by Calculated Risk on 11/20/2020 09:17:00 AM

Friday, November 20, 2020

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of November 17th.

From Black Knight: Forbearances Tick Up After Two-Week Decline

After falling by 273,000 (9 percent) over the past two weeks, forbearance volumes edged slightly upward this week.

This week’s rise was a result of an increase of 15,000 forbearances among FHA/VA loans, along with 14,000 and 1,000 additional loans in forbearance among private label securities/bank portfolios and the GSEs, respectively.

Despite these mild increases, there is still good news for the mortgage servicing market – the number of active forbearances remains down 7 percent from the same time in October. As of Nov. 17, there are 2.77 million active forbearances nationwide, down from a peak of 4.76 million in late May.

...

Click on graph for larger image.

Mid-month incremental increases have been common so far, with the strongest declines typically being seen early in the month as forbearance plans expire. 82 percent of active forbearance cases have had their terms extended.

emphasis added

Thursday, November 19, 2020

November 19 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 11/19/2020 08:07:00 PM

The CDC is now recommending no travel for Thanksgiving.

"As cases continue to increase rapidly across the United States, the safest way to celebrate Thanksgiving is to celebrate at home with the people you live with."Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have a safe holiday.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,469,206 test results reported over the last 24 hours.

There were 182,832 positive tests.

Over 21,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.4% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest level since May.

• Record Hospitalizations.

Comments on October Existing Home Sales

by Calculated Risk on 11/19/2020 01:59:00 PM

Earlier: NAR: Existing-Home Sales Increased to 6.85 million in October

A few key points:

1) This was the highest sales rate since 2006. Some of the increase over the last few months was probably related to pent up demand from the shutdowns in March and April. There are going to be some difficult comparisons next year!

2) Inventory is very low, and was down 19.8% year-over-year (YoY) in October. This is the lowest level of inventory for October since at least the early 1990s.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the Consensus.

This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, sales to date are up about 2.4% compared to the same period in 2019.

Sales NSA in October (573,000) were 24% above sales last year in October (462,000). This was the all time high for October (NSA).

Hotels: Occupancy Rate Declined 32.7% Year-over-year

by Calculated Risk on 11/19/2020 11:17:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 14 November

U.S. weekly hotel occupancy slipped further from previous weeks, according to the latest data from STR through 14 November.Since there is a seasonal pattern to the occupancy rate - see graph below - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

8-14 November 2020 (percentage change from comparable week in 2019):

• Occupancy: 43.2% (-32.7%)

• Average daily rate (ADR): US$90.58 (-28.6%)

• Revenue per available room (RevPAR): US$39.11 (-52.0%)

After ranging between 48% and 50% occupancy from mid-July into the later portion of October, the last three weeks have produced levels of 44.4%, 44.1% and 43.2%.

emphasis added

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

This suggests no improvement over the last 9 weeks, and occupancy might be getting worse.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year. Note that there was little pickup in business travel that usually happens in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAR: Existing-Home Sales Increased to 6.85 million in October

by Calculated Risk on 11/19/2020 10:11:00 AM

From the NAR: Existing-Home Sales Jump 4.3% to 6.85 Million in October

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 4.3% from September to a seasonally-adjusted annual rate of 6.85 million in October. Overall, sales rose year-over-year, up 26.6% from a year ago (5.41 million in October 2019).

...

Total housing inventory at the end of October totaled 1.42 million units, down 2.7% from September and down 19.8% from one year ago (1.77 million). Unsold inventory sits at an all-time low 2.5-month supply at the current sales pace, down from 2.7 months in September and down from the 3.9-month figure recorded in October 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (6.85 million SAAR) were up 4.3% from last month, and were 26.6% above the October 2019 sales rate.

This was the highest sales rate since early 2006.

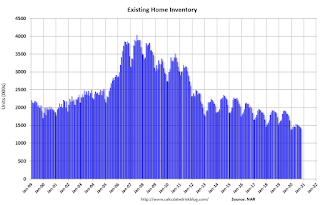

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.42 million in October from 1.46 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.42 million in October from 1.46 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 19.8% year-over-year in October compared to October 2019.

Inventory was down 19.8% year-over-year in October compared to October 2019. Months of supply decreased to 2.5 months in September.

This was above the consensus forecast. I'll have more later.

Philly Fed Manufacturing "Continued to Grow" in November

by Calculated Risk on 11/19/2020 09:44:00 AM

From the Philly Fed: November 2020 Manufacturing Business Outlook Survey

Manufacturing activity in the region continued to grow, according to firms responding to the November Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments remained positive for the sixth consecutive month but fell from their readings in October. However, employment increases were more widespread this month. Most future indexes also moderated this month but continue to indicate that firms expect growth over the next six months.This was close to the consensus forecast.

The diffusion index for current activity decreased 6 points to 26.3 in November, its sixth consecutive positive reading after reaching long-term lows in April and May The current employment index, however, fell 3 points to 12.7 this month ... On balance, the firms reported increases in manufacturing employment for the fifth consecutive month. The current employment index increased 15 points to 27.2.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (blue, through November), and five Fed surveys are averaged (yellow, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

These early reports suggest the ISM manufacturing index will still be solid, but will likely decrease slightly in November from the October level.

Weekly Initial Unemployment Claims increased to 742,000

by Calculated Risk on 11/19/2020 08:37:00 AM

The DOL reported:

In the week ending November 14, the advance figure for seasonally adjusted initial claims was 742,000, an increase of 31,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 709,000 to 711,000. The 4-week moving average was 742,000, a decrease of 13,750 from the previous week's revised average. The previous week's average was revised up by 500 from 755,250 to 755,750.This does not include the 320,237 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 296,374 the previous week. (There are some questions on PUA numbers).

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 742,000.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 6,372,000 (SA) from 6,801,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 8,681,647 receiving Pandemic Unemployment Assistance (PUA) that decreased from 9,433,127 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, November 18, 2020

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 11/18/2020 09:29:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is initial claims decreased to 700 thousand from 709 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 24.0, down from 32.3.

• At 10:00 AM, Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 6.45 million SAAR, down from 6.54 million in September.

• At 11:00 AM, the Kansas City Fed manufacturing survey for November.

November 18 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 11/18/2020 08:16:00 PM

The end of the pandemic is coming, possibly by Q2 2021!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,245,343 test results reported over the last 24 hours.

There were 163,975 positive tests.

Almost 19,500 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.2% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest level since May.

• Record Hospitalizations.

CAR on California October Housing: Sales up 20% YoY, Active Listings down 40%+ YoY

by Calculated Risk on 11/18/2020 07:13:00 PM

The CAR reported: California homebuying season extends into fall as home sales and prices remain elevated in October, C.A.R. reports

Continued record low mortgage interest rates sustained California’s housing market in October as home sales and prices took a breather from September’s record high levels and still recorded double-digit increases from a year ago, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in August and September. Sales-to-date, through October, are down 1.3% compared to the same period in 2019.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 484,510 units in October, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the October pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

October’s sales total climbed above the 400,000 level for the fourth straight month since the COVID-19 crisis depressed the housing market earlier this year and was just 15,000 units shy of the 500,000 benchmark. October sales dipped 1.0 percent from 489,590 in September and were up 19.9 percent from a year ago, when 404,240 homes were sold on an annualized basis.

...

Active listings continued to decline significantly, with most regions declining more than 40 percent from last year. The Central Valley had the biggest year-over-year drop of 49.6 percent in October, followed by Southern California (-46.6 percent), the Central Coast (-46.5 percent), the Far North (-40.9 percent), and the San Francisco Bay Area (-23.8 percent).

emphasis added