by Calculated Risk on 6/17/2020 03:10:00 PM

Wednesday, June 17, 2020

Quarterly Starts by Purpose and Design

Along with the monthly housing starts for May today, the Census Bureau released Quarterly Starts by Purpose and Design through Q1 2020.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale (red) were up 13.1% in Q1 2020 compared to Q1 2019.

Owner built starts (orange) were up 10.3% year-over-year.

Condos built for sale increased, but are still pretty low.

The 'units built for rent' (blue) and were up 48.1% in Q1 2020 compared to Q1 2019.

Phoenix Real Estate in May: Sales down 34% YoY, Active Inventory Down 30% YoY

by Calculated Risk on 6/17/2020 12:59:00 PM

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales were at 6,860 in May, down from 6,925 in April, and down from 10,341 in May 2019. Sales were down 0.9% from April 2020 (last month), and down 33.7% from May 2019.

2) Active inventory was at 11,418, down from 16,260 in May 2019. That is down 29.8% year-over-year.

3) Months of supply decreased to 2.46 in May from 2.59 in April. This remains low.

Sales are reported at the close of escrow, so these sales were mostly signed in March and April. Sales for May were negatively impacted by COVID since few contracts were likely signed in April, although it seems likely sales will rebound in June and/or July.

Comments on May Housing Starts

by Calculated Risk on 6/17/2020 10:13:00 AM

Although housing starts declined significantly in April - and remained fairly low in May - residential construction is considered essential, and starts did not decline as sharply as some other sectors.

Based on builder reports, and recent housing activity, I expect a significant increase in single family starts over the next couple of months.

Earlier: Housing Starts increased to 974 Thousand Annual Rate in May

Total housing starts in May were well below expectations, and revisions to prior months were negative (combined).

The housing starts report showed starts were up 4.3% in May compared to April, and starts were down 23.2% year-over-year compared to May 2019.

Single family starts were down 17.8% year-over-year, and multi-family starts were down 33.1% YoY.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were down 23.2% in May compared to May 2019.

Last year, in 2019, starts picked up in the 2nd half of the year, so the comparisons are easy early in the year.

Starts, year-to-date, are only down 2.4% compared to the same period in 2019.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - then mostly moved sideways. Completions (red line) had lagged behind - then completions caught up with starts- although starts picked up a little again lately.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions once the crisis abates.

Housing Starts increased to 974 Thousand Annual Rate in May

by Calculated Risk on 6/17/2020 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 974,000. This is 4.3 percent above the revised April estimate of 934,000, but is 23.2 percent below the May 2019 rate of 1,268,000. Single-family housing starts in May were at a rate of 675,000; this is 0.1 percent above the revised April figure of 674,000. The May rate for units in buildings with five units or more was 291,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,220,000. This is 14.4 percent above the revised April rate of 1,066,000, but is 8.8 percent below the May 2019 rate of 1,338,000. Single-family authorizations in May were at a rate of 745,000; this is 11.9 percent above the revised April figure of 666,000. Authorizations of units in buildings with five units or more were at a rate of 434,000 in May.

emphasis added

Click on graph for larger image.

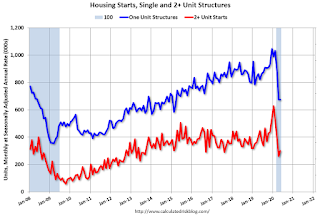

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in May compared to April. Multi-family starts were down 33.1% year-over-year in May.

Single-family starts (blue) increased slightly in May, and were down 17.8% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in May were well below expectations, and starts in April were revised down.

Residential construction is considered an essential business, and held up better than some other sectors of the economy, but was still negatively impacted by COVID-19.

I'll have more later …

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 6/17/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 8.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 12, 2020.

... The Refinance Index increased 10 percent from the previous week and was 106 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 21 percent higher than the same week one year ago.

...

“Purchase applications increased to the highest level in over 11 years and for the ninth consecutive week. The housing market continues to experience the release of unrealized pent-up demand from earlier this spring, as well as a gradual improvement in consumer confidence,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Mortgage rates dropped to another record low in MBA’s survey, leading to a 10 percent surge in refinance applications. Refinancing continues to support households’ finances, as homeowners who refinance are able to gain savings on their monthly mortgage payments in a still-uncertain period of the economic recovery.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.30 percent from 3.38 percent, the lowest level in survey history, with points decreasing to 0.29 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

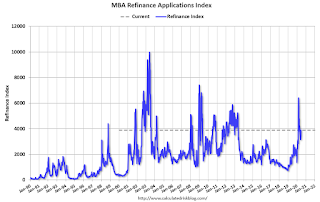

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is up signficantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 21% year-over-year. This index is at the highest level in over 11 years.

Note: Red is a four-week average (blue is weekly).

Tuesday, June 16, 2020

Wednesday: Housing Starts, Fed Chair Powell Testimony

by Calculated Risk on 6/16/2020 09:10:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for May. The consensus is for 1.100 million SAAR, up from 0.891 million SAAR in April.

• At 12:00 PM, Testimony, Fed Chair Jerome Powell, Monetary Policy Report submitted to the Congress on June 12, 2020, pursuant to section 2B of the Federal Reserve Act, Before the Committee on Financial Services, U.S. House of Representatives

June 16 COVID-19 Test Results

by Calculated Risk on 6/16/2020 06:03:00 PM

I wish we had more data. For example, it would be nice to know the reason for the tests - for example, was the testing because of symptoms? Or close contact with an infected person? Or a regular test for a healthcare worker? Or precautionary for elective surgery? Etc. It would be great to know the number of people tested as opposed to the number of tests. But we are lucky to have this data (thanks to the hard work of the volunteers at the COVID Tracking Project

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 464,715 test results reported over the last 24 hours. There were 23,498 positive tests.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.1% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Me on NPR The Indicator from Planet Money about High Frequency Indicators

by Calculated Risk on 6/16/2020 01:19:00 PM

Cardiff Garcia interviewed me yesterday at NPR The Indicator from Planet Money: High-Frequency Indicators. (with Cardiff and Stacey) Thanks to Cardiff for having me on!

Here are the high frequency indicators we discussed (with graphs)

NMHC: Rent Payment Tracker Finds 89 Percent Paid Rent as of June 13th, Same Pace as last year!

by Calculated Risk on 6/16/2020 11:34:00 AM

From the NMHC: NMHC Rent Payment Tracker Finds 89 Percent of Apartment Households Paid Rent as of June 13

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 89.0 percent of apartment households made a full or partial rent payment by June 13 in its survey of 11.4 million units of professionally managed apartment units across the country.CR Note: It appears most people are still paying their rent. This was a higher percentage than in May (at the same point in the month), and actually up 0.1 percentage points from the same date a year ago.

This is a 0.1-percentage point increase from the share who paid rent through June 13, 2019 and compares to 87.7 percent that had paid by May 13, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“Once again, it appears that residents of professionally managed apartments were able to largely pay their rent,” said Doug Bibby, NMHC President. “However, there is a growing realization that renters outside of this universe are experiencing profound hardships as the nation continues to grapple with historic unemployment and economic dislocation.

“In the midst of a pandemic and a recession, it is critical that those on the front lines are safely and securely housed. Accordingly, we urge lawmakers to take swift action to create a Rental Assistance Fund and extend unemployment benefits so we can avoid future eviction-related problems and don’t undermine the initial recovery.”

emphasis added

Several disaster relief programs have clearly helped renters pay their bills, such as the extra $600 per week in unemployment insurance, the PPP, and the Pandemic Unemployment Assistance (PUA). The PPP has been modified, but will need to be extended. And the $600 per week in extra benefits ends at the end of July (and will need to be extended, perhaps at a lower rate).

The PUA program with 9.7 million participants (mostly self-employed), expires at the end of 2020, but these individuals have also being receiving the extra $600 per week that expires in July.

NAHB: Builder Confidence Increased to 58 in June

by Calculated Risk on 6/16/2020 10:07:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 58, up from 37 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Surges in June

In a sign that housing stands poised to lead a post-pandemic economic recovery, builder confidence in the market for newly-built single-family homes jumped 21 points to 58 in June, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Any reading above 50 indicates a positive market.

...

All the HMI indices posted gains in June. The HMI index gauging current sales conditions jumped 21 points to 63, the component measuring sales expectations in the next six months surged 22 points to 68 and the measure charting traffic of prospective buyers vaulted 22 points to 43.

Looking at the monthly average regional HMI scores, the Northeast surged 31 point to 48, the South jumped 20 points to 62, the Midwest posted a 19-point gain to 51 and the West catapulted 22 points to 66.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.