by Calculated Risk on 6/26/2021 05:22:00 PM

Saturday, June 26, 2021

June 26th COVID-19 New Cases, Vaccinations, Hospitalizations

This data is from the CDC.

According to the CDC, on Vaccinations.

Total doses administered: 322,123,103, as of a week ago 317,117,797. Average daily doses last week: 0.72 million.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 65.9% | 65.8% | 65.3% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 152.2 | 151.3 | 149.1 | ≥1601 |

| New Cases per Day3,4🚩 | 11,512 | 11,342 | 11,365 | ≤5,0002 |

| Hospitalized3 | 12,125 | 12,235 | 13,344 | ≤3,0002 |

| Deaths per Day3,4🚩 | 294 | 287 | 274 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 4Cases and Deaths updated Mon - Fri 🚩 Increasing week-over-week | ||||

KUDOS to the residents of the 16 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia and D.C. are all over 70%.

Next up are Minnesota at 69.6%, Delaware at 69.5%, Colorado at 69.3%, Oregon at 69.2%, Wisconsin at 65.0%, Nebraska at 64.8%, and Florida at 64.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Schedule for Week of June 27, 2021

by Calculated Risk on 6/26/2021 08:11:00 AM

The key report scheduled for this week is the June employment report to be released on Friday.

Other key reports include the June ISM Manufacturing survey, June Vehicle Sales, April Case-Shiller house prices, and the Trade Deficit for May.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June. This is the last of the regional surveys for June.

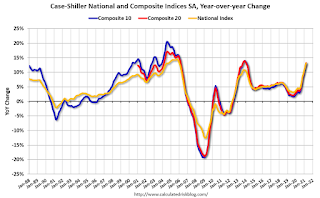

9:00 AM: S&P/Case-Shiller House Price Index for April.

9:00 AM: S&P/Case-Shiller House Price Index for April.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 12.3% year-over-year increase in the Comp 20 index for April.

9:00 AM: FHFA House Price Index for April 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 600,000 payroll jobs added in June, down from 978,000 lost in May.

9:45 AM: Chicago Purchasing Managers Index for June.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.8% increase in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 400 thousand from 411 thousand last week.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 61.5, up from 61.2 in May. The employment index was at 50.9% in May, and the new orders index was at 67.0%.

10:00 AM: Construction Spending for May. The consensus is for a 0.4% increase in construction spending.

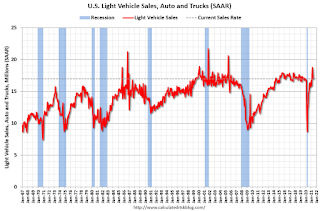

Late in the day: Light vehicle sales for June.

Late in the day: Light vehicle sales for June.The consensus is for light vehicle sales to be 17.1 million SAAR in June, up from 17.0 million in May (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

Wards Auto is forecasting sales of 15.8 million SAAR in June.

8:30 AM: Employment Report for June. The consensus is for 675,000 jobs added, and for the unemployment rate to decrease to 5.6%.

8:30 AM: Employment Report for June. The consensus is for 675,000 jobs added, and for the unemployment rate to decrease to 5.6%.There were 559,000 jobs added in May, and the unemployment rate was at 5.8%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $70.8 billion. The U.S. trade deficit was at $68.9 billion the previous month.

Friday, June 25, 2021

Real Personal Income less Transfer Payments Above Previous Peak

by Calculated Risk on 6/25/2021 03:41:00 PM

Government transfer payments decreased in May compared to April, but were still almost $1.0 trillion (on SAAR basis) above the February 2020 level (pre-pandemic) Note: Seasonal adjustment doesn't make sense with one time payments, but that is how the data is presented.

This table shows the amount of unemployment insurance and "Other" transfer payments since February 2020 (pre-crisis level). The increase in "Other" was mostly due to parts of the relief acts including direct payments.

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Feb-20 | $506 | $28 |

| Mar-20 | $515 | $74 |

| Apr-20 | $3,379 | $493 |

| May-20 | $1,360 | $1,356 |

| Jun-20 | $758 | $1,405 |

| Jul-20 | $760 | $1,331 |

| Aug-20 | $692 | $636 |

| Sep-20 | $936 | $359 |

| Oct-20 | $732 | $304 |

| Nov-20 | $620 | $281 |

| Dec-20 | $654 | $304 |

| Jan-21 | $2,355 | $556 |

| Feb-21 | $778 | $535 |

| Mar-21 | $4,748 | $541 |

| Apr-21 | $1,404 | $495 |

| May-21 | $865 | $459 |

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

Click on graph for larger image.

Click on graph for larger image.This graph shows real personal income less transfer payments since 1990.

This measure of economic activity increased 0.4% in May, compared to April, and was up 0.8% compared to February 2020 (previous peak).

This is the first of the key NBER measures - GDP, Employment, Industrial Production, Real Personal Income less Transfer Payments - that is above pre-recession levels. GDP will be above pre-recession levels in Q2.

June 25th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 6/25/2021 03:33:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 321,199,379, as of a week ago 316,048,776. Average daily doses: 0.74 million.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 65.8% | 65.7% | 65.1% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 151.6 | 151.3 | 148.5 | ≥1601 |

| New Cases per Day3,4🚩 | 11,512 | 11,342 | 11,365 | ≤5,0002 |

| Hospitalized3 | 12,235 | 12,329 | 13,538 | ≤3,0002 |

| Deaths per Day3,4🚩 | 294 | 287 | 274 | ≤502 |

| 1 America's Goal by July 4th, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 4Cases and Deaths updated Mon - Fri 🚩 Increasing week-over-week | ||||

KUDOS to the residents of the 16 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, New Jersey, Maine, Rhode Island, Pennsylvania, New Mexico, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia and D.C. are all over 70%.

Next up are Minnesota at 69.5%, Delaware at 69.4%, Colorado at 69.2%, Oregon at 69.1%, Wisconsin at 64.9%, Nebraska at 64.8%, and South Dakota at 63.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Q2 GDP Forecasts: 8% to 10%

by Calculated Risk on 6/25/2021 11:58:00 AM

From BofA:

Weak home sales, trade, and inventories this week led us to take down our 2Q GDP tracking estimate back down to 10% qoq saar. [June 25 estimate]From Goldman Sachs:

emphasis added

The May increase in services consumption was softer than our previous assumptions, and we lowered our Q2 GDP tracking estimate by ¼pp to 8.5% (qoq ar). [June 25 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.4% for 2021:Q2 and 4.1% for 2021:Q3. [June 25 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2021 is 8.3 percent on June 25, down from 9.7 percent on June 24. [June 25 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 6/25/2021 10:25:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of June 22nd.

From Andy Walden at Black Knight: Common, Marginal, Mid-Month Increase of Number of Forbearance Plans This Week

In what’s become a common trend of marginal mid-month increases, the number of active forbearance plans ticked up slightly from last week.

According to the weekly snapshot of Black Knight’s McDash Flash daily loan-level performance dataset, 2.06 million homeowners – representing 3.9% of mortgaged properties – remain in COVID-19 related forbearance plans.

While the total number of plans rose by 1,000 since last Tuesday, the population is still down 6% from the same time last month. That’s as compared to last week’s 5.4% monthly rate of improvement.

A 10,000 decline in the number of active GSE forbearance plans and a 7,000 drop in FHA/VA plans were both more than offset by a rise of 18,000 among portfolio and privately held mortgages.

Click on graph for larger image.

Meanwhile, starts edged lower this week and were 7% below their previous 4-week average. Likewise, removals hit their lowest level in five weeks and extension activity was down as well.

That said, more than 300K plans are still scheduled for quarterly reviews between now and next Wednesday, which could lead to more exits. We should all be expecting more activity one way or another as we near the 4th of July.

emphasis added

Personal Income decreased 2.0% in May, Spending increased Slightly

by Calculated Risk on 6/25/2021 08:39:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income decreased $414.3 billion (2.0 percent) in May according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $436.3 billion (2.3 percent) and personal consumption expenditures (PCE) increased $2.9 billion (less than 0.1 percent).The May PCE price index increased 3.9 percent year-over-year and the May PCE price index, excluding food and energy, increased 3.4 percent year-over-year.

Real DPI decreased 2.8 percent in May and Real PCE decreased 0.4 percent; goods decreased 2.0 percent and services increased 0.4 percent. The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.5 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through May 2021 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations, and the increase in PCE was below expectations.

Using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 16.2% annual rate in Q2 2021. (using the mid-month method, PCE was increasing at 18.2%). However, this reflects the impact of the American Rescue Plan in April and May, and overall Q2 growth will be lower than those estimates.

Thursday, June 24, 2021

Friday: Personal Income and Outlays

by Calculated Risk on 6/24/2021 09:01:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, May 2021. The consensus is for a 2.5 decrease in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.6% (3.4% YoY).

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 86.8.

Freddie Mac: Mortgage Serious Delinquency Rate decreased in May

by Calculated Risk on 6/24/2021 04:37:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in May was 2.01%, down from 2.15% in April. Freddie's rate is up year-over-year from 0.81% in May 2020.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble, and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.19%, down from 0.20% in April, and up more than double from 0.09% in May 2020.

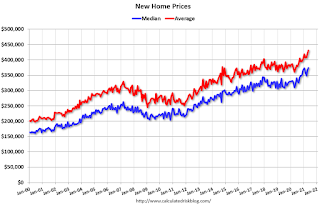

New Home Prices

by Calculated Risk on 6/24/2021 04:20:00 PM

As part of the new home sales report released yesterday, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in May 2021 was $374,400. The average sales price was $430,600."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in May 2021 was $430,600, up 17% year-over-year. The median price was $374,400, up 18% year-over-year.

The second graph shows the percent of new homes sold by price.

Very few new homes sold were under $200K in May 2021 (about 1.4% of all homes). This is down from 56% in 2002. In general, the under $200K bracket is going away.

Very few new homes sold were under $200K in May 2021 (about 1.4% of all homes). This is down from 56% in 2002. In general, the under $200K bracket is going away. The $400K and greater than $500K+ brackets increased significantly over the last decade. A majority of new homes (about 61% in May) in the U.S., are in the $200K to $400K range.