by Calculated Risk on 12/05/2007 04:00:00 PM

Wednesday, December 05, 2007

Home Builders and Homeownership Rates

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year. Note: A special thanks to Jan Hatzius. Much of the ideas for this post are from his piece: "Housing (Still) Holds the Key to Fed Policy", Nov 27, 2007 Click on graph for larger image.

Click on graph for larger image.

The first graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The reasons for the change in homeownership rate will be discussed later in this post, but here are two key points: 1) The change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the rate (red arrow is trend) appears to be heading down.

The U.S. population has been growing close to 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these numbers, there would be close to 1.25 million new households formed per year in the U.S. (just estimates).

Since about 2/3s of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year. If an additional 500K per year moved to homeownership - as indicated by the increase in the homeownership rate from 1995 to 2005 - then the U.S. would have needed 1.3 million additional owner occupied homes per year.

Important note: these number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for to compare the numbers.

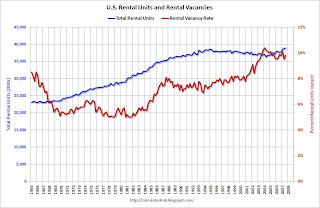

During that same period, since about 1/3 of all households rent, the U.S. would have needed about 400K+ new rental units per year, minus the 500K per year of renters moving to homeownership. So the U.S. needed fewer rental units per year from 1995 to 2005. Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Even though the total number of rental units was declining, this didn't completely offset the number of renters moving to homeownership, so the rental vacancy rate started moving up - from about 8% in 1995 to over 10% in 2004.

What this change in homeownership rate meant for the homebuilders was that they had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units, but the builders definitely benefited from the increase in homeownership rate.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.33% per year (Goldman's Hatzius estimated 0.5% per year). This would mean the net demand for owner occupied units would be 833K minus about 333K or 500K per year - about 40% of the net demand for owner occupied units for the period 1995 to 2005.

This means the builders have two problems over the next few years: 1) too much inventory, and 2) demand will be significantly lower over the next few years than the 1995-2005 period, and even when the homeownership rate stabilizes and the inventory is reduced, demand (excluding speculation) will only be about 2/3 of the 1995-2005 period.

Why did the homeownership rate increase?

A recent research paper - Matthew Chambers, Carlos Garriga, and Don E. Schlagenhauf (Sep 2007), "Accounting for Changes in the Homeownership Rate", Federal Reserve Bank of Atlanta - suggests that there were two main factors for the recent increase in homeownership rate: 1) mortgage innovation, and 2) demographic factors (a larger percentage of older people own homes, and America is aging).

The authors found that mortgage innovation accounted for between 56 and 70 percent of the recent increase in homeownership rate, and that demographic factors accounted for 16 to 31 percent. Not all innovation is going away (securitization and some smaller downpayment programs will stay), and the population is still aging, so the homeownership rate will probably only decline to 66% or 67% - not all the way to 64%.

This isn't the first time mortgage innovation contributed to a significant increase in the homeownership rate. The follow graph is from the referenced paper:

After World War II, the homeownership rate increased from 48 percent to roughly 64 percent over twenty years. This period was not only an important change in the trend, but determined a new level for the years to come. The expansion in homeownership during the postwar period has been part of the so-called "American Dream." ...Not all mortgage innovation is bad!

Prior to the Great Depression the typical mortgage contract had a maturity of less than ten years, a loan-to-value ratio of about 50 percent, and mortgage payment comprised of only interest payments during the life of the contract with a "balloon payment" at expiration. The FHA sponsored a new mortgage contract characterized by a longer duration, lower downpayment requirements (i.e., higher loan-to-value ratios), and self- amortizing with a mortgage payment comprised of both interest and principal.

And finally, the current boom in homeownership rate hasn't be a U.S. only phenomenon. This chart (from the paper) shows the 1995 and 2005 homeownership rate for various countries.

And finally, the current boom in homeownership rate hasn't be a U.S. only phenomenon. This chart (from the paper) shows the 1995 and 2005 homeownership rate for various countries.The 5% increase in the U.S. is actually less than many other countries.

Once again, looking forward this means the builders will face two problems over the next few years: too much supply and significantly lower demand (not even counting for speculation).