Cause you'll grab a fallin' knife

there's a dead cat on the rise

I hear pension funds implodin'

I know the end is coming soon

I'll see my short funds overflowin'

Bloomberg proclaiming rage & ruin

Don't go long tonight

Cause you'll grab a fallin' knife

there's a dead cat on the rise ... oh yeah

Hope you got your cash together

Hope you are quite prepared to die

Kudlow will soon be tarred and feathered

One eye is taken for an eye

Don't go long tonight

Cause you'll grab a fallin' knife

There's a dead cat on the rise

And finally a search on YouTube for "Tanta" brought up this song in Brazilian Portuguese. Maybe a little too much, but who cares! (Tanta actually means Aunt in Danish)

Esquecer você

(Portuguese to English Translator here)

All my best to everyone, CR

Friday, December 05, 2008

Innovative Thinking from Detroit?

by Calculated Risk on 12/05/2008 09:49:00 PM

Eric had to be inspired by the auto executives ...

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

... Democratic Congressional leaders said on Friday that they were ready to provide a rescue plan for American automakers, and that they expected to vote on the legislation in a special session next week.

Seeking to end a weeks-long stalemate between the Bush administration and House Speaker Nancy Pelosi, senior aides said that the money would most likely come from $25 billion in federally subsidized loans intended for developing advanced fuel-efficient cars.

By breaking that impasse, the lawmakers could also clear the way for the Treasury secretary, Henry M. Paulson Jr., to request the remaining $350 billion of the financial industry bailout fund.

Fleckenstein Shutting Down Short Hedge Fund

by Calculated Risk on 12/05/2008 08:29:00 PM

From Bill Fleckenstein's Daily Rap: (Here is Fleck's Site for the Daily Rap):

Note: reprinted with permission.

"After considerable thought and deliberation I have decided to make a major change in my life: I am going to close my hedge fund. I have several reasons for no longer wishing to run a short-only fund as I have for the past 12 years. First, my original reason for starting the fund was because of developments I saw occurring in the late 1990s that I wanted no part of. I felt that Greenspan was fomenting an environment that would lead to disaster, as consultants, financial advisors, and the public at large were losing all respect for risk. Of course, the reckless behavior carried far higher and lasted much, much longer than I ever imagined it could. However, the recent carnage in the stock market, real estate market and the financial system (as well as the job losses) has washed away those excesses to a large degree and it has violently demonstrated the risks associated with investing.

A future goal of mine, when I set up the fund in 1996 -- as I attempted to step aside from the madness -- was to return to the long side of the business at some point in time when I felt that investors had become more rational regarding risk and stocks offered a more favorable risk/reward proposition. I considered this option very briefly in 2002 after the stock bubble imploded, but the cleansing process was postponed due to the burgeoning real-estate bubble.

Second, though I think that the stock market still has unfinished business on the downside, I believe that 2009 is the year to prepare for a return to managing money in a more balanced fashion, with longs (and some shorts), as there are currently plenty of interesting ideas that appear to offer a margin of safety. On the flipside, compelling opportunities on the short side are not as abundant as they were just a few months ago (though there still are plenty.) The "value restoration project," to quote Jim Grant, has been brought about by the consequences of disastrous Fed policies and the madness of the crowd, both of which have concerned me for the last 15 or so years.

Lastly, on a personal note, I no longer want to run a short-only hedge fund, as it is very stressful, nerve-wracking and generally not very much fun, entailing an intense focus on the short term to effect risk control. In addition, one views the world differently when operating solely from the short side and I would like to widen my focus as I did when I managed money from 1982-1995. My wife is especially happy about this potential change.

My efforts in 2009 will be directed towards setting up an investment vehicle managed by Fred Hickey and me that won't be a hedge fund, which hopefully will be available to everyone. I feel that many (but certainly not everyone) in the "hedge" fund community have behaved in a disgraceful manner in the last couple years by taking huge fees along the way and then either running at the first sign of trouble (by giving money back to avoid having to recoup draw-downs from high watermarks), or locking people up and not giving them their money back at all. Consequently I'd rather not be part of that "industry" going forward. The Rap will continue as it has."

Bank Failure #23: First Georgia Community Bank, Jackson, Georgia

by Calculated Risk on 12/05/2008 05:08:00 PM

From the FDIC: United Bank Acquires All the Deposits of First Georgia Community Bank, Jackson, Georgia

First Georgia Community Bank, Jackson, Georgia, was closed today by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with United Bank, Zebulon, Georgia, to assume all of the deposits of First Georgia Community Bank.Now it feels like a Friday!

...

As of November 7, 2008, First Georgia Community Bank had total assets of $237.5 million and total deposits of $197.4 million. United Bank agreed to assume all the deposits for a .811 percent premium. In addition to assuming all of the failed bank's deposits, United Bank will purchase approximately $60.6 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $72.2 million.

...

First Georgia Community Bank is the 23rd bank to fail in the nation this year, and the fourth in Georgia.

WaPo: Obama Team Agrees to Aid Treasury

by Calculated Risk on 12/05/2008 04:54:00 PM

From the WaPo: Obama Team Agrees to Aid Treasury in Push for Rescue Funds

President-elect Barack Obama's transition team has agreed to accompany Treasury Department officials to meet with Capitol Hill leaders to help the Bush administration gain access to the second half of the $700 billion financial rescue package, government sources familiar with the matter said.We could all make lame duck jokes, but I'm not sure I want the last $350 billion being allocated by Paulson.

Fed Buys $5 Billion in Agency Debt

by Calculated Risk on 12/05/2008 03:44:00 PM

From Bloomberg: Fed Buys $5 Billion of Fannie, Freddie, FHLB Debt

The Federal Reserve bought $5 billion of Fannie Mae, Freddie Mac and Federal Home Loan Bank corporate debt under a new program aimed at reducing mortgage costs.This is exactly the road map Bernanke discussed in 2002: Deflation: Making Sure "It" Doesn't Happen Here.

The central bank acquired bonds with maturities between December 2009 and November 2010, according to the New York Fed’s Web site. Dealers offered $12.9 billion of the securities. The purchases under the $100 billion program are the Fed’s first buying of long-term “agency” debt in 28 years.

[S]ome observers have concluded that when the central bank's policy rate falls to zero--its practical minimum--monetary policy loses its ability to further stimulate aggregate demand and the economy. At a broad conceptual level, and in my view in practice as well, this conclusion is clearly mistaken. Indeed, under a fiat (that is, paper) money system, a government (in practice, the central bank in cooperation with other agencies) should always be able to generate increased nominal spending and inflation, even when the short-term nominal interest rate is at zero.A speech worth rereading.

...

Normally, money is injected into the economy through asset purchases by the Federal Reserve. To stimulate aggregate spending when short-term interest rates have reached zero, the Fed must expand the scale of its asset purchases or, possibly, expand the menu of assets that it buys.

...

So what then might the Fed do if its target interest rate, the overnight federal funds rate, fell to zero? One relatively straightforward extension of current procedures would be to try to stimulate spending by lowering rates further out along the Treasury term structure--that is, rates on government bonds of longer maturities.

...

[A]nother option would be for the Fed to use its existing authority to operate in the markets for agency debt (for example, mortgage-backed securities issued by Ginnie Mae, the Government National Mortgage Association).

emphasis added

More on Delinquencies and Foreclosures

by Calculated Risk on 12/05/2008 02:34:00 PM

First a graph, always a graph ... Click on graph for larger image.

Click on graph for larger image.

This graph shows the quarterly delinquency rate as reported by the MBA since 1979.

This shows that a fairly high percentage of mortgages were delinquent even in the best of times. As an example, in Q3 2005, at the height of the bubble, the MBA reported:

The third-quarter 2005 National Delinquency Survey (NDS), released today by the Mortgage Bankers Association (MBA), shows that the seasonally adjusted delinquency rate for mortgage loans on single-family residential properties stood at 4.44 percent at the end of the third quarter, down 10 basis points from the third quarter of 2004 but up 10 basis points from the second quarter of 2005.So even though the Q3 2008 delinquency rate of 6.99% is a record level for the MBA series, it is important to realize that 4% to 5% of mortgages are considered delinquent even during the good times.

This is why the MBA also reports on seriously delinquent mortgages. In 2005, 1.82% of loans were seriously delinquent, now, prime loans alone are at 2.87%, and subprime loans at 19.56%.

And how does this compare to the Great Depression? Glad you asked.

From David Wheelock at the St. Louis Fed: The Federal Response to Home Mortgage Distress: Lessons from the Great Depression

Comprehensive data on mortgage delinquency rates do not exist for the 1930s. However, a study of 22 cities by the Department of Commerce found that, as of January 1, 1934, 43.8 percent of urban, owner-occupied homes on which there was a first mortgage were in default. The study also found that among delinquent loans, the averagetime that they had been delinquent was 15 months. Among homes with a second or third mortgage, 54.4 percent were in default and the average time of delinquency was 18 months. Thus, at the beginning of 1934, approximately one-half of urban houses with an outstanding mortgage were in default (Bridewell, 1938, p. 172).So the delinquency rate was far higher during the Depression. Note that Wheelock is using the 90 delinquency number for comparison (as opposed to the 30 day number in the chart above).

For comparison, in the fourth quarter of 2007, 3.6 percent of all U.S. residential mortgages and 20.4 percent of adjustable-rate subprime mortgages had been delinquent for at least 90 days.

Here is some more interesting data from Wheelock:

This graph shows the foreclosure rate during the Great Depression. At the peak, there were almost 14 foreclosures per thousand mortgages per year during the Depression.

This graph shows the foreclosure rate during the Great Depression. At the peak, there were almost 14 foreclosures per thousand mortgages per year during the Depression. In 2008, according to the MBA, there will be about 2.2 million foreclosures started (not completed), and according to the Census Bureau 2007 estimate there are 51.6 million households with mortgages, or over 4% of households with mortgages entered foreclosure in 2008. The MBA reports that 2.97% of households with mortgages are currently in the foreclosure process.

So even though the current delinquency rate is much lower than during the Depression, it appears the foreclosure rate is higher. Wheelock also notes:

The rate of foreclosures would likely have been far higher were it not for the moratoria on (and other impediments to) foreclosure imposed by several states (Poteat, 1938), as well as the actions of the federal government to refinance delinquent mortgages ...And once again the government is stepping in to slow foreclosures.

I think it is important to note that mortgages were very different in the Depression era. It was typical for a buyer to put 50% down, and obtain a short duration loan (like 5 years) with a balloon payment. When you lost your home to foreclosure, it was a tragedy. Today many of the foreclosures are for buyers that put little or no money down (or extracted significant equity with 2nds or HELOCs), so these foreclosures are not wiping out a life time of savings like foreclosures during the Depression. Still a tragedy for some, but not quite the same impact for many others.

Chrysler Hires BK Law Firm

by Calculated Risk on 12/05/2008 01:37:00 PM

From the WSJ: Chrysler Hires Law Firm Jones Day as Bankruptcy Counsel

Chrysler's move suggests the auto maker is preparing for imminent financial failure should its efforts to persuade Congress to deliver federal rescue funds fall short.

| Click on cartoon for larger image in new window. Rerun of a great cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |