by Calculated Risk on 11/24/2008 10:00:00 AM

Monday, November 24, 2008

Existing Home Sales in October

From NAR: Existing-Home Sales Soften on Economic Volatility

Existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 3.1 percent to a seasonally adjusted annual rate1 of 4.98 million units in October from a downwardly revised pace of 5.14 million in September, and are 1.6 percent below the 5.06 million-unit level in October 2007.

...

Total housing inventory at the end of October slipped 0.9 percent to 4.23 million existing homes available for sale, which represents a 10.2-month supply at the current sales pace, up from a 10.0-month supply in September.

Click on graph for larger image in new window.

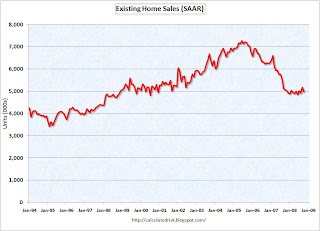

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2008 (4.98 million SAAR) were lower than in October 2007 (5.11 million SAAR) reversing the slight year-over-year increase last month.

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested last month that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

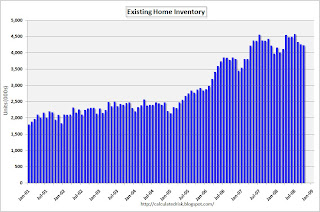

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.23 million in October, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.23 million in October, from an all time record of 4.57 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year. This decline was the normal seasonal pattern.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 10.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

I expect sales to fall further over the next few months, although inventory has peaked for the year. I'll have more on existing home sales soon - the NAR website is having problems.