by Calculated Risk on 10/27/2011 08:51:00 AM

Thursday, October 27, 2011

Weekly Initial Unemployment Claims decline slightly

The DOL reports:

In the week ending October 22, the advance figure for seasonally adjusted initial claims was 402,000, a decrease of 2,000 from the previous week's revised figure of 404,000. The 4-week moving average was 405,500, an increase of 1,750 from the previous week's revised average of 403,750.The following graph shows the 4-week moving average of weekly claims since January 2000:

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 405,500.

This is down from September, but still elevated - and still above the post-recession lows of earlier this year.

The next graph shows the 4-week average since 1971:

Advance Estimate: Real Annualized GDP Grew at 2.5% in Q3

by Calculated Risk on 10/27/2011 08:30:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.5 percent in the third quarter of 2011 (that is, from the second quarter to the third quarter) according to the "advance" estimate released by the Bureau of Economic Analysis.The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q2 at 2.5% annualized was below trend growth (around 3%) - and very weak for a recovery, especially with all the slack in the system.

The acceleration in real GDP in the third quarter primarily reflected accelerations in PCE and in nonresidential fixed investment and a smaller decrease in state and local government spending that were partly offset by a larger decrease in private inventory investment.

A few key numbers:

• Real personal consumption expenditures increased 2.4 percent in the second quarter, compared with an increase of 0.7 percent in the second.

• Change in private inventories subtracted 1.08 percentage point.

• Investment: "Real nonresidential fixed investment increased 16.3 percent in the third quarter, compared with an increase of 10.3 percent in the second. Nonresidential structures increased 13.3 percent, compared with an increase of 22.6 percent. Equipment and software increased 17.4 percent, compared with an increase of 6.2 percent. Real residential fixed investment increased 2.4 percent, compared with an increase of 4.2 percent.."

I'll have much more later today ...

Wednesday, October 26, 2011

Euro Summit Statement

by Calculated Risk on 10/26/2011 10:49:00 PM

EURO SUMMIT STATEMENT. Excerpts:

The Private Sector Involvement (PSI) has a vital role in establishing the sustainability of the Greek debt. Therefore we welcome the current discussion between Greece and its private investors to find a solution for a deeper PSI. Together with an ambitious reform programme for the Greek economy, the PSI should secure the decline of the Greek debt to GDP ratio with an objective of reaching 120% by 2020. To this end we invite Greece, private investors and all parties concerned to develop a voluntary bond exchange with a nominal discount of 50% on notional Greek debt held by private investors. The Euro zone Member States would contribute to the PSI package up to 30 bn euro. On that basis, the official sector stands ready to provide additional programme financing of up to 100 bn euro until 2014, including the required recapitalisation of Greek banks. The new programme should be agreed by the end of 2011 and the exchange of bonds should be implemented at the beginning of 2012. We call on the IMF to continue to contribute to the financing of the new Greek programme.On EFSF:

We agree that the capacity of the extended EFSF shall be used with a view to maximizing the available resources in the following framework:UPDATE: IIF Statement: (ht Brian)

• the objective is to support market access for euro area Member States faced with market pressures and to ensure the proper functioning of the euro area sovereign debt market, while fully preserving the high credit standing of the EFSF. These measures are needed to ensure financial stability and provide sufficient ringfencing to fight contagion;

• this will be done without extending the guarantees underpinning the facility and within the rules of the Treaty and the terms and conditions of the current framework agreement, operating in the context of the agreed instruments, and entailing appropriate conditionality and surveillance.

19. We agree on two basic options to leverage the resources of the EFSF:

• providing credit enhancement to new debt issued by Member States, thus reducing the funding cost. Purchasing this risk insurance would be offered to private investors as an option when buying bonds in the primary market;

• maximising the funding arrangements of the EFSF with a combination of resources from private and public financial institutions and investors, which can be arranged through Special Purpose Vehicles. This will enlarge the amount of resources available to extend loans, for bank recapitalization and for buying bonds in the primary and secondary markets.

20. The EFSF will have the flexibility to use these two options simultaneously, deploying them depending on the specific objective pursued and on market circumstances. The leverage effect of each option will vary, depending on their specific features and market conditions, but could be up to four or five.

Institute of International Finance

October 27, 2011 – Brussels, Belgium:

The following statement was issued by Mr. Charles Dallara, Managing Director

of the Institute of International Finance:

We welcome the announcement by the leaders of the Euro Area of a

comprehensive package of measures to stabilize Europe, to strengthen the

European banking system and to support Greece's reform effort. On behalf of

the private investor community, the IIF agrees to work with Greece, Euro

Area authorities and the IMF to develop a concrete voluntary agreement on

the firm basis of a nominal discount of 50% on notional Greek debt held by

private investors with the support of a 30 billion Euro official PSI

package. This should set the basis for the decline of the Greek debt to GDP

ratio with an objective of reaching 120% by 2020.

The specific terms and conditions of the voluntary PSI will be agreed by all

relevant parties in the coming period and implemented with immediacy and

force. The structure of the new Greek claims will need to be based on terms

and conditions that ensure an NPV loss for investors fully consistent with a

voluntary agreement.

Pres. Van Rompuy: Agreement on a comprehensive package reached

by Calculated Risk on 10/26/2011 10:12:00 PM

via twitter: "Agreement on a comprehensive package reached at today's #Eurosummit."

Press conference soon.

Council of the European Union (official releases)

EU Press Releases (no statement yet)

Earlier:

• New Home Sales increase in September to 313,000

Europe: After Midnight

by Calculated Risk on 10/26/2011 08:14:00 PM

UPDATE: AP reports an official said there is "broad agreement" on cutting Greek debt. Apparently this is a 50% cut ... no details.

Telegraph: Debt crisis: live

00.30 Jean-Claude Juncker's (head of the euro group) spokesman has told Bloomberg that Merkel and Sarkozy have met with bank representatives and are now relaying the outcome to the rest of the eurozone leaders.WSJ: Live Blog: European Debt-Crisis Summit

Bottom line, Germany wants banks to accept they will lose between 50pc and 60pc of their Greek sovereign debt investments. The banks don't want this. Question is, where do they meet in the middle?

Talks on leveraging the EFSF could drag into November, says a source.From the NY Times: Europe Agrees on Plan to Inject Capital Into Banks

European leaders agreed Wednesday on a plan to force the continent’s banks to raise new capital to insulate them against potential sovereign debt defaults, but disagreements over new financial aid to Greece threatened to derail efforts to devise a comprehensive solution ...Financial Times.

“There has been no agreement on any Greek deal or a specific ‘haircut,’ said Charles Dallara, the lead negotiator for the Institute for International Finance. “We remain open to a dialogue in search of a voluntary agreement. There is no agreement on any element of a deal.”

Council of the European Union (official releases)

EU Press Releases (nothing yet as of 8:15 PM ET)

Misc: COLA and Graphs

by Calculated Risk on 10/26/2011 06:56:00 PM

While we wait for a European announcement ...

Bloomberg reports: Sarkozy, Merkel, Lagarde, Van Rompuy Meeting Bankers’ Dallara. They are still working on the size of the haircut.

The Social Security Cost-of-Living adjustment is official: 3.6%.

The Contribution and benefit base will increase to $110,100 in 2012 from $106,800.

As I mentioned earlier, I'm making changes to graphs. If you click on a graph in a post, a larger graph will be displayed. If there are more than one graph in the post, then thumbnails will be displayed for the other graphs. This is very fast!

The galleries of current graphs is moving to http://www.crgraphs.com/. So far I've moved:

New Home Sales

Existing Home Sales

House Prices

Employment Graphs

Click on any graph and a large graph will be displayed with thumbnails along the bottom. Click on the "X" on the upper right to close.

Euro Watch

by Calculated Risk on 10/26/2011 02:16:00 PM

This is a great resource from the Financial Times: Eurozone crisis: live blog The meeting starts at 7:15 PM Brussels time and will probably continue late into the night.

A few stories ...

From the Financial Times: EU bids to slash Greek debt by third

From the WSJ: Europe Still Split On Crisis Package

The euro zone and banks are working on a plan that will cut the Greek debt held by private investors by 50% ... According to the plan, banks will be asked to exchange existing bonds for new 30-year bonds, carrying a 6% coupon plus 15% in cash, the official said. ... "This will cut the face value of the entire €205 billion ($285.10 billion) debt in private hands by half."From CNBC: Stocks Jump on Signs of EU Debt Talk Progress

The euro zone is planning on leveraging its EFSF bailout fund "several fold" with the finance ministers deciding the details in November, according to the draft euro zone summit statement attained by Reuters.

House Sales: Distressing Gap and New Graph Gallery

by Calculated Risk on 10/26/2011 12:23:00 PM

I'm making a few changes. Now when you left click on a graph, you will see the large image of the graph and thumbnails of all graphs in the post below it. Click on the thumbnails to scroll through the graphs. This is very fast - and doesn't use the scripts in the previous graph gallery. Click on the "X" in the upper right to return to the blog.

In addition, I will keep the most recent graphs in a new graph gallery http://www.crgraphs.com/. Here is the New Home sales gallery. It will take me a few weeks to add all the galleries to this new format.

The following graph shows existing home sales (left axis) and new home sales (right axis) through September. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Then along came the housing bubble and bust, and the "distressing gap" appeared due mostly to distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

I expect this gap to close over the next few years once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different. Also the National Association of Realtors (NAR) is working on a benchmark revision for existing home sales numbers and I expect significant downward revisions to sales estimates for the last few years - perhaps as much as 10% to 15% for 2009, 2010 and 2011. Even with these revisions, most of the "distressing gap" will remain.

On September Home Sales:

• New Home Sales increase in September to 313,000

• Last week: Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

New Home Sales increase in September to 313,000

by Calculated Risk on 10/26/2011 10:00:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 313 thousand. This was up from a revised 296 thousand in August (revised up from 295 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in September 2011 were at a seasonally adjusted annual rate of 313,000 ... This is 5.7 percent (±18.4%)* above the revised August rate of 296,000, but is 0.9 percent (±16.3%)* below the September 2010 estimate of 316,000.

The second graph shows New Home Months of Supply.

Months of supply decreased to 6.2 in September. The all time record was 12.1 months of supply in January 2009. This is still slightly higher than normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of September was 163,000. This represents a supply of 6.2 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 61,000 units in September. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In September 2011 (red column), 25 thousand new homes were sold (NSA). This ties the record low for September set in 2010. The high for September was 99 thousand in 2005.This was above the consensus forecast of 300 thousand, and was tied the record low for the month of September set last year (NSA). New home sales have averaged only 300 thousand SAAR over the 17 months since the expiration of the tax credit ... mostly moving sideways at a very low level (with a little upward slope recently).

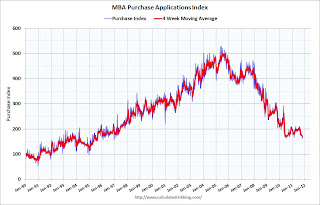

MBA: Mortgage Purchase Application Index increased slightly

by Calculated Risk on 10/26/2011 07:29:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 4.4 percent from the previous week. The seasonally adjusted Purchase Index increased 6.4 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) remained unchanged at 4.33 percent, with points decreasing to 0.47 from 0.48 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 4.68 percent from 4.64 percent, with points decreasing to 0.42 from 0.45 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate also increased from last week.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The purchase index is at about the same level as in 1996, and the 4-week average is at the lowest level this year. This does not include cash buyers, but this suggests weaker home sales in November and December.