by Calculated Risk on 7/31/2020 06:07:00 PM

Friday, July 31, 2020

July 31 COVID-19 Test Results

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 718,956 test results reported over the last 24 hours.

There were 67,503 positive tests.

The seven day average of daily deaths has moved higher for the 16th consecutive day to over 1,100 per day. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Fannie Mae: Mortgage Serious Delinquency Rate Increased Sharply in June

by Calculated Risk on 7/31/2020 04:14:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency increased to 2.65% in June, from 0.89% in May. The serious delinquency rate is up from 0.70% in June 2019.

This is the highest serious delinquency rate since July 2013.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.00% are seriously delinquent (up from 3.09% in May). For loans made in 2005 through 2008 (3% of portfolio), 8.37% are seriously delinquent (up from 5.22%), For recent loans, originated in 2009 through 2018 (95% of portfolio), only 2.21% are seriously delinquent (up from 0.53%). So Fannie is still working through a few poor performing loans from the bubble years.

With COVID-19, this rate will increase further in July (it takes time since these are mortgages three months or more past due).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

Comparing US, EU and China GDP

by Calculated Risk on 7/31/2020 01:58:00 PM

With the sharp GDP decline in Q2, there have been several comparisons of US numbers to other regions of the world.

First, it is important to understand:

The US reports GDP on a quarter-over-quarter (QoQ) annualized basis.

The EU reports GDP on a QoQ basis (not annualized).

China reports GDP on a year-over-year (YoY) basis.

So the US reported that GDP declined 32.9% in Q2 annualized, the EU reported GDP declined 11.9% in Q2, and China reported GDP increased 3.2% YoY in Q2 (China's big hit was in Q1).

This is just how the data is reported. There is no conspiracy to make the US look bad in Q2, or look good in Q3.

If we want to compare the US to the EU, we need to convert one of the numbers. For example, a 32.9% annualized decline is a 9.5% decline QoQ (not annualized).

So we would compare a -9.5% in the US to -11.9% in the EU. Both were terrible, but also necessary to "bend the curve" and suppress the virus, and the EU decline in GDP was worse.

However, the EU did a much better job of suppressing the virus, and the economic recovery in the EU will probably be better. As Dr. Fauci noted today (from CNN):

"If you look at what happened in Europe, when they shut down or locked down or went to shelter in place — however you want to describe it — they really did it to the tune of about 95% plus of the country did that," Fauci said.It will be interesting in Q3 to compare the bounce back. My guess is the EU will do better in Q3 since they did a better job of controlling the virus.

However, "when you actually look at what we did, even though we shut down, even though it created a great deal of difficulty, we really functionally shut down only about 50% in the sense of the totality of the country," Fauci added.

Click on graph for larger image.

Click on graph for larger image.There will be a sharp increase in GDP in Q3 in both the US and the EU.

This graph shows monthly real personal consumption expenditures (PCE) in the US (not GDP), and the dashed red lines are the quarterly levels for real PCE. PCE collapsed at a 6.9% annual rate in Q1, and at a 34.6% annual rate in Q2.

Note the red line for Q2 (the quarterly level of PCE). Even if PCE stayed at the June level in Q3, there would be 27% increase in Q3!

Early Q3 GDP Forecasts

by Calculated Risk on 7/31/2020 12:24:00 PM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). Also, even if activity is flat in Q3 compared to June, GDP will show a significant increase in Q3 over Q2 because of the sharp decline in April.

From Merrill Lynch:

We look for GDP to grow by 15.0% qoq saar in 3Q. We forecast a contraction of -5.7% in 2020, followed by a 2.8% rebound 2021. [July 31 estimate]And from the Altanta Fed: GDPNow

emphasis added

The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 11.9 percent on July 31. On July 30, the U.S. Bureau of Economic Analysis released its initial estimate of second-quarter real GDP growth as -32.9 percent, 0.8 percentage points below the final GDPNow model nowcast released on July 29. [July 31 estimate]

Real Personal Income less Transfer Payments

by Calculated Risk on 7/31/2020 10:03:00 AM

NOTE: All of these numbers are on a seasonally adjusted annual rate basis (SAAR).

In the Personal Income & Outlays report for June, the BEA noted that "Personal income decreased $222.8 billion (1.1 percent) in June". This decrease in Personal Income was due to a decrease in transfer payments.

Transfer payments decreased by $0.5 trillion in June (SAAR), after decreasing by $1.2 trillion in May, and increasing by $3.3 trillion in April.

Unemployment insurance increased from $74 billion in March (SAAR), to $473 billion in April, to $1.31 trillion in May, to $1.42 trillion in June..

And "Other" decreased by $611 billion in June (SAAR).

Without the decrease in transfer payments, Personal Income in June would have increased about 1.0%.

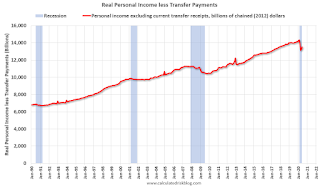

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

This graph shows real personal income less transfer payments since 1990.

This measure of economic activity decreased 2.9% in March, compared to February, and another 6.1% in April (compared to March).

This measure increased 1.5% in May compared to April, and increased 1.4% in June, but is still down 5.8% compared to February (pre-recession).

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased Slightly as of July 28th

by Calculated Risk on 7/31/2020 09:45:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Loans in Forbearance Fell by 17K This Week; National Forbearance Rate Drops to 7.7%

The latest data from the McDash Flash Forbearance Tracker shows that the number of loans in forbearance fell by 17K this week, dropping the national forbearance rate to 7.7%. There are now 4.1M loans that remain in active forbearance as of July 28th. While noticeable declines were seen among GSE (-30K) loans as well as loans held in portfolio and private labeled securities (-5K), FHA/VA forbearances rose for the third consecutive week (+18K) reaching their highest level since early July.

emphasis added

Click on graph for larger image.

Click on graph for larger image.CR Note: There will be another disaster relief package soon, but we might see an increase in forbearance activity next week as we wait for additional relief.

Personal Income decreased 1.1% in June, Spending increased 5.6%

by Calculated Risk on 7/31/2020 08:39:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income decreased $222.8 billion (1.1 percent) in June according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $255.3 billion (1.4 percent) and personal consumption expenditures (PCE) increased $737.7 billion (5.6 percent).The June PCE price index increased 0.8 percent year-over-year and the June PCE price index, excluding food and energy, increased 0.9 percent year-over-year.

Real DPI decreased 1.8 percent in June and Real PCE increased 5.2 percent. The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through June 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was less than expected, and the increase in PCE was at expectations.

Thursday, July 30, 2020

Friday: Personal Income and Outlays

by Calculated Risk on 7/30/2020 09:53:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, June 2020. The consensus is for a 0.5% decrease in personal income, and for a 5.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for July.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 72.9.

July 30 COVID-19 Test Results

by Calculated Risk on 7/30/2020 06:21:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 819,270 test results reported over the last 24 hours.

There were 69,917 positive tests.

The seven day average of daily deaths has moved higher for the 15th consecutive day to close to 1,100 per day. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Year-over-year and Quarterly Change in Real GDP

by Calculated Risk on 7/30/2020 01:26:00 PM

The following graph shows real GDP quarterly (blue, annualized), and the year-over-year (YoY) change in real GDP (red).

The worst quarterly change in real GDP during the Great Recession was -8.4% annualized in Q4 2008.

Note that the tax changes at the end of 2017 had minimal impact on GDP (maybe boosted slightly), and also, as shown earlier, there was no investment boom following the tax changes.

Click on graph for larger image.

Click on graph for larger image.There will be some bounce back for GDP in Q3. The worst month for economic activity was in April 2020, and the economy bounced back in May and June.