by Calculated Risk on 1/02/2021 12:03:00 PM

Saturday, January 02, 2021

Question #1 for 2021: How much will the economy grow in 2021?

Earlier I posted some questions for the new year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

1) Economic growth: Economic growth was probably around negative 3% in 2020 due to the pandemic (maybe 2.5% Q4 over Q4). The FOMC is expecting growth of 3.7% to 5.0% Q4-over-Q4 in 2021. How much will the economy grow in 2021?

Here is a table of the annual change in real GDP since 2005. Prior to the pandemic, economic activity was mostly in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%., although demographics are improving somewhat (more prime age workers).

Note: This table includes both annual change and q4 over the previous q4 (two slightly different measures). For 2020, I used a 5.0% annual growth rate in Q4 2020 (this gives -2.2% Q4 over Q4 or -3.4% real annual growth).

| Real GDP Growth | ||

|---|---|---|

| Year | Annual GDP | Q4 / Q4 |

| 2005 | 3.5% | 3.1% |

| 2006 | 2.9% | 2.6% |

| 2007 | 1.9% | 2.0% |

| 2008 | -0.1% | -2.8% |

| 2009 | -2.5% | 0.2% |

| 2010 | 2.6% | 2.6% |

| 2011 | 1.6% | 1.6% |

| 2012 | 2.2% | 1.5% |

| 2013 | 1.8% | 2.6% |

| 2014 | 2.5% | 2.9% |

| 2015 | 3.1% | 2.2% |

| 2016 | 1.7% | 2.1% |

| 2017 | 2.3% | 2.7% |

| 2018 | 3.0% | 2.5% |

| 2019 | 2.2% | 2.3% |

| 20201 | -3.4% | -2.2% |

| 1 2020 estimate based on 5.0% Q4 SAAR annualized real growth rate | ||

The FOMC is projecting real GDP growth of 3.7% to 5.0% in 2021 (Q4 over Q4).

Goldman Sachs recently projected real "GDP growth of +5.9% in 2021".

Merrill Lynch recently projected 4.6% real GDP growth in 2021.

GDP growth in 2021 depends on how quickly the pandemic subsides (I'm assuming mid-year), and how much economic scarring has occurred (permanent job losses, business closings, commercial real estate issues). With minimal scarring, GDP could return to path growth (about 2.3% per year real GDP growth). That would put GDP up 7% or so in 2021 (Q4 over Q4).

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

Schedule for Week of January 3, 2021

by Calculated Risk on 1/02/2021 08:11:00 AM

The key report this week is the December employment report on Friday.

Other key indicators include the December ISM manufacturing and services indexes, December vehicle sales, and the November trade deficit.

10:00 AM: Construction Spending for November. The consensus is for a 0.9% increase in construction spending.

All day: Light vehicle sales for December. Sales were at 15.55 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. Sales were at 15.55 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

8:00 AM ET: Corelogic House Price index for November.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 56.5, down from 57.5 in November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The report showed 307,000 jobs added in November.

8:30 AM: The initial weekly unemployment claims report will be released.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $64.5 billion. The U.S. trade deficit was at $63.1 billion in October.

10:00 AM: the ISM non-Manufacturing Index for December.

8:30 AM: Employment Report for December. There were 245 thousand jobs added in November, and the unemployment rate was at 6.7%.

8:30 AM: Employment Report for December. There were 245 thousand jobs added in November, and the unemployment rate was at 6.7%.This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

Friday, January 01, 2021

January 1 COVID-19 Test Results

by Calculated Risk on 1/01/2021 07:26:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,239,502 test results reported over the last 24 hours.

There were 173,255 positive tests.

Over 2,500 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 14.0% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

by Calculated Risk on 1/01/2021 03:34:00 PM

Earlier I posted some questions for the new year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

2) Employment: Through November 2020, the economy lost 9.37 million jobs. By April 2020, the economy had lost 21.7 million jobs, and then added back 12.33 million jobs by November. But job growth slowed over the last few months. Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

For review, here is a table of the monthly change in total nonfarm jobs, and ex-Decennial Census. Monthly job growth has been slowing, and was on 338 thousand, ex-Census in November.

| Jobs Added per Month (000s), 2020 | ||

|---|---|---|

|   | Total | ex-Census |

| Jan-20 | 214 | 209 |

| Feb-20 | 251 | 244 |

| Mar-20 | -1,373 | -1,390 |

| Apr-20 | -20,787 | -20,792 |

| May-20 | 2,725 | 2,740 |

| Jun-20 | 4,781 | 4,785 |

| Jul-20 | 1,761 | 1,734 |

| Aug-20 | 1,493 | 1,255 |

| Sep-20 | 711 | 752 |

| Oct-20 | 610 | 758 |

| Nov-20 | 245 | 338 |

| Dec-20 | --- | --- |

Some early December forecasts suggest even further slowing, from Merrill Lynch economists:

"We forecast nonfarm payrolls growth of 50k in December after increasing by just 245k in November. We think government payrolls will likely decline by 25k in December as the few remaining temporary census workers roll off payrolls and additional education workers at the state and local level are furloughed due to stricter COVID-19 restrictions. This implies private payrolls should grow by only 75k in December, decelerating from a gain of 344k in November."This will likely be a very difficult winter with the pandemic, and it seems likely job growth will be stunted for the next several months. If the pandemic subsides by mid-year, the monthly job gains should increase significantly.

With 3.7 million permanent job losers - about 2.5 million more than at the beginning of 2020 - it seems unlikely the economy will add back the remaining 9 million jobs lost within a year, and also add jobs for new entrants in 2021. I think something like 6 to 8 million jobs could be added in 2021, but it will depend on ending the pandemic and appropriate fiscal policy.

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

Question #3 for 2021: What will the unemployment rate be in December 2021?

by Calculated Risk on 1/01/2021 11:58:00 AM

Earlier I posted some questions for the new year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

3) Unemployment Rate: The unemployment rate was at 6.7% in November, up 3.2 percentage points year-over-year, but down from the peak of 14.7% in April. Currently the FOMC is forecasting the unemployment rate will be in the 4.7% to 5.4% range in Q4 2021. What will the unemployment rate be in December 2021?

First, the headline unemployment number significantly understates the current situation. Here is a table that shows the current number of unemployed and the unemployment rate (as of November). Then I calculated the unemployment rate by including the number of people that have left the labor force since early 2020, and the expected growth in the labor force.

| Number (000s) | Unemployment Rate | |

|---|---|---|

| Unemployed | 10,735 | 6.7% |

| Left Labor Force | 4,139 | 9.0% |

| Expected Labor Force Growth | 1,000 | 9.6% |

Lets say the economy adds back 6 million jobs, in 2021, of the 9 million jobs still lost since early 2020. Meanwhile 3 million of the remaining 4.1 million people that left the labor force return, and the labor force grows by 2 million over the two year period (2020 and 2021). The unemployment rate would fall to 5.9% by December 2021 - above the high end of the FOMC forecast.

Here is a graph of the unemployment rate over time:

Click on graph for larger image.

Click on graph for larger image.There has been a quick bounce back in the unemployment rate from the peak unemployment rate in April.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession is by far the worst recession since WWII in percentage terms, and is still worse than the worst of the "Great Recession".

It took several years to recover all the jobs lost following the 2001 and 2007 recessions, and that might happen again depending on fiscal policy, and how many permanent jobs were lost.

The third graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.

The third graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.This data is only available back to 1994, so there is only data for three recessions.

In November, the number of permanent job losers increased to 3.743 million from 3.684 million in October.

The pandemic recession has already seen more permanent job losses than the 2001 recession. It seems likely these will be the job that will be slow to recover.

Depending on the estimate for the participation rate and job growth (next question), my guess is the unemployment rate will decline into the mid 5% range by December 2021 from the current 6.7%. Hopefully I'm too pessimistic.

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 1/01/2021 09:06:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of December 29th.

From Black Knight: The U.S. Sees its Third Consecutive Week of Forbearance Plans Increases

In the past week, our McDash Flash Forbearance Tracker found that forbearance plan volumes ticked upwards for the third week in a row, rising by 15,000 from the prior week and pushing the number of active plans to its highest level since early November.

We saw FHA/VA forbearances increase by 11,000 this week, with portfolio/PLS forbearances increasing by 4,000 while GSE volumes remained flat.

...

Click on graph for larger image.

This week’s increase was primarily the result of limited forbearance plan removal activity, with removals falling to their lowest level since the start of the pandemic, likely due (at least in part) to the holiday week.

On a bright note, forbearance plan starts also hit their lowest level since the pandemic began, a number also likely impacted by the holidays. Forbearance start volumes have now fallen in each of the last three weeks running.

Despite three consecutive weekly rises, the number of active plans only stands 13,000 higher than the same point last month, and with nearly 270,000 forbearance plans still set to expire at the end of December, it’s possible that we could see an inflow of forbearance plan removals over the first week of January, a situation Black Knight experts will continue to monitor.

As of Dec. 29, some 2.83 million (5.3% of) homeowners remain in COVID-19-related forbearance plans, including 3.5% (964,000) of GSE mortgages, 9.6% (1.16 million) of FHA/VA loans and 5.4% (700,000) of portfolio-held and privately securitized loans.

emphasis added

Thursday, December 31, 2020

December 31 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 12/31/2020 06:51:00 PM

Wishing everyone a safe, healthy and Happy New Year!

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,719,181 test results reported over the last 24 hours.

There were 221,444 positive tests.

Over 77,000 US deaths were reported in December, far surpassing April as the deadliest month. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.9% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

by Calculated Risk on 12/31/2020 02:31:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

4) Participation Rate: In November 2020, the overall participation rate was at 61.5%, down year-over-year from 63.2% in November 2019. Long term, the BLS has been projecting the overall participation rate will decline to 61.2% by 2029 due to demographics. Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

The overall labor force participation rate is the percentage of the working age population (16 + years old) in the labor force. A large portion of the decline in the participation rate since 2000 was due to demographics and long term trends.

The Labor Force Participation Rate in November 2020 was at 61.5% (red), down from the pre-pandemic level of 63.4% in February, and up from the pandemic low of 60.2% in April 2020. (Blue is the employment population ratio).

When we look at the age groups that haven't returned to the workforce, a large number are younger (the largest number are in the 25 to 29 age cohort), and mostly prime age workers. This suggests most of these people will eventually return to the labor force.

My guess, based on the pandemic ending around mid-year, is that most of these people will return to the labor force. I don't expect that participation rate to increase to pre-pandemic levels (63.4%), but it seems reason the participation rate will increase to the mid-to-high 62s by year end.

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

by Calculated Risk on 12/31/2020 01:43:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2021. I'm adding some thoughts, and maybe some predictions for each question.

5) Inflation: Core PCE was only up 1.4% YoY through November. Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

Although there are different measure for inflation they mostly show inflation at or below the Fed's 2% inflation target.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy rose 1.6%. Core PCE is for October and increased 1.4% year-over-year.

The Fed is projecting core PCE inflation will increase to 1.7% to 1.8% by Q4 2021.

My guess is core PCE inflation (year-over-year) will increase in 2021 (from the current 1.4%), but I think too much inflation will NOT be a concern in 2021.

Here are the Ten Economic Questions for 2021 and a few predictions:

• Question #1 for 2021: How much will the economy grow in 2021?

• Question #2 for 2021: Will all the jobs lost in 2020 return in 2021, or will job growth be sluggish?

• Question #3 for 2021: What will the unemployment rate be in December 2021?

• Question #4 for 2021: Will the overall participation rate increase to pre-pandemic levels (63.4% in February 2020) , or will it will only partially recover in 2021?

• Question #5 for 2021: Will the core inflation rate increase in 2021? Will too much inflation be a concern in 2021?

• Question #6 for 2021: Will the Fed raise rates in 2021? What about the asset purchase program?

• Question #7 for 2021: How much will RI increase in 2021? How about housing starts and new home sales in 2021?

• Question #8 for 2021: What will happen with house prices in 2021?

• Question #9 for 2021: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

• Question #10 for 2021: How much damage did the pandemic do to certain sectors?

Hotels: Occupancy Rate Declined 33.0% Year-over-year, 2020 Worst Year on Record

by Calculated Risk on 12/31/2020 09:57:00 AM

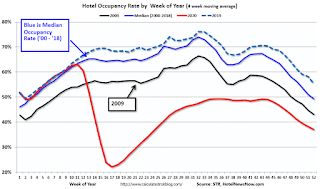

U.S. weekly hotel occupancy fell to its lowest level since early May, according to STR‘s latest data for the week of Christmas.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

20-26 December 2020 (percentage change from comparable week in 2019):

• Occupancy: 32.5% (-33.0%)

• Average daily rate (ADR): US$92.08 (-28.8%)

• Revenue per available room (RevPAR): US$29.94 (-52.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year, and then, usually, business travel would start to pick up in the new year.

Note: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate - see graph above - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

This suggests no improvement over the last several months.

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

| 11/21 | -32.6% |

| 11/28 | -28.5% |

| 12/5 | -37.9% |

| 12/12 | -37.4% |

| 12/19 | -26.4% |

| 12/26 | -33.0% |

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |