by Calculated Risk on 8/28/2020 08:11:00 PM

Friday, August 28, 2020

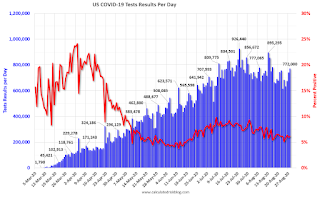

August 28 COVID-19 Test Results

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 772 thousand test results reported over the last 24 hours.

There were 47 thousand positive tests.

There have been over 28,000 COVID reported deaths in the first 28 days of August. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Lawler: July Residential Home Sales/Inventories in Selected Counties with Beach/Mountain Resort Areas

by Calculated Risk on 8/28/2020 01:39:00 PM

Some interesting data from housing economist Tom Lawler:

Below is a table showing July residential home sales and inventories for counties with beach resorts or, in the case of Monroe County, mountain resorts. Data are MLS based unless otherwise noted.

| Selected Transfer Payments Billions of dollars, SAAR | ||||||

|---|---|---|---|---|---|---|

| Residential Home Sales | Residential Inventory | |||||

| July-20 | July-19 | % Chg. | July-20 | July-19 | % Chg. | |

| Barnstable Co., MA (Cape Cod)* | 881 | 618 | 42.6% | |||

| Outer Banks, NC | 389 | 185 | 110.3% | 881 | 1506 | -41.5% |

| Hilton Head, SC | 709 | 503 | 41.0% | 1676 | 2321 | -27.8% |

| Sussex Co, DE (Rehoboth Beach) | 695 | 437 | 59.0% | 1614 | 2659 | -39.3% |

| Worcester Co., MD (Ocean City) | 374 | 190 | 96.8% | 634 | 1150 | -44.9% |

| Baldwin Co., AL (Orange Beach) | 895 | 649 | 37.9% | 2011 | 2875 | -30.1% |

| Monroe Co., PA (Poconos) | 418 | 283 | 47.7% | 723 | 1668 | -56.7% |

| *Based on Deeds Recorded | ||||||

Q3 GDP Forecasts

by Calculated Risk on 8/28/2020 11:41:00 AM

From Merrill Lynch:

2Q GDP was revised up to -31.7% qoq saar in the second release. 3Q GDP tracking rose by 2pp to 19% following recent strong capex and housing data. [August 28 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 15.3% for 2020:Q3. [August 28 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 28.9 percent on August 28, up from 25.6 percent on August 26. [August 28 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 25% annualized increase in Q3 GDP, is about 5.7% QoQ, and would leave real GDP down about 5.1% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 25% annualized increase in real GDP would look like in Q3.

Even with a 25% annualized increase (about 5.7% QoQ), real GDP will be down about 5.1% from Q4 2019; a larger decline in real GDP than at the depth of the Great Recession.

Real Personal Income less Transfer Payments

by Calculated Risk on 8/28/2020 10:05:00 AM

Transfer payments decreased by $70 billion in July, but were still $1.7 trillion (on SAAR basis) above the February level. Most of the increase in transfer payments - compared to the level prior to the crisis - is now from unemployment insurance.

However, there will be sharp decline in unemployment insurance in August.

This table shows the amount of unemployment insurance and "Other" transfer payments since February 2020 (pre-crisis level). The increase in "Other" was mostly due to other parts of the CARES Act such as the $1,200 one time payment.

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Feb | $506 | $28 |

| Mar | $515 | $74 |

| Apr | $3,379 | $496 |

| May | $1,354 | $1,372 |

| Jun | $743 | $1,470 |

| Jul | $748 | $1,364 |

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

Click on graph for larger image.

Click on graph for larger image.This graph shows real personal income less transfer payments since 1990.

This measure of economic activity increased 0.7% in July, compared to June, and was down 5.0% compared to February 2020 (previous peak).

Another way to look at this data is as a percent of the previous peak.

Another way to look at this data is as a percent of the previous peak.Real personal income less transfer payments was off 8.3% in April. This was a larger decline than the worst of the great recession.

Currently personal income less transfer payments are still off 5.0% (see red arrow).

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans "Improve Slightly"

by Calculated Risk on 8/28/2020 09:27:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of August 25th.

From Forbearances Improve Slightly

After holding flat last week, the total number of mortgages in active forbearance improved slightly. Forbearances ticked down by just 1,000 over the past week, making the second consecutive week of basically zero net improvement.

This is not unexpected, as improvement has slowed toward the end of each of the past several months. It has generally followed a stair-step progression with the most improvement seen at the beginning of the month and slowing as we move toward the end.

According to Black Knight’s McDash Flash Forbearance Tracker, as of August 25, 3.9 million homeowners remain in active forbearance, representing 7.4% of all active mortgages. This is unchanged from last week (or the week prior). Together, they represent $828 billion in unpaid principal. Of these, 72% have had their terms extended.

...

As we’ve discussed previously, there are a number of factors that continue to represent significant uncertainty as we move forward, including the ongoing COVID-19 pandemic and the expiration of expanded unemployment benefits last month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.CR Note: I'm still expecting another disaster relief package soon, but we might see an increase in forbearance activity in the coming weeks as we wait for additional relief.

Personal Income increased 0.4% in July, Spending increased 1.9%, Core PCE increased 0.3%

by Calculated Risk on 8/28/2020 08:41:00 AM

The BEA released the Personal Income and Outlays report for July:

Personal income increased $70.5 billion (0.4 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $39.9 billion (0.2 percent) and personal consumption expenditures (PCE) increased $267.6 billion (1.9 percent).The July PCE price index increased 1.0 percent year-over-year and the July PCE price index, excluding food and energy, increased 1.3 percent year-over-year.

Real DPI decreased 0.1 percent in July and Real PCE increased 1.6 percent. The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.3 percent.

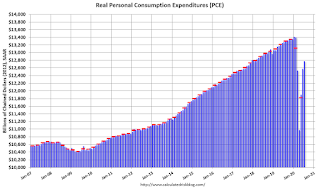

The following graph shows real Personal Consumption Expenditures (PCE) through July 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income and the increase in PCE were below expectations.

Even if PCE stayed at this level in August and September, PCE growth would be around 35% annualized compared to Q2 (since PCE was so low in April). But PCE would still be far below the levels at the beginning of 2020.

Thursday, August 27, 2020

Friday: Personal Income and Outlays, Chicago PMI

by Calculated Risk on 8/27/2020 09:00:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, July 2020. The consensus is for a 0.2% decrease in personal income, and for a 1.5% increase in personal spending. And for the Core PCE price index to increase 0.5%.

• At 9:45 AM, Chicago Purchasing Managers Index for August.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 72.8.

August 27 COVID-19 Test Results

by Calculated Risk on 8/27/2020 07:42:00 PM

IMPORTANT: The CDC has changed their guidance on who should be tested - at the direction of the White House - over the objections of scientists. This action is clearly intended to make the numbers look better over the next couple of months. See: Controversial change in guidelines about coronavirus testing directed by the White House coronavirus task force

The CDC estimates that 40 percent of those who test positive for the coronavirus have no symptoms but may be highly infectious and spread it to other people.These are the people the White House doesn't want to test. Testing, tracing and transparency are keys to suppressing the virus. This change in guidance is counterproductive.

The US is now mostly reporting over 700,000 tests per day (fewer recently). Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 742,340 test results reported over the last 24 hours.

There were 44,264 positive tests.

There have been over 27,000 COVID reported deaths in the first 27 days of August. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Las Vegas Visitor Authority: No Convention Attendance, Visitor Traffic Down 61% YoY in July

by Calculated Risk on 8/27/2020 04:47:00 PM

From the Las Vegas Visitor Authority: July 2020 Las Vegas Visitor Statistics

The destination hosted an estimated 1.4M visitors in July, about 40% of last year's levels but up from the approximately 1.1M visitors hosted in June. The convention segment continued to register no measurable volume with continued mandated restrictions on group sizes.Here is the data from the Las Vegas Convention and Visitors Authority.

With open properties representing an inventory of 123,684 rooms*, total occupancy reached 42.5% for the month while weekend occupancy came in at 54.4% and midweek occupancy reached 36.9%.

* Reflects weighted average of daily room tallies

Click on graph for larger image.

Click on graph for larger image. The blue and red bars are monthly visitor traffic (left scale) for 2019 and 2020. The dashed blue and orange lines are convention attendance (right scale).

Convention traffic in July was down 100% compared to July 2019.

And visitor traffic was down 61% YoY.

The casinos started to reopen on June 4th (it appears about 80% of rooms have now opened).

Comments on Weekly Unemployment Claims

by Calculated Risk on 8/27/2020 12:49:00 PM

Earlier: Weekly Initial Unemployment Claims decrease to 1,006,000

This was the 23rd consecutive week with extraordinarily high initial claims.

More importantly, continued claims are still extremely high (second graph).

The following graph shows regular initial unemployment claims (blue) and PUA claims (red) since early February.

Initial claims, including Pandemic Unemployment Assistance (PUA) are still above 1.6 million per week.

The worst week during the great recession was 665,000. So initial claims are still about 1 million per week higher than the worst week of the great recession!

We are probably seeing some layoffs related to the higher level of COVID cases and also from the end of some Payroll Protection Programs (PPP).

There are typically around 2 million people receiving benefits from the various programs (mostly regular unemployment insurance).

As of the release this morning, there were still 27 million people receiving benefits as of August 8th.