by Calculated Risk on 6/12/2020 09:30:00 AM

Friday, June 12, 2020

Mortgage Equity Withdrawal Flat in Q1

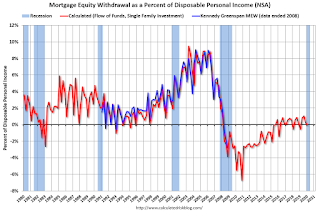

Note 1: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

Note 2: There have been reports showing an increase in cash out refinances, but it isn't showing up significantly in the Fed's Flow of Funds report.

The following data is calculated from the Fed's Flow of Funds data (released today) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q1 2020, the Net Equity Extraction was -$1 billion, or a -0.03% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been mostly positive for the last four years.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $59 billion in Q1.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Declines Slightly for the second consecutive week

by Calculated Risk on 6/12/2020 08:27:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

From Black Knight:

The number of homeowners in active forbearance on their mortgages fell for the second consecutive week. Overall, the number of active forbearance plans is down 77K from last week, and 112K from the peak the week of May 22.

Click on graph for larger image.

As of June 9, 4.66 million homeowners remain in forbearance plans, representing 8.8% of all active mortgages, down from 8.9% last week. Together, the 4.66M represent just over $1 trillion in unpaid principal ($1,028B). Some 7% of all GSE-backed loans and 12.2% of all FHA/VA loans are currently in forbearance plans. GSE loans saw the greatest reduction, with forbearances falling by 47K week-over-week, but decreases were seen across all investor classes – as compared to last week, which saw a decline among government-backed mortgages partially offset by a rise in portfolio and PLS mortgages.

emphasis added

Thursday, June 11, 2020

June 11 COVID-19 Test Results

by Calculated Risk on 6/11/2020 05:52:00 PM

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now usually conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 420,248 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 4.9% (red line).

For the status of contact tracing by state, check out testandtrace.com.

Houston Real Estate in May: Sales Down 20.7% YoY, Inventory Down 8.3% YoY

by Calculated Risk on 6/11/2020 01:52:00 PM

From the HAR: Coronavirus and Ailing Energy Industry Continue to Impact Houston Real Estate

Houston home sales fell for a second straight month in May as the impact of COVID-19 and related stay-at-home orders continued to play out throughout the market. Growing consumer interest in in-person open houses and property showings, as well as an increase in offers to purchase, demonstrated improving market conditions. The slumping energy industry limited buyers in the luxury home market, which affected the overall average price of single-family homes across the region. Predicting the future of the market remains a challenge, and just this week, the National Bureau of Economic Research declared that the United States has been in a deep recession since February. ...Inventory declined 8.3% year-over-year from 43,096 in May 2019 to 39,516 in May 2020.

According to the latest monthly Market Update from the Houston Association of Realtors (HAR), 6,671 single-family homes sold in May compared to 8,359 a year earlier. That translated to a 20.2 percent decline – the second consecutive monthly decline since the pandemic struck the market. ... Sales of all property types totaled 7,917, down 20.7 percent from May 2019. Total dollar volume for the month fell 25.9 percent to slightly more than $2.2 billion.

“May delivered another mixed bag of data for the Houston housing market given the ongoing coronavirus pandemic on top of strains in the oil patch and the broader recession,” said HAR Chairman John Nugent with RE/MAX Space Center. “We will eventually work our way through these challenges, and already see positive indicators in the form of strong rental activity, solid pending sales numbers and steady attendance at property showings across greater Houston. Historically low interest rates still make conditions appealing to would-be buyers.”

emphasis added

Sales in Houston set a record in 2019 and were off to a strong start in 2020. However the impact of COVID-19 (and lower oil prices) has been significant. Note that the closed sales in May were for contracts that were mostly signed in March and April - so a large decline was expected.

Fed's Flow of Funds: Household Net Worth Decreased $7.4 Trillion in Q1

by Calculated Risk on 6/11/2020 01:24:00 PM

The Federal Reserve released the Q1 2020 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits fell to $110.8 trillion during the first quarter of 2020. The value of directly and indirectly held corporate equities decreased $7.8 trillion and the value of real estate increased $0.4 trillion.

Household debt increased 3.9 percent at an annual rate in the first quarter of 2020. Consumer credit grew at an annual rate of 1.6 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 3.2 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Even with the decline in stock prices in March, household net worth, as a percent of GDP, was higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

Net Worth as a percent of GDP decreased in Q1.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

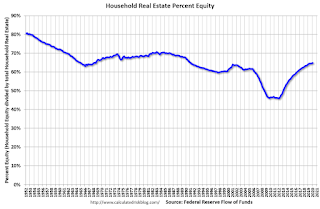

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2020, household percent equity (of household real estate) was at 64.8% - up from Q4.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have less than 64.8% equity - and about 1.82 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $59 billion in Q1.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 49.1% - up from Q4 due to the decline in GDP - but down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, increased in Q1, and is above the average of the last 30 years (excluding bubble).

Hotels: Occupancy Rate Declined 45.3% Year-over-year, Eighth Consecutive Week of Slightly Higher Demand

by Calculated Risk on 6/11/2020 10:54:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 6 June

STR data ending with 6 June showed another small rise from previous weeks in U.S. hotel performance. Year-over-year declines remained significant although not as severe as the levels recorded previously.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

31 May through 6 June 2020 (percentage change from comparable week in 2019):

• Occupancy: 39.3% (-45.3%)

• Average daily rate (ADR): US$85.01 (-35.9%)

• Revenue per available room (RevPAR): US$33.43 (-65.0%)

“Not much different from previous weeks, occupancy continued to climb toward the 40% mark with noticeably higher levels on Friday and Saturday,” said Jan Freitag, STR’s senior VP of lodging insights. “The lower end of the market continued to lead, with economy properties finally selling more than half of their rooms again, although all hotel classes were comfortably above 20%. Drilling down to the submarket level, the highest occupancy levels were recorded in various pockets of New York City as well as popular leisure spots in Florida, Texas and South Carolina. Thanks to higher demand, one submarket, West Palm Beach, showed a 21.0% year-over-year ADR increase for the entire week.

“Once again, there wasn’t a significant week-to-week change in the markets that were the focus of protests and unrest. Like we noted last week, there was not a great deal of demand in downtown areas previously, and most of the major metros showed small gains from the previous week.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Usually hotel occupancy starts to pick up seasonally in early June. So even though the occupancy rate was up slightly compared to last week, the year-over-year decline was actually worse this week than last week (45.3% decline vs. 43.2% decline last week).

Note: Y-axis doesn't start at zero to better show the seasonal change.

CoreLogic: 1.8 Million Homes with Negative Equity in Q1 2020

by Calculated Risk on 6/11/2020 09:27:00 AM

From CoreLogic: CoreLogic Reports Borrowers Gained Over $6 Trillion in Home Equity Since the End of The Great Recession

CoreLogic® ... today released the Home Equity Report for the first quarter of 2020. The report shows U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 6.5% year over year, representing a gain of $590 billion since the first quarter of 2019.

In the latter half of the first quarter of 2020, the coronavirus (COVID-19) began to spread across the country, with immediate economic impact not fully realized until the end of March. As the pandemic continued to unfold and shelter-in-place orders were extended, unemployment reached double digits within a few short weeks and left many homeowners scrambling to cover mortgage payments. However, home prices continued to rise, which added to borrower equity through March.

Negative equity, also referred to as underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. From the fourth quarter of 2019 to the first quarter of 2020, the total number of mortgaged homes in negative equity decreased by 3.1% to 1.8 million homes or 3.4% of all mortgaged properties. The number of mortgaged properties in negative equity in the first quarter of 2020 fell by 16%, compared to the first quarter of 2019, when 2.2 million homes, or 4.1% of all mortgaged properties, were in negative equity. Because home equity is affected by home price changes, the number of borrowers with equity positions near (+/-5%) the negative equity cutoff is most likely to move out of or into negative equity as prices change. Looking at the first quarter of 2020 book of mortgages, if home prices increase by 5%, 310,000 homes would regain equity, and if home prices decline by 5%, 420,000 would fall underwater.

...

“The pandemic recession will likely lead to price declines in many areas during the next year and weaken home equity gains,” said Dr. Frank Nothaft, chief economist for CoreLogic. “However, price declines will be far less than those experienced during the Great Recession, when the national CoreLogic Home Price Index fell 33% peak-to-trough. Our latest forecast shows the national index to have a peak-to-trough decline of 1.5%.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q1 to Q4 2019 equity distribution by LTV. There are still quite a few properties with LTV over 125%.

Most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 2.2 million to 1.8 million.

Weekly Initial Unemployment Claims decrease to 1,542,000

by Calculated Risk on 6/11/2020 08:37:00 AM

The DOL reported:

In the week ending June 6, the advance figure for seasonally adjusted initial claims was 1,542,000, a decrease of 355,000 from the previous week's revised level. The previous week's level was revised up by 20,000 from 1,877,000 to 1,897,000. The 4-week moving average was 2,002,000, a decrease of 286,250 from the previous week's revised average. The previous week's average was revised up by 4,250 from 2,284,000 to 2,288,250.The previous week was revised up.

emphasis added

This does not include the 623,073 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 2,002,000.

This was higher than the consensus forecast of 1.2 million initial claims.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already decreased to 20,929,000 (SA) from 21,268,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 9,715,948 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, June 10, 2020

Thursday: Unemployment Claims, PPI, Q1 Flow of Funds

by Calculated Risk on 6/10/2020 08:41:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 1.200 million initial claims, down from 1.877 million the previous week.

• At 8:30 AM, The Producer Price Index for May from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.1% decrease in core PPI.

• At 12:00 PM, Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

June 10 COVID-19 Test Results:

by Calculated Risk on 6/10/2020 05:38:00 PM

Note: Widespread mask-wearing could prevent COVID-19 second waves: study

Note: I started posting this graph when the US was doing a few thousand tests per day. Clearly the US was way under testing early in the pandemic. I'll continue posting this graph daily at least until the percent positive is continuously under 3% and the daily positive is significantly lower than today.

The US is now usually conducting over 400,000 tests per day, and that might be enough to allow test-and-trace in some areas. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly.

According to Dr. Jha of Harvard's Global Health Institute, the US might need more than 900,000 tests per day .

There were 419,637 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.0% (red line).

For the status of contact tracing by state, check out testandtrace.com.