by Calculated Risk on 6/26/2020 11:37:00 AM

Friday, June 26, 2020

Freddie Mac: Mortgage Serious Delinquency Rate increased in May, Highest in 2 Years

Freddie Mac reported that the Single-Family serious delinquency rate in May was 0.81%, up from 0.64% in April. Freddie's rate is down from 0.63% in May 2019.

This is the highest serious delinquency rate since June 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

With COVID-19, this rate will increase significantly in June and July (it takes time since these are mortgages three months or more past due).

I believe mortgages in forbearance will be counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Fannie Mae will report for May soon.

Q2 GDP Forecasts: Probably Around 33% Annual Rate Decline

by Calculated Risk on 6/26/2020 11:23:00 AM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 33% Q2 decline is around 9% decline from Q1 (SA).

Note: I'm just trying to make it clear the economy didn't decline by one-third in Q2. Previously I just divided by 4 (an approximation) to show the quarter to quarter decline. The actually formula is (1-.36) ^ .25 - 1 = -0.095 (a 9.5% decline from Q1)

From Merrill Lynch:

2Q GDP tracking fell to -36% qoq saar from -35% following weak trade and inventory data. [June 26 estimate]From Goldman Sachs:

emphasis added

We left our Q2 GDP forecast unchanged at -33% (qoq ar). We continue to expect -27% in the initial vintage of the report, reflecting incomplete source data and non-response bias. [June 23 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at -16.3% for 2020:Q2 and 1.5% for 2020:Q3. [June 26 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -39.5 percent on June 26, up from -46.6 percent on June 25. [June 26 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 6/26/2020 09:49:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight: Forbearances Rise After Three Weeks of Declines

The latest data from the McDash Flash Forbearance Tracker shows that the number of homeowners in active forbearance rose this week after three consecutive weeks of declines.

Overall, the number of active forbearance plans is up 79K from last week – erasing roughly half of the improvement seen since the peak of May 22 – with rises seen over each of the past five business days.

Click on graph for larger image.

As of June 23, 4.68 million homeowners are in forbearance plans, representing 8.8% of all active mortgages, up from 8.7% last week. Together, they represent just over $1 trillion in unpaid principal ($1,025B).

emphasis added

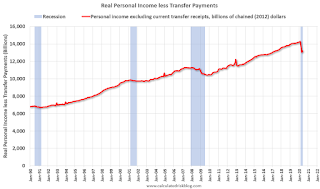

Real Personal Income less Transfer Payments

by Calculated Risk on 6/26/2020 08:56:00 AM

NOTE: All of these numbers are on a seasonally adjusted annual rate basis (SAAR).

In the Personal Income & Outlays report for May, the BEA noted that "Personal income decreased $874.2 billion (4.2 percent) in May". This decrease in Personal Income was due to a large decrease in transfer payments.

Transfer payments decreased by $1.1 trillion in May (SAAR), after increasing $3 trillion in April (SAAR).

Unemployment insurance increased from $70 billion in March (SAAR), to $430 billion in April (SAAR), to $1.28 trillion in May (SAAR).

And "Other" (mostly the CARES Act one time payments) decreased by $2 trillion in May (SAAR).

Without the decrease in transfer payments, Personal Income in April would have increased about 1.5%.

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

This graph shows real personal income less transfer payments since 1990.

This measure of economic activity decreased 2.9% in March, compared to February, and another 6.1% in April (compared to March).

This measure increased 1.5% in May compared to April, but is still down 7.5% compared to February (pre-recession).

Personal Income decreased 4.2% in May, Spending increased 8.2%

by Calculated Risk on 6/26/2020 08:36:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income decreased $874.2 billion (4.2 percent) in May according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $911.1 billion (4.9 percent) and personal consumption expenditures (PCE) increased $994.5 billion (8.2 percent).The May PCE price index increased 0.5 percent year-over-year and the May PCE price index, excluding food and energy, increased 1.0 percent year-over-year.

Real DPI decreased 5.0 percent in May and Real PCE increased 8.1 percent (tables 5 and 7). The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through May 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The decrease in personal income was less than expected, and the increase in PCE was below expectations.

Note that core PCE inflation was below expectations.

Thursday, June 25, 2020

Friday: Personal Income & Outlays

by Calculated Risk on 6/25/2020 08:56:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays, May 2020. The consensus is for a 6.0% decrease in personal income, and for a 9.0% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 78.9.

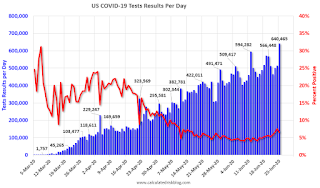

June 25 COVID-19 Test Results, Highest Daily Positive Cases Ever

by Calculated Risk on 6/25/2020 05:46:00 PM

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 640,465 test results reported over the last 24 hours. This is the most daily results reported (may be a data dump).

There were 41,939 positive tests. This is the most positive tests ever.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Economic Outlook: The Gathering Storm

by Calculated Risk on 6/25/2020 02:15:00 PM

On March 31st, I wrote:

This is a healthcare crisis, and the economic outlook is based on presumptions about the course of the pandemic.I've been updating my outlook monthly, and turning more and more pessimistic due to the poor US government response to the pandemic.

The Federal government's response has not been helpful, and in many ways, it has been counterproductive. The Vice President of the US, Mike Pence, wrote just last week in the WSJ: There Isn’t a Coronavirus ‘Second Wave’. The data has already proven Pence wrong.

Fortunately, some state and local governments have stepped up to fill the void, but in other localities, the response has been terrible. And it is possible the pandemic will get worse in the Fall.

Some countries have been able to open their economies without an increase in infections. For example, in Japan, the economy is mostly open, however 1) everyone wears a mask, 2) there is robust contact tracing, and 3) everyone is urged to follow the 3 C's (avoid Closed spaces, Crowded places, and Close-Contact settings). However, in the US, contact tracing is still ramping up, many people aren't wearing a mask or face covering, and many people are not following the 3Cs.

However, there is no leadership in the US to significantly change people's behavior.

It doesn't take an official lockdown to push local economies back into recession - many people will pull back as the number of cases and hospitalizations rise. Based on recent hospitalization data, I expect further layoffs in some states like Arizona, Texas, and Florida.

I do expect another round of disaster relief in July - extending the extra unemployment benefits (perhaps at a lower level), extending the PPP, and providing relief to the States. Without this disaster relief, the entire US economy might slide back into recession in August.

But even with another round of disaster relief, it seems likely the recovery will stall unless progress is made in slowing the spread of the virus. The longer the widespread pandemic continues, the more structural damage to the economy. And the more severe the economic damage, the longer it will take to recover from the pandemic.

Everyone is hoping for a vaccine in late 2020 or early 2021, but even if there is a vaccine, the damage to the economy will be extensive if we don't lower the infection rate significantly in the near term.

Perhaps there will be a sudden change in behavior while we wait for a vaccine - or some other breakthrough that will slow the spread of the virus - but I'm not sanguine.

After a decade of making fun of bearish analysts and writing "the future is bright", it pains me to be pessimistic. I hope I'm wrong on the virus, but if I'm correct, then I expect every major economic forecast will be revised down for the 2nd half of 2020 and for early 2021.

Kansas City Fed: "Tenth District Manufacturing Activity Grew Slightly " in June

by Calculated Risk on 6/25/2020 11:09:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Grew Slightly

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity grew slightly after sharply decreasing for three straight months. Activity still remained well below year-ago levels, while expectations for future activity rebounded moderately.This suggests activity has bottomed, but this is just a slight increase off the bottom. Three-fourth of the companies surveyed are using the PPP - and that suggests further layoffs coming if activity doesn't rebound.

“Regional factory activity expanded just slightly in June compared with a month ago, but was still well below year-ago levels,” said Wilkerson. “Of those surveyed, 76% of firms have taken advantage of emergency lending options, and expectations for future activity and employment levels have improved somewhat.”

…

The month-over-month composite index was 1 in June, up considerably from -19 in May and a record low of 30 in April. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The improvement in activity was driven by nondurable goods plants, while durable goods factories, especially nonmetallic mineral products, primary metals, fabricated metals, and computer and electronics plants continued to decline. Month-over-month indexes were mixed. Production, shipments, new orders, and supplier delivery time indexes recovered to positive levels, while indexes for order backlog, employment, new orders for exports, and inventories remained negative. Year over-year factory indexes mostly remained highly negative in June, but the composite index moved up slightly from -35 to -29. The future composite index rose considerably in June, rebounding from -2 to 9.

…

76% of factory contacts had applied for the Small Business Administration (SBA) Paycheck Protection Program since March 13, 2020 (up from 67% reported in April)

emphasis added

Hotels: Occupancy Rate Declined 41.8% Year-over-year

by Calculated Risk on 6/25/2020 10:15:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 20 June

U.S. hotel performance data for the week ending 20 June showed another small rise from previous weeks and less severe year-over-year declines, according to STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

14-20 June 2020 (percentage change from comparable week in 2019):

• Occupancy: 43.9% (-41.8%)

• Average daily rate (ADR): US$92.20 (-31.7%)

• Revenue per available room (RevPAR): US$40.48 (-60.3%)

“Occupancy was up another couple percentage points from last week, marking the 10th consecutive week of such an increase,” said Jan Freitag, STR’s senior VP of lodging insights. “Demand continues to be pushed upward by drive-to spots and the destinations with outdoor offerings such as beaches. For the week, 10 submarkets showed occupancy above 70%, led by Panama City (88.7%), where occupancy was just 0.7% lower than the comparable week in 2019.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Usually hotel occupancy starts to pick up seasonally in early June. So even though the occupancy rate was up slightly compared to last week, the year-over-year decline only slightly improved this week compared to the previous three weeks (41.8% decline vs 43.4% last week, 45.3% two weeks ago, and 43.2% decline three weeks ago).

The improvement appears related mostly to leisure travel as opposed to business travel.

Note: Y-axis doesn't start at zero to better show the seasonal change.