by Calculated Risk on 11/27/2020 12:14:00 PM

Friday, November 27, 2020

Q4 GDP Forecasts: Some Upward Revisions

From Merrill Lynch:

4Q GDP tracking jumped to 6.0% qoq saar as strong consumer, capex, housing and inventories data in October kicked the quarter off to a solid start. [Nov 25 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.8% for 2020:Q4. News from this week’s data releases decreased the nowcast by 0.1 percentage point. [Nov 27 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 11.0 percent on November 25, up from 5.6 percent on November 18. [Nov 25 estimate]

Lawler: The Dismal Demographics of 2020

by Calculated Risk on 11/27/2020 09:35:00 AM

From housing economist Tom Lawler: The Dismal Demographics of 2020

Surging deaths, plummeting net international migration, and a likely further decline in births in 2020 should result in an astonishing slowdown in US population growth this year. Using reasonable assumptions for all three key “components of change,” US population growth from the end of 2019 to the end of 2020 will be only 0.22% (about 720,000).

Deaths

Beginning not too long ago the CDC began releasing provisional weekly estimates of US deaths – not just those attributable to Covid-19, but total deaths as well. While the data for much of this year is not complete – especially for the most recent weeks – because of reporting delays, the data nonetheless provide analysts with a general idea of the direction of deaths.

Below is a table comparing deaths by selected age groups over the 42-week period ending 10/24/2020 to deaths over the 42-week period ending 10/26/2019. (Data for 2020 have been released through the second week of November, but reporting delays massively understate deaths for the latest weeks available). Also shown are deaths directly attributable to Covid-19 through October 10/24/2020.

| CDC Estimates of US Deaths by Selected Age Groups | |||||||

|---|---|---|---|---|---|---|---|

| 42 Week End | < 25 | 25-44 | 45-64 | 65-74 | 75-84 | 85+ | Total |

| 10/19 | 49,620 | 117,263 | 441,782 | 456,373 | 563,456 | 714,483 | 2,342,977 |

| 10/20 | 51,588 | 141,364 | 498,681 | 525,081 | 637,739 | 789,072 | 2,643,525 |

| Covid 19 | 487 | 6,163 | 39,862 | 47,989 | 59,013 | 68,188 | 221,702 |

| Ex Covid | 51,101 | 135,201 | 458,819 | 477,092 | 578,726 | 720,884 | 2,421,823 |

| Total Delta | 4.0% | 20.6% | 12.9% | 15.1% | 13.2% | 10.4% | 12.8% |

| Ex-Covid Delta | 3.0% | 15.3% | 3.9% | 4.5% | 2.7% | 0.9% | 3.4% |

As the table shows, deaths in the US year-to-date in 2020 were at least 12.8% (or 300,548) above the comparable period of 2019, and deaths not directly attributable to Covid-19 were up at least 3.4% (or 78,846). Note that in % terms the biggest increase in deaths from a year ago has been in the 25-44 year old category. While the factors behind the increase in non-Covid-related deaths are not known, possible reasons include Covid-related deaths not identified as such, people not accessing medical treatment because of the pandemic, and what appears to be a substantial increase in the number of drug overdose deaths.

Projecting deaths for the balance of 2020 is tricky, though most experts are expecting that Covid-related deaths will turn back up in December. Using low-end projections for Covid deaths, below is a table showing what I believe is a reasonable (and probably slightly too low) projection of deaths in 2020 compared to 2019 (note that the 2019 numbers are an estimate based on weekly CDC data; the official report on US mortality in 2019 has not yet been released)

| Estimated US Deaths by Selected Age Groups (Calendar Year) | |||||||

|---|---|---|---|---|---|---|---|

| < 25 | 25-44 | 45-64 | 65-74 | 75-84 | 85+ | Total | |

| 2019 | 60,210 | 142,926 | 537,518 | 556,911 | 688,899 | 874,194 | 2,860,658 |

| 2020 | 62,506 | 172,279 | 608,652 | 642,866 | 780,598 | 963,183 | 3,230,084 |

| Delta | 2,296 | 29,353 | 71,134 | 85,955 | 91,699 | 88,989 | 369,426 |

| % Delta | 3.8% | 20.5% | 13.2% | 15.4% | 13.3% | 10.2% | 12.9% |

Net International Migration

There is little doubt that the pandemic, combined with a host of actions by the Administration, has resulted in a sharp reduction in both immigration to and emigration from the United States. Unfortunately, I do not know of any timely data sources that would enable one to estimate year-to-date net international migration. The last Census estimate of NIM was 595,000 for the 12 month period ending 6/30/2019. In my view, though not supported by data, I’d say an estimate of 250,000 for net international migration in 2020 seems plausible.

Births

While I do not know of any timely data on total US births in 2020, births have steadily declined over the past five years, and most experts expect that births were down slightly in 2020. Experts expect that the pandemic will ultimately result in a significant reduction in births, that decline will mainly show up in 2021. (There is a known lag between conception and birth!). The CDC’s provisional estimate for births was 3,745,540 in 2019 compared to 3,791,712 in 2018. A reasonable projection for 2020 would be around 3,700,000.

Adding Things Up

While the last official Census estimate of the US resident population was for July 1, 2019 (the so-called “Vintage 2019” estimate), Census also produced “Vintage 2019” one-year ahead population projections by month through December 1, 2020. (These should not be confused with Census’ long-term population projections, the latest of which was produced in 2017 and which are hopelessly out of date). While the projections for most of 2020 will be way too high, the projection for January 1, 2020 (pre-pandemic) are probably not too far off.

The “Vintage 2019” projection for the US residential population for January 1, 2020 was 329,135,084. If one assumes that the deaths, net international migration, and birth projections for 2020 are reasonable, then a reasonable projection for the US residential population on January 1, 2021 would be:

329,135,084 – 3,230,084 + 250,000 + 3,700,000 = 329,855,000.

Such an estimate would mean that the US resident population from the end of 2019 to the end of 2020 increased by just 719,916, or 0.22%. By comparison, US population growth from 2010 to 2016 averaged about 2.27 million a year (or 0.72% annual growth).

In a later report I will have estimates of the change in population by age groups. It appears, however, that from the end of 2019 to the end of 2020 the US working age population did not increase at all.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 11/27/2020 08:57:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of November 23rd.

From Black Knight: Forbearances Numbers See Another Slight Uptick

Our weekly snapshot of daily forbearance tracking data showed another slight uptick in active forbearance plans through Monday, November 23. It’s worth noting that this week’s data represents a slightly truncated view – normally, we report forbearance numbers through the Tuesday of any given week.

After rising by some 30,000 last week, active forbearances were up another 27,000 from last Tuesday.

We should keep in mind that mild increases like this have been common in the middle of the month. Since the recovery started, the strongest declines have typically been seen early in the month, as expiring forbearance plans are removed. The performance of the last two weeks has continued this trend.

...

Click on graph for larger image.

Despite this week’s increase, the number of active forbearances remains down 7% (-207,00) from last month, roughly equivalent to the declines we’d seen in August and September.

In total, as of November 23, there are now 2.78 million homeowners in active forbearance plans. Together, representing approximately 5.3% of all active mortgages – up from 5.2% from last week – they account for approximately $564 billion in unpaid principal.

emphasis added

Thursday, November 26, 2020

November 26 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 11/26/2020 07:09:00 PM

Note: The data will show a decline over the holiday weekend due to less reporting. Stay Safe!!!

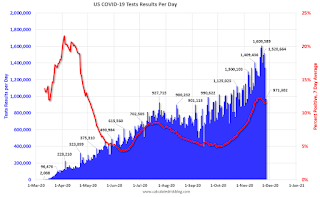

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 971,302 test results reported over the last 24 hours.

There were 125,082 positive tests.

Over 32,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.9% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations.

Five Economic Reasons to be Thankful

by Calculated Risk on 11/26/2020 11:02:00 AM

First, thanks to all the healthcare workers and first responders that have been on the front lines saving lives. And to the essential workers that have kept the economy going. Thank you!

Even with these difficult times, here are five economic reasons to be thankful this Thanksgiving. (Hat Tip to Neil Irwin who started doing this several years ago)

1) Household Debt Burdens are at Record Lows.

Household debt burdens have declined sharply.

The Household debt service ratio (red) was at 13.2% in 2007, and has fallen to a series low of 8.69% in Q2 2020 (most recent data).

This graph, based on data from the Federal Reserve, shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The consumer Debt Service Ratio (yellow) decreased in Q2 2020, and is near a series low. Note: The financial obligation ratio (FOR) declined in Q2 and is at a series low (not shown).

The DSR for mortgages (blue) is also at a series low (since at least 1980). This ratio increased rapidly during the housing bubble, and continued to increase until 2007.

With low interest rates, and a high savings rate, this data suggests aggregate household cash flow has improved.

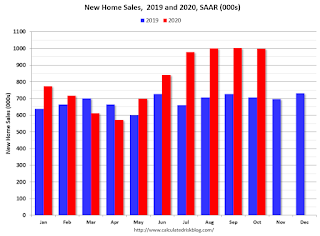

2) New Home sales are at a Cycle High.

New home sales were at 999 thousand SAAR (Seasonally Adjusted Annual Rate) in October, and 1.002 million SAAR in September (highest sales rate since 2006).

Sales are up almost four-fold from the cycle low of 270 thousand SAAR in February 2011.

Housing has been a strong sector during the pandemic, including new home sales, existing home sales and housing starts.

3) A Falling Unemployment Rate.

Unfortunately the unemployment rate significantly understates the current situation. Not only are 11 million people unemployed, another 3.7 million have left the labor force since February. And there are 2.3 million additional involuntary part time workers than a year ago

Still, this is significant improvement since April.

4) Falling unemployment claims.

Continued claims decreased to 6.038 million (SA) last week, down from a peak of almost 25 million in May 2020.

This is a huge decline in regular unemployment claims.

Note: There are an additional 9,147,753 receiving Pandemic Unemployment Assistance (PUA) that increased from 8,681,647 the previous week. This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

An additional 4,509,284 are receiving Pandemic Emergency Unemployment Compensation (PEUC) that increased from 4,376,847 the previous week. These last two programs are set to expire on December 26th - so there is more disaster relief needed soon.

5) Science!

And finally, thanks to all the infectious disease experts and epidemiologists that have provided guidance on how to mitigate the risks of COVID (washing hands, wearing masks, social distancing, etc).

A Happy and Safe Thanksgiving to All!

Wednesday, November 25, 2020

November 25 COVID-19 Test Results; Record Hospitalizations, Deaths Increasing

by Calculated Risk on 11/25/2020 07:33:00 PM

Note: Week-over-week case growth has slowed, and will probably show a decline over the holiday weekend. However, it is likely that cases will pickup again the following week. Stay Safe!!!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,329,565 test results reported over the last 24 hours.

There were 182,537 positive tests.

Almost 31,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.7% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest level since May.

• Record Hospitalizations.

FOMC Minutes: "Concerned about the possibility of a further resurgence of the virus that could undermine the recovery"

by Calculated Risk on 11/25/2020 02:05:00 PM

From the Fed: Minutes of the Federal Open Market Committee, November 4-5, 2020. A few excerpts:

Participants continued to see the uncertainty surrounding the economic outlook as quite elevated, with the path of the economy highly dependent on the course of the virus; on how individuals, businesses, and public officials responded to it; and on the effectiveness of public health measures to address it. Participants cited several downside risks that could threaten the recovery. While another broad economic shutdown was seen as unlikely, participants remained concerned about the possibility of a further resurgence of the virus that could undermine the recovery. The majority of participants also saw the risk that current and expected fiscal support for households, businesses, and state and local governments might not be sufficient to sustain activity levels in those sectors, while a few participants noted that additional fiscal stimulus that was larger than anticipated could be an upside risk. Some participants commented that the recent surge in virus cases in Europe and the reimposition of restrictions there could lead to a slowdown in economic activity in the euro area and have negative spillover effects on the U.S. recovery. Some participants raised concerns regarding the longer-run effects of the pandemic, including sectoral restructurings that could slow employment growth or an acceleration of technological disruptions that could be limiting the pricing power of some firms.

emphasis added

A few Comments on October New Home Sales

by Calculated Risk on 11/25/2020 01:14:00 PM

New home sales for October were reported at 999,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised up.

This was above consensus expectations of 975,000, and was the third highest sales rate since 2006 (behind August and September - that were both revised up). Clearly low mortgages rates, low existing home supply, and low sales in March and April (due to the pandemic) have led to a strong increase in sales. Favorable demographics (something I wrote about many times over the last decade) and a surging stock market have probably helped new home sales too.

Earlier: New Home Sales at 999,000 Annual Rate in October.

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 41.5% year-over-year (YoY) in October. Year-to-date (YTD) sales are up 20.6% (This is even above my optimistic forecast for 2020!).

And on inventory: since new home sales are reported when the contract is signed - even if the home hasn't been started - new home sales are not limited by inventory (except if no lots are available). Inventory for new home sales is important in that it means there will be more housing starts if inventory is low (like right now) - and fewer starts if inventory is too high (not now).

Personal Income decreased 0.7% in October, Spending increased 0.5%

by Calculated Risk on 11/25/2020 10:24:00 AM

The BEA released the Personal Income and Outlays report for October:

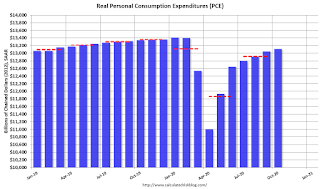

Personal income decreased $130.1 billion (0.7 percent) in October according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $134.8 billion (0.8 percent) and personal consumption expenditures (PCE) increased $70.9 billion (0.5 percent).The October PCE price index increased 1.2 percent year-over-year and the October PCE price index, excluding food and energy, increased 1.4 percent year-over-year.

Real DPI decreased 0.8 percent in October and Real PCE increased 0.5 percent. The PCE price index was unchanged from September. The PCE price index excluding food and energy was also unchanged.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through October 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was much lower than expected, and the increase in PCE was above expectations.

New Home Sales at 999,000 Annual Rate in October

by Calculated Risk on 11/25/2020 10:12:00 AM

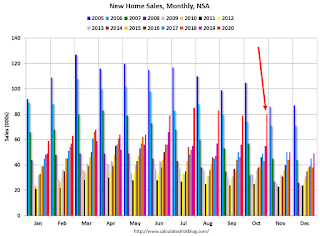

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 999 thousand.

The previous three months were revised up.

Sales of new single-family houses in October 2020 were at a seasonally adjusted annual rate of 999,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.3 percent below the revised September rate of 1,002,000, but is 41.5 percent above the October 2019 estimate of 706,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This is the third highest sales rate since 2006 (just below the last two months).

The second graph shows New Home Months of Supply.

The months of supply was unchanged in October at 3.3 months from 3.3 months in September.

The months of supply was unchanged in October at 3.3 months from 3.3 months in September. The all time record high was 12.1 months of supply in January 2009. The all time record low is 3.3 months in September and October 2020.

This is below the normal range (about 4 to 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of September was 284,000. This represents a supply of 3.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is low, and the combined total of completed and under construction is lower than normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2020 (red column), 80 thousand new homes were sold (NSA). Last year, 55 thousand homes were sold in October.

The all time high for October was 105 thousand in 2005, and the all time low for October was 23 thousand in 2010.

This was slightly above expectations and sales in the three previous months were revised up. I'll have more later today.