by Calculated Risk on 9/25/2012 11:08:00 AM

Tuesday, September 25, 2012

House Price Comments, Real House Prices, Price-to-Rent Ratio

Case-Shiller reported the second consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in July suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

On a Not Seasonally Adjusted (NSA) basis, the Case-Shiller 10-City composite is up 7.4% from the post-bubble low earlier this year, and the 20-City is up 7.8% from the post-bubble low. That is a significant increase, and even when NSA prices start to decline month-over-month in the September or October reports, I expect that house prices will remain above the recent low.

On a seasonally adjusted (SA) basis, prices are up 3.7% and 4.0% from the March lows for the 10-city and 20-city composite indexes.

However, no one should expect the strong price increases to continue. The Case-Shiller Composite 20 index NSA was up 1.6% from June to July. However a large portion of that increase was seasonal. On a Seasonally Adjusted (SA) basis, the Composite 20 index was up 0.4%. That is a 5% annualized rate - and that will probably not continue. I suspect much of the increase over the last few months was a "bounce off the bottom" and prices increases over the next year or two will probably be more gradual.

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through July) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q4 2010), and the Case-Shiller Composite 20 Index (SA) is back to July 2003 levels, and the CoreLogic index (NSA) is back to December 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation early in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

Case-Shiller: House Prices increased 1.2% year-over-year in July

by Calculated Risk on 9/25/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of May, June and July).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Increase Again in July 2012 According to the S&P/Case-Shiller Home Price Indices

Data through July 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed average home prices increased by 1.5% for the 10-City Composite and by 1.6% for the 20-City Composite in July versus June 2012. For the third consecutive month, all 20 cities and both Composites recorded positive monthly changes. It would have been a fourth had prices not fallen by 0.6% in Detroit back in April.

The 10- and 20-City Composites posted annual returns of +0.6% and +1.2% in July 2012, up from their unchanged and +0.6% annual rates posted for June 2012. Fifteen of the 20 MSAs and both Composites posted better annual returns in July as compared to June 2012.

...

“Home prices increased again in July,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “All 20 cities and both Composites were up on the month for the third time in a row. Even better, 16 of the 20 cities and both Composites rose over the last year. Atlanta remains the weakest city but managed to cut the annual loss to just under 10%.

“Among the cities, Miami and Phoenix are both well off their bottoms with positive monthly gains since the end of 2011. Many of the markets we follow have seen some decent recovery from their respective lows – San Francisco up 20.4%, Detroit up 19.7%, Phoenix up 17.0% and Minneapolis up 16.5%, to name the top few. These were some of the markets that were hit the hardest when the housing bubble burst in 2006.

Click on graph for larger image.

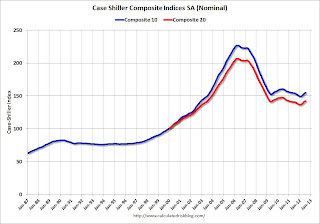

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.7% from the peak, and up 0.4% in July (SA). The Composite 10 is up 3.7% from the post bubble low set in March (SA).

The Composite 20 index is off 31.2% from the peak, and up 0.4% (SA) in July. The Composite 20 is up 4.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 0.6% compared to July 2011.

The Composite 20 SA is up 1.2% compared to July 2011. This was the second year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in July seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 5.9% from the peak. Note that the red column (cumulative decline through July 2012) is above previous declines for all cities.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in July seasonally adjusted (all 20 cities increased NSA). Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 5.9% from the peak. Note that the red column (cumulative decline through July 2012) is above previous declines for all cities.This was at the consensus forecast and the recent change to a year-over-year increase is significant. I'll have more on prices later.

Monday, September 24, 2012

Tuesday: House Prices

by Calculated Risk on 9/24/2012 09:27:00 PM

On Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for July will be released. The consensus is for a 1.2% year-over-year increase in the Composite 20 index (NSA) for July. The Zillow forecast is for the Composite 20 to increase 1.6% year-over-year, and for prices to increase 1.0% month-to-month seasonally adjusted.

• At 10:00 AM, the FHFA House Price Index for July 2012 will be released. The consensus is for a 0.8% increase in house prices.

• Also at 10:00 AM, the Conference Board's consumer confidence index for September will be released. The consensus is for an increase to 64.8 from 60.6 last month.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for September will be released. The consensus is for an increase to -4 for this survey from -9 in August (below zero is contraction).

A question for the September economic prediction contest:

Tim Duy: "Policy is effective even in the aftermath of a financial crisis"

by Calculated Risk on 9/24/2012 06:18:00 PM

This is an excellent followup to Josh Lehner's post (and the graph I posted) earlier today showing that the US recovery is doing better than most recoveries following a financial crisis.

From Tim Duy at EconomistsView: Excuses Not To Do More. Duy discusses Reinhart and Rogoff and excerpts from a piece by Ezra Klein:

...if you look at the leaked memo that the Obama administration was using when they constructed their stimulus, you’ll find, on page 10 and 11, a list of prominent economists the administration consulted as to the proper size for the stimulus package. And there, on page 11, is Rogoff, with a recommendation of “$1 trillion over two years” — which is actually larger than the American Recovery and Reinvestment Act. So if they’d been following Rogoff’s advice, the initial stimulus would have been even bigger — not nonexistent.Then Duy added this update:

As for Reinhart, I asked her about this for a retrospective I did on the Obama administration’s economic policy. “The initial policy of monetary and fiscal stimulus really made a huge difference,” she told me. “I would tattoo that on my forehead. The output decline we had was peanuts compared to the output decline we would otherwise have had in a crisis like this. That isn’t fully appreciated.”

Update: I notice some Twitter chatter of surprise that Rogoff was not completely opposed to fiscal stimulus (I thought everyone read Ezra Klein).The key point here is that short term stimulus, in a depressed economy, can actually reduce the long term deficit.

Fed's Williams: Economic Outlook

by Calculated Risk on 9/24/2012 03:25:00 PM

From San Francisco Fed President John Williams: The Economic Outlook and Challenges to Monetary Policy. A few excerpts:

In considering what maximum employment is, economists look at the unemployment rate. We tend to think of maximum employment as the level of unemployment that pushes inflation neither up nor down. This is the so-called natural rate of unemployment. It is a moving target that depends on how efficient the labor market is at matching workers with jobs. Although we can’t know exactly what the natural rate of unemployment is at any point in time, a reasonable estimate is that it is currently a little over 6 percent.5 In other words, right now, an unemployment rate of about 6 percent would be consistent with the Fed’s goal of maximum employment. In terms of the Fed’s other statutory goal—price stability—our monetary policy body, the Federal Open Market Committee, or FOMC, has specified that a 2 percent inflation rate is most consistent with our dual mandate.And on the economic outlook:

So, how are we doing on these goals? As I said earlier, the economy continues to grow and add jobs. However, the current 8.1 percent unemployment rate is well above the natural rate, and progress on reducing unemployment has nearly stalled over the past six months. If we hadn’t taken additional monetary policy steps, the economy looked like it could get stuck in low gear. That would have meant that, over the next few years, we would make relatively modest further progress on our maximum employment mandate. What’s more, the job situation could get worse if the European crisis intensifies or we go over the fiscal cliff. Progress on our other mandate, price stability, might also have been threatened. Inflation, which has averaged 1.3 percent over the past year, could have gotten stuck below our 2 percent target.

For the FOMC, this was the sobering set of circumstances we were staring at during our most recent policy meeting. Faced with this situation, it was essential that we at the Fed provide the stimulus needed to keep our economy moving toward maximum employment and price stability. So, at our meeting, we took two strong measures aimed at achieving this goal.

First, we announced a new program to purchase $40 billion of mortgage-backed securities every month. This is in addition to our ongoing program to expand our holdings of longer-term Treasury securities by $45 billion a month. Second, we announced that we expect to keep short-term interest rates low for a considerable time, even after the economy strengthens. Specifically, we expect exceptionally low levels of our benchmark federal funds rate at least through mid-2015.

Thanks in part to the recent policy actions, I anticipate the economy will gain momentum over the next few years. I expect real gross domestic product to expand at a modest pace of about 1¾ percent this year, but to improve to 2½ percent growth next year and 3¼ percent in 2014. With economic growth trending upward, I see the unemployment rate gradually declining to about 7¼ percent by the end of 2014. Despite improvement in the job market, I expect inflation to remain slightly below 2 percent for the next few years as increases in labor costs remain subdued and public inflation expectations stay at low levels.With this forecast, QE3 will continue for some time.

Of course, my projections, like any forecast, may turn out to be wrong. That’s something we kept in mind when we designed our new policy measures. Specifically, an important new element is that our recently announced purchase program is intended to be flexible and adjust to changing circumstances. Unlike our past asset purchase programs, this one doesn’t have a preset expiration date. Instead, it is explicitly linked to what happens with the economy. In particular, we will continue buying mortgage-backed securities until the job market looks substantially healthier. We said we might even expand our purchases to include other assets.

This approach serves as a kind of automatic stabilizer for the economy. If conditions improve faster than expected, we will end the program sooner, cutting back the degree of monetary stimulus. But, if the economy stumbles, we will keep the program in place as long as needed for the job market to improve substantially, in the context of price stability. Similarly, if we find that our policies aren’t doing what we want or are causing significant problems for the economy, we will adjust or end them as appropriate.

Employment Losses: Comparing Financial Crises

by Calculated Risk on 9/24/2012 01:15:00 PM

Last year economist Josh Lehner posted a number of charts and graphs as an update to work by Carmen Reinhart and Kenneth Rogoff: This Time is Different, An Update

Today, Lehner updated a few graphs again (through August, 2012). See: Checking in on Financial Crises Recoveries. Here is one graph and an excerpt:

Click on graph for larger image.

Click on graph for larger image.

From Lerner:

[W]hen the Great Recession is compared ... to the Big 5 financial crises and the U.S. Great Depression ... the current cycle actually compares pretty favorably. This is likely due to the coordinated global response to the immediate crises in late 2008 and early 2009. While the initial path of both the global and U.S. economies in 2008 and 2009 effectively matched the early years of the Great Depression – or worse – the strong policy response employed by nearly all major economies – both monetary and fiscal – helped stop the economic free fall.

Dallas Fed: Texas factory activity increased in September

by Calculated Risk on 9/24/2012 10:38:00 AM

From the Dallas Fed: Texas Manufacturing Growth Picks Up

Texas factory activity increased in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 6.4 to 10, suggesting stronger output growth.This is still weak, and the general business activity index has been negative 5 of last 6 months.

Other measures of current manufacturing activity also indicated growth in September. The new orders index rose to 5.3 following a reading of zero last month, suggesting a pickup in demand. The capacity utilization index advanced from 1.7 to 9.3, largely due to fewer manufacturers noting a decrease. The shipments index rose to 4.5, bouncing back into positive territory after falling to -2.3 in August.

Indexes reflecting broader business conditions were mixed. The general business activity index remained slightly negative but edged up from -1.6 to -0.9. The company outlook index was positive for the fifth month in a row but fell slightly to 2.4 from a reading of 4.1 in August.

Labor market indicators reflected slower labor demand growth and slightly longer workweeks. The employment index remained positive but fell to 5.9, its lowest reading in more than a year. Sixteen percent of firms reported hiring new workers, while 10 percent reported layoffs. The hours worked index moved up from -0.9 to 2.8.

LPS: Mortgage delinquencies decreased in August

by Calculated Risk on 9/24/2012 09:08:00 AM

LPS released their First Look report for August today. LPS reported that the percent of loans delinquent decreased in August from July, and declined about 10% year-over-year. The percent of loans in the foreclosure process also decreased in August, but remain at a very high level.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 6.87% from 7.03% in July. The percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.57%, so delinquencies have fallen over half way back to normal. The percent of loans in the foreclosure process declined to 4.04%.

The table below shows the LPS numbers for August 2012, and also for last month (July 2012) and one year ago (August 2011).

The number of delinquent properties, but not in foreclosure, is down about 10% year-over-year (530,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 5% or 100,000 year-over-year.

The percent of loans less than 90 days delinquent is close to normal, but the percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| August 2012 | July 2012 | August 2011 | |

| Delinquent | 6.87% | 7.03% | 7.68% |

| In Foreclosure | 4.04% | 4.08% | 4.12% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,910,000 | 1,960,000 | 2,240,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,520,000 | 1,560,000 | 1,720,000 |

| Number of properties in foreclosure pre-sale inventory: | 2,020,000 | 2,042,000 | 2,120,000 |

| Total Properties | 5,450,000 | 5,562,000 | 6,080,000 |

Chicago Fed: Economic Activity Weakened in August

by Calculated Risk on 9/24/2012 08:39:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Weakened in August

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.87 in August from –0.12 in July. All four broad categories of indicators that make up the index deteriorated from July, with each making a negative contribution to the index in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased from –0.26 in July to –0.47 in August—its lowest level since June 2011 and its sixth consecutive reading below zero. August’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests growth was below trend in August.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, September 23, 2012

Sunday Night Futures

by Calculated Risk on 9/23/2012 09:11:00 PM

On Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for August will be released. This is a composite index of other data.

• At 9:00 AM, the LPS "First Look" Mortgage Delinquency report for August will be released. Look for a decline in the delinquency rate.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for September will be released. The consensus is for 0.5 for the general business activity index, up from -1.6 in August.

• At 3:00 PM, San Francisco Fed President John Williams (voting member) speaks at The City Club of San Francisco, Jamison Roundtable Luncheon. This speech will be closely watched for any hints of possible "thresholds" with regard to QE3 and the unemployment rate and inflation.

The Asian markets are down tonight, with the Nikkei down 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down almost 2 points, and the DOW futures down 10 points.

Oil prices are mixed with WTI futures up slightly at $92.61 and Brent down at $111.74 per barrel. Both are down sharply from a week ago.

Yesterday:

• Summary for Week Ending Sept 21st

• Schedule for Week of Sept 23rd

• Goldman Estimate: QE3 could be $1.2 to $2.0 Trillion

Four more questions this week for the September economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).