by Calculated Risk on 5/28/2024 09:50:00 AM

Tuesday, May 28, 2024

Comments on March House Prices, FHFA: House Prices Increased 0.1% in March

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 6.5% year-over-year in March; FHFA: House Prices Increased 0.1% in March, up 6.6% YoY

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices). March closing prices include some contracts signed in November, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.30%. This was the fourteenth consecutive MoM increase, but a smaller MoM increase than the previous two months.

On a seasonally adjusted basis, prices increased month-to-month in 15 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 8.2% from the recent peak, Seattle is down 6.0% from the peak, Portland down 4.0%, and Phoenix is down 3.1%.

Case-Shiller: National House Price Index Up 6.5% year-over-year in March

by Calculated Risk on 5/28/2024 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Hits New All-Time High in March 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.5% annual gain for March, the same increase as the previous month. The 10- City Composite saw an increase of 8.2%, up from a 8.1% increase in the previous month. The 20-City Composite posted a slight year-over-year increase to 7.4%, up from a 7.3% increase in the previous month. San Diego continued to report the highest year-over-year gain among the 20 cities this month with an 11.1% increase in March, followed by New York and Cleveland, with increases of 9.2% and 8.8%, respectively. Portland, which still holds the lowest rank after reporting three consecutive months of the smallest year-over-year growth, posted the same 2.2% annual increase in March as the previous month.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite all continued their upward trend from last month, showing pre-seasonality adjustment increases of 1.3%, 1.6% and 1.6%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0. 3%, while the 20-City and the 10-City Composite both reported month-over-month increases of 0.3% and 0.5%, respectively.

“This month’s report boasts another all-time high,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “We’ve witnessed records repeatedly break in both stock and housing markets over the past year. Our National Index has reached new highs in six of the last 12 months. During that time, we’ve seen record stock market performance, with the S&P 500 hitting fresh all-time highs for 35 trading days in the past year.

“San Diego stands out with an impressive 11.1% annual gain, followed closely by New York, Cleveland, and Los Angeles, indicating a strong demand for urban markets."

emphasis added

Click on graph for larger image.

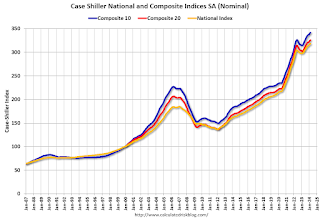

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in March (SA). The Composite 20 index was up 0.3% (SA) in March.

The National index was up 0.3% (SA) in March.

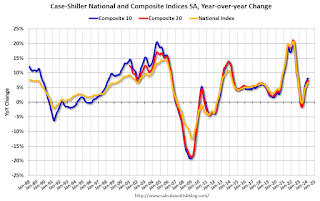

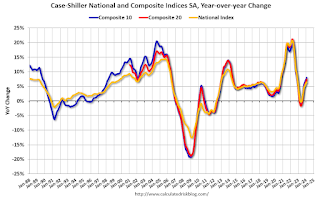

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 8.2% year-over-year. The Composite 20 SA was up 7.4% year-over-year.

The National index SA was up 6.5% year-over-year.

Annual price changes were close to expectations. I'll have more later.

Monday, May 27, 2024

Tuesday: Case-Shiller House Prices

by Calculated Risk on 5/27/2024 06:10:00 PM

Weekend:

• Schedule for Week of May 26, 2024

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.

• Also at 9:00 AM, FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Dallas Fed Survey of Manufacturing Activity for May.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 11 and DOW futures are up 51 (fair value).

Oil prices were down over the last week with WTI futures at $78.38 per barrel and Brent at $82.79 per barrel. A year ago, WTI was at $72, and Brent was at $76 - so WTI oil prices are up about 9% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.55 per gallon. A year ago, prices were at $3.55 per gallon, so gasoline prices are unchanged year-over-year.

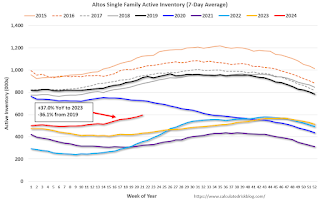

Housing May 27th Weekly Update: Inventory up 2.9% Week-over-week, Up 37.0% Year-over-year

by Calculated Risk on 5/27/2024 09:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, May 26, 2024

TSA: Airline Travel about 12% Above 2019 Levels to New Record High

by Calculated Risk on 5/26/2024 08:21:00 AM

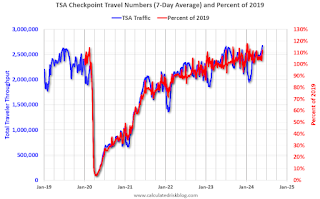

The TSA is providing daily travel numbers.

This data is as of May 24th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA (Blue).

The red line is the percent of 2019 for the seven-day average.

Air travel - as a percent of 2019 - is tracking at about 112% of pre-pandemic levels.

Saturday, May 25, 2024

Real Estate Newsletter Articles this Week: New Home Sales Decrease to 634,000 Annual Rate in April

by Calculated Risk on 5/25/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

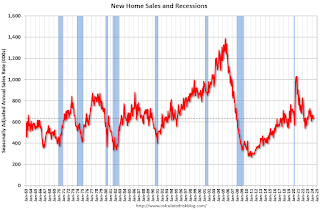

• New Home Sales Decrease to 634,000 Annual Rate in April

• NAR: Existing-Home Sales Decreased to 4.14 million SAAR in April

• Watch Months-of-Supply!

• Single Family Built-for-Rent Up 20% Year-over-year in Q1

• 4th Look at Local Housing Markets in April; California Home Sales Up 4.4% YoY in April

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 26, 2024

by Calculated Risk on 5/25/2024 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, March Case-Shiller house prices, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Dallas Fed manufacturing surveys will be released.

All US markets will be closed in observance of Memorial Day.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 215 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Second estimate). The consensus is that real GDP increased 1.2% annualized in Q1, down from the advance estimate of 1.6%.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.6% decrease in the index.

8:30 AM ET: Personal Income and Outlays, April 2024. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.7% YoY, and core PCE prices up 2.8% YoY.

9:45 AM: Chicago Purchasing Managers Index for May.

Friday, May 24, 2024

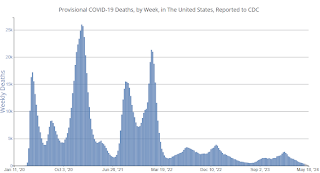

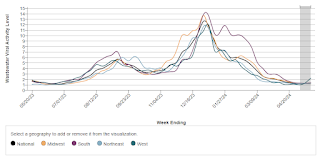

May 24th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 5/24/2024 07:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 374 | 471 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q2 GDP Tracking: 1.8% to 3.5%

by Calculated Risk on 5/24/2024 02:21:00 PM

From BofA:

2Q GDP tracking is down a tenth to 1.8% q/q saar. Also, we expect the second print of 1Q GDP to be revised down to 1.2% from 1.6%. [May 24th estimate]From Goldman:

emphasis added

We boosted our Q2 GDP tracking estimate by 0.1pp to +3.2% (qoq ar) and our domestic final sales estimate by the same amount to +2.5%. [May 24th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.5 percent on May 24, down from 3.6 percent on May 16. After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of second-quarter real gross private domestic investment growth decreased from 5.6 percent to 5.1 percent. [May 24th estimate]

Watch Months-of-Supply!

by Calculated Risk on 5/24/2024 11:16:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Watch Months-of-Supply!

A brief excerpt:

Although inventory is well below normal levels, so are sales. I think we need to keep an eye on months-of-supply. Historically nominal prices declined when months-of-supply approached 6 months - and that is unlikely this year - but we could see months-of-supply back to 2019 levels later this year.There is much more in the article.

What would it take to get months-of-supply back to 2019 levels by mid-year? The following table is a simple exercise. If sales stay depressed at 2023 levels, how much would inventory have to increase to put months-of-supply at 2019 levels?