by Calculated Risk on 7/16/2020 01:34:00 PM

Thursday, July 16, 2020

Philly Fed Manufacturing "continued to expand" in July

Note: Be careful with diffusion indexes. This shows a rebound off the bottom - some improvement from May to June to July - but doesn't show the level of activity.

From the Philly Fed: July 2020 Manufacturing Business Outlook Survey

Manufacturing activity in the region continued to expand this month, according to firms responding to the July Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments showed positive readings for the second consecutive month, coinciding with the phased reopening of the economy in our region. The employment index reached positive territory for the first time since March. Although future indicators for general activity, new orders, and shipments declined from last month’s readings, the indexes remained elevated, suggesting that the firms expect overall growth over the next six months.This was above the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current activity edged down 3 points to 24.1 in July, its second consecutive positive reading after reaching long-term lows in the spring … The firms reported increases in manufacturing employment overall for the first time since March, as the current employment index rose 24 points to 20.1 this month, its highest reading since October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (blue, through July), and five Fed surveys are averaged (yellow, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

These early reports suggest the ISM manufacturing index will increase further in July.

Hotels: Occupancy Rate Declined 38% Year-over-year

by Calculated Risk on 7/16/2020 11:01:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 11 July

U.S. hotel performance data for the week ending 11 July showed mostly flat occupancy and lower room rates from the previous week, according to STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

5-11 July 2020 (percentage change from comparable week in 2019):

• Occupancy: 45.9% (-38.0%)

• Average daily rate (ADR): US$97.33 (-26.8%)

• Revenue per available room (RevPAR): US$44.67 (-54.6%)

emphasis added

The occupancy rate for the last four weeks was 43.9%, 46.2%, 45.6% and 45.9%. Flattening out well below the median for this week of 75%.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Usually hotel occupancy starts to pick up seasonally in early June. So some of the recent pickup might be seasonal (summer travel). Note that summer occupancy usually peaks at the end of July or in early August.

According to STR, the improvement appears related mostly to leisure travel as opposed to business travel.

Note: Y-axis doesn't start at zero to better show the seasonal change.

NAHB: Builder Confidence Increased to 72 in July

by Calculated Risk on 7/16/2020 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 72, up from 58 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Rallies to Pre-Pandemic Level in July

In a strong signal that the housing market is ready to lead a post-COVID economic recovery, builder confidence in the market for newly-built single-family homes jumped 14 points to 72 in July, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. The HMI now stands at the solid pre-pandemic reading in March before the outbreak affected much of the nation.

“Builders are seeing strong traffic and lots of interest in new construction as existing home inventory remains lean,” said NAHB Chairman Chuck Fowke. “Moreover, builders in the Northeast and the Midwest are benefiting from demand that was sidelined during lockdowns in the spring. Low interest rates are also fueling demand, and we expect housing to lead an overall economic recovery.”

“While the housing market is clearly rebounding, challenges exist,” said NAHB Chief Economist Robert Dietz. “Lumber prices are at a two-year high and builders are reporting rising costs for other building materials while lot and skilled labor availability issues persist. Nonetheless, the important story of the changing geography of housing demand is benefiting new construction. New home demand is improving in lower density markets, including small metro areas, rural markets and large metro exurbs, as people seek out larger homes and anticipate more flexibility for telework in the years ahead. Flight to the suburbs is real.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.

Retail Sales increased 7.5% in June

by Calculated Risk on 7/16/2020 08:48:00 AM

On a monthly basis, retail sales increased 7.5 percent from May to June (seasonally adjusted), and sales were up 1.1 percent from June 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for June 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $524.3 billion, an increase of 7.5 percent from the previous month, and 1.1 percent above June 2019. Total sales for the April 2020 through June 2020 period were down 8.1 percent from the same period a year ago. The April 2020 to May 2020 percent change was revised from up 17.7 percent to up 18.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 7.0% in June.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 2.7% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 2.7% on a YoY basis.The increase in June was above expectations, and sales in April and May were revised up.

Weekly Initial Unemployment Claims decrease to 1,300,000

by Calculated Risk on 7/16/2020 08:37:00 AM

The DOL reported:

In the week ending July 11, the advance figure for seasonally adjusted initial claims was 1,300,000, a decrease of 10,000 from the previous week's revised level. The previous week's level was revised down by 4,000 from 1,314,000 to 1,310,000. The 4-week moving average was 1,375,000, a decrease of 60,000 from the previous week's revised average. The previous week's average was revised down by 2,250 from 1,437,250 to 1,435,000.The previous week was revised down.

emphasis added

This does not include the 928,488 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 1,375,000.

Initial weekly claims was at the consensus forecast of 1.3 million initial claims and the previous week was revised down.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 17,338,000 (SA) from 17,760,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 14,282,999 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, July 15, 2020

Thursday: Unemployment Claims, Retail Sales, Philly Fed Mfg, Homebuilder Survey

by Calculated Risk on 7/15/2020 08:40:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 1.200 million initial claims, down from 1.314 million the previous week.

• Also at 8:30 AM, Retail sales for June is scheduled to be released. The consensus is for 5.5% increase in retail sales.

• Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 20.0, down from 27.5.

• At 10:00 AM, The July NAHB homebuilder survey. The consensus is for a reading of 60, up from 58. Any number above 50 indicates that more builders view sales conditions as good than poor.

July 15 COVID-19 Test Results

by Calculated Risk on 7/15/2020 05:49:00 PM

The US is now conducting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 756,470 test results reported over the last 24 hours.

There were 65,106 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.6% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Fed's Beige Book: "Economic activity increased in almost all Districts, but remained well below where it was prior to the COVID-19 pandemic."

by Calculated Risk on 7/15/2020 02:08:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Chicago based on information collected on or before July 6, 2020. "

Economic activity increased in almost all Districts, but remained well below where it was prior to the COVID-19 pandemic. Consumer spending picked up as many nonessential businesses were allowed to reopen. Retail sales rose in all Districts, led by a rebound in vehicle sales and sustained growth in the food and beverage and home improvement sectors. Leisure and hospitality spending improved, but was far below year-ago levels. Most Districts reported that manufacturing activity moved up, but from a very low level. Demand for professional and business services increased in most Districts, but was still weak. Transportation activity rose overall on higher truck and air cargo volumes. Construction remained subdued, but picked up in some Districts. Home sales increased moderately, but commercial real estate activity stayed at a low level. Financial conditions in the agriculture sector continued to be poor, while energy sector activity fell further because of limited demand and oversupply. Loan demand was flat outside of some Paycheck Protection Program (PPP) activity and increased residential mortgages. The PPP and loan deferrals by private lenders reportedly provided many firms with sufficient liquidity for the near term. Outlooks remained highly uncertain, as contacts grappled with how long the COVID-19 pandemic would continue and the magnitude of its economic implications.CR Note: This information was on or before July 6th, and it appears activity has slowed recently.

...

Employment increased on net in almost all Districts as many businesses reopened or ramped up activity. Districts highlighted gains in the retail and leisure and hospitality sectors. However, payrolls in all Districts were well below pre-pandemic levels. Job turnover rates remained high, with contacts across Districts reporting new layoffs. Contacts in nearly every District noted difficulty in bringing back workers because of health and safety concerns, childcare needs, and generous unemployment insurance benefits. Many contacts who have been retaining workers with help from the PPP said that going forward, the strength of demand would determine whether they can avoid layoffs.

emphasis added

Census: Household Pulse Survey shows 34.9% of Households Expect Loss in Income

by Calculated Risk on 7/15/2020 10:41:00 AM

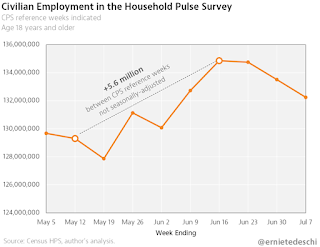

First, from @ernietedeschi

Employment in the @uscensusbureau Household Pulse Survey fell another -1.3 million last week alone. It's now fallen -2.6 million cumulatively over the past 3 weeks.This graph is from Ernie Tedeschi (former US Treasury economist).

Seasonality & survey noise may be factors, but the HPS did an excellent job of anticipating the June jobs report.

Note: The question on lost income is always since March 13, 2020 - so this percentage will not decline - but might increase.

From the Census Bureau: Measuring Household Experiences during the Coronavirus (COVID-19) Pandemic

The U.S. Census Bureau, in collaboration with five federal agencies, is in a unique position to produce data on the social and economic effects of COVID-19 on American households. The Household Pulse Survey is designed to deploy quickly and efficiently, collecting data to measure household experiences during the Coronavirus (COVID-19) pandemic. Data will be disseminated in near real-time to inform federal and state response and recovery planning.This will be updated weekly, and the Census Bureau released the recent survey results today. This survey asks about Loss in Employment Income, Expected Loss in Employment Income, Food Scarcity, Delayed Medical Care, Housing Insecurity and K-12 Educational Changes.

…

Data collection for the Household Pulse Survey began on April 23, 2020. The Census Bureau will collect data for 90 days, and release data on a weekly basis.

Click on graph for larger image.

Click on graph for larger image.The data was collected between July 2 and July 7, 2020.

Definitions:

Loss in employment income: "Percentage of adults in households where someone had a loss in employment income since March 13, 2020."

This number is since March 13, and has increased to 49.9% from 47% in the initial survey.

Expected Loss in Employment Income: "Percentage of adults who expect someone in their household to have a loss in employment income in the next 4 weeks."

34.9% of households expect a loss in income over the next 4 weeks. This is down from 38.8% in late April, but up from 32% two weeks ago. This might suggest the job gains stalled after the data was collected for the June employment report.

Food Scarcity: Percentage of adults in households where there was either sometimes or often not enough to eat in the last 7 days.

10.8% of households report food scarcity. This has been increasing slightly.

Delayed Medical Care: "Percentage of adults who delayed getting medical care because of the COVID-19 pandemic in the last 4 weeks."

40.1% of households report they delayed medical care over the last 4 weeks. This has declined slightly.

Housing Insecurity: "Percentage of adults who missed last month’s rent or mortgage payment, or who have slight or no confidence that their household can pay next month’s rent or mortgage on time."

25.3% of households reported they missed last month's rent or mortgage payment (or little confidence in making this month's payment). This has increased from a low of 22.1% in the survey of June 4th - June 9th.

Without an extension of the extra unemployment benefits (expires at the end of July), we will likely see a significant increase in housing stress.

K-12 Educational Changes: "Percentage of adults in households with children in public or private school, where classes were taught in a distance learning format, or changed in some other way."

Essentially all households with children are reporting were not being taught in a normal format.

NMHC: Rent Payment Tracker Finds Decline in People Paying Rent in July

by Calculated Risk on 7/15/2020 10:25:00 AM

Without further disaster relief, there will a significant housing and financial issue.

From the NMHC: NMHC Rent Payment Tracker Finds 87.6 Percent of Apartment Households Paid Rent as of July 13

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 87.6 percent of apartment households made a full or partial rent payment by July 13 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: It appears fewer people are paying their rent compared to last year (down 2.5 percentage points from a year ago). In the previous surveys, over the last few months, people were paying their rents at about the same pace as last year. The disaster relief has been key to helping people pay their bills, especially the extra unemployment benefits and the PPP.

This is a 2.5-percentage point decrease from the share who paid rent through July 13, 2019 and compares to 89.0 percent that had paid by June 13, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“The government support, including unemployment benefits, that has proven so important to so many apartment residents expires at the end of the month,” said Doug Bibby, NMHC President. “Lawmakers need to continue to protect the individuals and families that call an apartment home. If action isn’t taken now we risk making the nation’s housing affordability challenges far worse, rolling back the initial economic recovery and putting tens of millions at risk of greater health and financial distress.”

emphasis added