by Calculated Risk on 4/18/2025 06:42:00 PM

Friday, April 18, 2025

April 18th COVID Update: COVID Deaths Continue Declining

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 419 | 474 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has been moving down.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has been moving down.Housing and Demographics

by Calculated Risk on 4/18/2025 11:39:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing and Demographics

A brief excerpt:

I’ll return to the above graph and discuss some of the implications for the next decade, but first, here is a similar graph for July 2010.

The arrow points to the large cohort moving into the key renter age group in 2010. It was fifteen years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

Looking at demographics helped me call the bottom for rents and multi-family construction. And sure, enough multi-family starts bottomed around 2010.

...

What are the implications for the next decade?

Q1 GDP Tracking: Near Zero Growth

by Calculated Risk on 4/18/2025 08:30:00 AM

From BofA:

1Q GDP tracking increased three tenths to 0.7% q/q saar after the upward revisions to Jan and Feb core control retail sales. [Apr 17th estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +0.4% (quarter-over-quarter annualized). [Apr 17th estimate]

And from the Atlanta Fed: GDPNow

And from the Atlanta Fed: GDPNowThe GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.2 percent on April 17, unchanged from April 16 after rounding. The alternative model forecast, which adjusts for imports and exports of gold as described here, is -0.1 percent. After this morning’s housing starts report from the US Census Bureau, both the standard model’s and the alternative model’s nowcasts of first-quarter real residential fixed investment growth decreased from 3.7 percent to 2.9 percent. [Apr 17th estimate]

Thursday, April 17, 2025

Friday: Markets Closed for Good Friday

by Calculated Risk on 4/17/2025 08:31:00 PM

Friday:

• All US markets will be closed in observance of Good Friday.

• AT 10:00 AM ET, State Employment and Unemployment (Monthly) for March 2025

Realtor.com Reports Active Inventory Up 31.2% YoY

by Calculated Risk on 4/17/2025 01:05:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 28.5% YoY, but still down 20.2% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending April 12, 2025

• Active inventory climbed 31.2% from a year ago

The number of homes actively for sale remains significantly higher than last year, continuing a 75-week streak of annual gains.

• ew listings—a measure of sellers putting homes up for sale—increased 12.8%

New listings were up 12.8% compared with this time last year, marking the 14th straight week of annual growth.

• The median list price was flat year over year

The national median list price was flat compared with a year ago, aligning with the recent trend of flat or falling prices after last week’s slight uptick. In particular, recent economic uncertainty and concerns around job security could keep buyers on the sidelines, potentially applying downward pressure on prices.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 75th consecutive week.

Newsletter: Housing Starts Decreased to 1.324 million Annual Rate in March

by Calculated Risk on 4/17/2025 09:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts Decreased to 1.324 million Annual Rate in March

A brief excerpt:

First, from Reuters: D.R. Horton cuts 2025 revenue forecast on weak demand for homesThere is much more in the article.U.S. homebuilder D.R. Horton lowered its full-year revenue forecast and missed second-quarter profit and revenue estimates on Thursday due to weak demand for homes. … It sees about 85,000 to 87,000 transaction closings from homebuilding operations, down from its earlier forecast of 90,000 to 92,000 homes.I discussed weaker demand and higher costs last month in Policy and 2025 Housing Outlook

Housing Starts Decreased to 1.324 million Annual Rate in March

...

Total housing starts in March were well below expectations; however, starts in January and February were revised up slightly, combined.

The third graph shows the month-to-month comparison for total starts between 2024 (blue) and 2025 (red).

Total starts were up 1.9% in March compared to March 2024. Year-to-date (YTD) starts are down 1.5% compared to the same period in 2024. Single family starts are down 5.6% YTD and multi-family up 9.0% YTD.

Housing Starts Decreased to 1.324 million Annual Rate in March

by Calculated Risk on 4/17/2025 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,324,000. This is 11.4 percent below the revised February estimate of 1,494,000, but is 1.9 percent above the March 2024 rate of 1,299,000. Single-family housing starts in March were at a rate of 940,000; this is 14.2 percent below the revised February figure of 1,096,000. The March rate for units in buildings with five units or more was 371,000.

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,482,000. This is 1.6 percent above the revised February rate of 1,459,000, but is 0.2 percent below the March 2024 rate of 1,485,000. Single-family authorizations in March were at a rate of 978,000; this is 2.0 percent below the revised February figure of 998,000. Authorizations of units in buildings with five units or more were at a rate of 445,000 in March.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) decreased month-over-month in March. Multi-family starts were up sharply year-over-year (March 2024 was very weak).

Single-family starts (red) decreased in March and were down 9.7% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in March were well below expectations; however, starts in January and February were revised up slightly, combined.

I'll have more later …

Weekly Initial Unemployment Claims Decrease to 215,000

by Calculated Risk on 4/17/2025 08:31:00 AM

The DOL reported:

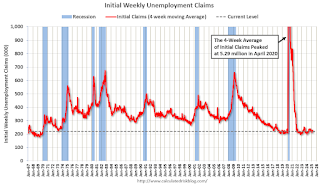

In the week ending April 12, the advance figure for seasonally adjusted initial claims was 215,000, a decrease of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 223,000 to 224,000. The 4-week moving average was 220,750, a decrease of 2,500 from the previous week's revised average. The previous week's average was revised up by 250 from 223,000 to 223,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,750.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Wednesday, April 16, 2025

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 4/16/2025 07:11:00 PM

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 224 initial claims up from 223 thousand last week.

• At 8:30 AM ET: Housing Starts for March. The consensus is for 1.410 million SAAR, down from 1.501 million SAAR in February.

• At 8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 6.7, down from 12.5.

Fed Chair Powell: "Higher inflation and slower growth"

by Calculated Risk on 4/16/2025 01:30:00 PM

From Fed Chair Powell: Economic Outlook Excerpt:

Looking forward, the new Administration is in the process of implementing substantial policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. Those policies are still evolving, and their effects on the economy remain highly uncertain. As we learn more, we will continue to update our assessment. The level of the tariff increases announced so far is significantly larger than anticipated. The same is likely to be true of the economic effects, which will include higher inflation and slower growth. Both survey- and market-based measures of near-term inflation expectations have moved up significantly, with survey participants pointing to tariffs. Survey measures of longer-term inflation expectations, for the most part, appear to remain well anchored; market-based breakevens continue to run close to 2 percent.

Monetary Policy

As we gain a better understanding of the policy changes, we will have a better sense of the implications for the economy, and hence for monetary policy. Tariffs are highly likely to generate at least a temporary rise in inflation. The inflationary effects could also be more persistent. Avoiding that outcome will depend on the size of the effects, on how long it takes for them to pass through fully to prices, and, ultimately, on keeping longer-term inflation expectations well anchored.

Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem. As we act to meet that obligation, we will balance our maximum-‑employment and price-stability mandates, keeping in mind that, without price stability, we cannot achieve the long periods of strong labor market conditions that benefit all Americans. We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension. If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.

emphasis added