by Calculated Risk on 10/29/2020 01:16:00 PM

Thursday, October 29, 2020

Q3 GDP: Investment

Investment has been weak for some time, and slumped in Q1, and fell off a cliff in Q2 along with the overall economy. Investment bounced back in Q3, especially for residential investment and investment in equipment - but not for non-residential structures.

The first graph below shows the contribution to GDP from residential investment,

equipment and software, and nonresidential structures (3 quarter trailing

average). This is important to follow because residential investment tends to

lead the economy, equipment and software is generally coincident, and

nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is

investment in non-residential structures. So the usual pattern - both into and

out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern

doesn't apply.

The dashed gray line is the contribution from the change in private

inventories.

Residential investment (RI) increased at a 59.3% annual rate in Q3.

Equipment investment increased at a 70.1% annual rate, and investment in

non-residential structures decreased at a 14.6% annual rate.

On a 3 quarter trailing average basis, RI (red) is up solidly, equipment (green) is up, and nonresidential structures (blue) is down sharply.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP increased in Q3. RI as a percent of GDP is still close to previous lows, and I expected RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

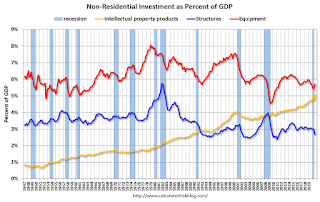

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

Hotels: Occupancy Rate Declined 31.7% Year-over-year

by Calculated Risk on 10/29/2020 10:25:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 24 October

U.S. weekly hotel occupancy fell back below the 50% mark, according to the latest data from STR through 24 October.Since there is a seasonal pattern to the occupancy rate, we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

18-24 October 2020 (percentage change from comparable week in 2019):

• Occupancy: 48.0% (-31.7%)

• Average daily rate (ADR): US$95.49 (-29.4%)

• Revenue per available room (RevPAR): US$45.83 (-51.8%)

emphasis added

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

This suggests no improvement over the last 6 weeks.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to start declining. Note that there was little pickup in business travel that usually happens in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAR: Pending Home Sales Decrease 2.2% in September

by Calculated Risk on 10/29/2020 10:05:00 AM

From the NAR: Pending Home Sales Falter 2.2% in September

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 2.2% to 130.0 in September. Year-over-year, contract signings rose 20.5%. An index of 100 is equal to the level of contract activity in 2001.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

...

The Northeast PHSI grew 2.0% to 119.4 in September, a 27.7% increase from a year ago. In the Midwest, the index slid 3.2% to 120.5 last month, up 18.5% from September 2019.

Pending home sales in the South decreased 3.0% to an index of 150.1 in September, up 19.6% from September 2019. The index in the West fell 2.6% in September to 116.8, up 19.3% from a year ago.

emphasis added

Weekly Initial Unemployment Claims decrease to 751,000

by Calculated Risk on 10/29/2020 08:52:00 AM

The DOL reported:

In the week ending October 24, the advance figure for seasonally adjusted initial claims was 751,000, a decrease of 40,000 from the previous week's revised level. The previous week's level was revised up by 4,000 from 787,000 to 791,000. The 4-week moving average was 787,750, a decrease of 24,500 from the previous week's revised average. The previous week's average was revised up by 1,000 from 811,250 to 812,250.This does not include the 359,667 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 344,905 the previous week. (There are some questions on PUA numbers).

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 811,250.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 7,756,000 (SA) from 8,465,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 10,324,779 receiving Pandemic Unemployment Assistance (PUA) that increased from 10,152,753 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

BEA: Real GDP Increased at 33.1% Annualized Rate in Q3

by Calculated Risk on 10/29/2020 08:40:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2020 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 33.1 percent in the third quarter of 2020, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 31.4 percent.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency. The "second" estimate for the third quarter, based on more complete data, will be released on November 25, 2020.

...

The increase in real GDP reflected increases in personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, and residential fixed investment that were partly offset by decreases in federal government spending (reflecting fewer fees paid to administer the Paycheck Protection Program loans) and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The increase in PCE reflected increases in services (led by health care as well as food services and accommodations) and goods (led by motor vehicles and parts as well as clothing and footwear). The increase in private inventory investment primarily reflected an increase in retail trade (led by motor vehicle dealers). The increase in exports primarily reflected an increase in goods (led by automotive vehicles, engines, and parts as well as capital goods). The increase in nonresidential fixed investment primarily reflected an increase in equipment (led by transportation equipment). The increase in residential fixed investment primarily reflected an increase in brokers' commissions and other ownership transfer costs.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q3 2020, and real GDP is currently off 3.5% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The advance Q3 GDP report, at 33.1% annualized, was close to expectations.

Personal consumption expenditures (PCE) increased at 40.7% annualized rate in Q3, up from 33.2% decrease in Q2. Residential investment (RI) increased at a 59.3% rate in Q3. Equipment investment increased at a 70.1% annualized rate, and investment in non-residential structures decreased at a 14.6% pace.

I'll have more later ...

Wednesday, October 28, 2020

Thursday: Q3 GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 10/28/2020 09:03:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2020 (advance estimate). The consensus is that real GDP increased 31.9% annualized in Q3, up from negative 31.4% in Q2.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is initial claims increased to 800 thousand from 787 thousand last week.

• At 10:00 AM, Pending Home Sales Index for September. The consensus is 4.5% increase in the index.

October 28 COVID-19 Test Results

by Calculated Risk on 10/28/2020 06:58:00 PM

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 875,738 test results reported over the last 24 hours.

There were 78,661 positive tests.

Almost 20,500 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.0% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average for the USA.

Freddie Mac: Mortgage Serious Delinquency Rate decreased in September

by Calculated Risk on 10/28/2020 05:09:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in September was 3.04%, down from 3.17% in August. Freddie's rate is up from 0.61% in August 2019.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Note: Fannie Mae will report for September soon.

October Vehicle Sales Forecast: Unchanged Year-over-year

by Calculated Risk on 10/28/2020 11:32:00 AM

From Wards: U.S. Light Vehicle Sales & Inventory Forecast, October 2020 (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for October (Red).

Sales have bounced back from the April low, and will likely be unchanged year-over-year in October.

The Wards forecast of 16.8 million SAAR, would be up about 3% from September.

This would put sales in 2020, through October, down about 17% compared to the same period in 2019.

Zillow Case-Shiller House Price Forecast: "Annual growth in September as reported by Case-Shiller is expected to accelerate"

by Calculated Risk on 10/28/2020 08:29:00 AM

The Case-Shiller house price indexes for August were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: August Case-Shiller Results and September Forecast: No Signs of Cooling

The remarkable surge in home prices continued into August as prices showed no signs of cooling down heading into the fall.

...

By some measures, home prices are rising at a faster pace than they ever have – an incredible feat considering the market is rising from an already elevated level. The supply of for-sale homes, already extremely tight, has only become more constrained in recent months, and historically low mortgage rates continue to encourage many buyers to enter the market. This heightened competition for the few homes on the market has placed consistent, firm pressure on home prices for months now, and there are few signs that this will relent any time soon. While the path of the overall economy is likely to be most directly dictated by coronavirus-related and political developments in the coming months, recent trends suggest that the housing market – which has basically withstood every pandemic-related challenge to this point – will continue its strong momentum in the months to come.

Annual growth in September as reported by Case-Shiller is expected to accelerate in all three main indices. S&P Dow Jones Indices is expected to release data for the September S&P CoreLogic Case-Shiller Indices on Tuesday, November 24.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 6.6% in September, up from 5.7% in August.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 6.6% in September, up from 5.7% in August. The Zillow forecast is for the 20-City index to be up 6.2% YoY in September from 5.2% in August, and for the 10-City index to increase to be up 5.7% YoY compared to 4.7% YoY in August.