by Calculated Risk on 11/06/2007 12:30:00 PM

Tuesday, November 06, 2007

IndyMac House Price Forecasts

IndyMac has provided a substantial amount of industry data and analysis: IndyMac Bancorp, Inc. Third Quarter Review (hat tip jmf). Here are a few charts and excerpts: Click on graph for larger image

Click on graph for larger image

IndyMac is forecasting 10% price declines in the high risk areas, 8% in the moderate risk areas, and 6% in the low risk areas.

Forecasted Home price depreciation ranging between 6% and 10% is factored into our loss expectations that drive valuation and reserves – average HPI declines expected to be around 9%

Indymac’s forecast of housing price declines are based on risk grades from PMI, MGIC and AIG/United Guaranty

These are the projected nationwide year over year house price declines based on the OFHEO index (from Moody's). IndyMac notes:

These are the projected nationwide year over year house price declines based on the OFHEO index (from Moody's). IndyMac notes: Expected home price declines used in our reserves and valuations are slightly higher than average US home declines as predicted by Moody’s economy.comThis would be a very short housing bust if year-over-year nationwide house prices started to recover in late '09 as shown by the OFHEO HPI. Also only a 10% decline in prices in the high risk areas is probably way too optimistic.

Give IndyMac credit, at least they are releasing their forecasts (and a substantial amount of data). I'd like to see the Citigroup house price forecast!

GM Watch, Again: Foreclosures and Fees

by Anonymous on 11/06/2007 11:10:00 AM

I know how disappointed everyone would be if I passed on an opportunity to publically describe Gretchen Morgenson as a tendentious writer with only a marginal grasp of her subject matter and what appears to be an insatiable desire to make uncontroversial facts sound sinister. So here we go again.

Obligatory declamation: I hate sloppy mortgage servicers, I think fee gouging is criminal, and nothing would make me happier than to see bankruptcy judges slapping some servicers around a little. Morgenson's article, "Borrowers Face Dubious Charges in Foreclosures," brings up one particular thing, payoff fees, that I have been bitching about for fifteen years and that I'd be happy to see outlawed. (News flash: those fees are charged by servicers to everyone who requests a payoff quote, including everyone who has ever refinanced a mortgage. This isn't just something that happens in bankruptcy or foreclosure. If there is a more normal course of business process than calculating what one is owed, which should therefore be a matter of general servicing fee compensation, I can't think of one. Total Ick.)

As usual, though, Morgenson's valid points are drowning in a sea of sensational swill:

Because there is little oversight of foreclosure practices and the fees that are charged, bankruptcy specialists fear that some consumers may be losing their homes unnecessarily or that mortgage servicers, who collect loan payments, are profiting from foreclosures.The article presents exactly zero evidence, anecdotal or otherwise, that any of the foreclosures or bankruptcies in question were "unnecessary." There is certainly the implication here that servicers profit more from a foreclosure than from simply servicing a performing loan. That idea could use some evidence. It may be true that once a loan defaults, the servicer loses less by foreclosing (where its costs are reimbursed by the noteholder out of the liquidation proceeds) than by working the loan out; this is a big problem with the modification thing, in which servicers generally have to absorb the costs of the modification. But if the accusation here is that servicers drive borrowers into default in order to foreclose, I'd like to see some evidence for that. (Really, I would. That would be a serious indictment of the servicing industry.)

Bankruptcy specialists say lenders and loan servicers often do not comply with even the most basic legal requirements, like correctly computing the amount a borrower owes on a foreclosed loan or providing proof of holding the mortgage note in question.Perhaps our attorney friends will tell me how it is that servicers have to prove that they are noteholders in a bankruptcy. I suspect that's news to all investors in mortgage bonds, who think they are the noteholders. Are we talking about sloppy filings, in which the servicer failed to include a copy of the note? Or are we really talking about servicers who cannot cough up an assignment of mortgage or deed of trust to show standing to foreclose? Is this predation by servicers who don't even have the right to collect on the debt, trying to worm their way into BK court, or botched paperwork?

In an analysis of foreclosures in Chapter 13 bankruptcy, the program intended to help troubled borrowers save their homes, Ms. Porter found that questionable fees had been added to almost half of the loans she examined, and many of the charges were identified only vaguely. Most of the fees were less than $200 each, but collectively they could raise millions of dollars for loan servicers at a time when the other side of the business, mortgage origination, has faltered.These are not impressive examples of servicer competence, and I don't object to public humiliation of any servicer who can make errors like that. But does anyone seriously think that these were attempts to "raise millions of dollars for loan servicers at a time when the other side of the business, mortgage origination, has faltered"? (Keep reading to get to the details of the Wells Fargo case, and notice that the inappropriate charges were overwhelmingly fees or charges that would not be payable to Wells as servicer but would be passed through to the investor or someone else.)

In one example, Ms. Porter found that a lender had filed a claim stating that the borrower owed more than $1 million. But after the loan history was scrutinized, the balance turned out to be $60,000. And a judge in Louisiana is considering an award for sanctions against Wells Fargo in a case in which the bank assessed improper fees and charges that added more than $24,000 to a borrower’s loan.

But that's the thing: once again, Morgenson displays her profound ignorance of the industry she spends so much time writing about:

Loan servicing is extremely lucrative. Servicers, which collect payments from borrowers and pass them on to investors who own the loans, generally receive a percentage of income from a loan, often 0.25 percent on a prime mortgage and 0.50 percent on a subprime loan. Servicers typically generate profit margins of about 20 percent.I have no idea where the 20 percent "profit margin" comes from or what it means in this context. I also do not know what "extremely lucrative" means in the context of a 25 bps servicing fee. But here's the kicker:

Now that big lenders are originating fewer mortgages, servicing revenues make up a greater percentage of earnings. Because servicers typically keep late fees and certain other charges assessed on delinquent or defaulted loans, “a borrower’s default can present a servicer with an opportunity for additional profit,” Ms. Porter said.When other sources of revenue go down, servicing revenue does, in fact, make up a larger percentage of total revenue even if servicing revenues are unchanged. Remember that you get that lordly 0.25-0.50% in servicing fees only as long as you have a loan to service. No new originations, no new servicing fees.

The amounts can be significant. Late fees accounted for 11.5 percent of servicing revenues in 2006 at Ocwen Financial, a big servicing company. At Countrywide, $285 million came from late fees last year, up 20 percent from 2005. Late fees accounted for 7.5 percent of Countrywide’s servicing revenue last year.

But these are not the only charges borrowers face. Others include $145 in something called “demand fees,” $137 in overnight delivery fees, fax fees of $50 and payoff statement charges of $60. Property inspection fees can be levied every month or so, and fees can be imposed every two months to cover assessments of a home’s worth.

But of course, we are talking revenue here. For instance, those late fees are revenue: they aren't "income" until you back out the expenses of collecting on late loans and the carrying costs of the payments servicers have to advance to the noteholders on time regardless of whether they're collected or not. Do servicers actually make a profit, at the end of the day, on late fees? I suspect most do. Is it less than 100% of revenue? Yes. How much less? Pity Morgenson didn't ask.

You get no argument from me that junk fees like payoff fees, fax fees, demand fees, and unnecessary overnight charges are a horror. I am less convinced that doing away with periodic property inspections for a home in the foreclosure or bankruptcy process is such a great idea: you need to know that the home is still occupied and that it hasn't been vandalized. There's surely a reasonable argument that inspection costs should come out of general servicing revenue, not pass-through fees to the borrower. If you did that, of course, I'd guess that servicing fees would probably go up, so you'd pay it anyway. However, unless the servicer owns the inspection company and makes a big markup (which is possible, although no evidence is presented here), then it's "revenue" with a matched expense. Mortgage servicers can be amazingly dumb at times, but if they're beefing up income with that strategy, you can rest assured it won't last long.

Here's the part of the article based on actual data from a researcher:

In 96 percent of the claims Ms. Porter studied, the borrower and the lender disagreed on the amount of the mortgage debt. In about a quarter of the cases, borrowers thought they owed more than the creditors claimed, but in about 70 percent, the creditors asserted that the debt owed was greater than the amounts specified by borrowers.Well, we don't know what the total amount of the loan debts listed is. Let's assume an average loan debt of $200,000. That gives us $346,600,000 in debts. A $6 million discrepancy is 1.7%. You have to assume that at least some of these are "discrepancies" because the borrowers simply have no idea how much back interest they owe (like all those folks who thought the accrual rate on their OA was 1.00%). There certainly seem to be some big outliers there, given a median of $1,366 and a mean of $3,533. I'm guessing that the one loan of $60,000 with a servicer balance of $1MM is probably throwing that off. End of the day, the discrepancy due to intentional servicer padding of fees has to be less than 1.0%.

The median difference between the amounts the creditor and the borrower submitted was $1,366; the average was $3,533, Ms. Porter said. In 30 percent of the cases in which creditors’ claims were higher, the discrepancy was greater than 5 percent of the homeowners’ figure.

Based on the study, mortgage creditors in the 1,733 cases put in claims for almost $6 million more than the loan debts listed by borrowers in the bankruptcy filings. The discrepancies are too big, Ms. Porter said, to be simple record-keeping errors.

Is that an impressive track record for the servicing industry? No. Are we relieved that bankruptcy judges are challenging these charges? Yes, we are: $1,366 might be small beer for a trillion-dollar servicer, but it's money no one needs to squeeze out of a bankrupt consumer. Does it support the contention that servicers are making up for a drop in origination income by loading up on inflated revenues that have no offsetting expenses? Not as far as I can see.

I realize that this will hurt the feelings of the conspiracy-minded, but I do believe that high rates of foreclosure and bankruptcy are money-losers for mortgage servicers, not profit centers. This is not a plea for sympathy for the servicing industry: I have wasted eleventy-jillion of your pixels on the subject of how the industry created this mess with ridiculous lending standards and dereliction of risk management duty. No one is happier than I am to see the little punks take it in the bottom line, and my enthusiasm for things like cram-downs and workouts--the cost of which is borne by the parties who got us into this mess--is an example of that.

It strikes me as quite plausible that some servicers are trying to make some lemonade by charging every fee they can think of. In a foreclosure of an upside down loan, of course, those fees come out of the investor's or insurer's pockets, not the consumer's. In a Chapter 13, these are fees borrowers are expected to repay, and with the cram-down prohibition, there's little incentive for servicers to control costs. So cram the damned things down.

The sad fact of the matter is that there are many businesses and industries that "profit off misfortune." There's money to be made in divorce lawyering, funeral parloring, and broken bone-setting, as well as default mortgage servicing. When profiting becomes profiteering, then yes, that should be punished to the fullest extent of the law. I suggest it also helps to create legal and regulatory structures that remove as many incentives for profiteering as possible in the first place. In order to do that, we have to understand how the business works. Nerdiness matters.

Are we to believe that payoff quote fees were OK until now? That late fees have never until the bust been a money-maker for servicers? That favorable bankruptcy treatment for mortage lenders was fine until 2007? That sloppy business practices have nothing to do with outsourcing, temping, mass layoffs, misguided technology projects, and any of the other myriad forces that corporate America has unleashed in its endless quest to enrich CEOs and keep you on hold for ten hours as you struggle to understand all that crap on your phone bill or locate your lost luggage? Mortgage servicing isn't any better or any worse than the rest of corporate America when it comes to half-assed business practices. It is, however, beginning to suffer the consequences of a huge boom, and I for one predict that we will get to see just how poorly managed a lot of these operations really were: there will be more than a few lost copies of promissory notes and misapplied payments. I'm sure it's too much to hope that everyone who bought shares of these outfits based on their impressive "cost management" will have to pay for it all.

Until justice does finally arrive, I guess we'll have to remember these words of wisdom:

No one likes to face ugly realities like financially ailing borrowers who are so strapped that nothing can save them. Not the lenders, not the Wall Street firms that sell the securities, not even the holders. But experienced investors know that a reliance on fantasy will only prolong the pain that is racking the huge and important mortgage market.

California Plans for Budget Cuts

by Calculated Risk on 11/06/2007 10:24:00 AM

From the LA Times: Schwarzenegger orders plan for 10% budget cuts

Gov. Arnold Schwarzenegger on Monday ordered all state departments to draft plans for deep spending cuts after receiving word that California's budget is plunging further into the red -- largely because of the troubled housing market.Drought. Fires. And now recession. Welcome to California.

...

Economists say the state's declining fortunes are due in large part to the shakeout in the housing market and a volatile revenue system overly reliant on income taxes.

...

[Chris Thornberg, a principal with Beacon Economics] said the trouble in the housing sector is reverberating through the entire state economy, causing income and consumer spending to decline. He noted that unemployment is up a full percent since the beginning of the year, a jump that typically foreshadows recession.

"What's happening right now is big in terms of the revenue hit," he said. "The numbers are coming in way below where they should be."

IndyMac Visits the Confessional

by Calculated Risk on 11/06/2007 09:51:00 AM

From Reuters: IndyMac mortgage loss dwarfs its own forecast

IndyMac ... posted a quarterly loss more than five times larger than it had projected, hurt by mounting delinquencies and a collapse in investor demand to buy its home loans.Higher than forecast, but "not unexpected"? Very funny.

The third-quarter net loss totaled $202.7 million ...

IndyMac also halved its dividend and said another cut is possible ...

...

"While this loss is substantially higher than we had been forecasting, it was clearly not unexpected" given losses elsewhere in the industry, Chief Executive Michael Perry said. "No one in the mortgage industry came away unscathed."

Monday, November 05, 2007

Fitch Reviewing Insurers

by Calculated Risk on 11/05/2007 07:35:00 PM

From Bloomberg: Fitch May Downgrade Bond Insurers After New Test

Fitch Ratings may lower the AAA credit ratings on one or more bond insurers after a new review of the companies' capital takes into account downgrades of collateralized debt obligations that they guarantee."What was hypothetical has become the base case." Great line!

Fitch said it will spend the next six weeks reviewing the capital of insurers including MBIA Inc., Ambac Financial Group Inc., CIFG Guaranty and Financial Guaranty Insurance Co. ... Any guarantor that fails the new test may be downgraded within a month unless the company is able to raise more capital ...

``It's safe to say our expectations have taken a turn for the worse,'' said Thomas Abruzzo, an analyst with Fitch in New York. ``What we thought was hypothetical based on analysis done in the summer has become the base case.''

Two More Credit Unions Bite the Dust

by Calculated Risk on 11/05/2007 05:10:00 PM

From the National Credit Union Administration

CAL State 9 Credit Union Is Placed Into Conservatorship (hat tip 4shzl)

The National Credit Union Administration (NCUA) today assumed control of the operations of Cal State 9 Credit Union, a state-chartered, federally insured, community-based credit union in Concord, California.The cause? According to the SFGate: the housing market.

...

Service continues uninterrupted at Cal State 9 Credit Union and members are free to make deposits, access funds, make loan payments and use share drafts. While the credit union was placed into conservatorship because of declining financial condition, the decision to conserve a credit union enables the institution to continue normal operations with expert management in place.

Member funds are federally insured up to at least $100,000 per account by the National Credit Union Share Insurance Fund (NCUSIF), a federal fund managed by NCUA and backed by the full faith and credit of the U.S. Government. Members with questions about their insurance coverage can contact NCUA’s Region V Division of Insurance at 602-302-6000 Monday through Friday during business hours.

Cal State 9 Credit Union, originally chartered in 1948 to serve University of California employees, has assets of nearly $388 million and over 29,000 members.

The takeover signals yet another misfortune in the unfolding mortgage crisis in which homeowners are defaulting on their loans and losing their properties. The bulk of Cal State 9's loans are for real estate transactions.And a small one in Pennsylvannia: NCUA Closes Green Tree Federal Credit Union

The state's action "is related to the credit union's defaults on mortgages," California Department of Financial Institutions spokeswoman Alana Golden said Saturday.

The National Credit Union Administration (NCUA) Board today liquidated the insolvent Green Tree Federal Credit Union, a $7 million association based credit union in Feasterville, Pennsylvania, that served Friends of Briar Bush, a nonprofit nature conservancy located in Glenside, Pennsylvania.

A portion of the credit union’s 500 member accounts were transferred to Freedom Credit Union, Warminster, Pa, a $339 million credit union with branches in close proximity to Green Tree Federal Credit Union members. Due to size, Freedom Credit Union is able to offer the incoming new members a broad range of financial services. The remaining accounts were transferred to NCUA for payout, which occurs within 10 days.

Commercial Real Estate Update

by Calculated Risk on 11/05/2007 04:20:00 PM

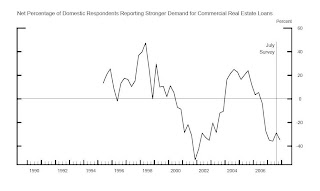

With the release of the Fed Loan Survey, we have further evidence of a possible Commercial Real Estate (CRE) slump. Click on graph for larger image

Click on graph for larger image

This graph shows the YoY change in nonresidential structure investment (dark blue) vs. loan demand data (red) and CRE lending standards (green, inverted) from the Fed Loan survey.

The net percentage of respondents tightening lending standards for CRE has risen to 50%. (shown as negative 50% on graph).

The net percentage of respondents reporting stronger demand for CRE has fallen to negative 34.6%.

Loan demand (and changes in lending standards) lead CRE investment for an obvious reason - loans taken out today are the CRE investment in the future. This report from the Fed suggests a slowdown in CRE investment in the near future.

Data Source: Net Percentage of Domestic Respondents Reporting Stronger Demand for Commercial Real Estate Loans

Fed: October 2007 Senior Loan Officer Opinion Survey

by Calculated Risk on 11/05/2007 02:57:00 PM

From the Fed: The October 2007 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the October survey, domestic and foreign institutions reported having tightened their lending standards and terms on commercial and industrial (C&I) loans over the previous three months. ... Both domestic and foreign institutions noted weaker demand for commercial real estate loans over the past three months. In the household sector, domestic banks reported, on net, tighter lending standards and terms on consumer loans other than credit card loans, as well as tighter lending standards on prime, nontraditional, and subprime residential mortgages over the survey period. Lending standards on credit card loans were, by contrast, little changed. Demand for residential mortgages and consumer loans of all types had reportedly weakened, on net, over the past three months.

Click on graph for larger image.

Click on graph for larger image.This graph from the Fed shows loan demand for CRE loans. Clearly demand is weak, and lenders are tightening standards. (more later on CRE).

More charts here for residential mortgage, consumer loans and C&I.

Fitch: Credit Uncertainty May Spread Further

by Calculated Risk on 11/05/2007 02:05:00 PM

Fitch Press Release: Credit Uncertainty May Begin Affecting U.S. Non-Mortgage ABS

U.S. structured finance sectors that have so far been immune to the subprime market troubles may show signs of vulnerability due to rising uncertainty about credit conditions, along with income and employment prospects, according to Fitch Ratings in its latest Credit Action Report.Maybe Fitch should have just checked with Professor Roubini: The bloodbath in credit and financial markets will continue and sharply worsen

'Economic growth was strong during the third quarter in spite of housing and credit market weakness, but tighter credit conditions will likely put a damper on consumer spending and lead to a deteriorating labor market outlook,' said Director Kevin D'Albert. 'Additionally, increased uncertainty about income and employment prospects may put a crimp in consumer spending, which in turn may adversely affect various consumer ABS segments.'

For the time being, however, non-mortgage ABS remains resilient as performance in prime segments is expected to remain positive through early part of next year, though subprime auto and credit card ABS may be under the microscope with delinquencies and losses expected to rise. Elsewhere, strong fundamentals are still evident in U.S. CMBS as performance remains strong, though Fitch also expects an uptick in delinquencies in 2008 (albeit off of historical lows) in part due to less available capital.

... calling this crisis a sub-prime meltdown is ludicrous as by now the contagion has seriously spread to near prime and prime mortgages. And it is spreading to subprime and near prime credit cards and auto loans where deliquencies are rising and will sharply rise further in the year ahead. And it is spreading to every corner of the securitized financial system that is either frozen or on the way to freeze: CDOs issuance is near dead; the LBO market – and the related leveraged loans market – is piling deals that have been postponed, restructured or cancelled; the liquidity squeeze in the interbank market – especially at the one month to three months maturities - is continuing; the losses that banks and investment banks will experience in the next few quarters will erode their Tier 1 capital ratio; the ABCP and related SIV sectors are near dead and unraveling; and since the Super-conduit will flop the only options are those of bringing those SIV assets on balance sheet (with significant capital and liquidity effects) or sell them at a large loss; similar problems and crunches are emerging in the CLO, CMO and CMBS markets; junk bonds spreads are widening and corporate default rates will soon start to rise. Every corner of the securitization world is now under severe stress, including so called highly rated and “safe” (AAA and AA) securities.What happened to containment?

Citigroup: $134.8 billion in 'level 3' assets

by Calculated Risk on 11/05/2007 11:00:00 AM

From MarketWatch: Citigroup reports $134.8 billion in 'level 3' assets

Citigroup Inc. ... said its so-called level 3 assets as of Sept. 30 were $134.84 billion. Level 3 assets are holdings that are so illiquid, or trade so infrequently, that they have no reliable price, so their valuations are based on management's best guess.From the Citi 10-Q:

Level 3—Model derived valuations in which one or more significant inputs or significant value drivers are unobservable.(emphasis in report)

More Citi

by Calculated Risk on 11/05/2007 12:23:00 AM

From Vikas Bajaj at the NY Times: Bankers’ Lesson From Mortgage Mess: Sell, Don’t Hold

Bankers on Wall Street frequently describe themselves as being in the moving and not the storage business. They make money by trading stocks and bonds, not by owning them.Bajaj goes on to describe how Merrill and Citigroup kept many CDOs on their balance sheets, waiting for better prices.

In the last week, top executives at two of the world’s largest banks, Citigroup and Merrill Lynch, have come under scrutiny for ignoring that fundamental principle.

“A lot of us were scratching our heads wondering ‘Where did these bonds go,’” said a banker at a rival institution who was not authorized to speak publicly.The banks didn't realize there was a systemic problem not captured by their historical models - falling house prices - and diversification doesn't reduce this risk.

“They just sat on them, putting them here or there on the balance sheet. They thought they were going to be O.K.”

C.D.O.’s were created on the premise that managers could lower the risks of default by investing in loans made by different companies and dispersed across the country. The notion that one could lower risk by diversifying, and including a small reserve of cash, was supported by historical patterns and allowed the bonds issued by C.D.O.’s to earn higher ratings than the bonds they owned, said Mark Adelson, an independent analyst and consultant.This brings us back to the key sentence in Citi's Press Release: Citi's Sub-Prime Related Exposure in Securities and Banking

...

“The notion that you could be really diversified because some of your production had an Option One name and some had the New Century name and some had the Ameriquest name seems absurd,” he said referring to mortgage companies that specialized in risky home loans.

... fair value of these super senior exposures is based on estimates about, among other things, future housing prices ...Perhaps Citi should release their forecast for house prices so we can see if the $8B to $11B writedown is sufficient.

Also note that many of the IBs (especially Citi) might be making a similar mistake - being in the "storage business" - by keeping the LBO related pier loans on their balance sheets while waiting for better prices.

Sunday, November 04, 2007

Citi: additional $8 billion to $11 billion in writedowns

by Calculated Risk on 11/04/2007 07:47:00 PM

From WSJ: Charles Prince Resigns As Citi CEO, Chairman

Meanwhile, Citigroup is poised to report billions of dollars in additional writedowns on mortgage-related securities, according to people familiar with the matter. Estimates of the writedowns ranged from $8 billion to $11 billion. That would far surpass the roughly $2.2 billion in mortgage-related writedowns and trading losses that Citigroup reported in its third-quarter earnings last month.ADDED: Here is the press release: Citi's Sub-Prime Related Exposure in Securities and Banking

Citigroup Inc. (NYSE: C - News) announced today significant declines since September 30, 2007 in the fair value of the approximately $55 billion in U.S. sub-prime related direct exposures in its Securities and Banking (S&B) business. Citi estimates that, at the present time, the reduction in revenues attributable to these declines ranges from approximately $8 billion to $11 billion (representing a decline of approximately $5 billion to $7 billion in net income on an after-tax basis).

These declines in the fair value of Citi’s sub-prime related direct exposures followed a series of rating agency downgrades of sub-prime U.S. mortgage related assets and other market developments, which occurred after the end of the third quarter. The impact on Citi’s financial results for the fourth quarter from changes in the fair value of these exposures will depend on future market developments and could differ materially from the range above.

Citi also announced that, while significant uncertainty continues to prevail in financial markets, it expects, taking into account maintaining its current dividend level, that its capital ratios will return within the range of targeted levels by the end of the second quarter of 2008. Accordingly, Citi has no plans to reduce its current dividend level.

The $55 billion in U.S. sub-prime direct exposure in S&B as of September 30, 2007 consisted of (a) approximately $11.7 billion of sub-prime related exposures in its lending and structuring business, and (b) approximately $43 billion of exposures in the most senior tranches (super senior tranches) of collateralized debt obligations which are collateralized by asset-backed securities (ABS CDOs).

Lending and Structuring Exposures

Citi’s approximately $11.7 billion of sub-prime related exposures in the lending and structuring business as of September 30, 2007 compares to approximately $13 billion of sub-prime related exposures in the lending and structuring business at the end of the second quarter and approximately $24 billion at the beginning of the year.1 The $11.7 billion of sub-prime related exposures includes approximately $2.7 billion of CDO warehouse inventory and unsold tranches of ABS CDOs, approximately $4.2 billion of actively managed sub-prime loans purchased for resale or securitization at a discount to par primarily in the last six months, and approximately $4.8 billion of financing transactions with customers secured by sub-prime collateral.2 These amounts represent fair value determined based on observable transactions and other market data. Following the downgrades and market developments referred to above, the fair value of the CDO warehouse inventory and unsold tranches of ABS CDOs has declined significantly, while the declines in the fair value of the other sub-prime related exposures in the lending and structuring business have not been significant.

ABS CDO Super Senior Exposures

Citi’s $43 billion in ABS CDO super senior exposures as of September 30, 2007 is backed primarily by sub-prime RMBS collateral. These exposures include approximately $25 billion in commercial paper principally secured by super senior tranches of high grade ABS CDOs and approximately $18 billion of super senior tranches of ABS CDOs, consisting of approximately $10 billion of high grade ABS CDOs, approximately $8 billion of mezzanine ABS CDOs and approximately $0.2 billion of ABS CDO-squared transactions.

Although the principal collateral underlying these super senior tranches is U.S. sub-prime RMBS, as noted above, these exposures represent the most senior tranches of the capital structure of the ABS CDOs. These super senior tranches are not subject to valuation based on observable market transactions. Accordingly, fair value of these super senior exposures is based on estimates about, among other things, future housing prices to predict estimated cash flows, which are then discounted to a present value. The rating agency downgrades and market developments referred to above have led to changes in the appropriate discount rates applicable to these super senior tranches, which have resulted in significant declines in the estimates of the fair value of S&B super senior exposures.

Damaged REOs in Las Vegas

by Calculated Risk on 11/04/2007 12:28:00 PM

From the Las Vegas Review-Journal: Foreclosure Fallout: Home Sour Home

Housing crisis leads some former owners, tenants to take anger out on property

...

As many as 25 percent of Las Vegas' bank-foreclosed homes suffer intentional damage, according to an informal R-J survey of valley appraisers and real estate agents. According to Thomas Blanchard, owner/broker of First Realty Group, this damage -- most of which is inflicted in the four to 12 months between the notice of default and the constable's knock at the door -- typically requires $3,000 to $10,000 to repair. However, it can approach or exceed 10 percent of a home's total value.

This is a video I found of a vandalized REO in Las Vegas."Some of the time, the house's worth is a detriment to the land value," says Blanchard. "It's amazing what some people will do to their houses." |

Housing Price Correction Calculator

by Calculated Risk on 11/04/2007 11:12:00 AM

From Kevin at the Baltimore Housing bubble:

This months edition of Fortune Magazine (November 12, 2007) had a great article on housing called How Low Can They Go? by Shawn Tully (no online link available yet, but I’ll modify post once it is). It combined extensive analysis of 54 metro housing markets with the combined work of Moody’s Economy.com, Fortune Analysts, PPR, & NAR. The basis of the article was to provide a snapshot of what the future of housing will look like in 5 years from June 2007. They determined a correction value (sometimes positive) by comparing present day price to rent ratios with the average of the past 15 years.Kevin has developed a spread sheet (download here) based on the numbers for all 54 metro housing markets from the Fortune article.

Instructions on how to use the calculator are in the file and you will be able to modify to be bullish or bearish on how the next 5 years play out.Here is Kevin's post: Price Correction Calculator. He would appreciate any feedback. Enjoy.

NY Times: Rubin Likely Interim Citi Chairman

by Calculated Risk on 11/04/2007 12:27:00 AM

From the NY Times: Ex-Treasury Chief to Fill In as Chairman at Citigroup

Citigroup’s board is highly likely to name Robert E. Rubin ... as its interim chairman at an emergency meeting today ...Waiting for the news ...

Saturday, November 03, 2007

Mortgage Risk Perception

by Anonymous on 11/03/2007 12:12:00 PM

Good morning, everyone. I slept better than Citicorp's board did last night. But didn't we all?

Yves at naked capitalism has an interesting post up this morning on risk perception. The text is this essay, "Researchers study how people think about what is and isn't risky," at PhysOrg.com, which takes as its point of departure the question of why people live in fire-hazard areas like Disneyland. And thereabouts.

I was struck by this paragraph:

Researchers found people link perceived risk and perceived benefit to emotional evaluations of a potential hazard. If people like an activity, they judge the risks as low. If people dislike an activity, they judge the risks as high. For example, people buy houses or cars they like and find emotionally attractive, then downplay risks associated with the purchase.Without having seen the original research, I can't tell if the word "activity" here is meant literally or is simply infelicitous phrasing. My intuition, at least, is that what people like in the above examples is more usefully described as a state of being rather than an activity: people like owning nice homes and cars, not the activity of purchasing homes and cars. In fact, my intuition is that on the whole most people seriously dislike at least certain parts of the activity of purchasing such things. It is only the emotional lure of getting past the purchasing activity that keeps them going.

Anyone who has purchased a home knows that once you get past the early steps--perusing the McMansion porn in the Sunday papers, touring the open houses with a flattering, obsequious real estate agent--it gets to unpleasantries like contracts, inspections, lawyers, financing. Recreational home shopping certainly exists as a phenomenon, as any disappointed broker or home seller will tell you, but recreational home buying is certainly rare. It's just not like whipping out the Visa to snap up another pair of Nikes that you don't really need. Not even the most devoted flipper or serial homebuyer can pull that off every weekend.

I bring this up because I have contended, for some time now, that it is a mistake to see lowering of credit standards as the only real problem we've had going in the mortgage industry lately. It is the attempts to make the process of financing or refinancing a home quick and "painless" that is at the root of the problem. Certainly part of the way you make it "painless" is by relaxing credit standards; these things are related. But the important effect is that borrowers no longer feel put under a microscope (or a proctoscope, as those who borrowed mortgage money ten years or more ago are likely to describe it).

How does that change a prospective mortgagor's perception of the risk of buying a home or refinancing an existing mortgage? It doesn't seem unreasonable to conclude that making the activity less intrusive, in the borrower's subjective experience of it, means that the borrower is less likely to take seriously the written disclosures that describe the risks.

Back when the mortgage process was a great deal more "intrusive," borrowers used to complain bitterly about it. This perception of "intrusiveness" didn't arise simply in the matter of the borrower's credit and financial history; borrowers would routinely moan about lenders "interfering" in sales contracts. Why does some appraisal matter? I should be able to pay whatever I decide the property is worth. Why should the lender delve into my "side agreements" with the seller? Why should the lender be able to delay closing over incomplete items? If I don't care whether the driveway is done or the sod laid, why should the lender care?

The usual lender retort was always that you're doing all these things with someone else's money, and that you pay a lower interest rate for secured money than for unsecured money, implying that the lender has to care as much about the quality of the collateral as about the quality of the borrower. Don't like the lender's view of your collateral? Put it on the Visa; Visa doesn't care what you buy with the loan proceeds. But one of our most powerful ripostes, particularly in the case of cash-out refinances, was the old "paternalistic" standby: you are hocking the roof over your family's head! Take this seriously, will you?

Of course all of that lender "interference" and borrower complaining made for some tense, unpleasant transactions for both sides. And since no "sales oriented culture," which is what even depository mortgage lending operations became once the consultants got done with us, can stand to have unpleasantness, we began easing up on precisely those credit and collateral processing standards that drew the most complaints.

I've heard a number of folks argue that the genesis of recent wretched lending standards is the growth, over the last 20 years or so, of "affordable lending" programs, as if those efforts, led mostly by HUD and the GSEs, to put first-time homebuyers in low-down programs were the main impetus, a number of years later, for stated wage-earner programs using an AVM to offer 1-hour approval for a 95% LTV cash-out refinance on a jumbo property. There may be some truth to the idea that the success of older affordable housing programs was used as a justification for letting subsequent homebuyers and current homeowners do any stupid thing they wanted to do, but to argue that none of it would have happened if those "government" programs hadn't existed is to display one's political biases.

The fact is that those older "government" programs were the most "intrusive," "red-tape"-laden loans that have ever existed. FHA and the GSEs steadily lost market share in the purchase-money mortgage business over the last seven to ten years, as did the private mortgage insurers, even in those markets in which loan amount limits weren't an issue, and even when the rates on their products (30-year fixed) were highly competitive and attractive. "Private" programs were being developed to meet a fairly specific "need," encapsulated by the name of the famous Countrywide product, "Fast and Easy."

I think you can argue that consumers paid more attention to disclosures, spent more time reading documents, and generally proceeded with more fearfulness when things were "Slow and Difficult." It's not because they used to be smarter or we used to disclose more; in fact, just about every year the number and timing of mortgage- and RE-related disclosures has increased in the last two decades. But because the activity of getting a mortgage was painful, the seriousness with which borrowers viewed the risks of it was heightened.

This implies that more disclosure, or more vivid disclosure, is not the answer. We have to go back to a mortgage process that is, intellectually and emotionally, commensurate with its risks. This position can easily be mocked as a suggestion that we do our civic duty by providing wretched customer service. Of course you have to argue, rather than merely assert, that "good customer service" includes removing all visible traces of risk assessment from the process. Nobody is saying you should be rude when you demand those W-2s, or that you should "forget" to ask for them up front, and badger some borrower the day before closing about it. At least one of us is willing to say that that kind of half-assed "customer service" is most likely to thrive precisely in an environment in which our view of risk analysis is totally incoherent to start with.

There's a perfectly silly e-mail making the rounds, asking people to sign a petition opposing H.R. 3519, which the authors of the petition believe would outlaw yield spread premiums (money paid to a broker in exchange for a customer taking a higher rate). The unproven assertion is that all YSP is used to "pay" the borrower's closing costs via a credit, and therefore outlawing YSP would make loans more expensive to consumers. (Yes, the "closing costs" that are "paid" by the YSP include the broker's fees. This is different from the broker just taking YSP from the wholesaler in cash and not charging its compensation in the closing costs because.) It's really a lovely composition, purporting to be from "President" of mortgage company, not third-grader of Mother Khazakstan:

I need all the help I can get this morning. We have U.S. House of Representatives that are considering changing law that would eliminate the use of yield spread premiums in the mortgage place. This bill, H.R. 3915 will affect every one of us weather you are in the mortgage industry or if you are a consumer. This will allow the banks to take full control of all pricing and products available to all Americans. This would make it impossible for third party mortgage loan origination, which would reduce the number of real estate transactions for attorneys, appraisers and home inspectors. This bill would make it impossible for anyone to negotiate an interest rate with lower closing costs associated with the loan or if a borrower has credit issues may not get a loan at all.Nobody is asking what the effect on consumer perception of risk is in a situation in which not only is no cash down payment required for a purchase, no actual cash outlay for closing costs on a refi is required. It is unpleasant to cough up even a token contribution toward closing costs in actual cash. But that moment of concentration of the mind--writing a check for a thousand or two to a mortgage lender--has been eliminated from the process. It really isn't that the financial facts of this are not disclosed: the TILA disclosures do pretty clearly show the effect on APR of these "no cost" deals. But people do not perceive that "real money" is at risk when they are not asked to pay "real money" in order to close the transaction.

Back in the old days, we referred to that deposit that a property seller requires before signing a sales contract as "earnest money." As in, proof that the buyer is in earnest about going through with the transaction, as it was nonrefundable. Earnest money weeds out recreational and impulse buyers, and also forces serious buyers to pay attention to the process. (It appears to have little effect on manic speculators, but how manic do speculators get when 20% down payments are required on non-owner-occupied properties?)

Removing all the unpleasantness as well as the cash outlays from mortgage transactions, and speeding them up enough to seriously cut into the "cooling off period," is like removing earnest money from RE transactions. I seriously doubt that any study of consumer ability to read and comprehend mortgage loan disclosures is going to tell us anything useful, unless and until the researchers can find a way to approximate stakes for it: the experimental subjects need to have the emotional pull (buying the house, getting the cash) as well as the emotional push (you forfeit your privacy, your time, and a hefty check in the process). It would be enlightening to see a control group with the pull but not the push (no docs required, 1-hour approval, no cash fees). My guess is that more people can spot the difference between the APR and the "payment rate" on an Option ARM if you tell them they forfeit $1,000, payable immediately in cash, if they get the wrong answer, than if they face a monthly payment that is $5.00 higher (because the $1,000 is financed in the loan).

There really isn't anything you can do about the pull: as long as people like to own homes--this isn't an intellectual matter at this level--the pull will be there, as it will be for that big fat check you get in a cash-out. There isn't any particular reason for people not to enjoy those things. My point is that you can waive disclosure documents in front of people all day long, but if the pull is strong enough and the process is so painless that there is no countervailing pain in the activity of getting what you want, the disclosures will strike people as involving remote, rare, manageable risks if they bother to read them at all.

There is some evidence to suggest that borrowers don't actually read them, based on oral representations by interested parties that they are "just legalese": a perfect illustration of an attempt to make the homebuying or refinancing process "painless" (don't subject yourself to the unpleasantness of having to read awkwardly-written, math-heavy documents). A common sense response to this is to make the first disclosure a one-sentence form in 36-point boldface on neon orange paper that says "ANYONE SUGGESTING THAT YOU NOT READ EVERY WORD OF EVERY DOCUMENT YOU SIGN 24 HOURS PRIOR TO CLOSING IS NOT YOUR FRIEND AND IS TRYING TO MAKE MONEY OFF OF YOUR FOOLISHNESS AND IS VIOLATING FEDERAL LAW." But if you did that, you would, well, be taking the "Fast and Easy" part out of the whole transaction.

I expect, by the way, that a real-world example of this dynamic is underway around some preternaturally-waxed conference table in some climate-controlled high-rise office building in New York as we speak. The risk of all those CDOs was undoubtedly presented in the board packets, but the CEO assured the board members that it was just a bunch of "legalese."

I Love Subprime

by Calculated Risk on 11/03/2007 12:11:00 AM

A couple of ditties for you all ...

First up, a Country Western hit "I Love Subprime". (The singing starts about the 2nd chorus)

A one minute comedy piece featuring the Tan Man:

Friday, November 02, 2007

Citi CEO to Resign

by Calculated Risk on 11/02/2007 08:48:00 PM

Time for a new thread ...

From the WSJ: Citigroup CEO Plans to Resign As Losses Grow (hat tip many!)

MarketWatch version: Citi board gathering for emergency meeting

Special hat tip to Barley who broke the news:

Prince at Citi cancels speaking engagements on Sunday

Barley | 11.02.07 - 3:43 pm |

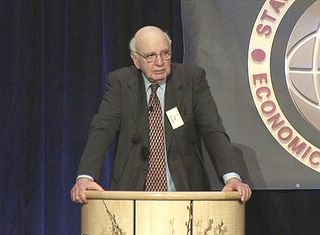

UPDATE: By popular request ... the following is from one of my original posts (in Feb 2005):

Former Fed chief Paul Volcker spoke last week at the second annual summit of the Stanford Institute for Economic Policy Research. In his keynote speech he warned that the nation is facing 'huge imbalances and risks'.

Here is a video of the speech.

Paul Volcker, Stanford, Feb 11, 2005

A few selected excerpts:

"Altogether, the circumstances seem as dangerous and intractable as I can remember."

"Boomers are spending like there is no tomorrow."

"Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

"I come now to the heart of the problem, as a Nation we are consuming and investing, that is spending, about 6% more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 Billion per day."

"What I'm really talking about boils down to the oldest lesson of financial policy in Central Banking: A strong sense of monetary and fiscal discipline."

Citi to Hold Emergency Board Meeting

by Calculated Risk on 11/02/2007 04:29:00 PM

From WSJ: Citi to Hold Emergency Board Meeting

Citigroup Inc. board members are expected to gather for an emergency meeting this weekend ...The music has stopped.

It wasn't immediately clear what the meeting would address, but the subject of further writedowns could come up.

S&P cuts D.R. Horton, Pulte Debt to Junk

by Calculated Risk on 11/02/2007 01:02:00 PM

From Reuters: S&P cuts D.R. Horton, Pulte debt into junk territory

Standard & Poor's ... cuts its ratings on D.R. Horton Inc and Pulte Homes Inc into junk territory, citing the vulnerability of the home builders to the deteriorating housing market and macroeconomic conditions.No surprise.

...

The outlook for both companies is negative, indicating an additional cut is likely over the next two years.