by Calculated Risk on 11/21/2008 08:50:00 PM

Friday, November 21, 2008

Update: Banks Lending

FYI: A friend (in management at a public company) told me his company just obtained a new loan for expansion and a revolving line of credit. This loan is on the order of $100 million. One loan doesn't mean the credit markets are thawing - but the discussion definitely sounded like the banks are starting to lend again. Show me the money!

Bank Failure #20: Community Bank, Loganville, Georgia

by Calculated Risk on 11/21/2008 06:50:00 PM

From the FDIC: Bank of Essex, Tappahannock, Virginia Acquires All the Deposits of The Community Bank, Loganville, GA

The Community Bank, Loganville, Georgia, was closed today by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Bank of Essex, to assume all of the deposits of The Community Bank.One down today ...

...

As of October 17, 2008, The Community Bank had total assets of $681.0 million and total deposits of $611.4 million. Bank of Essex purchased approximately $84.4 million of The Community Bank's assets, and did pay the FDIC a premium of $3.2 million for the right to assume the failed bank's deposits. The FDIC will retain the remaining assets for later disposition.

...

The transaction is the least costly resolution option, and the FDIC estimates that the cost to its Deposit Insurance Fund will be between $200 million and $240 million. The Community Bank is the twentieth FDIC-insured institution to be closed nationwide, and the third in Georgia, this year.

Bank Failure Friday: Downey Edition?

by Calculated Risk on 11/21/2008 04:06:00 PM

From the LA Times: Downey Financial could be next bank casualty

Reeling from mortgage loan losses, Downey Financial Corp. warned last week that its choices were stark: Raise capital or risk a government takeover.Other possibilities mentioned (the usual suspects):

It's still waiting for that capital. And since today is Friday, the day when bank takeovers generally occur, industry observers will be watching again to see whether Downey turns the keys to its executive suite over to the Federal Deposit Insurance Corp.

The Inland Empire's PFF Bancorp, Vineyard National Bancorp and Temecula Valley Bancorp, for example, have seen their stocks punished especially hard by investors worried that their heavy emphasis on home construction loans will make it impossible to raise new capital or sell themselves.

Geithner Picked as Treasury Secretary

by Calculated Risk on 11/21/2008 03:19:00 PM

From the WSJ: Obama to Pick Geithner as Treasury Secretary

Mr. Obama plans to introduce his entire economic team early next week, hoping to sooth the roiling financial markets and answer rising pressure on the president-elect to become more involved.For more on NY Fed President Tim Geithner, see (from Feb 2007): Calm Before and During a Storm

BTW, Brad Setser at Follow the Money worked for Geithner at both the IMF and the Treasury. I'll be interested in his comments.

I think Geithner is a great choice.

California Unemployment Rate Hits 8.2%

by Calculated Risk on 11/21/2008 02:56:00 PM

From the LA Times: California unemployment jumps to 8.2%, third-highest in the U.S.

California's unemployment rate rose dramatically in October to 8.2%, its highest level in 14 yearsIt is grim here in California ...

...

The slowdown in the state's economy worsened in October as job losses spread from the hard-hit construction, real estate and financial services areas to retail sales, said Howard Roth, chief economist for the California Department of Finance. ...

"It looks like the grinch is stealing Christmas here," he said

Buffett: Unemployment will hit "New Heights"

by Calculated Risk on 11/21/2008 01:48:00 PM

Here are some excerpts, via the U.S. News & World Report, of a Fox News interview with Warren Buffett to be aired this afternoon.

On unemployment:

“There are going to be more people unemployed ... Five months from now ... it will be considerably higher ... It will happen eventually [surpassing 8%], and we will go on to new heights, but it will not turn around by mid-year next year.”On the potential auto bailout:

“I would drive a deal like I would drive myself if I were buying a business. And I think, I would say there's plan A or plan B. And if you don't want to do it this way, you know, then...take bankruptcy.

I would make the CEOs buy in. I would say, you know, the United States government is willing to put in X dollars, but we're going to have you put in a certain percentage of your net worth right along with us. We'll give you more upside, but you're going to lose if we lose.”

Kedrosky: The Option ARM Non-Bomb?

by Calculated Risk on 11/21/2008 12:14:00 PM

Paul Kedrosky writes: The Option ARM Non-Bomb? (hat tip Brett)

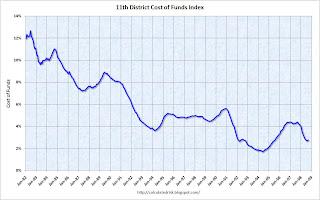

I just had someone email me something interesting today about their adjustable-rate mortgage resetting –- but to considerably lower levels. How widespread is this phenomenon? Or, asked differently, what percentage of ARMs are tied to Treasuries, as opposed to Libor, etc.?The answer from American CoreLogic, via Sue McAllister at the Mercury News, is 60% of ARMs are tied to a LIBOR index, about 25% to various treasuries, and the remaining 15% to the 11th District Cost of Funds Index (COFI -popular in California).

Click on graph for larger image.

Click on graph for larger image.This graph shows the 11th District Cost of Funds Index.

It appears ARMs tied to the COFI and treasuries will be non-bombs. The other 60% of loans tied to LIBOR might reset at a higher rate, although with the 3-month LIBOR down to 2.16% (it was 5.02% one year ago), even these 60% aren't bombs.

But we have to remember a higher interest rate is only one problem. Many of these borrowers had Option ARMs and were choosing the negatively amortizing or interest only options. When these loans recast, the borrowers will be required to pay the amortizing payment - and that could have a much larger impact on the monthly payment than the change in interest rates.

Remember "Reset" refers to a rate change. "Recast" refers to a payment change. See Tanta's Reset Vs. Recast, Or Why Charts Don't Match

Credit Crisis Indicators

by Calculated Risk on 11/21/2008 09:49:00 AM

Yesterday saw a stunning flight to treasuries across the board. The 3-month yield fell to zero. The 2 year yield was at a record low. Even the 30 year yield decreased sharply. The 3-month at zero can be explained as a flight to quality and another crisis in the credit markets, but the declines in the longer yields probably suggest deflation trades.

Here are a few indicators of credit stress once again suggesting little progress over the last few days.

The TED spread is stuck above 2.0, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5.

The 10-Year Treasury Note yield is also up slightly at 3.17%. The rush to treasuries of all durations was stunning yesterday!

This is the spread between high and low quality 30 day nonfinancial commercial paper. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

For the LIBOR, the TED spread, and the two-year swap, there has been clear progress - but there is still a ways to go. For the A2P2 spread (and all treasury yields), the markets are still in crisis.

Goldman Slashes GDP forecast

by Calculated Risk on 11/21/2008 08:29:00 AM

From Bloomberg: Goldman Slashes U.S. Growth Forecasts, Says Recession Deepens

In a research note released this morning, Goldman Sachs slashed their Q4 GDP forecast from a decline of 3.5%, to a decline of 5% in Q4 (at an annual rate). They are now forecasting unemployment will reach 9% by Q4 2009.

They are also forecasting (not in Bloomberg article) that unemployment will rise to 6.8% in November with 350,000 in reported job losses.

This isn't quite the "just awful" scenario, but it is pretty close.

Singapore in Recession

by Calculated Risk on 11/21/2008 01:57:00 AM

From MarketWatch: Singapore falls into recession, cuts 2009 outlook

Singapore became the third major Asia-Pacific economy to fall into recession after data released Friday showed the economy had contracted for two straight quarters.Pretty soon it will be easier to list the countries NOT in recession ...

...

The contraction, which followed a revised 5.3% fall in the second quarter from the first, means Singapore technically follows Japan and Hong Kong into recession.

Thursday, November 20, 2008

Citigroup to Hold Unscheduled Board Meeting Friday

by Calculated Risk on 11/20/2008 08:29:00 PM

From the WSJ: Citi Weighs Its Options, Including Firm's Sale

Executives at Citigroup ... began weighing the possibility of auctioning off pieces of the financial giant or even selling the company outright ...Here is the CNBC story: Citigroup May Seek Merger as Stock Plunges Further

Citigroup's board of directors is scheduled to have a formal meeting Friday to discuss the options ... In addition to pondering a move to sell the entire company to another bank, executives have started exploring the possibility of selling off parts of the firm, including the Smith Barney retail brokerage, the global credit-card division and the transaction-services unit, which is one of Citigroup's most lucrative and fast-growing businesses, the people said.

Repeat: Four Bad Bears and Two "Experts"

by Calculated Risk on 11/20/2008 07:36:00 PM

A couple of images of the day ... Click on graph for larger image in new window.

Doug Short of dshort.com (financial planner) sent me this graph of "Four Bad Bears".

The current stock market decline is the worst since the Great Depression.

| Click on cartoon for larger image in new window. This cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. was inspired by Professor Duy's post last night: Fed Watch: Policy Adrift |

Treasury Capital Purchase Program (TARP)

by Calculated Risk on 11/20/2008 05:38:00 PM

Here is the site for the TARP data (hat tip Ras Stash)

Here are the details released as of Nov 17th:

CAPITAL PURCHASE PROGRAM: $158,561,409,000 Total

| $15,000,000,000 | Bank of America Corporation |

| $3,000,000,000 | Bank of New York Mellon Corporation |

| $25,000,000,000 | Citigroup Inc. |

| $10,000,000,000 | The Goldman Sachs Group, Inc. |

| $25,000,000,000 | JPMorgan Chase & Co. |

| $10,000,000,000 | Morgan Stanley |

| $2,000,000,000 | State Street Corporation |

| $25,000,000,000 | Wells Fargo & Company |

| $10,000,000,000 | Merrill Lynch & Co., Inc. |

| $17,000,000 | Bank of Commerce Holdings |

| $16,369,000 | 1st FS Corporation |

| $298,737,000 | UCBH Holdings, Inc. |

| $1,576,000,000 | Northern Trust Corporation |

| $3,500,000,000 | SunTrust Banks, Inc. |

| $9,000,000 | Broadway Financial Corporation |

| $200,000,000 | Washington Federal Inc. |

| $3,133,640,000 | BB&T Corp. |

| $151,500,000 | Provident Bancshares Corp. |

| $214,181,000 | Umpqua Holdings Corp. |

| $2,250,000,000 | Comerica Inc. |

| $3,500,000,000 | Regions Financial Corp. |

| $3,555,199,000 | Capital One Financial Corporation |

| $866,540,000 | First Horizon National Corporation |

| $1,398,071,000 | Huntington Bancshares |

| $2,500,000,000 | KeyCorp |

| $300,000,000 | Valley National Bancorp |

| $1,400,000,000 | Zions Bancorporation |

| $1,715,000,000 | Marshall & Ilsley Corporation |

| $6,599,000,000 | U.S. Bancorp |

| $361,172,000 | TCF Financial Corporation |

Fannie and Freddie to Suspend Foreclosures

by Calculated Risk on 11/20/2008 04:43:00 PM

Press Release from Fannie Mae (no link yet): Fannie Mae to Suspend Foreclosures Until January

In order to support the streamlined modification program announced on November 11, 2008, Fannie Mae (NYSE: FNM) today issued a notice to its loan servicing organizations and retained foreclosure attorneys directing them to suspend foreclosure sales on occupied single-family properties as well as the completion of evictions from occupied single-family properties scheduled to occur from November 26, 2008 until January 9, 2009.Freddie Mac also announced they are suspending foreclosures.

The temporary suspension of foreclosures is designed to allow affected borrowers facing foreclosure to retain their homes while Fannie Mae works with mortgage servicers to implement the streamlined modification program scheduled to launch December 15.

Graph: Worst Crash Since Great Depression

by Calculated Risk on 11/20/2008 04:31:00 PM

Check out Doug's site - he has added some tabs to see other crashes and recoveries ... Click on graph for larger image in new window.

Doug Short of dshort.com (financial planner) sent me this graph of "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Most Severe Market Crash Since Great Depression

by Calculated Risk on 11/20/2008 03:53:00 PM

I'll have the graph soon ...

DOW off 430

S&P500 off 53 at 11 1/2 year low (April 1997).

NASDAQ off 70

Another day of cliff diving.

LA Times: Auction of Building Equipment

by Calculated Risk on 11/20/2008 02:16:00 PM

The front page (pdf) of the LA Times has this picture of building equipment for sale in the Inland Empire. Click on photo for larger image in new window. |  |

From the LA Times: Housing slowdown spurs auction of construction equipment

Sellers said they were purging their inventories to pull in operating capital. Buyers said they were lured by cheap prices, although several expressed reluctance to spend money on equipment that could remain idle for months.Not much demand to move dirt in Southern California!

"These are the worst prices I've ever seen," said Steve Thompson, 52, who was there to make bids for Chuck Green & Associates Inc., a San Diego County company that buys, resells and rents heavy equipment.

Back in 2005, during the boom, the company sold a used hydraulic dirt excavator for $309,000. That same excavator changed hands Tuesday for just $50,000.

DataQuick: Foreclosure Resales Almost Half of Bay Area California Activity

by Calculated Risk on 11/20/2008 01:13:00 PM

From DataQuick: Bay Area median price tumbles to $375K; sales reach high for '08

Bay Area homes sold at their fastest pace in 17 months in October as buyers favored more affordable inland areas where depreciation and foreclosures have hit hardest. As a result, the median sale price continued its steep, months-long decline, falling a record 40.6 percent, or $256,000, from a year ago, a real estate information service reported.Be careful with the median price - the mix has shifted to more homes in lower priced neighborhoods with significant foreclosure resale activity - and that reduces the median price. The Case-Shiller index is a better measure of house price declines.

...

Last month's sales were the highest for any month since June 2007, when 7,964 homes sold. But sales were still the second-lowest for any October since 1995 and were 14.2 percent below the average number sold during October since 1988, when DataQuick's statistics begin.

...

Last month 44.8 percent of all existing homes sold in the Bay Area had been foreclosed on at some point in the prior 12 months, up from 41.9 percent in September and 8.2 percent a year ago.

Report: Senate Reaches Deal on Automaker Bailout

by Calculated Risk on 11/20/2008 12:41:00 PM

From the Detroit Free Press: Compromise reached on $25-billion auto bailout

Key senators reached a compromise today on a $25-billion bailout of Detroit's automakers, but questions remained as to whether there were enough votes or time to pass the bill today.It is not clear there are enough votes to pass this compromise bill - and if President Bush will sign it.

...

A draft of the compromise being worked on by Michigan Sen. Carl Levin and Sen. Christopher Bond, R-Mo., would have used the $25 billion set aside by Congress in September for retooling auto plants over the next several years and lend it to automakers immediately.

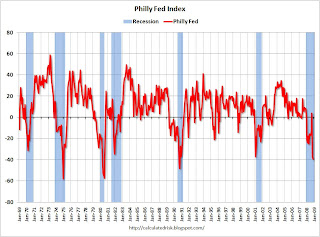

Philly Fed: Manufacturing sector index "lowest level since October 1990"

by Calculated Risk on 11/20/2008 10:41:00 AM

Until recently the manufacturing sector (except the automakers) was holding up pretty well. Not anymore ...

Here is the Philadelphia Fed Index for November activity released today: Business Outlook Survey.

Conditions in the region's manufacturing sector continued to deteriorate, according to firms polled for this month's Business Outlook Survey. Most broad indicators declined again in November, following sharp decreases in October. ... Most of the survey's indicators of future activity slid further into negative territory this month, suggesting that the region's manufacturing executives expect continued declines over the next six months.

...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from -37.5 in October to -39.3 this month. This index, which fell a dramatic 41 points last month, is now at its lowest level since October 1990.

...

The current employment index fell notably this month, declining seven points, to -25.2

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index vs. recessions for the last 40 years. The manufacturing sector is clearly in recession - although still not as bad as during earlier recessions.