by Calculated Risk on 7/15/2025 07:14:00 PM

Tuesday, July 15, 2025

Wednesday: PPI, Industrial Production, Beige Book

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for June from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.4%.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

An Early Look at 2026 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/15/2025 04:06:00 PM

The BLS reported earlier today:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.6 percent over the last 12 months to an index level of 315.945 (1982-84=100). For the month, the index increased 0.4 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2024, the Q3 average of CPI-W was 308.729.

The 2024 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 2.6% year-over-year in June (up from 2.2% YoY in May), and although this is very early - we need the data for July, August and September - my early guess is COLA will probably be in 3% range this year, up from 2.5% in 2025.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2024 yet, although we know wages increased solidly in 2024. If wages increased 5% in 2024, then the contribution base next year will increase to around $185,000 in 2026, from the current $176,100.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

Cleveland Fed: Median CPI increased 0.2% and Trimmed-mean CPI increased 0.3% in June

by Calculated Risk on 7/15/2025 11:14:00 AM

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in May. The 16% trimmed-mean Consumer Price Index increased 0.3%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 7/15/2025 08:49:00 AM

Here are a few measures of inflation:

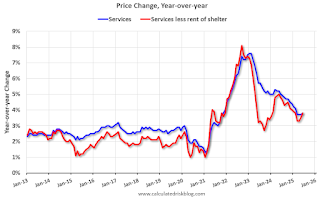

The first graph is the one Fed Chair Powell had mentioned two years ago when services less rent of shelter was up around 8% year-over-year. This declined and is now up 3.8% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through June 2025.

Services less rent of shelter was up 3.8% YoY in June, up from 3.5% YoY in April.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were at 0.6% YoY in June, up from 0.3% YoY in May.

Here is a graph of the year-over-year change in shelter from the CPI report (through June) and housing from the PCE report (through May)

Here is a graph of the year-over-year change in shelter from the CPI report (through June) and housing from the PCE report (through May)Shelter was up 3.8% year-over-year in June, down from 3.9% in May. Housing (PCE) was up 4.1% YoY in June, down from 4.2% in May.

Core CPI ex-shelter was up 2.1% YoY in June, up from 1.9% in May.

BLS: CPI Increased 0.3% in June; Core CPI increased 0.2%

by Calculated Risk on 7/15/2025 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in June, after rising 0.1 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.The change in CPI was close to expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter rose 0.2 percent in June and was the primary factor in the all items monthly increase. The energy index rose 0.9 percent in June as the gasoline index increased 1.0 percent over the month. The index for food increased 0.3 percent as the index for food at home rose 0.3 percent and the index for food away from home rose 0.4 percent in June.

The index for all items less food and energy rose 0.2 percent in June, following a 0.1-percent increase in May. Indexes that increased over the month include household furnishings and operations, medical care, recreation, apparel, and personal care. The indexes for used cars and trucks, new vehicles, and airline fares were among the major indexes that decreased in June.

The all items index rose 2.7 percent for the 12 months ending June, after rising 2.4 percent over the 12 months ending May. The all items less food and energy index rose 2.9 percent over the last 12 months. The energy index decreased 0.8 percent for the 12 months ending June. The food index increased 3.0 percent over the last year.

emphasis added

Monday, July 14, 2025

Tuesday: CPI, NY Fed Mfg

by Calculated Risk on 7/14/2025 07:43:00 PM

Today's movement in mortgage rates, in and of itself, is barely worth mentioning. The average lender remains close enough to Friday's levels but is technically just a hair higher. That fact is offset by the counterpoint that most of the past two months saw higher rates.Tuesday:

The future is far more interesting than the present--specifically, the immediate future. Tomorrow morning brings the release of the Consumer Price Index (CPI). This is one of the most important economic reports as far as interest rates are concerned and tomorrow's example is especially notable.

This CPI marks the first major opportunity for the official data to show (or not show) a meaningful impact on inflation from tariffs.[30 year fixed 6.83%]

emphasis added

• At 8:30 AM ET, The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 2.6% year-over-year and core CPI to be up 2.9% YoY.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of -10.1, up from -16.0.

CPI Preview

by Calculated Risk on 7/14/2025 02:31:00 PM

The Consumer Price Index for May is scheduled to be released tomorrow. The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 2.6% year-over-year and core CPI to be up 2.9% YoY.

From Goldman Sachs economists:

We expect a 0.23% increase in June core CPI (vs. +0.3% consensus), corresponding to a year-over-year rate of 2.93% (vs. +3.0% consensus). We expect a 0.30% increase in headline CPI (vs. +0.3% consensus), reflecting higher food prices (+0.25%) and energy prices (+1.2%).From BofA:

...

Going forward, tariffs will likely provide a somewhat larger boost to monthly inflation, and we expect monthly core CPI inflation between 0.3-0.4% over the next few months.

We forecast headline and core CPI to print at 0.3% m/m in June, which would be a notable acceleration from the recent trend. Stronger price hikes for core goods, discretionary services, and medical services should drive the pickup in core inflation. Based on our forecast, we project core PCE to print at 0.22% m/m in June, which would lower the likelihood of a September cut.Note that month-to-month inflation was soft in May and June 2024.

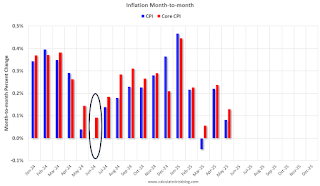

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month change in both headline and core inflation since January 2024.

The circled area is the change for last when inflation was soft. CPI was down fractionally in June 2024, and core CPI was up 0.09%.

Will House Prices Decline Nationally in 2025?

by Calculated Risk on 7/14/2025 11:26:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Will House Prices Decline Nationally in 2025?

A brief excerpt:

Most forecasts for 2025 were for U.S. house prices to increase modestly in the 3% to 4% range. My early view was “mostly flat prices nationally in 2025” with some areas seeing price declines. I didn’t expect either a crash in prices or a surge in prices.There is much more in the article.

With inventory increasing, year-over-year (YoY) price growth has slowed nationally, and declining in many areas. The following table shows the YoY price slowdown. Note that the median price is impacted by the mix of homes sold.

The seasonally adjusted Case-Shiller National Index is essentially unchanged year-to-date (YTD). The index was at 327.81 in December 2024 and was at 327.90 in the April report.

And the Freddie Mac HPI SA is down slightly YTD. The index was at 299.29 in December, and is now at 297.69, a decline of 0.5%.

Other measures are also indicating a slowdown in the YoY growth, but not a collapse in prices.

Housing July 14th Weekly Update: Inventory down 0.7% Week-over-week, Down 11% from 2019 Levels

by Calculated Risk on 7/14/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, July 13, 2025

Sunday Night Futures

by Calculated Risk on 7/13/2025 06:13:00 PM

Weekend:

• Schedule for Week of July 13, 2025

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 26 and DOW futures are down 185 (fair value).

Oil prices were up over the last week with WTI futures at $68.45 per barrel and Brent at $70.36 per barrel. A year ago, WTI was at $83, and Brent was at $87 - so WTI oil prices are down about 18% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.11 per gallon. A year ago, prices were at $3.50 per gallon, so gasoline prices are down $0.39 year-over-year.