by Calculated Risk on 9/25/2008 10:10:00 AM

Thursday, September 25, 2008

August New Home Sales: Lowest August Since 1982

According to the Census Bureau report, New Home Sales in August were at a seasonally adjusted annual rate of 460 thousand. Sales for July were revised up slightly to 520 thousand.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for August since 1982. (NSA, 39 thousand new homes were sold in August 2008, 36 thousand were sold in August 1982).

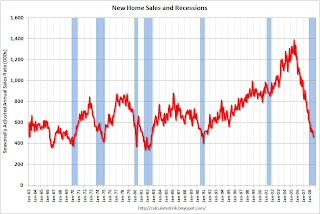

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in August 2008 were at a seasonally adjusted annual rate of 460,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.5 percent below the revised July rate of 520,000 and is 34.5 percent below the August 2007 estimate of 702,000.And one more long term graph - this one for New Home Months of Supply.

"Months of supply" is at 10.9 months.

"Months of supply" is at 10.9 months. Note that this doesn't include cancellations, but that was true for the earlier periods too. Sales are falling quickly, but inventory is declining too, so the months of supply is slightly lower than the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of August was 408,000. This represents a supply of 10.9 months at the current sales rate.Inventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

As I noted last month, I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

This is a very weak report, but as grim as the news is for new home sales, I remain more pessimistic about existing home sales, and existing home prices, than new home sales.

New Home Sales Decline Sharply

by Calculated Risk on 9/25/2008 10:05:00 AM

From the Census Bureau: New Residential Sales in August 2008

Sales of new one-family houses in August 2008 were at a seasonally adjusted annual rate of 460,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.5 percent below the revised July rate of 520,000 and is 34.5 percent below the August 2007 estimate of 702,000.This is a very weak report. Analysis and graphs coming ...

Reports: Paulson Plan Deal Near

by Calculated Risk on 9/25/2008 09:18:00 AM

From the WSJ: Bailout Pact Gains Momentum Amid Push for Tough Controls

A likely bill would include limits on executive pay in situations where the government puts a large amount of money into a failing institution. In certain cases, the government could receive warrants that would give it the right to acquire shares in the company. Also included is beefed-up oversight through the Government Accountability Office, an investigative arm of Congress.The real question is the price mechanism for buying securities.

Likely not included is a controversial idea to let judges alter the terms of mortgages during bankruptcy proceedings.

Vikas Bajaj writes in the NY Times: Plan’s Mystery: What’s All This Stuff Worth?. See the story about the Bear Stearns Alt-A Trust 2006-7.

Bear Stearns bundled the loans into 37 different kinds of bonds, ranked by varying levels of risk, for sale to investment banks, hedge funds and insurance companies.This is the problem when you hear about the losses associated with a Trust. In this case the overall losses are only 1.6% so far (but this is Alt-A so it will get much worse), but many of lower tranches have been wiped out.

If any of the mortgages went bad — and, it turned out, many did — the bonds at the bottom of the pecking order would suffer losses first, followed by the next lowest, and so on up the chain. By one measure, the Bear Stearns Alt-A Trust 2006-7 has performed well: It has suffered losses of about 1.6 percent. Of those loans, 778 have been paid off or moved through the foreclosure process.

But by many other measures, it’s a toxic portfolio.

We don't know if Paulson will overpay for assets - losing money for the taxpayers - and that is why warrants are necessary.

Weekly Unemployment Claims Jump to 493,000

by Calculated Risk on 9/25/2008 08:44:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 20, the advance figure for seasonally adjusted initial claims was 493,000, an increase of 32,000 from the previous week's revised figure of 461,000. It is estimated that the effects of Hurricane Gustav in Louisiana and the effects of Hurricane Ike in Texas added approximately 50,000 claims to the total. The 4-week moving average was 462,500, an increase of 16,000 from the previous week's revised average of 446,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims. The four moving average is at 462,500.

Some of the jump in unemployment claims is a result of the hurricanes - and should be temporary - but away from the financial crisis this shows there are significant weaknesses in the labor market and real economy.

GE Warns: "Difficult Conditions", Sees No Near Term Improvement

by Calculated Risk on 9/25/2008 08:29:00 AM

The WSJ reports: GE Cuts Earnings Forecast, Suspends Stock Buyback that GE lowered its earning guidance, suspended its stock buyback, and will probably not increase its dividend.

[GE cited] "unprecedented weakness and volatility in the financial-services markets," and ... issued a harrowing projection for the economy, as predicting "that difficult conditions in the financial-services markets are not likely to improve in the near future."

Wednesday, September 24, 2008

Bush: "Entire Economy is in Danger"

by Calculated Risk on 9/24/2008 09:32:00 PM

From the WSJ: Bush Addresses Bailout Plan

President George W. Bush on Wednesday warned Americans and legislators reluctant to pass a historic financial rescue plan that failing to act fast risks wiping out retirement savings, rising foreclosures, lost jobs, closed business and "a long and painful recession."From the NY Times: President Issues Warning to Americans

From the WaPo: Bush: 'Our Entire Economy Is in Danger'

Bush painted a grim picture view of the future if Congress doesn't act, but he really didn't address how the plan would work. Bush did comment that the plan was to buy assets "at the current low price", seemingly contradicting the comments from Bernanke and Paulson earlier today that they would buy at above the current "fire sale" prices.

I'm not sure if this speech will motivate people to call their representatives, but it might motivate people that haven't been paying attention to say: "Wow, this is bad. Let's make sure our money is safe, and watch our expenditures." And that could lead to a deeper recession.

Video: Bush on Financial Crisis at 9PM ET

by Calculated Risk on 9/24/2008 08:36:00 PM

President Bush will speak on the financial crisis and Paulson bailout plan at 9 PM ET. The speech is expected to run 12 to 14 minutes according to the WSJ.

The speech will be on (C-SPAN2) for those that want to watch online. Here is the C-SPAN live video.

And on CNBC. Here is the live video from CNBC.

Discussion in the comments.

Fitch cuts WaMu to Junk

by Calculated Risk on 9/24/2008 07:01:00 PM

From MarketWatch: Fitch cuts WaMu long-term issuer default rating to junk

Is it Friday yet?

In Their Own Words: Paulson, Bush, Bernanke in 2007

by Calculated Risk on 9/24/2008 05:27:00 PM

[I]sn’t it bizarre to have officials who miscalled so much ... confidently declaring that they know better than the market what a broad class of securities is worth?Here are clips of Paulson, Bernanke, Bush and presidential economic advisor Edward Lazear from 2007:

Professor Krugman, Sept 24, 2008

Krugman: "Slap in the Face" Theory

by Calculated Risk on 9/24/2008 03:56:00 PM

From Professor Krugman: A $700 billion slap in the face

[L]et’s talk about how governments normally respond to financial crisis: namely, they rescue the failing financial institutions, taking temporary ownership while keeping them running. If they don’t want to keep the institutions public, they eventually dispose of bad assets and pay off enough debt to make the institutions viable again, then sell them back to the private sector. But the first step is rescue with ownership.There is much more, but this point can't be emphasized enough:

That’s what we did in the S&L crisis; that’s what Sweden did in the early 90s; that’s what was just done with Fannie and Freddie; it’s even what was done just last week with AIG. It’s more or less what would happen with the Dodd plan, which would buy bad debt but get equity warrants that depend on the later losses on that debt.

But now Paulson and Bernanke are proposing, very nearly, to do the opposite: they want to buy bad paper from everyone, not just institutions in trouble, while taking no ownership. In fact, they’ve said that they don’t want equity warrants precisely because they would lead financial institutions that aren’t in trouble to stay away. So we’re talking about a bailout specifically designed to funnel money to those who don’t need it.

It took four days before P&B offered any explanation whatsoever of their logic. But as of now, it seems that the argument runs like this: mortgage-related assets are currently being sold at “fire-sale” prices, which don’t reflect their true, “hold to maturity” value; we’re going to pay true value — and that will make everyone’s balance sheet look better and restore confidence to the markets.

As I said, this is really a giant version of the slap-in-the-face theory: markets are getting hysterical, and the feds can calm them down by buying when everyone else is selling.

And isn’t it bizarre to have officials who miscalled so much — “All the signs I look at,” declared Paulson in April 2007, show “the housing market is at or near a bottom” — confidently declaring that they know better than the market what a broad class of securities is worth?If these are "fire sale" prices because of impending distress, then shouldn't the government be stepping in and taking temporary ownership? Or at the least a percentage of ownership while making an investment to increase capital, like with the Reconstruction Finance Corporation (RFC) during the Depression?

emphasis added

Note: the RFC is considered by most economists to have been very successful.

Video: Bernanke and Paulson at 2:30 PM ET Testify Before Congress

by Calculated Risk on 9/24/2008 02:24:00 PM

For those that want to watch online, here is the C-Span live video.

And here is a live video from CNBC.

Discussion in the comments.

AP: Paulson Agrees to Executive Pay Limits as Part of Plan

by Calculated Risk on 9/24/2008 01:51:00 PM

From AP: Bush to address nation tonight on economy woes

But what about contingent shares, oversight, and transparency?

UPDATE: CNBC reports: Treasury Denies Report of Deal on Capping CEO Pay

Bank Run in Asia

by Calculated Risk on 9/24/2008 01:16:00 PM

From the NY Times: Anxious Depositors Withdraw Cash From Asian Bank (hat tip Dave B)

Throngs of depositors lined up outside the headquarters and branches of the Bank of East Asia here on Wednesday to withdraw their money, underlining widespread anxiety in Asia that Wall Street’s recent difficulties might spread across the Pacific.Check out the photo. It looks like the earlier bank runs at Northern Rock and IndyMac.

Bernanke on Recapitalization

by Calculated Risk on 9/24/2008 01:02:00 PM

I listened to Chairman Bernanke's testimony this morning. It is clear the goal is to recapitalize the banks, and Dr. Bernanke implied this would happen either by paying more than current book value (with the banks taking write-ups) or by building confidence in private investors after the toxic securities are bought by the taxpayers.

Bernanke went on to say that private investors might not be interested in investing if there were contingent shares outstanding - because they would be afraid of dilution.

From Bloomberg: Paulson, Bernanke Put Bank Aid Ahead of Best Deal

Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben S. Bernanke have signaled that their priority is shoring up the nation's banks even if it means they don't get taxpayers the cheapest prices for the devalued assets the government buys.And if the program was changed to an RFC type recapitalization (as opposed to buying toxic assets), then most lenders wouldn't participate until they were at death's door.

``I am not advocating that the government intentionally overpay,'' Bernanke told the Joint Economic Committee today, in response to a question from U.S. Rep. Jim Saxton, a New Jersey Republican.

...

Senate Banking Committee Chairman Christopher Dodd has proposed that the Treasury potentially receive equity stakes in some companies that sell assets to the government. The stakes would ``vest'' in an amount equal to the 125 percent of the dollar value of the loss realized by the Treasury on the sale of the assets.

That type of ``loss participation'' proposal would endanger companies' ability to raise private capital afterwards, Jeffrey Rosenberg, head of credit strategy research at Bank of America Corp. in New York, wrote in a report yesterday.

What a mess.

And a final point, many people are saying the government can only lose a portion of the $700 billion because there will be offsetting assets. This is true in the Fannie and Freddie conservatorship (the mortgage assets mostly offset the debt of Fannie and Freddie), but it is not true here. Although Paulson and Bernanke are talking about hold-to-maturity prices, they are also talking about both buying and selling securities. A little math will show that if you take a loss (say 30%) on each transaction, it doesn't take many transaction to lose most of the entire $700 billion.

S&P cuts WaMu to 'poor quality'

by Calculated Risk on 9/24/2008 11:51:00 AM

From MarketWatch:

[S&P] ... lowered Washington Mutual Inc.'s counterparty credit rating to "poor quality" of CCC/C from BB-/B. "The downgrade was due to the increased likelihood that a potential sale of the company may not involve the whole company, which increases the risk of default for holding company creditors," said Victoria Wagner, an S&P credit analyst.Is it Friday yet?

emphasis added

Bernanke Live Video

by Calculated Risk on 9/24/2008 11:22:00 AM

For those that want to watch online, here is a live video from CNBC. (hat tip NoVAOnlooker)

Update: Over now.

Existing Home Sales, NSA

by Calculated Risk on 9/24/2008 10:43:00 AM

Here is a look at Not Seasonally Adjusted existing home sales: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in August 2008 compared to the previous three years.

NSA sales were reported at 489 thousand in August, about 15% less than August 2007. Usually NSA sales in August are higher than July, but not this year.

There have been 3.38 million sales so far in 2008, and sales are currently on pace for about 4.9 million total this year.

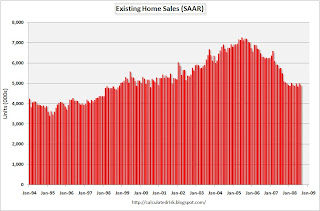

August Existing Home Sales Decline

by Calculated Risk on 9/24/2008 09:47:00 AM

From NAR: Existing-Home Sales Slide on Tight Mortgage Availability

Existing-home sales were down in August following a healthy gain in July as tight mortgage credit curtailed activity, according to the National Association of Realtors®. Sales rose in the Midwest and South but fell in the Northeast and West.

Nationally, existing-home sales – including single-family, townhomes, condominiums and co-ops –declined 2.2 percent to a seasonally adjusted annual rate1 of 4.91 million units in August from an upwardly revised pace of 5.02 million in July, but are 10.7 percent below the 5.50 million-unit pace in August 2007.

Total housing inventory at the end of August fell 7.0 percent to 4.26 million existing homes available for sale, which represents a 10.4-month supply at the current sales pace, down from a revised 10.9-month supply in July.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2008 (4.91 million SAAR) were the weakest August since 1998 (4.74 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested two months ago that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means activity (ex-foreclosures) is running around 3.3 million SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.26 million in August, from an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.26 million in August, from an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year. This decline was the normal seasonal pattern.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply declined to 10.4 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

My forecast was for Months of Supply to peak at about 12 months this year and this metric was pretty close.

I expect sales to fall further over the next few months, although I think inventory has peaked for the year.

TED Spread: Back in "Credit Hell"

by Calculated Risk on 9/24/2008 09:39:00 AM

Here is the TED Spread from Bloomberg. The TED spread has increased to 3.02% (after falling to just over 2.5% yesterday). This suggests the credit markets are still in "credit hell" as reader BR put it this morning.

Most of the increase in the TED spread is because the three month T-bill is trading back down to 0.47%.

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

Buffett: Paulson Plan "Absolutely Necessary"

by Calculated Risk on 9/24/2008 09:07:00 AM

Warren Buffett was interviewed on CNBC this morning.

From Bloomberg: Buffett Calls Crisis an `Economic Pearl Harbor,' Backs Paulson

Billionaire investor Warren Buffett, calling the market turmoil ``an economic Pearl Harbor,'' said Treasury Secretary Henry Paulson's $700 billion proposal to prop up the U.S. financial system is ``absolutely necessary.''On his investment in Goldman, Buffett said:

``I am betting on the Congress doing the right thing for the American public and passing this bill,'' Buffett said.

"If I didn't think the government was going to act I wouldn't have done anything."