by Calculated Risk on 7/27/2020 08:27:00 AM

Monday, July 27, 2020

High Frequency Indicators for the Economy

Note: I've added a New York specific indicator - subway usage - at the bottom.

These indicators are mostly for travel and entertainment - some of the sectors that will recover very slowly.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On July 26th there were 751,205 travelers compared to 2,700,723 a year ago.

That is a decline of 72%. There had been a slow steady increase from the bottom, but air travel has mostly moved sideways over the last few weeks.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through July 25, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

The 7 day average for New York is still off 77%.

Florida is down 60% YoY. Note that dining declined in many areas as the number of COVID cases surged. It appears dining has flattened out at a lower level (probably mostly outdoor dining).

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through July 23rd.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through July 23rd.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up a slightly from the bottom, but are still under $1 million per week (compared to usually around $300 million per week), and ticket sales have essentially been at zero for eighteen weeks.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).2020 was off to a solid start, however, COVID-19 crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

The occupancy rate for the last five weeks was 43.9%, 46.2%, 45.6%, 45.9% and 47.5% The increases in occupancy have slowed and are well below the median for this week of 78%.

Usually hotel occupancy starts to pick up seasonally in early June. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows the year-over-year change in gasoline consumption.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows the year-over-year change in gasoline consumption.At one point, gasoline consumption was off almost 50% YoY.

As of July 17th, gasoline consumption was only off about 12% YoY (about 88% of normal).

Note: I know several people that have driven to vacation spots - or to visit family - and they usually would have flown. So this might be boosting gasoline consumption over the summer.

The final graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through July 25th for the United States and several selected cities.

This data is through July 25th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is still only about 51% of the January level. It is at 45% in New York, and 52% in Houston (down over the last few of weeks).

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.This data is through Friday, July 24th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings"

Sunday, July 26, 2020

Sunday Night Futures

by Calculated Risk on 7/26/2020 07:27:00 PM

Weekend:

• Schedule for Week of July 26, 2020

Monday:

• At 8:30 AM ET, Durable Goods Orders for June from the Census Bureau. The consensus is for a 7.2% increase in durable goods orders.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for July.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 14 and DOW futures are down 120 (fair value).

Oil prices were mixed over the last week with WTI futures at $40.97 per barrel and Brent at $42.98 barrel. A year ago, WTI was at $55, and Brent was at $61 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.17 per gallon. A year ago prices were at $2.74 per gallon, so gasoline prices are down $0.57 per gallon year-over-year.

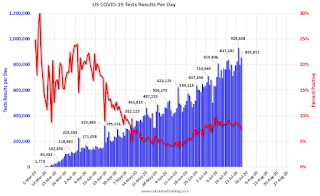

July 26 COVID-19 Test Results

by Calculated Risk on 7/26/2020 05:49:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 855,811 test results reported over the last 24 hours.

There were 61,713 positive tests.

The seven day average of daily deaths has moved higher for the 11th consecutive day. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.2% (red line). This is the lowest percent positive in 3 weeks.

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

FOMC Preview

by Calculated Risk on 7/26/2020 11:47:00 AM

Expectations are there will be no change to policy when the FOMC meets this week.

Here are some comments from Goldman Sachs economist David Mericle:

"We do not expect major changes at the July meeting ... We now expect the FOMC to complete its framework review in September and to then change its forward guidance and asset purchase policies in November ... [In the future] we expect the FOMC to adopt average inflation targeting, effectively raising the inflation goal to a 2-2.5% range when the economy is at full employment ... We think the FOMC will eventually switch to outcome-based forward guidance that delays liftoff until the economy achieves both full employment and 2% inflation, a goal that we do not expect to be met until roughly 2025.For review, here are the June FOMC projections. (Projections will not be updated at this meeting)

GDP decreased at a 5.0% annual rate in Q1, and most forecasts are for a seasonal adjusted annual rate decline of 30% to 35% in Q2 - and for GDP to decline in 2020. As an example, from Merrill Lynch economists:

The advance 2Q GDP estimate comes out next Thursday and will reveal the depth of the recession. Real activity likely collapsed -36% qoq saar, translating into a peak-to-trough decline of -11.7%. ... We forecast a contraction of -5.7% in 2020, followed by a 3.4% rebound 2021.The course of the economy will depend on the course of the pandemic, so the FOMC has to factor in their expectations of when the pandemic will subside and end (nobody knows at this time).

With the recent surge in COVID cases and deaths, the 2nd half of 2020 might be weaker than the FOMC expected in June.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | -7.6 to -5.5 | 4.5 to 6.0 | 3.0 to 4.5 | |

The unemployment rate was at 11.1% in June. The unemployment rate declined faster in May and June than most expectations, however, it appears the bounce back in employment has stalled in July.

Note that the unemployment rate doesn't remotely capture the economic damage to the labor market. Not only are there almost 18 million people unemployed, close to 5 million people have left the labor force since January. And millions more are being supported by the Paycheck Protection Program (PPP). Over 50% of households have reported lost income in a recent Census survey.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 9.0 to 10.0 | 5.9 to 7.5 | 4.8 to 6.1 | |

As of May 2020, PCE inflation was up 0.5% from May 2019.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 0.6 to 1.0 | 1.4 to 1.7 | 1.6 to 1.8 | |

PCE core inflation was up 1.0% in May year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2020 | 2021 | 2022 | |

| June 2020 | 0.9 to 1.1 | 1.4 to 1.7 | 1.6 to 1.8 | |

Inflation is not a concern for the FOMC.

Saturday, July 25, 2020

July 25 COVID-19 Test Results

by Calculated Risk on 7/25/2020 06:29:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 797,589 test results reported over the last 24 hours.

There were 65,413 positive tests.

This was the 5th consecutive day with over 1,000 deaths. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.2% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Free Webinar: UCI Professor Chris Schwarz Economic and Market Update on Tuesday, July 28th

by Calculated Risk on 7/25/2020 12:36:00 PM

UCI Professor Chris Schwarz and I have presented together before. Always interesting!

He will be offering his thoughts on the economy, Tuesday, July 28th at 11:30 AM PT (2:30 PM ET).

Professor Schwarz writes: "Given the new lockdowns, uncertainty over the stimulus package, Q2 earnings, and financial market conditions, I will host another Economic and Market Update on July 28th at 11:30AM PST. As usual, the event is free."

You can register here.

Schedule for Week of July 26, 2020

by Calculated Risk on 7/25/2020 08:11:00 AM

The key report this week is the advance estimate of Q2 GDP.

Other key reports include Personal Income and Outlays for June and Case-Shiller house prices for May.

For manufacturing, the July Richmond and Dallas Fed manufacturing surveys will be released.

The FOMC meets this week, and no change to policy is expected.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 7.2% increase in durable goods orders.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for July.

9:00 AM: S&P/Case-Shiller House Price Index for May.

9:00 AM: S&P/Case-Shiller House Price Index for May.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 4.0% year-over-year increase in the Comp 20 index for May.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. This is the last of the regional surveys for July.

10:00 AM: The Q2 2019 Housing Vacancies and Homeownership report from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 15.3% increase in the index.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: Gross Domestic Product, 2nd quarter 2020 (advance estimate), and annual update. The consensus is that real GDP decreased 34.0% annualized in Q2, down from -5.0% in Q1.

8:30 AM: The initial weekly unemployment claims report will be released. The early consensus is for a 1.550 million initial claims, up from 1.416 million the previous week.

8:30 AM ET: Personal Income and Outlays, June 2020. The consensus is for a 0.5% decrease in personal income, and for a 5.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for July.

10:00 AM: University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 72.9.

Friday, July 24, 2020

July 24 COVID-19 Test Results

by Calculated Risk on 7/24/2020 06:27:00 PM

The US is now reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 929,838 test results reported over the last 24 hours. This is a new record.

There were 75,193 positive tests.

This was the 4th consecutive day with over 1,000 deaths. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

July Vehicle Sales Forecast: 16% Year-over-year Decline

by Calculated Risk on 7/24/2020 01:21:00 PM

From Wards: U.S. Light-Vehicle Sales Continue Improvement in July Despite Inventory Concerns (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for July (Red).

Sales have bounced back from the April low, but are still down sharply year-over-year.

The Wards forecast of 14.1 million SAAR, would be up 8% from June, and down 16% from July 2019.

This would put sales in 2020, through July, down about 23% compared to the same period in 2019.

Q2 GDP Forecasts: Probably Around 35% Annual Rate Decline

by Calculated Risk on 7/24/2020 11:39:00 AM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 35% Q2 decline is around 10% decline from Q1 (SA).

From Merrill Lynch:

The advance 2Q GDP estimate comes out next Thursday and will reveal the depth of the recession. Real activity likely collapsed -36% qoq saar, translating into a peak-to-trough decline of -11.7%. ... We forecast a contraction of -5.7% in 2020, followed by a 3.4% rebound 2021. [July 24 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -14.3% for 2020:Q2 and 13.3% for 2020:Q3. [July 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -34.7 percent on July 17, down from -34.5 percent on July 16. [July 17 estimate]