by Calculated Risk on 11/24/2008 01:22:00 PM

Monday, November 24, 2008

Credit Crisis Indicators

The 3-month treasury is still at zero ... and that is not good. Here is more more data:

The TED spread is stuck above 2.0, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5.

The 10-Year Treasury Note yield is up to 3.34% from 3.17%.

This is the spread between high and low quality 30 day nonfinancial commercial paper. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

Most of these indicators are slightly worse or unchanged, but there was some progress with the A2/P2 spread.

NAR: Re-Default Rate 50% of Modifications

by Calculated Risk on 11/24/2008 12:00:00 PM

Here is a video report from CNBC's Diana Olick: Existing Home Sales. Listen to the end (hat tip Hal)

"The Realtors are reporting that foreclosure sales - that is distress sales being foreclosures or short sales - have risen from what they thought was 35% to 40% of all existing home sales, now they are saying it is 45% of all existing home sales. They also are saying they are seeing further softening toward the November numbers.

And they are hearing from the Realtors they talk to that the re-default rate on a lot of these loan modifications are running at 50% - that is half those of modifications aren't working."

emphasis added

Existing Home Sales (NSA)

by Calculated Risk on 11/24/2008 10:30:00 AM

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales were slightly lower in October 2008 than in October 2007 - after the first year-over-year increase in September 2008 since November 2005.

It might seem like sales have stabilized, however many of the sales this year are foreclosure resales. As an example, DataQuick reported that 51% of all sales in Socal in October were foreclosure resales as opposed to 16% in October 2007. This is probably boosting sales at the low end as investors buy properties to rent. Although foreclosure resales will stay elevated in 2009, I expect total sales to fall further.

Also, the impact of the most recent wave of the credit crisis is just beginning to impact home sales. I expect sales in November and December to be lower than in 2007.

There have been 4.23 million sales so far in 2008, and sales are currently on pace for just over 4.9 million total this year - the lowest annual sales since 1997. The second graph shows inventory by month starting in 2002.

The second graph shows inventory by month starting in 2002.

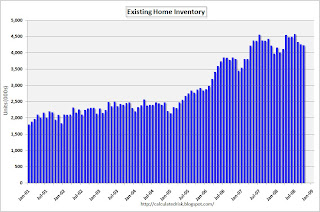

Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have only increased slightly in 2008. In fact inventory for the last three months (August, September and October 2008) are slightly below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle (inventory has peaked for 2008), however there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time.

Existing Home Sales in October

by Calculated Risk on 11/24/2008 10:00:00 AM

From NAR: Existing-Home Sales Soften on Economic Volatility

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 3.1 percent to a seasonally adjusted annual rate1 of 4.98 million units in October from a downwardly revised pace of 5.14 million in September, and are 1.6 percent below the 5.06 million-unit level in October 2007.

...

Total housing inventory at the end of October slipped 0.9 percent to 4.23 million existing homes available for sale, which represents a 10.2-month supply at the current sales pace, up from a 10.0-month supply in September.

Click on graph for larger image in new window.

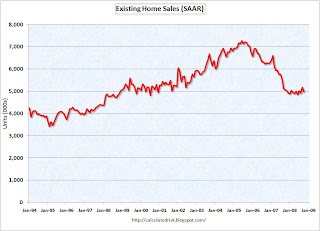

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2008 (4.98 million SAAR) were lower than in October 2007 (5.11 million SAAR) reversing the slight year-over-year increase last month.

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested last month that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.23 million in October, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.23 million in October, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year. This decline was the normal seasonal pattern.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 10.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

I expect sales to fall further over the next few months, although inventory has peaked for the year. I'll have more on existing home sales soon - the NAR website is having problems.

Krugman on Citigroup Bailout: "a lousy deal"

by Calculated Risk on 11/24/2008 09:16:00 AM

From Paul Krugman: Citigroup

Mark Thoma has the rundown of informed reactions. A bailout was necessary — but this bailout is an outrage: a lousy deal for the taxpayers, no accountability for management, and just to make things perfect, quite possibly inadequate, so that Citi will be back for more.

Setser: "Thrilled" with Geithner Pick for Treasury

by Calculated Risk on 11/24/2008 08:51:00 AM

Brad Setser at Follow the Money writes: A new economic team

[B]efore moving to New York I worked for Mr. Geithner at both the Treasury and the IMF. Mr. Geithner was, by the end of the 1990s, in charge of Treasury’s International Affairs division, so almost everyone who worked there — Tim Duy and Nouriel Roubini to name two — also worked for Mr. Geithner. At the IMF, Mr. Geithner encouraged the IMF to pay more attention to balance sheet vulnerabilities — and helped to push a paper I worked on with a group of talented young IMF economists through the IMF’s internal review process.Setser writes much more on Mr. Geithner including linking to a number of speeches and other resources.

It consequently is no surprise that I am thrilled that Mr. Geithner looks to be Obama’s choice for Treasury Secretary. I am also pleased that President Obama also found a way to pull Dr. Summers — a voracious consumer of economic and financial analysis, including economic and financial blogs — into the administration.

Wow. Three of my favorite bloggers all worked for Geithner. Hopefully Tim Duy (at Economist's View with Mark Thoma) and Nouriel Roubini (RGE Monitor) will also comment.

Statements by Fed, FDIC, Treasury on Citi Bailout

by Calculated Risk on 11/24/2008 12:19:00 AM

Form the Fed: Joint Statement by Treasury, Federal Reserve, and the FDIC on Citigroup

The U.S. government is committed to supporting financial market stability, which is a prerequisite to restoring vigorous economic growth. In support of this commitment, the U.S. government on Sunday entered into an agreement with Citigroup to provide a package of guarantees, liquidity access, and capital.Here is the term sheet.

As part of the agreement, Treasury and the Federal Deposit Insurance Corporation will provide protection against the possibility of unusually large losses on an asset pool of approximately $306 billion of loans and securities backed by residential and commercial real estate and other such assets, which will remain on Citigroup's balance sheet. As a fee for this arrangement, Citigroup will issue preferred shares to the Treasury and FDIC. In addition and if necessary, the Federal Reserve stands ready to backstop residual risk in the asset pool through a non-recourse loan.

In addition, Treasury will invest $20 billion in Citigroup from the Troubled Asset Relief Program in exchange for preferred stock with an 8% dividend to the Treasury. Citigroup will comply with enhanced executive compensation restrictions and implement the FDIC's mortgage modification program.

With these transactions, the U.S. government is taking the actions necessary to strengthen the financial system and protect U.S. taxpayers and the U.S. economy.

We will continue to use all of our resources to preserve the strength of our banking institutions and promote the process of repair and recovery and to manage risks. The following principles guide our efforts:We will work to support a healthy resumption of credit flows to households and businesses. We will exercise prudent stewardship of taxpayer resources. We will carefully circumscribe the involvement of government in the financial sector. We will bolster the efforts of financial institutions to attract private capital.

Sunday, November 23, 2008

WSJ: Government to Guarantee $300 Billion in Citigroup Assets

by Calculated Risk on 11/23/2008 11:33:00 PM

From the WSJ: U.S. Agrees to Citigroup Bailout

Treasury has agreed to inject an additional $20 billion in capital into Citigroup under terms of the deal hashed out between the bank, the Treasury Department, the Federal Reserve, and the Federal Deposit Insurance Corp. ...

In addition to the capital, Citigroup will have an extremely unusual arrangement in which the government agrees to backstop a roughly $300 billion pool of its assets, containing mortgage-backed securities among other things. Citigroup must absorb the first $37 billion to $40 billion in losses from these assets. If losses extend beyond that level, Treasury will absorb the next $5 billion in losses, followed by the FDIC taking on the next $10 billion in losses. Any losses on these assets beyond that level would be taken by the Fed.

CNBC: Expect Citi Bailout Announcement Soon

by Calculated Risk on 11/23/2008 08:51:00 PM

UPDATE: CNBC reports at 9:30PM ET that members of Congress are being consulted about an additional capital infusion for Citi. No details yet ... the situation is still fluid. $10 to $20 Billion capital infusion - and some possible capping of losses - something to be announced tonight ...

From CNBC: Citi, Government Working Feverishly on Rescue Plan

The U.S. government and Citigroup are working feverishly to hammer out a rescue plan for the beleaguered bank. If all goes according to plan, there will likely be an announcement of some type of plan in a couple of hours.Soon ...

WSJ: Citigroup, U.S. Near Agreement on Bad Assets

by Calculated Risk on 11/23/2008 05:32:00 PM

UPDATE2: CNBC reports: Government Now Said To Have Cold Feet

From the WSJ: Citigroup, U.S. in Talks to Create 'Bad Bank'

Citigroup Inc. is nearing agreement with U.S. government officials to create a structure that would house some of the financial giant's risky assets ...The announcement is expected tonight.

... talks were progressing Sunday toward creation of what would essentially be a "bad bank." ... The bad bank also might absorb assets from Citigroup's off-balance-sheet entities, which hold $1.23 trillion. ...

Under the terms being discussed, Citigroup would agree to absorb losses on assets covered by the agreement up to a certain threshold. ... After weekend discussions between Citigroup executives and officials at the Federal Reserve and Treasury Department, the parties are hoping to unveil an agreement Sunday evening, the people said.

Hey, I thought Citi WAS the bad bank!

UPDATE: Here is a story from Bloomberg: Citigroup, Fed Said to Weigh Plan to Limit Losses on Bad Assets

And from the NY Times: Plan Begins to Emerge to Rescue Citigroup

Under the proposal, the government would shoulder losses at Citigroup if those losses exceeded certain levels, ...

If the government should have to take on the bigger losses, it would receive a stake in Citigroup.

CNBC Reports Government could buy $100+ Billion in Citigroup Assets

by Calculated Risk on 11/23/2008 03:57:00 PM

From CNBC: Citigroup Update: Government Looking To Buy Assets

The government is looking to buy substantial amount of assets from Citi like a good bank, bad bank structure. The Government will absorb much of the losses for citi if there are losses and Citi would issue preferred stock to the government. The government could buy more than $100 billion in the bad assets if the plans go throughThe BBC is reporting that an announcement is expected before the markets open Monday.

UPDATE: Financial Times: Citigroup board in crisis talks (hat tip Dwight)

Citigroup's board was on Sunday locked in crisis talks ... the board is considering all options ...

Representatives of the New York Federal Reserve, as well as Treasury officials, are also monitoring developments.

... Citi is in no danger of bankruptcy. It recently received a $25bn investment from the Treasury and its credit is backed by the Fed. Its counterparties are not scrambling to put their business elsewhere, as was the case with Bear Stearns and Lehman. ... the Fed ... has taken a more hands-off approach ...

UK: Gordon Brown Expected to Announce Stimulus Package Monday

by Calculated Risk on 11/23/2008 11:34:00 AM

From The Telegraph: Pre-Budget report: Gordon Brown defends tax cuts

[Prime Minister Gordon Brown] told BBC1's The Politics Show world leaders agreed the need for an injection of cash into the economy.

"Everybody generally agrees that the fiscal stimulus - and what we mean by fiscal stimulus is real help for businesses and families now - has got to be substantial to have an impact."

The Government is expected to pump between £15 and £20 billion into the economy ... [in addition to changing] the VAT ... from 17.5% to 15%, which would cost £12.5 billion, moves are thought to include further tax cuts targeted at the least well off.

...

There are also suggestions of a new three month grace period for mortgage holders struggling to keep up with their repayments before repossession proceedings kick in.

...

But debt is predicted to soar to more than £120 billion, fuelling concerns about the tax rises and spending cuts that may be necessary later.

Mr Brown said: "If you say at the moment that there is nothing that government can do by spending more or investing more at the moment then that is a gospel of despair in the future."

WaPo: Regulatory Failure at the Office of Thrift Supervision

by Calculated Risk on 11/23/2008 01:15:00 AM

The WaPo has an article reviewing how the Office of Thrift Supervision (OTS) failed to properly regulate lenders: Banking Regulator Played Advocate Over Enforcer

OTS is responsible for regulating thrifts, also known as savings and loans, which focus on mortgage lending. As the banks under OTS supervision expanded high-risk lending, the agency failed to rein in their destructive excesses despite clear evidence of mounting problems, according to banking officials and a review of financial documents.The article references the infamous chainsaw incident:

Instead, OTS adopted an aggressively deregulatory stance toward the mortgage lenders it regulated. It allowed the reserves the banks held as a buffer against losses to dwindle to a historic low.

...

The agency championed the thrift industry's growth during the housing boom and called programs that extended mortgages to previously unqualified borrowers as "innovations." In 2004, the year that risky loans called option adjustable-rate mortgages took off, then-OTS director James Gilleran lauded the banks for their role in providing home loans. "Our goal is to allow thrifts to operate with a wide breadth of freedom from regulatory intrusion," he said in a speech.

In the summer of 2003, leaders of the four federal agencies that oversee the banking industry gathered to highlight the Bush administration's commitment to reducing regulation. They posed for photographers behind a stack of papers wrapped in red tape. The others held garden shears. Gilleran ... hefted a chain saw.

| This photo from 2003 shows two regulators: John Reich (then Vice Chairman of the FDIC and later at the OTS) and James Gilleran of the Office of Thrift Supervision (with the chainsaw) and representatives of three banker trade associations: James McLaughlin of the American Bankers Association, Harry Doherty of America's Community Bankers, and Ken Guenther of the Independent Community Bankers of America. |

In 2006, at the peak of the boom, lenders made $255 billion in option ARMs ... Most option ARMs were originated by OTS-regulated banks.Back in 2005 I posted frequently on the progress of the proposed new guidance. I spoke with a number of regulators in 2005 and 2006 who were involved in the process, and a number of them expressed frustration with the OTS and the Fed.

Concerns about the product were first raised in late 2005 by another federal regulator, the Office of the Comptroller of the Currency. The agency pushed other regulators to issue a joint proposal that lenders should make sure borrowers could afford their full monthly payments. "Too many consumers have been attracted to products by the seductive prospect of low minimum payments that delay the day of reckoning," Comptroller of the Currency John C. Dugan said in a speech advocating the proposal.

OTS was hesitant to sign on ... [John] Reich, the new director of OTS, warned against excessive intervention. He cautioned that the government should not interfere with lending by thrifts "who have demonstrated that they have the know-how to manage these products through all kinds of economic cycles."

Here is an excerpt from the NY Times from July 2005: A Hands-Off Policy on Mortgage Loans

For two months now, federal banking regulators have signaled their discomfort about the explosive rise in risky mortgage loans.I was outraged by the foot dragging at the time ... the regulators knew there was a lax lending problem in early 2005 (they were already late), and the continual foot dragging just made the inevitable crisis worse (as an example the peak year for Option ARM lending was in 2006).

First they issued new "guidance" to banks about home-equity loans, warning against letting homeowners borrow too much against their houses. Then they expressed worry about the surge in no-money-down mortgages, interest-only loans and "liar's loans" that require no proof of a borrower's income.

The impact so far? Almost nil.

"It's as easy to get these loans now as it was two months ago," said Michael Menatian, president of Sanborn Mortgage, a mortgage broker in West Hartford, Conn. "If anything, people are offering them even more than before."

The reason is that federal banking regulators, from the Federal Reserve to the Office of the Comptroller of the Currency, have been reluctant to back up their words with specific actions. For even as they urge caution, officials here are loath to stand in the way of new methods of extending credit.

This willful lack of oversight by certain regulators was outrageous.

Daily Show: Pirates!

by Calculated Risk on 11/23/2008 12:38:00 AM

Headlines (hat tip Justin):

*SOMALI PIRATES APPLY TO BECOME BANK TO ACCESS TARP

*PAULSON: TARP PIRATE EQUITY IS AN `INVESTMENT,' WILL PAY OFF

*KASHKARI SAYS `SOMALI PIRATES ARE 'FUNDAMENTALLY SOUND' '

*Moody's upgrade Somali Pirates to AAA

*HUD SAYS SOMALI DHOW FORECLOSURE PROGRAM HAD `VERY LOW' PARTICIPATION

*SOMALI PIRATES IN DISCUSSION TO ACQUIRE CITIBANK

*FED OFFICIALS: AGGRESSIVE EASING WOULD CUT SOMALI PIRATE RISK

*FED AGREED OCT. 29 TO TAKE `WHATEVER STEPS' NEEDED FOR SOMALI PIRATES

Saturday, November 22, 2008

Obama: "Act Swiftly and Boldly"

by Calculated Risk on 11/22/2008 07:00:00 PM

From the NY Times: Obama Vows Swift Action on Vast Economic Stimulus Plan

Mr. Obama said he would direct his economic team to design a two-year stimulus plan with the goal of saving or creating 2.5 million jobs, “a plan big enough to meet the challenges we face that I intend to sign soon after taking office” on Jan. 20, an indication that he would begin pushing his plan through Congress even before taking office.Here is Obama's radio address today (3 min 52 secs):

...

“The news this week has only reinforced the fact that we are facing an economic crisis of historic proportions,” Mr. Obama said. “We now risk falling into a deflationary spiral that could increase our massive debt even further.”

On the size of the stimulus plan from a Goldman Sachs research note yesterday:

We need a fiscal stimulus package that offsets most of the retrenchment in private spending that remains after offsets from a smaller real trade deficit and lower oil prices. Our recommendation has been a $300-$500bn package, but we regard this as the minimum of what would be desirable. The 4% of GDP that we estimate for the retrenchment amounts to $600bn.It sounds like we should expect a massive stimulus package to be signed by the end of January.

The good news is that the likelihood of a large package under President Obama is rising. Now many economists are calling for $300-$400bn, and some have proposed as much as $600bn; as recently as late October, when we first outlined the case for significant stimulus, $200bn was the highest figure on the table. The bad news is that implementation of whatever is adopted is at least two to three months away absent an extraordinary bipartisan effort. This is unfortunate, as the dynamics of the retrenchment have clearly developed a life of their own.

There is a good chance the simulus package will be along the lines proposed in September by Larry Summers:

The Composition of Stimulus

In many ways the composition of a fiscal stimulus program is a decision that goes to value rather than economic judgments. It seems to me however that particularly strong arguments can be made for the following components:

Support for low income families and for those who have been laid off is much more likely to be spent rapidly than support diffused more widely throughout the economy. Possible vehicles here include food stamps and extensions of unemployment insurance. [CR Note: President Bush signed an extension of unemployment benefits this week]

There is a compelling case for significant new commitment to infrastructure spending. While infrastructure spending is often seen as operating only with significant lags, I have become convinced that properly designed infrastructure support can make a timely difference for the economy. Evidence from the Minneapolis bridge collapse suggests that it is possible to launch infrastructure programs where the vast majority of the money is spent within a year. Moreover, the combination of declining trust fund revenues, and dramatic (more than 70 percent) increases in some categories of construction costs mean that there are a large number of projects that are currently on hold, slowed down, or contracted and awaiting funding. Properly designed infrastructure projects have the virtue of being helpful as short run stimulus, especially for the employment of the workers most hard hit by the housing decline, while at the same time augmenting the economy’s productive potential in the long run.

State and local governments are facing grave budget pressures resulting in forced cutbacks that in many cases compromise either very vulnerable populations, or necessary long term investments. While it is true that some state and local problems are consequences of imprudent tax cutting during the good times, there is a strong case that properly targeted assistance perhaps through temporary changes in Medicaid reimbursement rules could provide valuable stimulus to the economy while at the same time avoiding dangerous cutbacks.

Other areas that should receive consideration include compensating consumers in the most affected regions for the effects of higher energy prices through LIHEAP [CR note: with falling gasoline prices, this may not be needed] , beginning a process of making necessary investments in energy efficiency and renewable energy and where appropriate, responding to the adverse impacts of the ongoing financial turbulence.

Unemployment Hits the Inland Empire Hard

by Calculated Risk on 11/22/2008 03:33:00 PM

Please indulge me ...

Back in 2005, I wrote:

Of all the areas experiencing a housing boom, the areas most at risk have had the greatest increase in real estate related jobs. These jobs include home construction, real estate agents, mortgage brokers, inspectors and more. ... I believe that areas like the Inland Empire will suffer the most when housing activity slows.And in 2006, in response to a sanguine forecast from a local economist, I wrote: Housing: Inverted Reasoning?

[W]hat happens during a housing bust? Just look at the unemployment rate in the previous bust.And from the LA Times today: Surge in unemployment puts California's Inland Empire in tailspin

The unemployment rate in California rose from 5.2% to 10.4% in just over two years. For the Inland Empire, the unemployment rate rose from 4.8% to double digits in the same period, peaking at 12.4%. Yes, California was impacted by Defense cutbacks in the early '90s, but the areas that were most dependent on housing saw the largest increases in the unemployment rate.

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

If the Inland Empire is one of the birthplaces of the current recession, it is also at the forefront of the nation's growing pain over joblessness -- with the highest unemployment rate of any large metropolitan area in the country.Hoocoodanode?

State numbers released Friday show the Riverside, San Bernardino and Ontario area is now suffering from its highest unemployment rate in 13 years at 9.5% in October -- 3 percentage points higher than the national rate and 1.3 points higher than the state's rate of 8.2%.

Ignited by the collapse of the local housing market, which decimated the construction and lending industries, the wave of unemployment has trickled into almost every area, including retail, manufacturing and local government.

Downey Memories

by Calculated Risk on 11/22/2008 01:22:00 PM

Graphs: FDIC Bank Failures

by Calculated Risk on 11/22/2008 07:03:00 AM

Three banks were closed by the FDIC yesterday. To put these failures into perspective, here are two graphs: the first shows the number of bank failures by year since the FDIC was founded, and the second graph shows the size of the assets and deposits (in current dollars). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Back in the '80s, there was some minor multiple counting ... as an example, when First City of Texas failed on Oct 30, 1992 there were 18 different banks closed by the FDIC. This multiple counting was minor, and there were far more bank failures in the late '80s and early '90s than this year.

Note: there are 8,451 FDIC insured banks as of Q3 2008.

However banks are much larger today. The second graph (hat tip Kurt) shows the bank failures by total assets and deposits per year starting in 1934 (in current dollars adjusted with CPI).

The second graph (hat tip Kurt) shows the bank failures by total assets and deposits per year starting in 1934 (in current dollars adjusted with CPI).

WaMu accounts for a vast majority of the assets and deposits of failed banks in 2008, and it is important to remember that WaMu was closed by the FDIC, and sold to JPMorgan Chase Bank, at no cost to the Deposit Insurance Fund (DIF) or taxpayers.

There are many more bank failures to come over the next couple of years, mostly because of losses related to Construction & Development (C&D) and Commercial Real Estate (CRE) loans, but, excluding WaMu, the total assets and deposits of failed banks will probably be lower than in the '80s and early '90s.

NY Times: Citi in Talks With U.S. Government

by Calculated Risk on 11/22/2008 12:01:00 AM

From Andrew Ross Sorkin and Louise Story at the NY Times: Citigroup, Under Siege, Holds Talks With U.S.

Citigroup ... executives on Friday entered into talks with federal officials about how to stabilize the struggling financial giant.There is much more in the article. This weekend might be busy.

In a series of tense meetings and telephone calls, the executives and officials weighed several options, including whether to replace Citigroup’s chief executive, Vikram S. Pandit, or sell all or part of the company.

Friday, November 21, 2008

Bank Failures #21 and #22: Downey Savings & Loan Association, Newport Beach and PFF Bank & Trust, Pomona

by Calculated Risk on 11/21/2008 09:21:00 PM

From the FDIC: U.S. Bank Acquires All the Deposits of Two Southern California Institutions

U.S. Bank, National Association, Minneapolis, MN, acquired the banking operations, including all the deposits, of Downey Savings and Loan Association, F.A., Newport Beach, CA, and PFF Bank & Trust, Pomona, CA, in a transaction facilitated by the Federal Deposit Insurance Corporation.That makes three today!

...

As of September 30, 2008, Downey Savings had total assets of $12.8 billion and total deposits of $9.7 billion. PFF Bank had total assets of $3.7 billion and total deposits of $2.4 billion. Besides assuming all the deposits from the two California banks, U.S. Bank will purchase virtually all their assets. The FDIC will retain any remaining assets for later disposition.

The FDIC and U.S. Bank entered into a loss share transaction. U.S. Bank will assume the first $1.6 billion of losses on the asset pools covered under the loss share agreement, equal to the net asset position at close. The FDIC will then share in any further losses. Under the agreement, U.S. Bank will implement a loan modification program similar to the one the FDIC announced in August stemming from the failure of IndyMac Bank, F.S.B., Pasadena, CA.

The loss-sharing arrangement is expected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers as they will maintain a banking relationship.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Downey Savings will be $1.4 billion and $700 million for PFF Bank. U.S. Bank's acquisition of all the deposits of the two institutions was the "least costly" option for the FDIC's DIF compared to alternatives.

These were the twenty first and twenty second banks to fail in the nation this year, and the fourth and fifth banks to close in California.