by Calculated Risk on 6/22/2020 08:35:00 AM

Monday, June 22, 2020

Six High Frequency Indicators for a Recovery

These indicators are mostly for travel and entertainment - some of the sectors that will probably recover very slowly.

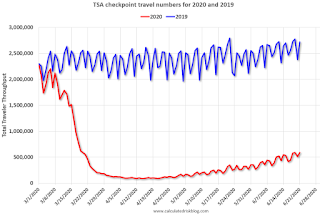

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On June 21st there were 590,456 travelers compared to 2,719,643 a year ago.

That is a decline of 78.3%. There has been a slow steady increase from the bottom, but air travel is still down significantly.

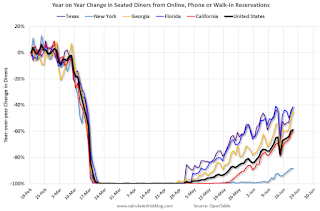

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through June 20, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market".

New York is still off 88%.

Florida is only down 41% YoY.

Note that the data is noisy and depends on when blockbusters are released.

Movie ticket sales have picked up a little, but are still under $1 million per week (compared to usually around $300 million per week), and ticket sales have essentially been at zero for three months.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

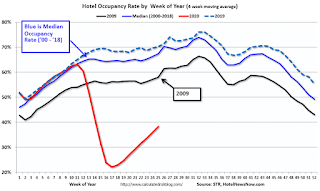

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Usually hotel occupancy starts to pick up seasonally in early June. So even though the occupancy rate was up slightly compared to last week, the year-over-year decline was about the same this week as the previous two weeks (43.4% decline vs. 45.3% last week, and 43.2% decline two weeks ago).

At one point, gasoline consumption was off almost 50% YoY.

As of June 12th, gasoline consumption was off about 21% YoY (about 79% of normal). After rebounding from the low in early April, gasoline consumption has remained down about 20% YoY since early May.

The final graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the US is still only about 46% of the January level. It is at 33% in New York, and 61% in Houston.

Chicago Fed National Activity "Suggests Economic Growth Increased Substantially in May"

by Calculated Risk on 6/22/2020 08:34:00 AM

From the Chicago Fed: Index Suggests Economic Growth Increased Substantially in May

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +2.61 in May from –17.89 in April. All four broad categories of indicators used to construct the index made positive contributions in May, and all four categories increased from April. The index’s three-month moving average, CFNAI-MA3, moved up to –6.65 in May from –7.50 in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was in a recession starting in March (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, June 21, 2020

Monday: Existing Home Sales

by Calculated Risk on 6/21/2020 06:54:00 PM

Weekend:

• Schedule for Week of June 21, 2020

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, down from 4.33 million. Housing economist Tom Lawler expects the NAR to report sales of 3.8 million SAAR for May.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 38 and DOW futures are down 325 (fair value).

Oil prices were up over the last week with WTI futures at $39.41 per barrel and Brent at $42.13 barrel. A year ago, WTI was at $57, and Brent was at $66 - so WTI oil prices are down about 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.13 per gallon. A year ago prices were at $2.66 per gallon, so gasoline prices are down $0.53 per gallon year-over-year.

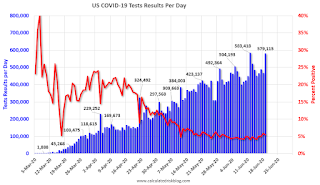

June 21 COVID-19 Test Results

by Calculated Risk on 6/21/2020 05:59:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 518,347 test results reported over the last 24 hours.

There were 27,465 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.3% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Saturday, June 20, 2020

June 20 COVID-19 Test Results; Most Positive Results Since May 1st

by Calculated Risk on 6/20/2020 05:38:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 500,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 583,940 test results reported over the last 24 hours. This was a new daily high for test results.

There were 32,325 positive tests, the most since May 1st, and the second consecutive day over 30,000.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 6/20/2020 11:14:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 10 years. And he has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

The NAR is scheduled to release Existing Home Sales for May at 10:00 AM, Monday, June 22nd.

The consensus is for 4.10 million SAAR in May, down from 4.33 million in April. Tom Lawler estimates the NAR will report sales of 3.8 million SAAR and that inventory will be down about 20% year-over-year. Based on Lawler's estimate, I expect existing home sales to be below the consensus in May.

The consensus was 4.38 million SAAR for May, but moved down sharply after Lawler released his projections. This happens frequently - analysts change their outlook based on Lawler's projections.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last 10 years, the consensus average miss was 140 thousand, and Lawler's average miss was 69 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.10 | 3.80 | NA |

| 1NAR initially reported before revisions. | |||

Schedule for Week of June 21, 2020

by Calculated Risk on 6/20/2020 08:11:00 AM

The key reports this week are the third estimate of Q1 GDP, May New and Existing Home Sales, and Personal Income and Outlays for May.

For manufacturing, the June Richmond and Kansas City Fed manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

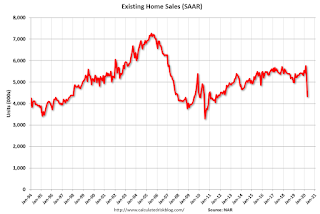

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, down from 4.33 million.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, down from 4.33 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 3.8 million SAAR for May.

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 640 thousand SAAR, up from 623 thousand in April.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for April 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 1.300 million initial claims, down from 1.508 million the previous week.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 10.6% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 1st quarter 2020 (Third estimate). The consensus is that real GDP decreased 5.0% annualized in Q1, unchanged from the second estimate of a 5.0% decrease.

11:00 AM: the Kansas City Fed manufacturing survey for June. This is the last of regional manufacturing surveys for June.

8:30 AM ET: Personal Income and Outlays, May 2020. The consensus is for a 6.0% decrease in personal income, and for a 9.0% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 78.9.

Friday, June 19, 2020

June 19 COVID-19 Test Results; Most Positive Results Since May 1st

by Calculated Risk on 6/19/2020 05:55:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 579,115 test results reported over the last 24 hours. There were 31,777 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Sacramento Housing in May: Sales decline 37% YoY, Active Inventory down 23% YoY

by Calculated Risk on 6/19/2020 01:35:00 PM

Note that May sales are for contracts typically signed in March and April - when the economy was shutdown - so the report for May is pretty weak. Sales will pick up in the June / July reports.

From SacRealtor.org: May 2020 Statistics – Sacramento Housing Market – Single Family Homes

May closed with 1,032 sales, up 1.9% from the 1,013 sales in April. Compared to one year ago (1,630), the current figure is a 36.7% drop.1) Overall sales decreased to 1,032 in May, down 36.7% from 1,630 in May 2019. Sales were up 1.9% from April 2020 (previous month).

...

The Active Listing Inventory decreased 2.6% from April to May, from 1,823 units to 1,775 units. Compared with May 2019 (2,314), inventory is down 23.3%. The Months of Inventory decreased from 1.8 Months to 1.7 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory

...

The Median DOM (days on market) increased from 7 to 9 and the Average DOM decreased from 16 to 19. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,775, down from 2,314 in May 2019. That is down 23.3% year-over-year. This is the thirteenth consecutive month with a YoY decline in inventory.

Q2 GDP Forecasts: Probably Around 33% Annual Rate Decline

by Calculated Risk on 6/19/2020 11:20:00 AM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 33% Q2 decline is around 8% decline from Q1 (SA).

From Merrill Lynch:

We revise up 2Q GDP to -35% qoq saar from -40% and 3Q to 20% from 7%, given the faster and more successful reopening. [June 18 estimate]From Goldman Sachs:

emphasis added

We have adjusted our real GDP growth forecasts and now expect -33% in Q2, +33% in Q3, and +8% in Q4 (vs. -36%, +29%, and +11% previously) in qoq annualized terms. [June 18 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at -19.0% for 2020:Q2 and -1.9% for 2020:Q3. [June 19 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -45.5 percent on June 17, down from -45.4 percent on June 16. [June 17 estimate]