by Calculated Risk on 10/09/2007 12:25:00 AM

Tuesday, October 09, 2007

Buyers Want Out of Condos

From the NY Times: A Bank Bet on Condos, but Buyers Want Out.

“We’re at the riskiest point of the condo lending cycle as these projects are being completed,” Jefferson L. Harralson, a bank analyst at Keefe, Bruyette & Woods, said. “In the coming weeks and months, we’re going to find out what the demand for these condos really is.”Note: Many of these are the kind of condo units that don't show up in the Census Bureau's New Home report. Some quotes from the article:

...

Today, developers owe Corus $4 billion, $3.7 billion of which, or 92 percent, is in condominiums. Of that, about 25 percent of them are in projects in the Miami area and 9 percent are in Las Vegas, according to regulatory filings. More than $2.15 billion of its outstanding loans are due by the end of this year. Nationwide, the number of condos completed this year will be up 45 percent — 232,933 vs. 160,239 — from 2006, according to data tracked by Marcus & Millichap Real Estate Investment Services, a real estate investment brokerage based in Encino, Calif.

“I don’t want to take possession of it.”Not only are there many unsold units, but some buyers are trying to break their contracts, or are thinking about walking away from their deposits.

“I can go a whole week without seeing a neighbor.”

Monday, October 08, 2007

Housing Inventory

by Calculated Risk on 10/08/2007 06:59:00 PM

The story this morning on distressed home sales in Orange County reminded me that all inventory isn't counted in either the Census Bureau's New Home, and the NAR's Existing Home, inventory reports.

Note: Distressed homes are usually homes that will sell for less than the amount owed (including tax liens). This includes properties in foreclosure and short sales. Some people also include 'must sell' properties (divorce) or seriously damaged properties. I prefer the first definition.

Let's start with New Homes. During periods of changing cancellation rates, the Census Bureau may overestimate or underestimate the actual changes to the inventory. Currently my estimate - based on an analysis of public builder's cancellations rates - is that the Census Bureau is underestimating New Home inventory by 77K units.

Another problem with the New Home data (both inventory and sales) is that some condos are not included. It appears town home style condos (with no neighbor above or below) are included in the New Home report, but high rise condos aren't included. Look at this marketing piece: First Condo Auction in D.C. Suburbs Offers Prices Not Seen in a Decade. The press release calls these "two story condos" and it appears from the picture that these are side by side type condos, so they are probably included in the New Home report as inventory. From the Press Release:

"There are currently about 19,000 unsold condominiums actively marketing in the Washington metropolitan area, with at least 16,000 new units coming on the market in the next 36 months," said William Rich, Vice President of Delta Associates.Why a marketing piece would want to remind buyers of the excess inventory is a different issue, but some of these 35,000 units - if they are multiple story units - might not be included in the New Home report.

For existing homes, some distressed properties are not included in the Existing Home inventory report. Some bank REOs (Real Estate Owned) are not listed - and some REOs are. So it's difficult during periods of high foreclosure activity to accurately estimate the total inventory for existing homes.

The Census Bureau and NAR numbers are useful in comparing to prior periods, but this is just a reminder that the current reported inventory numbers are probably lower than actual.

Fannie Mae: Jumbo Market "Remains in Distress"

by Calculated Risk on 10/08/2007 05:51:00 PM

From Fannie Mae chief economist David Berson's Weekly Commentary

"... lenders reported a lack of investor demand for high credit quality jumbo mortgages and other mortgages not eligible for agency purchase. This dislocation pushed the cost of prime jumbo financing significantly higher relative to rates on conforming loans. Figure 1 shows the spread between rates being offered by lenders on prime jumbo and prime conforming 30-year fixed-rate mortgages. In mid-August this spread spiked to above 90 basis points after fluctuating between 15 and 25 basis points for the prior year-and-a-half (about equal to its historic spread). This spread has moderated somewhat over the past couple of weeks, however, and fell below 80 basis points in late September, suggesting some modest improvement in the market conditions for prime loans with balances above the conforming loan limit. Even so, the spread remains historically wide -- suggesting that the prime jumbo market remains in distress."

The key sentence: "the spread remains historically wide -- suggesting that the prime jumbo market remains in distress."

Credit Suisse: "Time to Buckle Up"

by Calculated Risk on 10/08/2007 12:18:00 PM

In a research note released today, titled "Time to Buckle Up the Seat Belts", Credit Suisse argues that consumer spending was weaker than expected in September, and they believe this may be "a sign of what's to come" in the 4th quarter.

In an earlier post, I noted that growth in real consumer spending was around 3% annualized in Q3 using the two month estimate (based on the first two months of the quarter). Usually I go with the two month estimate, however I think Q3 2007 might be an exception and real PCE growth could have slowed sharply in September.

UPDATE: From Ryder Press Release:

Economic conditions have softened considerably in more industries beyond those related to housing and construction.On a related note, from MarketWatch: Ryder lowers quarterly, yearly profit outlook (hat tip Al, Brian)

... the truck leasing company warned that soft demand for its commercial rentals, lower used-vehicle prices and higher costs would yield lower third-quarter earnings than earlier forecast.

The company blamed a slowdown in the housing and construction industries for the lower outlook, a situation that Ryder said was likely to persist through the end of the year.

...

Though transportation fundamentals have been weak for the last couple of quarters, Ryder's case is surprising because it's been considered to have a more stable outlook as most of their business is contractual, said Todd Fowler, analyst with Keybanc Capital Markets.

Context Is Everything

by Anonymous on 10/08/2007 11:30:00 AM

Nonetheless, broad-brush numbers like these do provide a kind of context for certain discussions of the mortgage market. I tend, personally, to cringe a lot when certain numbers are reported in the press, because I possess a sense of context that, frankly, non-insiders don't have. It is second nature to me, for instance, to distinguish between origination volume and level of loans outstanding at the end of a period, but you will find press reports moving back and forth from originations and outstandings in blithe disregard of the issues.

So make of this what you will. A few nerdly observations about the data:

1. Total originations are hard to pin down; there's often a lot of vapor as well as volatility in those numbers. I pick what I think is the most reliable, but you should know that data collection and reporting practices change over time, and so a lot of the older numbers are pretty approximate. That's one reason why I don't care to go back before 1988.

2. The ownership rate statistical calculation changed significantly in the early 90s. The pre-1993 numbers should be thrown around with even more caution than the 1993-2006 numbers.

3. There are a lot of different rates you can use to establish an average mortgage interest rate. I chose the FHFB conforming fixed contract rate because it can be considered an index of "refinance incentive."

4. Mortgage FOR is a statistical measure of mortgage debt, property taxes, and insurance divided by disposable personal income for all homeowners with a mortgage. As a level, it's not particularly helpful, but it does help establish trends, and it is certainly more consistently calculated than DTI.

5. Refinance percent is all refinances. I am not yet ready to try to sort out the cash-out issue over this time period, and I may never be. But general refi share is a useful bit of context for those changes that you see in the other numbers.

A couple of general observations I would make about this data:

1. Notice the volatility of origination volume compared to mortgage outstandings. A large part of some of the knotty issues we've talked about on this blog, like use of brokers, barriers to entry (or the lack thereof) for mortgage originators, and historical changes in quality of mortgage origination personnel (including loan officers and appraisers), has to do with that volatility. The short version is that originators staff up and staff down in the cycle, and that loan quality (not just borrower credit quality, but accuracy of paperwork, depth of documentation, clarity of disclosures) zigs and zags along that cycle. In the early part of those big booms, for instance, you can see a lot of novice work. In the troughs, you can see a lot of desperate commission-paid people doing desperate things. That's something to take into account when you look at, say, vintage charts of loan performance. I believe, for instance, that a lot of the problems with the (in)famous 2001 vintage had to do with a huge crop of brand-new brokers and loan officers and appraisers getting into the business to cope with the volume. A lot of the problems with the 2000 vintage is that a bunch of originators who had been, in the past couple of years, making plenty of money off the refi boom started scraping the bottom of the barrel when volume dropped off. The 1993-1994 period had a similar problem.

2. There has always been much more stability on the servicing side; the problems there in terms of expertise are more a function of technological "productivity" changes and outsourcing reducing the cadre of gray-haired veterans of past crises. The thing to notice here is the level of turnover in the outstandings. In 2003, for instance, around a third of the outstanding mortgage book turned over in refinances. Mortgage sevicers can do a lot of work to stay in the same place, let alone to grow a servicing portfolio.

3. Whatever generalizations you want to make about earlier periods, the 2004-2006 period confounds them.

Lansner: Distressed properties 12% of O.C. housing supply

by Calculated Risk on 10/08/2007 10:39:00 AM

Jon Lansner writes at the O.C. Register: Distressed properties 12% of O.C. housing supply

Market watcher Steve Thomas at Re/Max Real Estate Services in Aliso Viejo notes the impact of distressed properties in his biweekly summary of housing supply ...After finding a new way to search for short sales and foreclosures on the market and in escrow, the new findings are disconcerting. Currently, short sales and foreclosures in Orange County account for 12% of the active inventory and 15% of all escrows opened within the prior month.Thomas also calculates “market time,” a benchmark of how many months it theoretically takes to sell all the inventory in the local MLS for-sale listings at the current pace of pending deals being made. This index shows the inventory-to-selling ratio continuing to erode. By this Thomas logic, it would take 15.17 months for buyers to gobble up all homes listed for sale at the current pace of deals vs. 14.73 months two weeks earlier and vs. 7.10 months a year ago.

Sunday, October 07, 2007

Just Say Yes To Cram Downs

by Anonymous on 10/07/2007 11:09:00 AM

A lot of people have raised questions in the comments regarding proposed changes to federal bankruptcy law to accommodate modifications of mortgage loans.

Here's the issue, in a nutshell. Until the 2005 bankruptcy reform, insolvent homeowners could choose Chapter 7 (liquidation) or Chapter 13 (repayment plan) bankruptcy. After the reform bill, for practical purposes most homeowners are limited to Chapter 13.

Chapter 7 filings usually do not result in borrowers keeping their homes, although they can (if the borrower reaffirms the mortgage debt, the court accepts the reaffirmation, and the borrower has the financial capacity to continue to make mortgage payments). In most cases, the BK stay is lifted and the loan is foreclosed.

You can think of Chapter 13 as itself a kind of loan modification: the court establishes a 3-5 year repayment plan for all the borrower's debts, with the unpaid remainder discharged at the end of the repayment plan period. In Chapter 13, the debtor can keep a mortgaged home, as long as he continues to make mortgage payments throughout the plan period, and makes up any past-due amounts (including fees) during the repayment period as determined by the repayment plan. If the borrower does not or cannot continue to pay the mortgage, the stay is lifted and the lender can foreclose.

However, secured debts can be restructured or modified in a Chapter 13 bankruptcy, and secured creditors, except the mortgage lender on a principal residence, can be subject to what is called a "cram down." This happens when the amount of the debt is greater than the value of the collateral securing it; the court reduces the value of the secured debt to the market value of the collateral, with the remainder being treated as unsecured (and subject to the same repayment plan/discharge terms as any other unsecured debt). The prohibition of court-ordered modifications for mortgages on principal residences was created in 1978; between 1978 and 1993 most bankruptcy courts interpreted the law to mean that while interest-rate reduction or term-extension modifications were not allowed, home mortgages could still be crammed down.

In 1993, with Nobleman v. American Savings Bank, the Supreme Court held that the prohibition on modifications of principal-residence mortgage loans also included cram downs. The result is that borrowers who are upside down and who have toxic, high-rate mortgages are simply, in practical terms, unable to maintain their homes in Chapter 13.

According to the Center for Responsible Lending:

The language we seek to change was enacted in 1978, a time when virtually all home mortgages were fixed-interest rate instruments with low loan-to-value ratios. The loans were rarely the source of a family’s financial distress. As originally introduced, the House legislation permitted a plan to modify any secured indebtedness, including that represented by a home mortgage.21 During Senate hearings on the proposed legislation, advocates for secured lenders suggested that home-mortgage lenders were “performing a valuable social service through their loans,” and “needed special protection against modification.” At their urging, the original proposal was subsequently amended to insert the exception for mortgages on primary residences. 22 This claim likely succeeded through effective lobbying since, as described below in section III, the merits of the argument are groundless. Whatever the merits of this claim in 1978, however, when home mortgage loans were responsibly underwritten thirty-year fixed rate loans, it plainly does not apply to the practices of subprime mortgage lenders during the last decade.As far as I'm concerned, if you believe that prior to 1978, when modifications of home mortgages were unrestricted, and in the period of 1978-1993, when term modifications were restricted but cram downs were widely practiced, mortgage lenders offered higher-rate (relative to prevailing market), higher-LTV mortgage terms than they have in the post-1993 period, when they are safe from any restructurings, I would like to discuss a bridge purchase with you. Nonetheless, that reliable source of comic relief, the Mortgage Bankers Association, wants you to think that allowing cram downs or other kinds of loan restructuring would, um, ruin the party:

“Giving judges free rein to rewrite the terms of a mortgage would further destabilize the mortgage backed securities market and will exacerbate the serious credit crunch that is currently hindering the ability of thousands of Americans to get an affordable mortgage,” said Kurt Pfotenhauer, Senior Vice President for Government Affairs and Public Policy for MBA. “The current legislation gives no guidance as to the proper parameters for judges to modify existing loan contracts.”In other words, the MBA implicitly admits that in the post-1993 era lenders have made low- or no-down loans at interest rates that, while high enough in terms of the blood they extract from strapped borrowers, are still lower than what they would have been if the lenders had had a healthy fear of BK court restructurings. Of course it's beyond ludicrous to argue that being forced to take what they can reasonably get by a BK judge is the "destabilizing" factor here, but you can count on the mortgage industry be ludicrous when dollars are on the table.

By allowing judges to rewrite loan contracts and provide whatever relief they individually deem appropriate, HR 3609 would cast doubt on the value of the asset against which the mortgage loan is secured. As a result, lenders and investors would likely demand a higher premium for offering these loans. This premium could come in the form of higher fees, a higher interest rate or the requirement for a larger downpayment, all of which would serve to make the American dream of homeownership less attainable for many Americans.

In fact, I have some sympathy with the view that mortgage lenders "perform a valuable social service through their loans." That's why, when they stop doing that and become predators, equity strippers, and bubble-blowers instead of valuable social service providers, I like seeing BK judges slap them around. Everybody talks a lot about moral hazard, and the reality is that you're a lot less likely to put a borrower with a weak credit history, whose income you did not verify and whose debt ratios are absurd, into a 100% financed home purchase loan on terms that are "affordable" only for a year or two, if you face having that loan restructured in Chapter 13. If you are aware that your mortgage loan can be crammed down, I'm here to tell you that you will certainly not "forget" to model negative HPA in your ratings models, and will probably pay more than a few seconds' attention to your appraisals. You might even decide that, if a loan does get into trouble, you're better off working it out yourself, via forbearance or modification or short sale, rather than hanging tough and letting the BK judge tell you what you'll accept. That would be a major bummer, right?

But I think my favorite part of the MBA lament is this: "HR 3609 would cast doubt on the value of the asset against which the mortgage loan is secured." Translation: lenders mark to model, but if you let them, BK judges will mark to market.

Is it possible that BK judges would use the lowest plausible "distressed liquidation value" to determine the secured part of the mortgage loan? Sure it is. BK judges don't have parts of their job descriptions that refer to supporting home values or keeping those comps up or controlling "price discovery." The cram down is, precisely, the "mark to market" you don't want to get, which is why the risk of it used to function as a brake on lender stupidity.

I am fully in favor of removing restrictions on modifications of mortgage loans in Chapter 13, but not necessarily because that helps current borrowers out of a jam. I'm in favor of it because I think it will be part of a range of regulatory and legal changes that will help prevent future borrowers from getting into a lot of jams, which is to say that it will, contra MBA, actually help "stabilize" the residential mortgage market in the long term. Any industry that wants special treatment under the law because of the socially vital nature of its services needs to offer socially viable services, and since the industry has displayed no ability or willingness to quit partying on its own, then treat it like any other partier under BK law.

Saturday, October 06, 2007

BusinessWeek on Housing: That Sinking Feeling

by Calculated Risk on 10/06/2007 05:56:00 PM

From BusinessWeek: Housing: That Sinking Feeling (hat tip seminole83). This article asks if the recent significant price cuts by home builders will shorten the duration of the slump. Here are a few excerpts:

For the first time, big builders are offering massive, often six-figure, price cuts in overbuilt developments nationwide, giving the industry a kind of shock treatment designed to move inventory off the books fast. It remains to be seen whether these radical measures will revive the market or deepen the slump, but it's certainly having an impact on the local communities.Reducing prices is a necessary first step towards a recovery, but the builders are in a trap of their own making: so many builders bought into the "land bank" fallacy during the boom, and those builders now find themselves having to keep building too many homes - and sell them at a loss - just to liquidate land to make their debt payments. This means the builders are still starting far too many homes to make a dent in the current huge inventory overhang.

...

The real question is whether the drastic price-cutting will short-circuit the usual long, painful downturn builders seem destined to undergo in this economically sensitive business. ... If by doing so the builders can force the market to accept the reality that housing values have fallen--and accept it fast--there's at least the possibility of emerging from the current bust sooner than in earlier down cycles.

...

When builders cut their prices in one fell swoop, rather than letting them drift slowly downward, they in essence force sellers of existing homes to do the same. At the very least, that can be a severe psychological blow that in earlier slumps was absorbed over a period of time rather than all at once. For some homeowners, it's a catastrophic financial blow as well. With new, clearly established market prices, troubled homeowners who paid peak prices will have a harder time refinancing. ... As painful as such situations are, however, the excesses must be wrung out of the market before the sector or the broader economy can recover.

...

Homeowners are almost always slower than builders to bite the bullet and cut their asking prices. That's why prices on sales for existing homes haven't dropped as precipitously as prices for new homes. ... The resale market will eventually have to realign--meaning homeowners will have to cut their prices--before the slump can end.

...

The current housing downturn and the damage it's inflicting on the overall economy are far from over. With a slew of risky, adjustable-rate mortgages still to reset next year, foreclosure rates could climb even higher. ... "Builders definitely responded more quickly this time, and that's a good thing," says Banc of America Securities analyst Daniel Oppenheim. "But the inventory overhang is so great, it's going to take a long time to work through this. They still have a ways to go before there's a recovery."

And the new price realities will put even more existing homeowners upside down in their homes, either trapping them in their homes for years or forcing more distressed property on the market. This will undoubtedly keep pressure on home prices, probably for years.

Saturday Rock Blogging

by Anonymous on 10/06/2007 02:05:00 PM

Advice for all you UberNerds: if your PC is already acting squirrelly, and your dsl connection is slower than usual, it is not a good time to decide to download a giant MIRS dataset from the Federal Housing Finance Board, because three hours later after you've finally restored your system and rebooted in normal mode and retrieved the fragments of your damaged spreadsheet, you will have forgotten what the hell you needed that data for.

This isn't the tune I had planned for today, but under the circumstances it will do.

Merrill's $5 Billion Write-Down

by Calculated Risk on 10/06/2007 12:34:00 AM

From the WSJ: Merrill's $5 Billion Bath Bares Deeper Divide. This article is mostly about internal issues at Merrill Lynch. A few excerpts:

Merrill Lynch & Co.'s announcement Friday that it would take a $5.5 billion hit to third-quarter earnings is exposing the weak oversight exercised by top Merrill executives as it became a big force in the mortgage-securities business.Are the problems now behind Merrill and the other banks?

...

In July, before the market worsened, Merrill's chief financial officer, Jeff Edwards, said in a conference call with investors that the firm's exposure to subprime mortgages was "limited, contained and appropriate."

...

Credit-rating agencies maintained Merrill Lynch's current credit ratings but revised the outlook to negative. Standard & Poor's said Friday's announcement "raises concerns over Merrill Lynch's risk-management practices in allowing such a large exposure to build."

...

The write-down means Merrill will report a loss of about $450 million, or 50 cents a share, for the third quarter, after showing quarterly operating profits averaging over $2.1 billion for the past four quarters.

Friday, October 05, 2007

Does a Recession matter?

by Calculated Risk on 10/05/2007 08:15:00 PM

First, what is normal economic growth? To answer that question, look at this graph of the distribution of four quarter real GDP growth since 1956 (the last 50 years).

Note: this graph uses each moving four quarter period as a data point. Each quarter will eventually be in four different events (they are not all independent). Click on graph for larger image.

Click on graph for larger image.

The bars represent the number of times the four quarter real GDP growth was within a certain range. As an example, the ">1%" range is for a four quarter growth rate of 1% to 2% real GDP.

In general, the probability of real GDP growth is a bell curve distribution centered around 3% to 4% real GDP growth.

Most forecasts start with trend GDP growth and then try to decide why growth in the next period will be higher or lower than trend. Instead of trying to forecast a specific number for GDP growth, I usually try to forecast in one of the four circles market on the graph. These are arbitrary definitions that I use: Booming Growth, Trend Growth, Sluggish Growth / mild Recession, and Severe Recession.

For 2007 my forecast was for Sluggish Growth / mild Recession, and I've tried to break it down a little further by saying it is pretty much a coin flip between a mild recession and sluggish growth, but I lean towards a recession. Although there is a bright line between a recession and no recession, the economic difference between sluggish growth and a mild recession is pretty minor.

What is a Recession?

In the U.S., recessions are identified by the National Bureau of Economic Research (NBER), a private, nonprofit, nonpartisan research organization. Here is the NBER’s Recession Dating Procedure. Here are some excerpts:

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough. Between trough and peak, the economy is in an expansion. Expansion is the normal state of the economy; most recessions are brief and they have been rare in recent decades.For the four quarter period ending in Q2 2007, real GDP growth was 1.9% (for the Q1 ending period, four quarter GDP growth was 1.5%). So the U.S. economy is currently in the Sluggish Growth / mild Recession category.

...

Q: The financial press often states the definition of a recession as two consecutive quarters of decline in real GDP. How does that relate to the NBER's recession dating procedure?

A: Most of the recessions identified by our procedures do consist of two or more quarters of declining real GDP, but not all of them. According to current data for 2001, the present recession falls into the general pattern, with three consecutive quarters of decline. Our procedure differs from the two-quarter rule in a number of ways. First, we consider the depth as well as the duration of the decline in economic activity. Recall that our definition includes the phrase, "a significant decline in economic activity." Second, we use a broader array of indicators than just real GDP. One reason for this is that the GDP data are subject to considerable revision. Third, we use monthly indicators to arrive at a monthly chronology.

If we go back to the graph, 5 out of the 19 events with 1% to 2% growth happened during a NBER defined recession. For the 0% to 1% category, 9 out of 11 events happened during a recession. This suggests that the U.S. economy is skating just above a recession, and if the four quarter real growth rate falls below 1%, there is a good chance the NBER will declare a recession.

So do Recessions matter?

What matters is what happens when the economy slows. With a slow economy, the unemployment rate will rise as is currently happening in the U.S. If the economy slides into a recession, then employment will actually decline month after month.

Another key impact is profit growth slows - or profits even decline - as the economy slows. We are already seeing declining profits in housing related sectors, and we will probably see declining profits for the financials too. Note: many analysts are arguing S&P earnings will still be strong, even if the U.S. economy slows, because so many earnings are from strong overseas economies. This is part of the "decoupling" debate.

Also, during an economic slowdown, many problems that were hidden during the previous expansion will be exposed. As an example, sales growth will slow at many companies exposing various structural problems - especially in highly leveraged companies. Some of these companies will go bankrupt making investors more cautious, increasing the spread between high and low quality debt. The recent bank failures are an example of a slowing economy exposing problems.

So recessions do matter in that economic activity slows down, but the key point here is that there is very little difference between sluggish growth and a mild recession (my current forecast). There is a significant difference between the current economic environment and either booming growth or a severe recession; however I think both of those scenarios are unlikely in the near future. Even trend growth seems unlikely over the next year.

Lansner: Late-Sept. home prices at April ‘05 level

by Calculated Risk on 10/05/2007 04:37:00 PM

From Jon Lansner at the O.C. Register on Orange County: Late-Sept. home prices at April ‘05 level

DataQuick’s latest sales update reveals a serious disruption to the O.C. housing market created by the mid-summer credit crunch. These new stats — for the 22 business days through Sept. 21 — show an O.C. median selling price of $590,000. If that held for the full month, that would be the lowest since April ‘05. ...I think this is how prices will be tracked - comparing the current prices to an earlier date.

The sales activity news is no better with house buying through Sept. 21 off 36% vs. the ‘06 pace. If that pattern holds for the full month, September will be the slowest selling month since Jan. 1995 (and the second slowest in DataQuick’s 20-year record.)

Click on graph for larger image.

Click on graph for larger image.If we use the OFHEO house price index for Orange County, it would take a drop of 18% from the peak to reach Q2 2005 house prices. The OFHEO index probably excludes most transactions in Orange County because OFHEO only uses repeat transaction below the conforming limit.

DataQuick probably provides a better measure of house prices in Orange County.

Home ATM Closed? Consumers turn to Credit Cards!

by Calculated Risk on 10/05/2007 03:18:00 PM

From MarketWatch: U.S. consumer credit rises in August

Outstanding U.S. consumer debt rose at an annual rate of 5.9% in August, pushed higher mostly by a hefty gain in credit-card debt, the Federal Reserve reported Friday.

...

Revolving debt such as credit cards was the biggest driver behind the overall rise in August, the data show. That debt climbed by 8.1% in August, or by $6.1 billion. In July, credit-card debt rose by a revised 7.4%

Fed's Kohn: Economic Outlook

by Calculated Risk on 10/05/2007 01:29:00 PM

From Fed Vice Chairman Donald L. Kohn: Economic Outlook. A few excerpts (video of speech at bottom of post).

... Our policy action will not be able to avert all of the weakness in the economy that may be in train for the next several months. Monetary policy works with a lag, and the effects of our easing action will have their maximum effect only after several quarters. In particular, housing markets are likely to remain depressed in coming months as housing demand is restrained by the difficulty in obtaining mortgages and perhaps also by spreading expectations on the part of buyers that house prices will fall, as they already have in a number of markets. And, although builders have reduced housing starts sharply, they have made very little progress in reducing the number of unsold new homes on the market. As a result, even absent a further deterioration in sales, residential construction would probably decline further in the months ahead, imparting a significant drag on overall growth in real gross domestic product.

Beyond housing, it is too early to tell what effect financial market turmoil is having on household and business spending, though very preliminary and partial information suggest that thus far the effects seem to be limited. Moreover, the available data indicate that the economy entered this period still expanding at a moderate pace. For example, consumption held up well this summer supported by solid growth in real incomes. And, the recent data on orders and shipments of capital goods and on nonresidential construction indicated further growth in capital outlays in August. That said, credit availability is likely to be tighter than before, consumer confidence is down, and businesses will probably be a little more cautious for a while, suggesting that these components of aggregate demand could become more subdued in coming months.

... To be sure, households are likely to start to save more out of their current incomes as they come to realize that they cannot count on a rise in the value of their real estate to build their retirement nest eggs. However, households have been surprisingly resilient to recent economic shocks, and any rise in the saving rate probably would be gradual. More generally, consumer spending should continue to be supported by ongoing growth in employment and income. In the business sector, balance sheets are in good shape, and most firms are not likely to face an appreciable tightening of credit availability. As a result, I anticipate that they will expand their investment spending to keep pace with rising household demands and with strength in export markets. In sum, once we get through the near-term weakness caused by the extra downleg from the housing contraction and any spillover from tighter credit conditions, I am looking for moderate growth with high levels of employment.

But you should view these forecasts even more skeptically than usual. The FOMC emphasized the considerable uncertainty in the outlook.

... Of course, we would not have eased policy if the outlook for inflation had not been favorable. The recent data on consumer price inflation have been encouraging. ... And, it will be critical for inflation expectations to remain well contained.

That said, I do not want to minimize the upside risks to inflation either. Rates of resource utilization are still relatively high, and the slower rates of productivity growth over the past two years, coupled with a pickup in compensation growth, have led to a noticeable acceleration in unit labor costs. Moreover, the decline in the exchange value of the dollar has put upward pressure on prices of imported goods, which have both direct and indirect effects on overall consumer prices.

Click image for video.

Kohn Says Fed Must Be `Nimble' in Setting Interest Rates: Video October 5 (Bloomberg) -- Federal Reserve Board Vice Chairman Donald Kohn speaks at the Greater Philadelphia Chamber of Commerce Annual Meeting in Philadelphia about the Fed's half-point reduction in the benchmark lending rate to 4.75 percent last month, the outlook for the U.S. economy and the need for policy makers to be "nimble" in setting interest rates. (Source: Bloomberg)

Homebuilders Struggle to Survive

by Calculated Risk on 10/05/2007 12:37:00 PM

From Bloomberg: Homebuilders Liquidate Assets as Threat to Survival Spurs Sales (hat tip Jim)

``It's desperation time and some companies may not make it,'' said Alex Barron, an industry analyst at Agency Trading Group Inc. in Wayzata, Minnesota. ``At this point in the housing cycle, if you have too much debt, it's hard to get out from under it.''We could make fun of the analysts that claimed the homebuilders would have strong cash flow during a downturn (due to less investment in land and improvements) and that the homebuilders were "land banks". Those investment ideas were Dumb and Dumber!

...

``They are all losing money,'' [John Burns, president of John Burns Real Estate Consulting] said.

...

The 15 largest homebuilders are saddled with $7.75 billion in debt due to be repaid through 2009 and the companies' bonds trade as if they were junk ...

The five biggest homebuilders by revenue -- Lennar, D.R. Horton, Pulte, Centex and KB Home -- wrote off a combined $3.3 billion in the third quarter on land they own and will not build on or options to buy land they are choosing not to exercise.

But the more important point is that the homebuilders struggle to survive shows why the builders are still overbuilding. Building homes, and selling at a deep discount, is the only way they can liquidate land to raise cash and pay down their debts in the current environment. This is why housing starts are still too high and will likely fall further over the next few quarters.

WaMu Visits the Confessional

by Calculated Risk on 10/05/2007 09:08:00 AM

From Bloomberg: Washington Mutual Says Third-Quarter Profit Fell 75%

Washington Mutual Inc., the biggest U.S. savings and loan, said third-quarter net income fell about 75 percent because of "a weakening housing market and disruptions in the secondary market."Added: Merrill Lynch Says Credit Market Conditions to Adversely Impact Third Quarter 2007 Results

Loan loss provisions total about $975 million and losses and writedowns on mortgage loans and securities amount to $410 million, the Seattle-based company said in a statement today.

Merrill Lynch & Co., Inc. today announced that challenging credit market conditions will have an adverse impact on its net earnings for the third quarter. The company expects to report a net loss per diluted share ... resulting from significant negative mark-to-market adjustments to its positions in two specific asset classes: collateralized debt obligations (CDOs) and sub-prime mortgages; and leveraged finance commitments.There appears to be a line at the confessional, also from Bloomberg: JPMorgan, Bank of America May Write Down Buyout Loans

...

The primary drivers of the FICC net losses in the third quarter were as follows:* Write-downs of an estimated $4.5 billion, net of hedges, related to incremental third quarter market impact on the value of CDOs and sub-prime mortgages. These valuation adjustments reflect in part significant dislocations in the highest-rated tranches of these securities which were affected by an unprecedented move in credit spreads and a lack of market liquidity in these securities, which intensified during the third quarter. During the quarter, the company significantly reduced its overall exposure to these asset classes.

* Write-downs of an estimated $967 million on a gross basis, and $463 million net of related underwriting fees, related to all corporate and financial sponsor, non-investment grade lending commitments, regardless of the expected timing of funding or closing. These commitments totaled $31 billion at the end of the third quarter of 2007, a net reduction of 42% from $53 billion at the end of the second quarter. The net losses related to these commitments were limited through aggressive and effective risk management, including disciplined and selective underwriting and exposure reductions through syndication, sales and transaction restructurings.

JPMorgan Chase & Co. and Bank of America Corp., the biggest arrangers of U.S. leveraged loans, may have combined markdowns of $3 billion in the third quarter ...These possible writedowns are because of LBO related pier loans.

September Employment Report

by Calculated Risk on 10/05/2007 08:46:00 AM

From MarketWatch: Job growth rebounds to 110,000 in September

Nonfarm payrolls rose by 110,000 in September, including 73,000 in the private sector, very close to expectations of 113,000 total payrolls.Here is the BLS report. Note that the decline in employment in August has been revised away. The unemployment rate increased slightly again and is now at 4.7%.

Payroll growth in July and August was revised higher by 118,000, the government said. Instead of falling by 4,000 in August, payrolls rose 89,000 after revisions. The unemployment rate ticked up to 4.7%, the highest in a year. ...

The annual benchmark revision will lower the level of employment by an estimated 297,000 as of March 2007. ... The actual revision occurs in February, but a preliminary estimate is given in October.

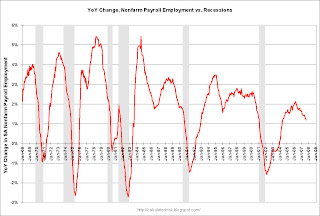

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in nonfarm employment. This shows the weak - but not recessionary - job growth over the last year.

Residential construction employment declined 20,000 in September, and including downward revisions to previous months, is down 191.5 thousand, or about 5.6%, from the peak in March 2006. (compare to housing starts off 30%+).

Note the scale doesn't start from zero: this is to better show the change in employment.

The initial benchmark revision shows the loss of an additional 8,000 construction jobs, but the initial report doesn't breakout residential construction.

Overall this is a stronger than expected report. Even the projected downward revision (that will be included in the January report) is smaller than expected.

Excellent Hedge, There, But Your Tie is Ugly

by Anonymous on 10/05/2007 08:45:00 AM

Because we really needed to know that 47% of you think a professional opinion about cycling vs. jogging or miniblinds vs. drapes or mary janes vs. t-straps is of more value to you than a professional opinion about stocks vs. bonds.

According to the Securities Industry and Financial Markets Association:

Washington, D.C., October 3, 2007 – A majority of adults (53%) would choose to receive financial advice over that of a personal trainer, interior designer or fashion consultant if given the opportunity, according to the findings of a recent survey conducted on behalf of the Securities Industry and Financial Markets Association (SIFMA).Should you for some reason really care, the question was "If you could have a free consultation session with an expert, which would you choose?" The responses were:

Financial Advisor: 53%

Personal Trainer: 23%

Interior Designer: 9%

Fashion/Style Consultant: 6%

Don't Know: 8%

We have certainly managed successfully to redefine the term "expert." I for one see great opportunities for financial advisors who also offer personal training services. If you could discuss portfolio allocation while teaching yoga--good morning, CR!--you could make a fortune. (I, whose interior design has been described as "presence of the usual items of furniture" and whose fashion has been described as "clothed and shod" and whose major form of aerobic exercise is typing, am angling for the "don't know" crowd.)

Homeowners "Too Broke to Sell"

by Calculated Risk on 10/05/2007 12:00:00 AM

From the Chicago Tribune: Here's a new one: Being too broke to sell

A survey of mortgage brokers suggests that one in three consumers who recently signed purchase contracts canceled in August -- up from just 4 percent three years ago, according to the research firm that conducted the survey for Inside Mortgage Finance, a trade journal.Actually this isn't "new"; if the seller is making the payments - and can afford the payments - the lender won't do a short sale. The only way out is for the seller to bring cash to the closing. I wrote about this in March: Escrow to Seller: "Bring Money". Tanta called this "making your downpayment after the fact."

The cancellation rate undoubtedly was fed by two scenarios playing out: Many buyers couldn't get mortgage approval because lending suddenly tightened; or, financially strained lenders yanked funding from their borrowers at the last minute.

But another factor was at work: Sellers -- not buyers -- were in trouble as their closing dates neared.

"Our office had four sales in one week that failed to close because the seller didn't have the cash," said the real estate agent, who declined to be identified because she feared office repercussions.

Thursday, October 04, 2007

More Moody's Subprime Data

by Anonymous on 10/04/2007 05:50:00 PM

As a follow-up to CR's post below, here's a chart from the Moody's report, "Subprime Mortgage Market Update: September 2007," released yesterday.

Note that this chart calculates delinquencies as a percent of the original security balance, so these numbers may not match other delinquency measures you have seen reported that are based on current security balances.

And what seems to be driving 2006 and 2007 delinquencies?

The data show that, as we have noted in previous communications, loan performance for the 2006 subprime vintage seems to be driven primarily by the proportions of stated documentation loans and high CLTV loans backing the transactions as well as the proportion of loans that combine (or "layer") these risk characteristics. (Stated documentation loans are those loans for which the borrower's income and assets are not verified by documentation during the loan approval process and therefore are more likely to be overstated.) Interestingly, FICO scores and LTV ratios do not vary significantly between the strongest and weakest performing transactions and on average transaction performance does not appear to have been influenced by these characteristics.