by Calculated Risk on 12/06/2007 07:16:00 PM

Thursday, December 06, 2007

Fed: Existing Household Real Estate Assets Decline $67 Billion in Q3

Here is some more data from the Fed's Flow of Funds report.

The Fed report shows that household real estate assets increased from $20.94 Trillion in Q2 to $20.99 Trillion in Q3. However, when we subtract out new single family structure investment and residential improvement, the value of existing household real estate assets declined by $67 Billion.

The simple math: Increase in household assets: $20,991.18 Billion minus $20,937.62 Billion equals $53.56 Billion. Now subtract investment in new single family structures ($297.2 Billion Seasonally Adjusted Annual Rate) and improvements ($185.8 Billion SAAR). Note: to make it simple, divide the SAAR by 4.

Finally $53.56B minus $297.2B/4 minus $185.8B/4 equals a decline in existing assets of $67.2B. This was a quarterly price decline of about 0.3%, about the same as the OFHEO House Price index decline.

As mentioned earlier, household equity declined by $128 Billion in Q3.

Household debt increased by $182.1 Billion in Q3 (down from $213.6B in Q2, and up slightly from $181.48B in Q1 2007). The mortgage equity withdrawal numbers will probably still be fairly strong in Q3.

Household percent equity was at an all time low of 50.4%. Click on graph for larger image.

This graph shows homeowner percent equity since 1954. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity extraction 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.

Also note that this percent equity includes all homeowners. Based on the methodology in this post, aggregate percent equity for households with a mortgage has fallen to 33% from 36% at the end of 2006.The second graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining, although mortgage debt as a percent of GDP still increased in Q3.

If Goldman Sachs and Moody's are correct and house prices fall 15% nationally (30% in some areas), the value of existing household real estate assets will fall by $3 Trillion over the next few years.

You Can't Make Stuff Like This Up

by Anonymous on 12/06/2007 06:55:00 PM

From CNN:

WASHINGTON (CNN) — Harried homeowners seeking mortgage relief from a new Bush administration hotline Thursday had to contend with a bit of temporary misdirection from the president himself.

As he announced his plan to ease the mortgage crisis for consumers, President Bush accidentally gave out the wrong phone number for the new “Hope Now Hotline” set up by his administration.

Anyone who dialed 1-800-995-HOPE did not reach the mortgage hotline but instead contacted the Freedom Christian Academy — a Texas-based group that provides Christian education home schooling material.

The White House press office quickly put out a correction moments after the President’s remarks. After dialing the correct number, 1-888-995-HOPE, CNN was connected to a “counselor” within three minutes.

The Plan: My Initial Reaction

by Anonymous on 12/06/2007 04:20:00 PM

A lot of people are very worked up over the idea that the New Hope Plan is, in essence, the government mandating a kind of reneging on private contracts (the PSAs or Pooling and Servicing Agreements that govern how securitized loans are handled). I personally think you can all stand down on that one. From what I have seen about the plan to date, it is clear to me that it is in fact structured with the overarching goal of making sure that it stays on the allowable side of the existing contracts. I proceed from the assumption that nobody could write such a convoluted and counter-intuitive plan if that wasn’t the goal. So everyone who is thinking, “Gee, we’re violating contracts and we still don’t get much out of it!” is thinking the wrong thing, in my view. It’s more like “Gee, we don’t get much out of it when we don’t violate contracts.”

American Banker has a summary of The Plan details up here (it’s free this week if you register, and the registration process is painless). The basic outline is that loans are put into three segments:

1. Borrower appears (from fairly superficial analysis of the data, not any deep digging) to be eligible for a refinance. These borrowers are to be encouraged to refinance.

2. Borrower appears able to make payment at current rate, but appears (again, from fairly superficial analysis) to be unlikely to be able to refinance (generally because LTV is too high with FICO too low). These borrowers are eligible for the “fast-tracked” mod (the rate freeze) if they meet some FICO and payment increase tests.

3. Borrower appears unable to make payment even at current rate; these borrowers are presumed to be unable to refinance. They are not eligible for the “fast track” rate freeze mod; they may be eligible for some kind of work out, but it would have to be handled the old-fashioned fully-analyzed case-by-case way.

There’s some detail about the FICO and payment tests used in segment 2.

I’m guessing that structuring of things will strike folks as weird. To me, it says that a rule of thumb is being created that puts borrowers in three categories:

1. Not in default and default not imminent

2. Not in default and default reasonably foreseeable

3. In default or default imminent

As it happens, the PSAs for these deals will nearly universally contain language that says loans can only be modified if they are in default, or default is imminent, or default is reasonably foreseeable. Therefore, what The Plan does is simply provide a kind of standard definition of those categories for the vintages of loans in question. That’s why the Group 1 borrowers—those who could be eligible for a refinance—are never eligible for these “fast track” mods. It is hard to say that default (in the current pool) is reasonably foreseeable for a loan that has a refinance opportunity. No, it doesn’t make any difference that the refinanced loan might be highly likely to default at some fairly soon point in some new pool. This isn’t about solving the borrower’s problems permanently in the best possible way (a mod might be a better permanent solution than a refi for the borrower). It’s about solving the problem while staying inside the security rules.

And the rules in question are really important ones, not just idiosyncratic servicing rules that could probably be waived in a crisis by the trustee with the consent of the rating agencies.

First, REMICs (go here if you have no idea what a REMIC is). REMIC election involves the tax treatment of principal and interest payments and is much too complex to summarize here. The basic issue is that it creates a trust that owns the underlying pool of loans. The trust issues two classes of securities, regular interests and a residual interest. Interest income is taxable (as ordinary income) to the holders of regular interests. Gain/loss for tax purposes is also taken by the residual holder. The trust itself is not taxed; it’s just a pass-through entity. That prevents a “double taxation” from arising, in which the trust would have to pay taxes on interest income and then the regular class holders would also pay taxes.

One of the qualifying requirements of REMIC status is that the underlying pool of loans is “fixed.” REMICs do not acquire new loans after their pools are established; they do not account for any loans on a “held for sale” basis and they do not sell any loans. (Putbacks for breach are an exception, and always transact at par, not at market value.) If at any time the trust starts taking actions that can be interpreted as “actively managing” the underlying pool, the REMIC status is in jeopardy (the trust might have to start paying taxes, which would make the whole deal uneconomical).

So while the legislation and IRS rules authorizing and dealing with REMICs are not really about defining default servicing practices, they have affected default servicing practices (loss mitigation) because they have defined a kind of transaction that might look like active management of the pool but really isn’t: modifications (or other workouts) for defaulted or about-to-default loans. In essence, the REMIC law creates an exception for these loss-mit practices, so that servicers can use them without endangering the REMIC status of the trust. This is how what might seem like unrelated issues—how to best service a mortgage loan, how trust entities are or are not taxed by the IRS—get related.

The issue is further complicated by the off-balance-sheet nature of these trusts. (They don’t have to be off-balance sheet, but most of them are.) To be accounted for off the issuer’s balance sheet, the trust must be “qualifying” under the SFAS 140 rules. The “Q status” is similar to the REMIC status: the pool must be “static” or fixed or not actively managed or, in the charming industry parlance, “brain dead.” If it is determined that a pool is being actively managed, it “loses its Q” and gets forced onto the issuer’s balance sheet. SFAS 140, like the tax code, isn’t designed to be about good mortgage servicing practices, but it, like the tax code, has to include some definitions of acceptable “managing” of individual loans that are exceptions to the “brain dead pool” rule.

There was a bit of a dust-up earlier this year over the SFAS 140 issue. In a nutshell, while the REMIC law says that modifications are OK when the loan is in default or default is reasonably foreseeable, there was some concern that SFAS 140 only allows modifications if the loan is in default. That would mean that if you modified a loan that was current today, but that you had reason to believe would default next month (say, at reset) if you didn’t do anything about it, you’d be OK with your REMIC status but not OK with your Q status. The waters were calmed when the SEC published an official opinion that “reasonably foreseeable default” was an acceptable basis for modifying a loan under SFAS 140 as well as IRS 860D.

The takeaway point: a great deal of more-or-less informed commentary and blather you will find on whether securitizations “allow” modifications is based not on a question of what verbiage is or is not in the PSA, but rather on an interpretation of what is or is not required for REMIC tax treatment or off-balance sheet accounting. All the PSAs say, somewhere, that servicers will not do things that would jeopardize REMIC status or Q election. The whole point of the letter opinion released by the SEC this summer was to create a kind of regulatory “safe harbor” here: it said that if servicers use the “reasonably foreseeable default” standard that they are already allowed to use for REMIC-status purposes, they are OK with Q-status.

This “safe harbor” for Q-status did not and does not “override” any explicit contractual limitations on modifications that might be in any given PSA. In other words, if the PSA says explicitly that mods are allowed only for loans in default, but not for loans that are current (but likely to default), then that’s the standard. If a servicer went ahead and modified a current loan (under the “reasonably foreseeable” standard), then the servicer could be in breach of the PSA contract, even though the servicer is OK on the REMIC status and Q status. This raises the interesting question of whether there are actually any PSAs that so explicitly forbid this kind of modification, and if so, how many; that’s our next subject. But I know of no informed, sane observer who is claiming that the SEC letter, for instance, was a form of government abrogating of existing contracts. It was simply a case of a regulator ruling that if the PSA allows a certain class of modifications (implicitly or explicitly), the servicer’s exercise of the option to pursue those mods would not create an accounting nightmare. You may, if you like, interpret that as a regulator removing an obstacle to the enforcement of contracts as written.

So what do the PSAs say?

This is a hard question to answer definitively, because the PSAs for mortgage-related securitizations have not been forced to be uniform on this (or about 100 other) subjects. It is possible that some verbiage related to loss mit and modifications differs between contracts because someone somewhere really thought it was important; it is possible that some of it differs just because different law firms with different styles were used to draft the PSAs; it is possible that some of this is a matter of a lapse of attention somewhere. I think it never pays to underestimate the extent to which the industry does certain things because they did it that way back when they did their first securitization, and at no time since then has it ever become an issue, and nobody makes bonuses by making issues out of things that aren’t issues. Certain people have reacted to proposals for “safe harbor” legislation involving mortgage modifications by assuming, not necessarily wisely, that the contractual provisions in question are always and everywhere something that the parties to the contract have a real interest in defending or enforcing. The possibility that both servicers and investors are going back, reading these things, slapping themselves on the heads and saying, “Damn, why’d we put that in there?” is very real. Unfortunately, “investors” are so diverse and numerous and diffused that you just don’t get two parties sitting down and amicably agreeing to amend these PSAs to clear up a little problem.

So we get back to the apparently empirical question of what these PSAs actually do say. I have read many of them, but I sure haven’t read all of them. I am therefore willing to take the American Securitization Forum’s word for it here:

These agreements typically employ a general servicing practice standard. Typical provisions require the related servicer to follow accepted servicing practices and procedures as it would employ “in its good faith business judgment” and which are “normal and usual in its general mortgage servicing activities” and/or certain procedures that such servicer would employ for loans held for its own account.The ASF goes on to propose model contract language that it encourages the industry to adopt. This would go a long way to preventing this kind of chaos in the future. But even with existing documents, you will note that it appears that very few have explicit restrictions on modifications (aside from the “golden rule” standard of generally accepted servicing practices, with the expectation that the servicer will treat the pooled loans in the same way it would treat its own portfolio of loans). Those that do have explicit restrictions have mechanisms for those restrictions to be amended, in most cases by less than 100% concurrence of all investors.

Most subprime transactions authorize the servicer to modify loans that are either in default, or for which default is either imminent or reasonably foreseeable. Generally, permitted modifications include changing the interest rate on a prospective basis, forgiving principal, capitalizing arrearages, and extending the maturity date. The “reasonably foreseeable” default standard derives from and is permitted by the restrictions imposed by the REMIC sections of the Internal Revenue Code of 1986 (the “REMIC Code”) on modifying loans included in a securitization for which a REMIC election is made. Most market participants interpret the two standards of future default – imminent and reasonably foreseeable – to be substantially the same.

The modification provisions that govern loans that are in default or reasonably foreseeable default typically also require that the modifications be in the best interests of the securityholders or not materially adverse to the interests of the securityholders, and that the modifications not result in a violation of the REMIC status of the securitization trust.

In addition to the authority to modify the loan terms, most subprime pooling and servicing agreements and servicing agreements permit other loss mitigation techniques, including forbearance, repayment plans for arrearages and other deferments which do not reduce the total amount owing but extend the time for payment. In addition, these agreements typically permit loss mitigation through non-foreclosure alternatives to terminating a loan, such as short sales and short payoffs.

Beyond the general provisions described above, numerous variations exist with respect to loan modification provisions. Some agreement provisions are very broad and do not have any limitations or specific types of modifications mentioned. Other provisions specify certain types of permitted modifications and/or impose certain limitations or qualifications on the ability to modify loans. For example, some agreement provisions limit the frequency with which any given loan may be modified. In some cases, there is a minimum interest rate below which a loan's rate cannot be modified. Other agreement provisions may limit the total number of loans that may be modified to a specified percentage (typically, 5% where this provision is used) of the initial pool aggregate balance. For agreements that have this provision: i) in most cases the 5% cap can be waived if consent of the NIM insurer (or other credit enhancer) is obtained, ii) in a few cases the 5% cap can be waived with the consent of the rating agencies, and iii) in all other cases, in order to waive the 5% cap, consent of the rating agencies and/or investors would be required. It appears that these types of restrictions appear only in a minority of transactions. It does not appear that any securitization requires investor consent to a loan modification that is otherwise authorized under the operative documents.

So is all this uproar over contractual provisions just a tempest in a teapot? Well, some of it is. The issue around “safe harbor” and enforcement of contracts heated up once we moved from the proposition of doing mods the old-fashioned “case by case” way, and into this new idea of the “freeze” or a kind of across-the-board approach to modifications. It is that, specifically, that appears to some people to be a violation of contract provisions; therefore, to give servicers “safe harbor” for using the “freeze” approach would, it seems to many people, be a case of the government invalidating contracts.

Whether this is really a serious issue or not depends on how the “freeze” thing works out in detail. It seems likely to me that Sheila Bair’s original proposal for the “across the board” freeze of all ARM rates would, in fact, have run into this very serious problem. It’s not that in that case the number of modifications would exceed the set caps in the contracts; it would clearly do so for those contracts with caps, but as we’ve seen those caps can be waived or amended in most cases. The problem with the Bair proposal is that it doesn’t measure each modification against the standard of benefit to or neutral effect on the trust, and that loans that are probably not in any reasonably foreseeable danger of default would get included. That would cause the REMIC and Q status problems to come back into play.

The Hope Now proposal is intended to be an improvement on the Bair proposal by limiting the “freeze” precisely to the “in reasonably foreseeable danger of default” category. That solves the REMIC and Q-related problems. The difficulty that remains is whether, in any given case, the default that is in foreseeable danger of happening would cost more to the security than the modification. That is where the rubber meets the road.

That’s the rationale for excluding loans that could qualify for a refinance. The presumption is always that the trust would lose less by a refinance (since it would get paid off at par) than a mod, and so you can’t say that modifying one of these loans shows a net benefit to the trust. The rationale for defining the modification-eligible group, number 2, as “not refinanceable” is that that creates a presumption that a mod would be a net benefit or neutral to the trust (since the only other option, given that we believe default is reasonably foreseeable, is foreclosure).

So it’s not that we’re necessarily replacing the old-fashioned case-by-case mods with the fast-track “freeze” mods. We’re creating a way of segmenting the borrower class so that one class of borrowers can be presumed to meet all the requirements in the PSAs for modifications. If the borrower isn’t in that group (2), then a modification could still be done, but it doesn’t have the presumption of meeting the rules, you still have to determine whether a mod is less loss to the trust than not modifying (and therefore letting the loan default and foreclosing), you have to examine the borrower’s circumstances (to make sure that they are no longer in reasonably foreseeable danger of default after the mod), get a new appraisal or AVM or broker price opinion on the property (to estimate losses in event of foreclosure), and run the comparative numbers.

At the end of it, then, it gets a lot easier to figure out the rationale of some of the details of the Group 2 process (FICOs here or there, income verified or not, etc.). None of that is about figuring out whether the borrower "needs" or "deserves" to be helped. It is about figuring out whether the borrower has any realistic option of refinancing, given current contraints in the mortgage market and the HPA outlook. That, in turn, is crucial because to modify a loan that could have refinanced opens up the servicer to liability for contract violations (and potentially loss of REMIC tax status and Q-status, too).

There isn't, as far as I can see, any "safe harbor" provision in all of this. That tells me, at this point, that the authors of this plan believe it is liability-proof (that it basically meets the requirements of the existing PSAs, with the caveat that it isn't a legally binding mandate on all servicers and securities, so a deal with a very restrictive PSA that this isn't compatible with can just opt out).

Is it all kind of anemic after all the build-up? Yep. Does it mean contracts are now invalidated in the U.S.? Not as far as I can see; in fact, I'd say the contracts were the part of this that got the most thorough protection. In my reading of this, giving a deal to a borrower almost seems incidental.

MBA Mortgage Delinquency Graph

by Calculated Risk on 12/06/2007 02:21:00 PM

While we patiently wait for Tanta's analysis of the Freeze, here is a graph of the MBA mortgage delinquency rate since 1979 (hat tip Bill). Click on graph for larger image.

Click on graph for larger image.

This is the overall delinquency rate, and it is at the highest rates since 1986. As noted earlier this morning, delinquencies are getting worse in every category - including prime fixed rate mortgages - and getting worse at a faster rate in every category.

It seems like a long time ago, but it was in July of this year that Bernanke presented a report to Congress arguing that the subprime problems would stay in subprime, and that the problems were contained to variable rate subprime loans (see this post). Bernanke couldn't have been more wrong.

About Mod Re-Defaults

by Anonymous on 12/06/2007 01:39:00 PM

While we're all eagerly crowding around the teevee waiting for the Great Loan Modification Speech (can it get any nerdier than that? Can it? Sheesh) I want to comment on this little statistic, that is getting thrown around a lot:

Modified loans frequently re-default. Joshua Rosner at Graham-Fisher & Co. says 40% to 60% of subprime and Alt-A borrowers who have their loans modified end up defaulting anyway within the next two years. Fitch Ratings puts the recidivism rate at a slightly lower 35% to 40% for good modification programs.Let us bear in mind that such statistics have to be based on loans that were modified no more recently than 2005 (newer mods would not have a 24-month post-modification history). It is quite possible, indeed it is likely, that modifications done in 2005 and earlier (when there were many more refi opportunities and most borrowers could sell their homes for at least the loan amount) were done for borrowers with problems like job loss or illness that either simply recurred or that created other (non-mortgage) debt problems down the road.

This is not to argue that modifications done now for loans originated in 2005 and after would perform better. Or worse. Or the same. It is to say that we are probably in uncharted territory and that "past history" was a lousy guide when we made the loans and might be a lousy guide when we have to work them out.

Furthermore, 40-60% is a very big range. In the absence of other information, I would certainly guess that most if not all of that variation is due to servicer quality, not borrower quality. If that is true, then performance of modified loans can be improved by something that is well within the control of the industry.

Now you can go back to waiting around the teevee . . .

Fed: Homeowner Percent Equity Falls to Record Low

by Calculated Risk on 12/06/2007 12:14:00 PM

The Fed released the Q3 Flow of Funds report today.

Homeowner equity declined by $128 Billion in Q3 as appreciation slowed (why didn't assets decline?) and equity withdrawal was still strong.

Homeowner percent equity fell to a record low of 50.4% (this includes the almost 1/3 of homeowners with no mortgage). I'll have more this afternoon.

The Big Freeze: Details Soon

by Calculated Risk on 12/06/2007 12:11:00 PM

Mr. Bush speaks at 1:40PM ET. Mr. Paulson at 1:45PM. Tanta at 2:00PM.

OK, I'm just kidding about Tanta, but I'm looking forward to her comments.

MBA: Mortgage Delinquencies Highest Since 1986

by Calculated Risk on 12/06/2007 10:07:00 AM

The MBA is reporting today (no link) that mortgage delinquencies increased sharply in Q3 2007. A few data points:

Total, 1-4 units delinquences increased to 5.59% from 5.12% in Q2.

Prime increased to 3.12% from 2.73% in Q2.

Subprime increased to 16.31% from 14.82% in Q2.

Delinquencies and foreclosures increased for every category, including prime fixed rates.

'Lack of interest' in Super Fund SIV

by Calculated Risk on 12/06/2007 01:46:00 AM

From the WSJ: 'Super Fund' for SIVs, Hoped for $100 Billion, May Be Half the Size

The three banks assembling a "super fund" ... are scaling back its size due to a lack of interest ...Two weeks ago it was "next week". Now it's the next several days. Shrinkage and schedule slippage are not a good signs for the

Originally envisioned as a $100 billion fund that would buy assets from the struggling investment vehicles, the fund may now wind up being about half that size... The banks, which have informally been seeking participation from other financial institutions, expect to start a formal syndication process within the next several days.

Wednesday, December 05, 2007

CDO Liquidates for "Less than 25% of par value"

by Calculated Risk on 12/05/2007 09:11:00 PM

From Standard & Poor's: S&P Cuts All Adams Square Funding I Rtgs To ‘D’ On Liquidation (hat tip Brian)

Standard & Poor's Ratings Services today lowered its ratings to 'D' on the senior swap and the class A, B-1, B-2, C, D, and E notes issued by Adams Square Funding I Ltd. The downgrades follow notice from the trustee that the portfolio collateral has been liquidated and the credit default swaps for the transaction terminated.Bloomberg is reporting (no link) that $165 million of debt, originally rated AAA will not be repaid.

The issuance amount of the downgraded collateralized debt obligation (CDO) notes is $487.25 million.

According to the notice from the trustee, the sale proceeds from the liquidation of the cash assets, along with the proceeds in the collateral principal collection account, super-senior reserve account, credit default swap (CDS) reserve account, and other sources, were not adequate to cover the required termination payments to the CDS counterparty. As a result, the CDO had to draw the balance from the super-senior swap counterparty. Based on the notice we received, the trustee anticipates that proceeds will not be sufficient to cover the funded portion of the super-senior swap in full and that no proceeds will be available for distribution to the class A, B, C, D, or E notes.

Today's rating actions reflect the impact of the liquidation of the collateral at depressed prices. Therefore, these rating actions are more severe than would be justified had liquidation not been ordered, in which case our rating actions would have been based on the credit deterioration of the underlying collateral. Across the cash flow assets sold and credit default swaps terminated, we estimate, based on the values reported by the trustee, that the collateral in Adams Square Funding I Ltd. yielded, on average, the equivalent of a market value of less than 25% of par value.

From triple AAA to nothing. That is a deep cut.

More on the Freeze Plan

by Anonymous on 12/05/2007 07:30:00 PM

I am, in fact, working on detailed post about The Plan. Since it appears there will be details released tomorrow, I expect to have more worthwhile to say after that.

But, to speak to what just got released (as presented in Bloomberg): this thing with the FICO score buckets seems to have taken a lot of people aback. Certainly we hadn't heard explicit mentions of FICO bucketing in the earlier hints about The Plan.

I think what this is about is a way to keep this focused on subprime loans. As regular readers of this blog (at least) know, there really aren't hard-and-fast definitions of subprime. Saying that efforts will be "prioritized" by FICOs under 660 is a way to try to target this effort to what we would consider "subprime," regardless of how the loans might be described by a servicer or in a prospectus.

And that, really, is a way to target the "freeze" to start rates that are already pretty high. I think some people are getting a bit misled by the idea of "teaser" rates here. As Bloomberg reports quite correctly, the loans being targeted have a start rate in the 7.00% to 8.00% range. (My back-of-the-envelope calculation is a weighted average of about 7.70%, with a weighted average first adjustment rate of just over 10.00%.) Nobody wants to come out and say that "Hope Now" is all about freezing just the highest initial ARM rates that there are, but that's in fact what it's about.

So asking, in essence, why we are "rewarding" people with the worst credit profiles is, really, missing the point. The point is that the cost of this goes directly to investors in asset-backed securities, and those investors are being asked to forgo 10% (the reset rate) and take 7.70% (the current or start rate). They are not being asked, say, to forgo 7.70% and take 5.70%, which is roughly what it would be if this "freeze" were extended to the significantly-over-660 crowd (Alt-A and prime ARMs).

So far, I'm prepared to believe assurances that this will not involve taxpayer subsidies: the cost of this is, actually, going to be absorbed by investors in mortgage-backed securities. This is why "good credit" borrowers are not going to be "rewarded"--because investors cannot be brought to forgo that much interest. Somebody did the math, and somebody concluded that freezing a rate that is still about 200-250 bps over the 6-month LIBOR isn't going to be a disaster (at least not compared to having to foreclose these things).

More tomorrow.

The Bush / Paulson Mortgage Freeze Plan

by Calculated Risk on 12/05/2007 05:08:00 PM

I believe Tanta is working on an analysis for tomorrow or later this week. Meanwhile here are some details via Bloomberg: Subprime Rate Five-Year Fix Agreed by U.S. Regulators

The freeze may apply to mortgages issued between January 2005 and July 2007 that are currently scheduled to reset between January 2008 and July 2010, said a person who has seen a draft proposal. Borrowers whose credit scores are below 660 out of a possible 850 and haven't risen by 10 percent since the loan was issued will be given priority.

Home Builders and Homeownership Rates

by Calculated Risk on 12/05/2007 04:00:00 PM

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year. Note: A special thanks to Jan Hatzius. Much of the ideas for this post are from his piece: "Housing (Still) Holds the Key to Fed Policy", Nov 27, 2007 Click on graph for larger image.

Click on graph for larger image.

The first graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The reasons for the change in homeownership rate will be discussed later in this post, but here are two key points: 1) The change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the rate (red arrow is trend) appears to be heading down.

The U.S. population has been growing close to 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these numbers, there would be close to 1.25 million new households formed per year in the U.S. (just estimates).

Since about 2/3s of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year. If an additional 500K per year moved to homeownership - as indicated by the increase in the homeownership rate from 1995 to 2005 - then the U.S. would have needed 1.3 million additional owner occupied homes per year.

Important note: these number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for to compare the numbers.

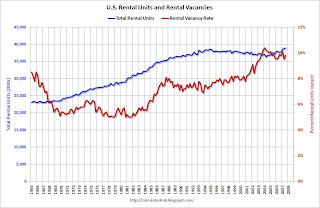

During that same period, since about 1/3 of all households rent, the U.S. would have needed about 400K+ new rental units per year, minus the 500K per year of renters moving to homeownership. So the U.S. needed fewer rental units per year from 1995 to 2005. Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Even though the total number of rental units was declining, this didn't completely offset the number of renters moving to homeownership, so the rental vacancy rate started moving up - from about 8% in 1995 to over 10% in 2004.

What this change in homeownership rate meant for the homebuilders was that they had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units, but the builders definitely benefited from the increase in homeownership rate.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.33% per year (Goldman's Hatzius estimated 0.5% per year). This would mean the net demand for owner occupied units would be 833K minus about 333K or 500K per year - about 40% of the net demand for owner occupied units for the period 1995 to 2005.

This means the builders have two problems over the next few years: 1) too much inventory, and 2) demand will be significantly lower over the next few years than the 1995-2005 period, and even when the homeownership rate stabilizes and the inventory is reduced, demand (excluding speculation) will only be about 2/3 of the 1995-2005 period.

Why did the homeownership rate increase?

A recent research paper - Matthew Chambers, Carlos Garriga, and Don E. Schlagenhauf (Sep 2007), "Accounting for Changes in the Homeownership Rate", Federal Reserve Bank of Atlanta - suggests that there were two main factors for the recent increase in homeownership rate: 1) mortgage innovation, and 2) demographic factors (a larger percentage of older people own homes, and America is aging).

The authors found that mortgage innovation accounted for between 56 and 70 percent of the recent increase in homeownership rate, and that demographic factors accounted for 16 to 31 percent. Not all innovation is going away (securitization and some smaller downpayment programs will stay), and the population is still aging, so the homeownership rate will probably only decline to 66% or 67% - not all the way to 64%.

This isn't the first time mortgage innovation contributed to a significant increase in the homeownership rate. The follow graph is from the referenced paper:

After World War II, the homeownership rate increased from 48 percent to roughly 64 percent over twenty years. This period was not only an important change in the trend, but determined a new level for the years to come. The expansion in homeownership during the postwar period has been part of the so-called "American Dream." ...Not all mortgage innovation is bad!

Prior to the Great Depression the typical mortgage contract had a maturity of less than ten years, a loan-to-value ratio of about 50 percent, and mortgage payment comprised of only interest payments during the life of the contract with a "balloon payment" at expiration. The FHA sponsored a new mortgage contract characterized by a longer duration, lower downpayment requirements (i.e., higher loan-to-value ratios), and self- amortizing with a mortgage payment comprised of both interest and principal.

And finally, the current boom in homeownership rate hasn't be a U.S. only phenomenon. This chart (from the paper) shows the 1995 and 2005 homeownership rate for various countries.

And finally, the current boom in homeownership rate hasn't be a U.S. only phenomenon. This chart (from the paper) shows the 1995 and 2005 homeownership rate for various countries.The 5% increase in the U.S. is actually less than many other countries.

Once again, looking forward this means the builders will face two problems over the next few years: too much supply and significantly lower demand (not even counting for speculation).

Moody's: MBIA Capital Shortfall "Somewhat Likely"

by Calculated Risk on 12/05/2007 01:40:00 PM

From Bloomberg: MBIA Capital Shortfall May Be `Likely,' Moody's Says (hat tip Mike and Brian)

MBIA Inc. is ``somewhat likely'' to face a capital shortfall, throwing its AAA credit rating in jeopardy and putting at risk the rankings of the state, municipal and corporate debt it guarantees, Moody's Investors Service said. ...

A review of MBIA, the largest bond insurer, will be completed within two weeks ...

``The guarantor is at greater risk of exhibiting a capital shortfall than previously communicated,'' Moody's said. ``We now consider this somewhat likely.''

The loss of MBIA's top ranking would cast doubt over the ratings of $652 billion of municipal and structured finance bonds that the company guarantees.

Orange County: Bankrupt in '94, Now Invested in SIVs

by Calculated Risk on 12/05/2007 12:19:00 PM

From Bloomberg: Orange County Funds Hold SIV Debt on Moody's Review

Orange County, California, bankrupted in 1994 by bad bets on interest rates, bought structured investment vehicles similar to those that caused a run on funds invested by local governments in Florida.It doesn't sound like Orange County will suffer any significant losses, but I doubt they will be investing in any more SIV asset backed commercial paper.

Twenty percent, or $460 million, of the county's $2.3 billion Extended Fund is invested in so-called SIVs that may face credit-rating cuts, said Treasurer Chriss Street. ...

Orange County's money is invested in commercial paper under review by Moody's that was issued by Centauri Corp.'s CC USA Inc., Citigroup Inc.'s Five Finance Inc., Standard Chartered Plc.'s Whistlejacket Capital Ltd. and Tango Finance Corp., according to Rodenhuis.

FHASecure, OK. FHA Modernization, Not OK.

by Anonymous on 12/05/2007 11:17:00 AM

Much has been said and debated about the Hope Now Alliance and Treasury Secretary Paulson’s comments last week thereon. Accrued Interest has a good post on the subject, which I take in part as kind of a nudge to explain some of my discomfort with the proposal. I’m working on a longer post addressing the question that seems to bother people the most, namely the question of the extent to which this involves the government changing the terms of existing contracts, or providing protection from liability for servicers who might be accused of violating contracts. That’s a big issue and in many ways a highly technical one, so it may take me a while to deal with it.

In the meantime, though, I wanted to point out one large problem I have with Paulson’s remarks, and a news item this morning gives me a great excuse to do so:

NEW YORK, Dec 5 (Reuters) - Countrywide Financial Corp's (CFC.N: Quote, Profile , Research) chief executive called on the U.S. Congress to temporarily raise the maximum size of mortgages that Fannie Mae (FNM.N: Quote, Profile , Research), Freddie Mac (FRE.N: Quote, Profile , Research) and the Federal Housing Administration may buy or insure by 50 percent to $625,000.You may recall that Bernanke, in a fit of exuberance, had suggested at one point that the GSE limit be raised to $1,000,000. Like most people, I pretty much instantly discounted that as a real possibility. Apparently even Angelo Mozilo has been forced to back off from $850,000 down to $625,000, and only on a temporary basis, at that. I suggest to the powers that be that continuing to ignore this sort of thing is working: wait til they get down to about $420,000, and then close the deal.

In an opinion piece in the Wall Street Journal on Wednesday, Chief Executive Angelo Mozilo, whose company is the largest U.S. mortgage lender, said the increase from $417,000 should be implemented for up to a year.

He said this would go a long way toward alleviating a nationwide housing crunch, which analysts expect to pinch borrowers and lenders throughout 2008 and probably beyond.

"It should be enacted as part of a broader package of reforms to ensure that these linchpins of our mortgage system can aggressively support the housing market in a time of need, and that the appropriate controls and oversight are in place to protect taxpayers," Mozilo wrote.

Mozilo had previously called for the cap to be raised to as much as $850,000.

But I do not trust Henry Paulson one little bit when it comes to ignoring this sort of thing. This is from Paulson’s speech to the OTS’s National Housing Forum, part of his remarks on the Hope Now proposals:

We in the federal government are also taking steps. This fall, HUD initiated "FHASecure" to give the FHA the flexibility to help more families stay in their homes, even those who have good credit but may not have made all of their mortgage payments on time. An estimated 240,000 families can avoid foreclosure by refinancing their mortgages under the FHASecure plan.FHASecure and “FHA Modernization” are horses of a different color. “FHASecure” is HUD’s response to the subprime refinance market meltdown; it is a way to offer refinances for a specific class of borrowers facing exploding ARM resets. It still requires a minimum of 3.00% equity, and it does not involve an increase in the maximum mortgage amount. You can read about the details here.

The Administration is taking action to help homeowners, and Congress must do the same before it leaves for the year. Since August, the President has been calling on Congress to pass his FHA modernization proposal which, by lowering the down payment requirement, increasing the loan limit and allowing risk-based pricing, will make affordable FHA loans more widely available. The Administration's proposed bill would help refinance another estimated 200,000 families into FHA-insured loans.

“FHA Modernization” is the kind of thing that got us into this mess in the first place. It is disingenuous of Paulson to say that Bush has been asking for this “since August”; he has been asking for it as far as I know since his first presidential campaign in 1999 (when the whole “Ownership Society” thing got launched). Only someone drinking too much bongwater, in my view, can think that now is a good time for FHA to start taking the oversized no-down loans (with casual appraisals) that are blowing up in the conventional sector. The Bush administration simply treats “FHA Modernization” like tax cuts: they’re good when the economy is good, they’re good when the economy is bad, they’re good when the economy is indifferent. They’re good; it’s a religion. Using the cover of the current crisis to sneak in permanent changes to the base FHA programs, changes that would allow future purchase transactions of the sort that we need FHASecure to bail out, is playing politics. Bad on Paulson.

Do note that FHA loan limits are now, and would be under “modernization,” tied to some percentage of the GSE conforming limit. This means that any change to Fannie and Freddie’s loan limits are an automatic change to the FHA limits. The “modernization” proposal would increase “lower cost” area limits from 48% to 65% of the conforming limit, and “higher cost” areas from 87% to 100% of the conforming limit. Therefore, the combination of “modernization” and—should it occur—increases in the conforming limit could very rapidly increase FHA loan amounts, at the same time that it relaxes appraisal requirements and lowers down payments. If Mozilo’s proposal were enacted along with FHA Modernization, the FHA limits would go to $406,000 (lower cost areas) and $625,000 (higher cost areas). Without “modernization,” the FHA limits would still increase to $300,000 and $546,000, respectively, unless there were a specific limitation in the bill holding the line on FHA limits. Those are pretty big loan amounts for a program that currently allows 97% financing and that is lobbying for the ability to offer 100% financing.

So far, cooler heads seem to be prevailing on the question of raising the conforming limits. So far. This is what Lockhart had to say on the subject to American Banker (subscription only):

"From the Fannie and Freddie side at this point, they should really stick to their knitting, given their capital constraints and given their lack of experience in the jumbo market," Office of Federal Housing Enterprise Oversight Director James Lockhart said in an interview last week. "From my standpoint, they have their hands full in the conforming loan market, and they're doing a good job, and if they're going to go anywhere, I think it should be to help out more in the affordable [housing market], because that's part of their mission."If Fannie and Freddie don’t belong in the jumbo market, then FHA certainly doesn’t.

My position has always been that the only really good thing about a full-blown credit crisis is that it creates a context in which restrictive legislation that would normally get successfully fended off by industry lobbyists can get passed, as part of the price tag of various bailout or pseudo-bailout efforts. In other words, you can kick them while they’re down. Changes to bankruptcy law to allow cram-downs is a great example of this, as are the state laws seriously curtailing or outright prohibiting stated-income lending. Those aren’t the kind of regulations you get when the punchbowl is still full.

Using the current crisis as an excuse to sneak through more irresponsible “innovation” is making a bad situation worse. The best thing you can say about FHA and the GSEs over the last several years is that while they took on some real risk—everyone did—they did not—they could not—participate in the worst of the excesses. It was left to the purely private sector to go where the agencies would not go; they went there; we got a postcard; it’s not a pretty one. So the agencies will have to be part of the cleanup. Programs like FHASecure and the GSEs’ various near-prime or “expanded approval” refinances for troubled loans are out there, and will save as many loans as they can save. I can live with that, personally.

What I don’t intend to live with is changes to the agencies’ statutory and charter limits that put them in the front of the next bubble. Put down your coffee and any sharp objects you happen to be holding, and read this interview from August of 2006 with Brian Montgomery, FHA Commissioner (and former “director of advance” for Bush-Cheney 2000):

Q: When we spoke about a year ago, on your 34th day on the job, you noted your vision for FHA and the things about FHA that you wanted to improve. Has your vision for FHA changed or evolved during your first year as FHA commissioner? What do consider your biggest accomplishment at FHA within the past year?That's the Bush administration in a nutshell: give happy speeches, see happy faces, hit "send." The fact that they're still pushing hard for this even "post-turmoil" tells me that it has nothing to do with "Hope Now," and everything to do with "Just Keep Hoping."

A: I'll tell you that the vision is pretty much the same, as far as what we need to do to make FHA viable again. I'd even go so far as to say that it's been strongly reinforced by the many speeches that I give around the country and the many home-ownership events and ribbon-cuttings where I'm actually getting to meet some of the families who've been able to purchase their first home because of FHA. Getting to see the excitement on their faces tells us we're doing the right thing.

I'd also say that, speaking relative to the industry, when we embarked on this quest to modernize FHA, we worked closely with many industry partners, including the MBA [Mortgage Bankers Association]--in particular, at their conference [92nd Annual Convention & Expo 2005] down in Orlando.

Kurt [Pfotenhauer, MBA's senior vice president, government affairs] and others had set up a roundtable of about 25 small to medium-sized FHA lenders, and what was going to be about an hour-long sit-down ended up being an hour and 45 minutes where they all gave me their input on how FHA should be.

Every one of them essentially gave me an earful--in a pleasant way, mind you--but every one of them would start off [by saying], "I started out in FHA" and "I cut my teeth in FHA or my partner did."

It was good for me to see--again reinforcing that our industry partners firmly believe that FHA needs to play a large role in today's mortgage marketplace--that we're definitely heading down the right path. I haven't met anyone yet who said, "We think FHA has outlived its usefulness." Quite the contrary--they all tell us we're doing the right things.

As far as a biggest accomplishment, I would say modernizing some of the ways we do our business relative to our procedures and processes. Some of the feedback we've gotten from the industry, because we rely on the industry and we're partners in all of this, [include] improvements in how we do appraisals.

Some previously called [our rules for appraisals] "unique," some called them "onerous" and some [called them] things worse than that, and we just thought maybe in today's hurry-up world it's not so important to go back two or three times to make sure a cracked window pane is fixed or maybe the tear in the carpet has been adequately repaired. Now, if it's something structural, that's a different story.

I think [another accomplishment would be a] lot of those common-sense solutions--the lender insurance initiative [FHA's Lender Insurance Program, introduced by HUD in September 2005], that now about half our loans are using lender insurance, but we were about the last entity out there to send the thick case binders back and forth as our only means of really processing loans.

We decided that it was time for us to come into this century and do what everyone else was doing--just hitting the "send" key.

Cuomo Lifts Another Rock

by Anonymous on 12/05/2007 08:07:00 AM

And it will be interesting to see what crawls out from under this one:

NEW YORK (Reuters) - New York state prosecutors have sent subpoenas to Wall Street firms seeking information related to the packaging and selling of debt tied to high-risk mortgages, the Wall Street Journal reported, citing people familiar with the matter. . . .Well, well, well. I'm guessing there will be all kinds of interesting stuff on those potted plant reports. Somebody's aspidistra is going to be in a sling . . .

The probe appears to be examining the relationships between mortgage companies, third-party due-diligence firms, securities firms and credit-rating firms as they relate to the role securities firms played in the subprime mortgage crisis, the Journal said.

O.C. Register on CRE: Turn out the lights ...

by Calculated Risk on 12/05/2007 01:00:00 AM

"The party is over"From Jon Lansner at the O.C. Register: Commercial real estate ‘party is over’

Jerry Anderson, President, Irvine-based commercial real estate brokerage

Stan Ross, chair of USC Lusk Center for Real Estate ... said today that the nation likely will have a weaker economy next year, and “that spills over into the commercial sector.” Ross stopped short of predicting a commercial downturn. ...Historically non-residential investment in structures follows residential investment by between 3 and 8 quarters; with the normal lag of about 5 quarters. Based on this typical relationship, at the end of 2006 I started forecasting a slowdown in CRE at the end of '07.

Commercial real estate “will clearly be impacted” by a weaker economy, Ross said. “The question is how much and where and what products.”

...

Jerry Anderson, newly appointed president of Sperry Van Ness, an Irvine-based commercial real estate brokerage ... forecast an end to a 7-year-long boom, saying that “the party is over.” issued a prediction today that commercial real estate values will decrease by 10% to 12% next year. ... “It’s been a wild ride, but now it’s over.”

Click on graph for larger image.

Click on graph for larger image.Investment in non-residential structures continues to be very strong, increasing at a 14.3% annualized rate in Q3 2007.

This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In a typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters (although the lag can range from 3 to about 8 quarters). Residential investment has fallen significantly for six straight quarters. So, if this cycle follows the typical pattern, non-residential investment will start declining about now.

Due to the deep slump for CRE during the business led recession in 2001, CRE is nowhere near as overbuilt as residential - even though the CRE lending standards were very loose. Still, it appears there is a slowdown in non-residential investment starting now.

The second graph shows the YoY change in nonresidential structure investment (dark blue) vs. loan demand data (red) and CRE lending standards (green, inverted) from the Fed Loan survey.

The second graph shows the YoY change in nonresidential structure investment (dark blue) vs. loan demand data (red) and CRE lending standards (green, inverted) from the Fed Loan survey.The net percentage of respondents tightening lending standards for CRE has risen to 50%. (shown as negative 50% on graph).

The net percentage of respondents reporting stronger demand for CRE has fallen to negative 34.6%.

Loan demand (and changes in lending standards) lead CRE investment for an obvious reason - loans taken out today are the CRE investment in the future. This report from the Fed also suggests an imminent slowdown in CRE investment.

Data Source: Net Percentage of Domestic Respondents Reporting Stronger Demand for Commercial Real Estate Loans

NYTimes on Those E*Trade ABS Haircuts

by Calculated Risk on 12/05/2007 12:01:00 AM

Kudos to Brian who caught this last Thursday: ETrade ABS Haircuts

From the NYTimes: In E*Trade Deal, Pain Went Far Beyond Subprime

... here is a point worth considering: Only about $450 million of E*Trade’s $3 billion portfolio was made up of the riskiest kinds of securities — C.D.O.’s and second-lien mortgages — that have made headlines recently.

What was the other $2.6 billion or so? In E*Trade’s own words, it was “other asset-backed securities, mainly securities backed by prime residential first-lien mortgages.”

In other words, E*Trade’s enormous haircut went far beyond subprime.

A large part of E*Trade’s basket of assets was securities backed by high-quality mortgages — loans to homeowners with strong credit ratings and reasonably large equity cushions. That could raise troubling questions on Wall Street about the true value of “prime” mortgage assets, especially when they need to be liquidated in a hurry.

The picture becomes clearer when you look at this breakdown, which E*Trade shared with investors in October. It shows that more than $1.35 billion of E*Trade’s asset-backed portfolio consisted of prime, first-lien residential mortgages rated “AA” or better — hardly toxic sludge by any stretch of the imagination.

So consider this: Even if E*Trade got nothing — not a cent — for anything but these top-quality mortgage securities, it still sold $1.35 billion in prime mortgage assets for $800 million, or less than 60 cents on the dollar.

That’s just a back-of-the-envelope calculation, but a potentially unnerving one.

Tuesday, December 04, 2007

Moody's: Loss Estimates for Alt-A Double

by Calculated Risk on 12/04/2007 05:15:00 PM

From Reuters: Subprime bond losses to climb to 20 pct -analysts (hat tip Cal)

Moody's Investors Service on Tuesday raised its forecast for expected losses for U.S. mortgages known as "Alt-A" residential mortgage debt. Loss estimates for Alt-A bonds reviewed by Moody's increased by an average of 110 percent from initial expectations, with some loss estimates up by as much as 270 percent, Moody's said in a report.Well, I'm stunned, but not surprised.