by Calculated Risk on 7/02/2007 01:53:00 PM

Monday, July 02, 2007

Krugman: Just Say AAA

Paul Krugman writes in the NY Times: Just Say AAA

(For excerpts, see Economist's View)

What do you get when you cross a Mafia don with a bond salesman? A dealer in collateralized debt obligations (C.D.O.’s) — someone who makes you an offer you don’t understand.Krugman criticizes the rating agencies and regulators, and notes these failures have been all too common:

... you might have thought that S.& P. and Moody’s, which gave Thailand an investment-grade rating until five months after the start of the Asian financial crisis, and gave Enron an investment-grade rating until days before it went bankrupt, would by now have learned to be a bit suspicious. And you would think that the regulators, in particular the Federal Reserve, would have learned from the stock bubble and the wave of corporate malfeasance that went with it to keep a watchful eye on overheated markets.

But apparently not.

Mortgage Lender Quote of the Day

by Anonymous on 7/02/2007 01:19:00 PM

It seems that not everybody is getting the point yet. From Reuters, "U.S. regulators stymie mortgage lenders again":

"I think (regulators) are coming in after the fire," said Peter Paul, president of Paul Financial LLC in San Rafael, California. "I'm a little concerned about legislating credit standards. You could start to limit credit."Why, yes, Mr. Paul, you certainly could start to limit credit. There's a theory that those heartless regulators actually thought that was a feature, not a bug.

Record Price for Office Building

by Calculated Risk on 7/02/2007 11:55:00 AM

From the WSJ: New York Building's Record Price Shows Office Market's Strength

... investors agreed late last week to buy 450 Park Ave., ... for $1,589 a square foot, or about $510 million.It doesn't look like tighter lending standards have slowed the NY commercial real estate market yet.

The price -- believed to be the most expensive on a per-square-foot basis for an office building in U.S. history -- demonstrates that trends like strong foreign currencies and the availability of equity are helping the market for commercial office space, at least in premium markets such as New York, despite concerns over tighter lending practices.

....

The 33-story building at 57th Street and Park is being sold by a partnership that includes New York State Common Retirement Fund and Taconic Investment Partners LLC, which paid $158 million, or about $492 per square foot, in 2002.

...

The contract shatters the per-square-foot record set just four weeks previously, when Italy-based Gruppo Zunino agreed to pay $1,476 a square foot for New York's 660 Madison Ave....

Bloomberg: The Backyard Possum Theory of Financial Markets

by Anonymous on 7/02/2007 10:00:00 AM

This may not be the most hysterical article ever to appear on the subject of the subprime mortgage market, but it is certainly the most hysterical one I've yet seen on Bloomberg. Please note that I am using the term "hysterical" here in the clinical sense, not the ha-ha-funny sense. "Bear Stearns Meets Possums in Georgia as Foreclosures Increase." That's the headline.

And how did them city slickers at Bear Stearns become acquainted with southern varmints?

July 2 (Bloomberg) -- Only the possums are enjoying the backyard of 2035 Lilac Lane in Decatur, Georgia, where Wall Street titan Bear Stearns Cos. is just another homeowner by default. . . .

Bear Stearns took possession of the three-bedroom Lilac Lane house for $76,500 on March 6, according to the foreclosure deed. The owner who defaulted had purchased the house in April 2005 for $160,000 using a subprime loan that required no money down. He had been renting it out, according to the neighbor, Ford.

The lender was Meritage Mortgage Corp., one of more than 60 subprime home loan companies that have halted operations, gone bankrupt or sought buyers since the start of 2006, according to data compiled by Bloomberg. Bear Stearns had bought the mortgage from Meritage at a discount.

The firm sold the Lilac Lane house on June 28 for $84,000, said Elisa Marks, a Bear Stearns spokeswoman. That's about half the price paid two years ago. Other homes on the street sold this year for $85,000 to $185,000, according to public records.

The house's condition deteriorated while it was a rental property, Ford said. Being empty for six months only made it worse to the extent that possums had the run of the backyard, she said. . . .

Home values and the $6 trillion U.S. mortgage-backed securities market are locked in a downward spiral. Bear Stearns is bailing out one money-losing hedge fund it controls and leaving another to liquidation by creditors. Both funds invested in securities backed by subprime loans. The loans, for borrowers with bad or limited credit histories, are secured by houses such as the one on Lilac Lane. . . .

Conditions are the worst since the 1990-1991 recession, which was caused by a credit crunch that followed a boom-bust real estate cycle similar to the last seven years, Gumbinger said. Like the 2000 to 2005 boom, the previous surge in sales and prices was sparked by a decline in mortgage rates, and featured ``risky mortgage lending,'' he said.

The whole article is one of the strangest combinations of fact, hype, oversimplification and just weirdness that I've seen in a long time in the "respectable press." Look, I grew up in a part of the country in which having occasional possums--not to mention raccoons, rabbits, squirrels, chipmunks, groundhogs and, if you lived close enough to the river, the odd muskrat--in the backyard was considered, um, neither surprising nor particularly subprime. Am I imagining things, or are we beginning to see this "subprime contaigon" metaphor work itself into something a bit panicky?

Bear Stearns: Investors Will Know Losses by mid-July

by Calculated Risk on 7/02/2007 01:58:00 AM

From the WSJ: Bear Stearns Investors Await Tally on Losses

Investors in two Bear Stearns hedge funds will have to wait until as late as July 16 to learn how much money they have lost.

The Wall Street firm has had difficulty calculating the funds' fair value, apparently because many of the mortgage-related securities they hold are thinly traded and the market for them has been volatile.

...

Investors are watching the process closely because they believe that other hedge funds also are holding thinly traded mortgage-related securities, and they want to see how far Bear thinks their value has fallen.

Sunday, July 01, 2007

The Q2 Consumer Slowdown

by Calculated Risk on 7/01/2007 02:49:00 PM

There is barely a mention of the Q2 consumer spending slowdown in the weekend papers. One of the few who noticed was the ever reliable Asha Bangalore at Northern Trust: Core Inflation Is In “Comfort Zone,” Q2 Consumer Spending Should Be Noticeably Slow

The April-May data of consumer spending and a conservative assumption for June point to about a 1.7% annualized increase in consumer outlays during the second quarter. Consumer spending grew at an annual rate of 4.2% in each of the prior two quarters. This bodes poorly for headline GDP in the second quarter, after a 0.7% increase in the first quarter.Is this just a one quarter slowdown? Or is this the beginning of a housing related slump in consumer spending?

Saturday, June 30, 2007

Saturday Rock Blogging: Scenes From a Brookstreet Investors' Meeting

by Anonymous on 6/30/2007 12:00:00 PM

Here are the lyrics, pure and unadulterated. Certainly I don't possess the talent to improve on them:

If you didn't care what happened to me,

And I didn't care for you

We would zig zag our way through the boredom and pain

Occasionally glancing up through the rain

Wondering which of the buggers to blame

And watching for pigs on the wing.

You know that I care what happens to you

And I know that you care for me

So I don't feel alone

Of the weight of the stone

Now that I've found somewhere safe

To bury my bone

And any fool knows a dog needs a home

A shelter from pigs on the wing.

Brookstreet Update III: The Marks Speak

by Anonymous on 6/30/2007 10:46:00 AM

No, no, not the marks to market. The marks to whom Brookstreet sold inverse floaters, according to the OC Register:

"Those investments are pretty involved and sophisticated," said Wayne Willer, a Brookstreet client in Galena, Ill. "And I probably got involved in something I shouldn't have."

"I have no idea what this stuff is," said H.H. Hartmann, a southern Illinois resident who invested $150,000 in Brookstreet CMOs. Nonetheless, when Brookstreet sent him a two-page list of warnings about CMOs this spring, he did what the brokerage asked: He initialed each disclosure and mailed it back.

"(Brokers) kept telling me 'You're going to make money,' " said Gary Stephens, a Brookstreet investor in Missouri. When his monthly statements showed his CMOs declining in value, Stephens said, brokers told him "there was more money there than the (statement) showed."

(risk capital, I'm not sure we can take any more of this today . . . but thanks . . .)

Brookstreet Update II: "A Notional Pricing Disparity"

by Anonymous on 6/30/2007 09:55:00 AM

Lord help us. We're beginning to get some detail on just what Brookstreet's clients were buying. From the OC Register:

The securities, called Collateralized Mortgage Obligations, are backed by pools of residential mortgages. Most CMOs are safe, paying investors principal and interest drawn from thousands of mortgages.

But 30 Brookstreet CMOs reviewed by the Register were more complex than most CMOs. Their structures expose investors to losing or gaining money following tiny fluctuations in interest rates. As such, they are difficult to value. Most are "interest-only strips," which pay investors the interest stream but no principal from mortgages.

Brooks said the accounts collapsed because the clearing firm, a subsidiary of Fidelity Investments, used what are called "notional values" to price the CMOs. Those values plummeted as confidence plunged in mortgage-backed securities to subprime home loans.

"We never had a performance issue," Brooks said of the CMOs. "We had a notional pricing disparity."

These jokers were selling IO strips to retail investors?

For those of you playing along at home, here's a quick definition of the IO strip (and the yin to its yang, the PO strip) from SIFMA:

Principal-Only (PO) Securities.

Some mortgage securities are created so that investors receive only principal payments generated by the underlying collateral. These Principal-Only (PO) securities may be created directly from mortgage pass-through securities, or they may be tranches in a CMO. In purchasing a PO security, investors pay a price deeply discounted from the face value and ultimately receive the entire face value through scheduled payments and prepayments.

The market values of POs are extremely sensitive to prepayment rates and therefore interest rates. If interest rates are falling and prepayments accelerate, the value of the PO will increase. On the other hand, if rates rise and prepayments slow, the value of the PO will drop. A companion tranche structured as a PO is called a “Super PO.”

Interest-Only (IO) Securities.

Separating principal payments to create PO mortgage securities necessarily involves the creation of Interest-Only (IO) securities. CMOs that have PO tranches will therefore also have IO tranches. IO securities are sold at a deep discount to their “notional” principal amount, namely the principal balance used to calculate the amount of interest due. They have no face or par value. As the notional principal amortizes and prepays, the IO cash flow declines.

Unlike POs, IOs increase in value when interest rates rise and prepayment rates slow; consequently, they are often used to “hedge” portfolios against interest rate risk. IO investors should be mindful that if prepayment rates are high, they may actually receive less cash back than they initially invested.

Issue number one: all IOs have a "notional value" by definition. This has exactly jack to do with sinister manipulation of pricing by some nefarious model. The "notional value" of an IO strip will change, just as the face value of a PO strip will change, as payments and prepayments of principal are made on the underlying mortgage loans.

The OC Register story does not tell us what the vintage was of these CMOs, but I'm sure readers of this blog can imagine that IO strips of mortgage-backed securities originated in the period from about 2002 to last quarter had pretty darned fast prepayment speeds. Us insiders call that a "refi boom." A "refi boom" is one of those things in which buying IO strips can bite you in the ass. In any case, while there's a lot of rocket science in the CMO business, calculating the notional balance of an IO strip isn't all that hard: original notional balance minus prepayments of principal equals less notional balance for you to earn interest payments on. Your problem in this circumstance is not that the balance is "notional."

That is why these things are known as sophisticated hedge vehicles and are never, ever sold to retail investors on margin. Unless, apparently, you're Brookstreet. After all, it's probably quite true that they "never had a performance issue." You do not lose your shirt on an IO strip because of principal losses. You lose your shirt because enough of those underlying loans are high-quality enough (or enough refi lenders are low-standard enough) that the damned things prepay.

Brooks said clients who paid the full price for their CMOs – and other financial products – still have money in their accounts, which will accompany his former brokers to whatever new jobs they get.

What?

SEC filings said Brookstreet managed $571 million for 3,644 clients.

Although he served as Brookstreet's president, Brooks said Friday he was not responsible for overseeing the company's trades, which relied on a network of 650 independent brokers nationwide.

In March 2005, the National Association of Securities Dealers suspended Brooks' securities license for two years for inadequate supervision of trades. Last week, Brooks' license was suspended again, this time for 60 days, because of failures in record keeping.

That must be why it's all the clearing firm's fault.

(thanks again, risk capital!)

Brookstreet Update: It Depends On What You Mean By "Lunch"

by Anonymous on 6/30/2007 07:39:00 AM

Remember Brookstreet, the brokerage whose overleveraged retail clients discovered the magic of mark to market a while ago? Evidently the SEC is interested in exactly how that went down. Stories are being, well, not exactly stuck to yet. They're in the works:

[Stanley Brooks] said he is still trying to sort out how the firm imploded. "It's so complicated that the smartest guys in the industry got their lunch handed to them," he said. "It was a perfect storm."

It was also, apparently, a dark and stormy night, during which the Ronco Pocket Cliché Generator began to malfunction. I suppose the industry having its lunch handed to it is better than competitors trying to eat each others' . . . models. Ahem.

Brooks, who founded the family-owned firm in 1990, said the markdowns were executed by its clearing firm, the National Financial unit of Fidelity Investments, the biggest U.S. mutual funds company.

Brooks said "the pricing services [employed by National Financial] issued theoretical pricing [on the CMOs] that apparently wasn't accurate." But he said it was unclear if the firm is planning litigation in the wake of the collapse.

"We are not responsible," Fidelity spokesman Adam Banker said. "While we won't comment on an individual client, I can tell you certain contractual provisions apply when investors borrow on margin purchased securities.

"National Financial has clear margin agreements in place with its clients and uses reputable firms to price securities held in brokerage accounts."

One New York lawyer, who asked not to be named, said he may be retained by one Brookstreet client who lost $1.5 million and is considering litigation.

So Mr. Brooks has settled on the "theoretical pricing" story. One wonders: did Mr. Brooks and his merry band of brokers have any idea that this pricing was "theoretical" before they sold this stuff to clients with 90% borrowed money? Was there some observable market price generated by frequent trades in the asset in question in May that suddenly became "theoretical" in June? Are we to understand that National Financial never marked those positions on the way up?

So now we know: it's "mark to market" during the boom, but it's "mark to model" in the bust. I am eager to find out whether Brookstreet's retail investors get treated with the same contempt certain parties have been heaping on hapless first-time homebuyers who took out 100% toxic loans they didn't understand on the mistaken belief that house prices only go up. I mean, if you want fun, just walk into any group of mortgage-market participants and mention "fiduciary requirements." You will be told in no uncertain terms that your average unsophisticated would-be homeowner carries all the responsibility for doing the due diligence, and that the mortgage brokers are just here to take orders.

If you're an "investor" with $1.5 million to blow? The SEC will get right on it.

(hat tip, risk capital!)

Friday, June 29, 2007

Estimating PCE Growth for Q2

by Calculated Risk on 6/29/2007 05:06:00 PM

The BEA releases Personal Consumption Expenditures monthly (as part of the Personal Income and Outlays report) and quarterly, as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE. The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next (several people have asked me about this). Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q2, you would average PCE for April, May and June, then divide by the average for January, February and March. Of course you need to take this to the fourth power (for the annual rate) and subtract one.

Of course June isn't released until after the advance Q2 GDP report. But we can use the change from January to April, and the change from February to May (the Two Month Estimate) to approximate PCE growth for Q2. Click on graph for larger image.

Click on graph for larger image.

This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.92).

Sometimes the growth rate for the third month of a quarter is substantially stronger or weaker than the first two months. As an example, in Q3 2005, PCE growth was strong for the first two months, but slumped in September because of hurricane Katrina. So the two month estimate was too high.

And the following quarter (Q4 2005), the two month estimate was too low. The first two months of Q4 were negatively impacted by the hurricanes, but real PCE growth in December was strong.

You can see a similar pattern in Q3 2001 because of 9/11.

But in general, the two month estimate is pretty accurate. Maybe June was exceptionally strong, or maybe April and May will be revised upwards, but the two month estimate suggests real PCE growth in Q2 will be about 1.5%.

For other reasons - like business investment and inventory changes - Q2 growth will probably be stronger than Q1. But the scratching sound you are hearing is from Wall Street firms revising down estimates for Q2 PCE and GDP growth.

BofA RE Agent Survey: Another Leg Down in Traffic

by Calculated Risk on 6/29/2007 04:49:00 PM

Bank of America analysts Daniel Oppenheim, Michael R. Wood, and Michael G. Dahl, released a research note this morning:

BofA Monthly Real Estate Agent Survey

Buyers Take Their Time and Watch Prices Drift Lower

The analysts wrote:

"Another leg down in June as traffic and prices worsen further. Our traffic index fell to 21.9 in June (down 4.5 points from 26.3 in May), the lowest level since we started the survey."This fits my view that housing activity is continuing to decline.

underline emphasis in research note

Excerpted with permission

Personal Income: "Incomes Grew Solidly" in May?

by Calculated Risk on 6/29/2007 02:26:00 PM

If you read this AP article - Consumer Spending Up As Incomes Rebound - you might think that the Personal Income and outlays report showed strong real growth in May. You'd be wrong.

From the AP:

Consumers boosted their spending in May as their incomes grew solidly, an encouraging sign that high gasoline prices haven't killed people's appetite to buy. Inflation moderated.Incomes up "solidly". Spending up. Inflation moderated. What's not to like?

It was the second month in a row that consumer spending went up 0.5 percent, the Commerce Department reported on Friday.

Incomes, the fuel for future spending, rebounded in May, growing 0.4 percent.

From the Census Bureau report on real Disposable Personal Income (DPI):

Real DPI -- DPI adjusted to remove price changes -- decreased 0.1 percent in May.And spending?

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in May.So real disposable income declined in May and real spending barely increased. Oh, and that great 0.1% increase in spending is really 0.06% rounded up. Annualize that!

Federal Financial Regulatory Agencies Issue Final Statement on Subprime Mortgage Lending

by Calculated Risk on 6/29/2007 10:56:00 AM

From the Fed: Federal Financial Regulatory Agencies Issue Final Statement on Subprime Mortgage Lending

The federal financial regulatory agencies today issued a final Statement on Subprime Mortgage Lending to address issues relating to certain adjustable-rate mortgage (ARM) products that can cause payment shock.Here is the Statement on Subprime Mortgage Lending.

May Construction Spending, Part I

by Calculated Risk on 6/29/2007 10:36:00 AM

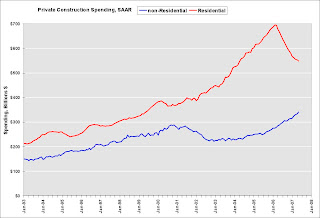

From the Census Bureau: February 2007 Construction Spending at $1,170.8 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during May 2007 was estimated at a seasonally adjusted annual rate of $1,176.6 billion, 0.9 percent above the revised April estimate of $1,166.0 billion.

...

[Private] Residential construction was at a seasonally adjusted annual rate of $549.0 billion in May, 0.8 percent below the revised April estimate of $553.6 billion.

[Private] Nonresidential construction was at a seasonally adjusted annual rate of $343.1 billion in May, 2.7 percent above the revised April estimate of $334.1 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private construction spending for residential and non-residential (SAAR in Billions). While private residential spending has declined significantly, spending for private non-residential construction has been strong.

The second graph shows the YoY change for both categories of private construction spending.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.This will probably be one of the keys for the economy going forward: Will nonresidential construction spending follow residential "off the cliff" (the normal historical pattern)? Or will nonresidential spending stay strong. I'll have some comments on this question later today.

Bloomberg's Numbers

by Anonymous on 6/29/2007 08:50:00 AM

Hat tip to Ministry of Truth for bringing up this startling Bloomberg article, "S&P, Moody's Hide Rising Risk on $200 Billion of Mortgage Bonds." (How much did Fitch pay to get out of the headline?) As our fine commenters have noted, that's an amazingly bearish headline for Bloomberg. It's also a startlingly bald accusation: there's a line between asserting that the rating agencies are not downgrading bonds as fast as some observers think they should, and asserting that they are "hiding rising risk," without the usual "may be" weasel. Bloomberg just stomped right over that line, which suggests to me that tempers have become a bit short:

Standard & Poor's, Moody's Investors Service and Fitch Ratings are masking burgeoning losses in the market for subprime mortgage bonds by failing to cut the credit ratings on about $200 billion of securities backed by home loans.

"Are masking burgeoning losses"? That's even worse than "hiding rising risk." One rather hopes that Bloomberg has its numbers right.

This particular blogger is not sure she understand's Bloomberg's numbers. We get, in order:

- "$200 billion of securities backed by home loans" should have their ratings cut.

- "Almost 65 percent of the bonds in indexes that track subprime mortgage debt don't meet the ratings criteria in place when they were sold"

- "the $800 billion market for securities backed by subprime mortgages"

- "$1 trillion of collateralized debt obligations, the fastest growing part of the financial markets"

- "estimates that collateralized debt obligations . . . will lose $125 billion"

- "25 percent of the face value of CDOs is in jeopardy, or $250 billion"

- "asset-backed bonds, securities that use consumer, commercial and other loans and receivables as collateral . . . which includes mortgage securities, has doubled to about $10 trillion"

- "the $6.65 trillion in outstanding mortgage-backed debt"

- "Investors snapped up $500 million of the securities [CDOs] globally last year"

- "subprime-related debt made up about 45 percent of the collateral backing the $375 billion of CDOs sold in the U.S. in 2006"

- "Of the 300 bonds in ABX indexes, the benchmarks for the subprime mortgage debt market, 190 fail to meet the credit support standard . . . Most of those, representing about $200 billion, are rated below AAA"

OK. So we know right off the bat that item 9 has to be off by an order of magnitude if item 10 is true. If the true size of "the market" of subprime-backed mortgage bonds is $800B, that makes it 80% of the size of the CDO market, 12% of the size of the total MBS market, and 8% of the size of the total ABS market.

If $375B of CDOs were sold in 2006 in the U.S. and 45% of that involved "subprime-related debt," and we assume just for fun that "subprime-related debt" means subprime-backed MBS and that CDOs invest mostly in subordinate tranches (because we aren't sure otherwise where they get enough high-yield to make their numbers work), that suggests that there were at least $169B of low-rated tranches of subprime securitizations available to resecuritize into a CDO last year. That would be just over 20% of this "total market" of $800B. That would imply a pretty thick layer of subordination. I'm thinking that either those CDOs are buying higher-rated paper than we've been led to believe, or else, possibly, "subprime-related debt" includes things like credit default swaps on subprime paper, which implies that brains will explode before we'll be able to line up bond balances on one hand and the notional value of CDO holdings on the other.

Whatever. My brain exploded a good 20 minutes ago. Does anyone else want to take a stab at estimating the potential principal losses that exceed the current estimated principal losses on $200B in subprime ABS, so that we have some idea of how many dollars of losses the rating agencies are "hiding"?

Thursday, June 28, 2007

American Home Mortgage Pulls 2007 Guidance

by Calculated Risk on 6/28/2007 05:27:00 PM

From Reuters: American Home Mortgage pulls outlook on credit losses

American Home Mortgage Investment Corp. on Thursday withdrew its 2007 earnings forecast, and will likely suffer a surprise second-quarter loss as it takes "substantial" charges for credit-related losses.Another "surprise".

Countrywide Subprime Second-Lien ABS Downgraded

by Anonymous on 6/28/2007 05:02:00 PM

And it's only Thursday.

28 Jun 2007 3:08 PM (EDT)

Fitch Ratings-New York-28 June 2007: Fitch Ratings has taken the following actions on classes from Countrywide Asset-Backed Securitizations (CWABS) series 2006-SPS1:

--Class A rated 'AAA', placed on Rating Watch Negative;

--Class M-1 rated at 'AA+', placed on Rating Watch Negative;

--Class M-2 rated at 'AA+', placed on Rating Watch Negative;

--Class M-3 rated at 'AA+', placed on Rating Watch Negative;

--Class M-4 rated at 'AA', placed on Rating Watch Negative;

--Class M-5 rated at 'AA-', placed on Rating Watch Negative;

--Class M-6 downgraded to 'BBB-' from 'A', remains on Rating Watch Negative;

--Class M-7 downgraded to 'BB+' from 'A-', remains on Rating Watch Negative;

--Class M-8 downgraded to 'C' from 'BB+' and assigned a Distressed Recovery (DR) Rating of 'DR6';

--Class M-9 downgraded to 'C' from 'BB' and assigned a Distressed Recovery (DR) Rating of 'DR6';

--Class B downgraded to 'C' from 'BB-' and assigned a Distressed Recovery (DR) Rating of 'DR6'.

The above trust consists entirely of second liens extended to sub-prime borrowers on one- to four-family residential properties and certain other property and assets. CWABS purchased the mortgage loans from CHL and deposited the loans in the trust, which issued the certificates, representing undivided beneficial ownership in the trust.

The negative ratings actions of all classes in the trust reflect the deterioration in the relationship of credit enhancement (CE) to future loss expectations and affect $189.6 million in outstanding certificates.

The impact of the slowdown in the housing market has been particularly evident in highly leveraged subprime borrowers, and delinquency and losses to date for series 2006-SPS1 have been significantly higher than initially expected. After 12 months of seasoning, losses to date as a percentage of the original pool balance are 9.86%. Approximately 14% of the outstanding pool balance is delinquent. Due to the high percentage of losses to date, the cumulative loss trigger will likely fail for the life of the transaction. The failed trigger will generally maintain a sequential allocation of principal with the exception of principal cashflow from the subsequent recoveries of charged-off loans, which may be allocated to subordinate bonds. Fitch expects the amount of principal cashflow from subsequent recoveries to be limited.

While the subordinate classes are expected to incur principal writedowns - as reflected by their distressed ratings - the failed triggers and sequential principal allocation should help mitigate some of the risk of the weak collateral performance for the senior classes. Fitch will closely monitor the delinquency trends and roll rates in the coming months to assess the credit risk of the mezzanine and senior classes.

It Depends On How You Define "Unlucky"

by Anonymous on 6/28/2007 01:35:00 PM

June 28 (Bloomberg) -- Carlyle Group, the buyout firm run by David Rubenstein, postponed a planned $415 million initial public offering of a fund that invests in bonds backed by mortgages after a slump in the U.S. subprime market.

Carlyle is preparing a revised timetable for the sale, it said in a statement today. The Washington-based firm planned to use most of the money from the IPO to buy AAA-rated residential mortgage-backed securities. The fund also targeted loans, high- yield bonds, and collateralized debt obligations. . . .

"Carlyle's fund looked very similar to the Bear Stearns hedge fund," said Toby Nangle, who helps manage $45 billion in assets at Baring Investment Services in London. "They were unlucky with the timing."

I'd say if you're a retail investor you just dodged a bullet. I don't know that I'd call that "unlucky."

Subprime and CDOs II

by Anonymous on 6/28/2007 12:00:00 PM

This is one weird New York Times article on the Bear Hedge Horror of 2007. I'll let you all work out the blog-movie review angle.

When I came across this paragraph, I thought, aha! Exactly what I've been saying all along:

Mr. Cioffi, a longtime bond salesman who had been trading Bear Stearns’s own money for about six months, was brought over to start a hedge fund, the High-Grade Structured Credit Fund. It would invest in bonds and securities backed by subprime mortgages. While some of the mortgage-related securities were easily valued and traded, others, like collateralized debt obligations, or C.D.O.’s, do not trade frequently and can be very difficult to value.

But then I got to this part:

The approach was so successful that the company started a sister fund last summer, the High-Grade Structured Credit Enhanced Leverage Fund, that would use even more leverage.

The timing of that fund, however, could not have been worse; the cooling housing market began to reveal the lax lending standards used by subprime lenders. Last fall, delinquencies and defaults began rising, making the environment for trading and valuing the esoteric securities that are related to those loans much more difficult.

So are the mortgage-related securities the "easily valued and traded ones" or the "esoteric" ones? If the second hedge fund was started right at the time when subprime mortgage investing started to look iffy, how did it get "more difficult" to value the securities? Last fall the deterioration of the housing market and "exotic" mortgage loans was so secret we were having televised hearings on the subject by Congress. Some secret. How, exactly, does that make these puppies "difficult to value"?

(hat tip Walt!)