by Calculated Risk on 10/16/2020 09:22:00 AM

Friday, October 16, 2020

Industrial Production Decreased 0.6 Percent in September; 7.1% Below Pre-Crisis Level

From the Fed: Industrial Production and Capacity Utilization

Industrial production fell 0.6 percent in September, its first decline after four consecutive months of gains. The index increased at an annual rate of 39.8 percent for the third quarter as a whole. Although production has recovered more than half of its February to April decline, the September reading was still 7.1 percent below its pre-pandemic February level. Manufacturing output decreased 0.3 percent in September and was 6.4 percent below February's level. The output of utilities dropped 5.6 percent, as demand for air conditioning fell by more than usual in September. Mining production increased 1.7 percent in September; even so, it was 14.8 percent below a year earlier. At 101.5 percent of its 2012 average, total industrial production was 7.3 percent lower in September than it was a year earlier. Capacity utilization for the industrial sector decreased 0.5 percentage point in September to 71.5 percent, a rate that is 8.3 percentage points below its long-run (1972–2019) average but 7.3 percentage points above its low in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April, but still well below the level in February 2020.

Capacity utilization at 71.5% is 8.3% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in September to 101.5. This is 7.1% below the February 2020 level.

The change in industrial production was well below consensus expectations, however industrial production in July and August were revised up.

Retail Sales increased 1.9% in September

by Calculated Risk on 10/16/2020 08:37:00 AM

On a monthly basis, retail sales increased 1.9 percent from August to September (seasonally adjusted), and sales were up 5.4 percent from September 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $549.3 billion, an increase of 1.9 percent from the previous month, and 5.4 percent above September 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 1.9% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 6.8% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 6.8% on a YoY basis.The increase in September was above expectations, and sales in July and August were revised up, combined.

Thursday, October 15, 2020

Friday: Retail Sales, Industrial Production

by Calculated Risk on 10/15/2020 09:00:00 PM

Friday:

• At 8:30 AM ET, Retail sales for September will be released. The consensus is for a 0.7% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 71.9%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for October).

October 15 COVID-19 Test Results

by Calculated Risk on 10/15/2020 06:49:00 PM

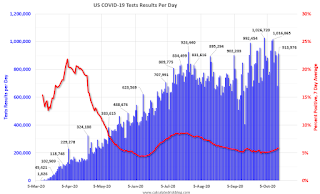

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 913,976 test results reported over the last 24 hours.

There were 63,172 positive tests.

Over 10,400 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.9% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high cases this Fall and Winter.

Hotels: Occupancy Rate Declined 29.2% Year-over-year

by Calculated Risk on 10/15/2020 11:31:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 10 October

U.S. hotel weekly occupancy hit 50% for just the second time since the low point of the pandemic, according to the latest data from STR through 10 October.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

4-10 October 2020 (percentage change from comparable week in 2019):

• Occupancy: 50.0% (-29.2%)

• Average daily rate (ADR): US$97.67 (-25.9%)

• Revenue per available room (RevPAR): US$48.85 (-47.5%)

While a handful of the highest occupancy markets were those in areas affected by natural disasters (i.e. California wildfires), Saturday produced the week’s highest occupancy (65.2%) and ADR (US$110.84), indicating that the leisure and weekend staycation demand seen during the summer may make appearances into the fall.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

So far there has been little business travel pickup that usually happens in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.

NMHC: Rent Payment Tracker Shows Households Paying Rent Declined in October

by Calculated Risk on 10/15/2020 11:20:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 86.8 Percent of Apartment Households Paid Rent as of October 13

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 86.8 percent of apartment households made a full or partial rent payment by October 13 in its survey of 11.5 million units of professionally managed apartment units across the country.

This is a 2.4-percentage point, or 271,000-household decrease from the share who paid rent through October 13, 2019 and compares to 86.2 percent that had paid by September 13, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“While the broader multifamily industry continues to show its resilience at a national level, other metrics in the industry are beginning to highlight the growing localized financial distress due to inaction by political leaders in Washington,” said Doug Bibby, NMHC President.

emphasis added

This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 13th of the month.

CR Note: This is mostly for large, professionally managed properties.

Philly Fed Manufacturing "Picked Up"; NY Fed Manufacturing "Increased Modestly" in October

by Calculated Risk on 10/15/2020 08:52:00 AM

Note: Be careful with diffusion indexes. This shows a rebound off the bottom - some improvement from May to October - but doesn't show the level of activity.

From the Philly Fed: October 2020 Manufacturing Business Outlook Survey

Manufacturing activity in the region picked up this month, according to firms responding to the October Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments all showed notable improvement. Most future indexes increased and continue to reflect optimism among firms about growth over the next six months.This was above the consensus forecast.

The diffusion index for current activity increased 17 points to 32.3 in October, its fifth consecutive positive reading after reaching long-term lows in April and May … On balance, the firms reported increases in manufacturing employment for the fourth consecutive month. The current employment index, however, fell 3 points to 12.7 this month.

emphasis added

From the NY Fed: Empire State Manufacturing Survey

Business activity expanded modestly in New York State, according to firms responding to the October 2020 Empire State Manufacturing Survey. The headline general business conditions index fell seven points to 10.5, pointing to a slower pace of growth than in September.This was below the consensus forecast.

...

The index for number of employees moved up five points to 7.2, indicating that employment levels grew. The average workweek index rose nine points to 16.1, a multi-year high, signaling a significant increase in hours worked.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (blue, through October), and five Fed surveys are averaged (yellow, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

These early reports are mixed, and suggest the ISM manufacturing index might increase slightly in October from the September level.

Weekly Initial Unemployment Claims increase to 898,000

by Calculated Risk on 10/15/2020 08:38:00 AM

Special technical note on California (two week pause).

The DOL reported:

In the week ending October 10, the advance figure for seasonally adjusted initial claims was 898,000, an increase of 53,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 840,000 to 845,000. The 4-week moving average was 866,250, an increase of 8,000 from the previous week's revised average. The previous week's average was revised up by 1,250 from 857,000 to 858,250.This does not include the 372,891 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 463,897 the previous week. (There are some questions on PUA numbers).

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 866,250.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 10,018,000 (SA) from 11,183,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 11,172,335 receiving Pandemic Unemployment Assistance (PUA) that decreased from 11,394,832 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, October 14, 2020

Thursday: Unemployment Claims, NY and Philly Fed Mfg

by Calculated Risk on 10/14/2020 09:15:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. Initial claims were 840 thousand the previous week.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for October. The consensus is for a reading of 15.0, down from 17.0.

• Also at 8:30 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of 14.5, down from 15.0.

October 14 COVID-19 Test Results

by Calculated Risk on 10/14/2020 07:44:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 949 thousand test results reported over the last 24 hours.

There were 56,727 positive tests.

Almost 9,500 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.0% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high cases this Fall and Winter.