by Calculated Risk on 6/28/2020 12:49:00 PM

Sunday, June 28, 2020

Additional Disaster Relief

It is time for additional disaster relief.

The key proposals will likely include:

1. Extension of Federal Pandemic Unemployment Compensation (FPUC). The current amount is $600 per week for those receiving unemployment benefits, in addition to the state benefits. This expires at the end of July. This might be reduced to $400 per week (or a percentage of state benefits). This will probably be extended through the election in November (Ideally the extension period would not be calendar based, but determined by the state unemployment rate). This is critical, or we will see a significant slump in spending in August, and a sharp increase in delinquencies (rents, mortgages, credit cards, etc).

2. State government relief: It is time for a substantial state relief package. Without relief, the states and local governments will have to start laying off a significant number of employees (Don't be fooled by state and local government hiring in the June employment report - that will be due to a seasonal adjustment quirk). State governments will have no choice - they have to run a balanced budget.

3. Recent Graduate Program: There are few job opportunities for people graduating from high school or college this year. These people should be immediately eligible for unemployment benefits (or maybe hired as contact tracers!).

4. Expand the Paycheck Protection Program (PPP): This program has kept many small businesses alive, and millions of employees employed. There will have to be additional disaster relief for these companies, or millions of people will be let go soon.

Even with all this disaster relief, there will be significant structural damage to the economy even with an effective treatment and/or vaccine at the end of the year or in early 2021. We need to start thinking about how to put people back to work in 2021 so we don't have an extended period with excessive unemployment.

Saturday, June 27, 2020

June 27 COVID-19 Test Results

by Calculated Risk on 6/27/2020 05:08:00 PM

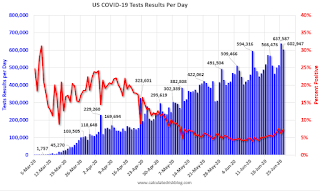

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 590,877 test results reported over the last 24 hours.

There were 43,471 positive tests. This is the second most positive tests ever.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

June Vehicle Sales Forecast: 29% Year-over-year Decline

by Calculated Risk on 6/27/2020 12:45:00 PM

From Edmunds.com: New Vehicle Sales Expected to Drop in June, Closing a Second Down Quarter in 2020, Edmunds Forecasts

The car shopping experts at Edmunds say that June will be another down month for auto sales as the industry continues to combat market challenges posed by the coronavirus (COVID-19) pandemic, forecasting that 1,080,656 new cars and trucks will be sold in the U.S. in June for an estimated seasonally adjusted annual rate (SAAR) of 12.8 million. This reflects a 28.7% decrease in sales from June 2019 and a 3.6% decrease from May 2020.

…

"It comes as no surprise that the second quarter was a disappointing one for the automotive industry, but the good news is that auto sales didn't come to a complete standstill either," said Jessica Caldwell, Edmunds' executive director of insights. "The fact that retail sales — not fleet — are what kept the market propped up speaks volumes to the resilience of the American consumer. And the way that dealers were quick to pivot to online sales also underscores the incredibly responsive and resourceful nature of the industry in the face of adversity."

Although Edmunds data shows a steady growth in sales since the end of March, analysts caution that some of the strains of the pandemic are starting to show as more shoppers return to the market.

"The marketplace is growing less inviting as automakers pull back on incentives and inventory dwindles due to factory shutdowns, particularly when it comes to trucks, which have been the one bright spot for sales during the pandemic," said Caldwell. "Current sales paint an optimistic picture given the circumstances, but between COVID-19 and today's politically charged climate, the industry needs to prepare for uncertainties ahead."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Edmunds forecast for June (Red).

Note that the low in April of 8.73 million SAAR was lower than the lowest sales rate during the great recession of 9.02 million SAAR in February 2009.

Sales have bounced back from the April low, but are still down sharply year-over-year.

Schedule for Week of June 28, 2020

by Calculated Risk on 6/27/2020 08:11:00 AM

The key report scheduled for this week is the June employment report to be released on Thursday.

Other key reports include the June ISM Manufacturing survey, June Vehicle Sales, April Case-Shiller house prices, and the Trade Deficit for May.

On Tuesday, Fed Chair Jerome Powell speaks on the Coronavirus Aid, Relief, and Economic Security Act.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 19.7% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June. This is the last of the regional surveys for June.

9:00 AM: S&P/Case-Shiller House Price Index for April.

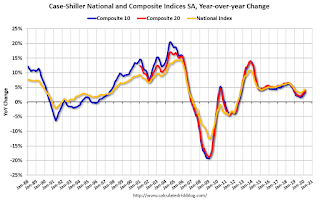

9:00 AM: S&P/Case-Shiller House Price Index for April.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 3.8% year-over-year increase in the Comp 20 index for April.

9:45 AM: Chicago Purchasing Managers Index for June.

12:30 PM: Testimony, Fed Chair Jerome Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Financial Services, U.S. House of Representatives

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 3,000,000 payroll jobs added in June, up from 2,760,000 lost in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 49.0, up from 43.1 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 49.0, up from 43.1 in May.Here is a long term graph of the ISM manufacturing index.

The employment index was at 32.1% in May, and the new orders index was at 31.8%.

10:00 AM: Construction Spending for May. The consensus is for a 1.0% increase in construction spending.

All day: Light vehicle sales for June from the BEA. The consensus is for light vehicle sales to be 13.0 million SAAR in June, up from 12.2 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June from the BEA. The consensus is for light vehicle sales to be 13.0 million SAAR in June, up from 12.2 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

2:00 PM: FOMC Minutes, Meeting of June 9-10, 2020

8:30 AM: Employment Report for June. The consensus is for 3,074,000 jobs added, and for the unemployment rate to decrease to 12.3%.

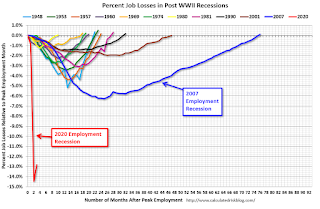

8:30 AM: Employment Report for June. The consensus is for 3,074,000 jobs added, and for the unemployment rate to decrease to 12.3%.There were 2,509,000 jobs added in May, and the unemployment rate was at 13.3%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession is by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.400 million initial claims, down from 1.480 million the previous week.

8:30 AM: Trade Balance report for May from the Census Bureau.

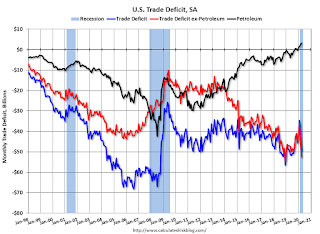

8:30 AM: Trade Balance report for May from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $52.4 billion. The U.S. trade deficit was at $49.4 Billion the previous month.

All US markets will be closed in observance of Independence Day.

Friday, June 26, 2020

June 26 COVID-19 Test Results, Highest Daily Positive Cases Ever - Again

by Calculated Risk on 6/26/2020 05:58:00 PM

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 602,947 test results reported over the last 24 hours. This is the most daily results reported (may be a data dump).

There were 44,373 positive tests. This is the most positive tests ever.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Freddie Mac: Mortgage Serious Delinquency Rate increased in May, Highest in 2 Years

by Calculated Risk on 6/26/2020 11:37:00 AM

Freddie Mac reported that the Single-Family serious delinquency rate in May was 0.81%, up from 0.64% in April. Freddie's rate is down from 0.63% in May 2019.

This is the highest serious delinquency rate since June 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

With COVID-19, this rate will increase significantly in June and July (it takes time since these are mortgages three months or more past due).

I believe mortgages in forbearance will be counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Fannie Mae will report for May soon.

Q2 GDP Forecasts: Probably Around 33% Annual Rate Decline

by Calculated Risk on 6/26/2020 11:23:00 AM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 33% Q2 decline is around 9% decline from Q1 (SA).

Note: I'm just trying to make it clear the economy didn't decline by one-third in Q2. Previously I just divided by 4 (an approximation) to show the quarter to quarter decline. The actually formula is (1-.36) ^ .25 - 1 = -0.095 (a 9.5% decline from Q1)

From Merrill Lynch:

2Q GDP tracking fell to -36% qoq saar from -35% following weak trade and inventory data. [June 26 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP forecast unchanged at -33% (qoq ar). We continue to expect -27% in the initial vintage of the report, reflecting incomplete source data and non-response bias. [June 23 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at -16.3% for 2020:Q2 and 1.5% for 2020:Q3. [June 26 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -39.5 percent on June 26, up from -46.6 percent on June 25. [June 26 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 6/26/2020 09:49:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight: Forbearances Rise After Three Weeks of Declines

The latest data from the McDash Flash Forbearance Tracker shows that the number of homeowners in active forbearance rose this week after three consecutive weeks of declines.

Overall, the number of active forbearance plans is up 79K from last week – erasing roughly half of the improvement seen since the peak of May 22 – with rises seen over each of the past five business days.

Click on graph for larger image.

As of June 23, 4.68 million homeowners are in forbearance plans, representing 8.8% of all active mortgages, up from 8.7% last week. Together, they represent just over $1 trillion in unpaid principal ($1,025B).

emphasis added

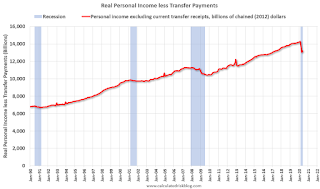

Real Personal Income less Transfer Payments

by Calculated Risk on 6/26/2020 08:56:00 AM

NOTE: All of these numbers are on a seasonally adjusted annual rate basis (SAAR).

In the Personal Income & Outlays report for May, the BEA noted that "Personal income decreased $874.2 billion (4.2 percent) in May". This decrease in Personal Income was due to a large decrease in transfer payments.

Transfer payments decreased by $1.1 trillion in May (SAAR), after increasing $3 trillion in April (SAAR).

Unemployment insurance increased from $70 billion in March (SAAR), to $430 billion in April (SAAR), to $1.28 trillion in May (SAAR).

And "Other" (mostly the CARES Act one time payments) decreased by $2 trillion in May (SAAR).

Without the decrease in transfer payments, Personal Income in April would have increased about 1.5%.

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

This graph shows real personal income less transfer payments since 1990.

This measure of economic activity decreased 2.9% in March, compared to February, and another 6.1% in April (compared to March).

This measure increased 1.5% in May compared to April, but is still down 7.5% compared to February (pre-recession).

Personal Income decreased 4.2% in May, Spending increased 8.2%

by Calculated Risk on 6/26/2020 08:36:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income decreased $874.2 billion (4.2 percent) in May according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $911.1 billion (4.9 percent) and personal consumption expenditures (PCE) increased $994.5 billion (8.2 percent).The May PCE price index increased 0.5 percent year-over-year and the May PCE price index, excluding food and energy, increased 1.0 percent year-over-year.

Real DPI decreased 5.0 percent in May and Real PCE increased 8.1 percent (tables 5 and 7). The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through May 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The decrease in personal income was less than expected, and the increase in PCE was below expectations.

Note that core PCE inflation was below expectations.