by Calculated Risk on 5/11/2020 08:21:00 AM

Monday, May 11, 2020

Four High Frequency Indicators for the Eventual Recovery

These indicators are for travel and entertainment - some of the sectors that will probably recover very slowly.

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On May 10th there were 200,815 travelers compared to 2,419,114 a year ago.

That is a decline of over 91.7%. There has been some increase off the bottom, but it is pretty small compared to the normal level of travel.

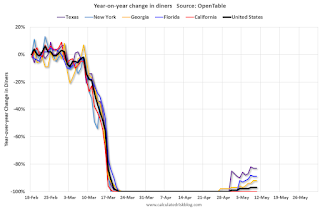

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through May 10, 2020.

The US was off 100% YoY as of March 21st.

California and New York are still off 100%.

Some states - like Texas and Georgia - have started to open up. In Texas, diner traffic was only down 83% YoY.

Note that the data is noisy and depends on when blockbusters are released.

Movie ticket sales have been essentially at zero for seven weeks.

Basically movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

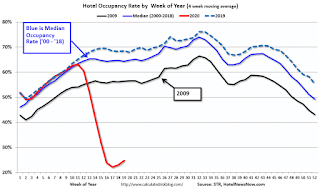

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

STR reported hotel occupancy was off 58.5% year-over-year last week. Occupancy has increased slightly over the last few of weeks.

Sunday, May 10, 2020

Sunday Night Futures

by Calculated Risk on 5/10/2020 07:20:00 PM

Weekend:

• Schedule for Week of May 10, 2020

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 5 and DOW futures are up 50 (fair value).

Oil prices were up over the last week with WTI futures at $24.52 per barrel and Brent at $30.67 barrel. A year ago, WTI was at $62, and Brent was at $72 - so WTI oil prices are down about 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.84 per gallon. A year ago prices were at $2.86 per gallon, so gasoline prices are down $1.02 per gallon year-over-year.

May 10 Update: US COVID-19 Test Results

by Calculated Risk on 5/10/2020 05:32:00 PM

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

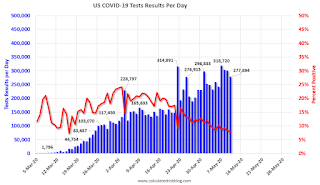

There were 277,897 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.8% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Employment: April Diffusion Indexes Decline to Record Lows

by Calculated Risk on 5/10/2020 11:34:00 AM

The BLS diffusion index for total private employment was at a record low 4.8 in April, down from 28.5 in March.

For manufacturing, the diffusion index was at a record low 2.6, down from 26.3 in March.

Think of this as a measure of how widespread job gains or losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Click on graph for larger image.

Click on graph for larger image.Both indexes generally trended down in 2019 indicating job growth was becoming less widespread across industries (especially manufacturing).

Then both indexes declined sharply in March 2020, and collapsed to new record lows in April, due to the impact from COVID-19.

Saturday, May 09, 2020

May 9 Update: US COVID-19 Test Results: Third Consecutive Day Over 300K

by Calculated Risk on 5/09/2020 04:51:00 PM

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 300,842 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.4% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Recession Measures and NBER

by Calculated Risk on 5/09/2020 12:58:00 PM

Calling the beginning or end of a recession takes time. The National Bureau of Economic Research (NBER) waits until the data is revised, and if the recovery is sluggish, this process can take from 18 months to two years or longer.

In addition, if the economy slides into recession again, the committee will only consider it a new recession if most major indicators were close to or above their previous highs. Otherwise it will just be considered a continuation of the previous recession.

A good example of the NBER calling two separate recessions was in the early '80s, from the NBER memo:

"The period following July 1980 will appear in the NBER chronology as an expansion. An important factor influencing that decision is that most major indicators, including real GNP, are already close to or above their previous highs."It will take some time for most major indicators to be above their previous high after the current recession because of the severe contraction as the graphs below show.

emphasis added

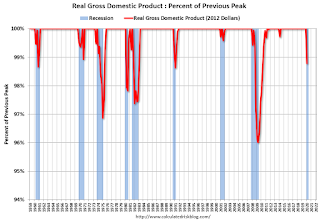

GDP is the key measure, as the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.

Click on graph for larger image.

Click on graph for larger image.This graph is for real GDP through Q1 2020. Real GDP returned to the pre-recession peak in Q3 2011, and has been at new post recession highs for almost a decade.

This is the key measure, and the NBER will probably use GDP and GDI to determine the trough of the recession.

Real GDP is only 1.2% below the pre-recession peak - however real GDP is expected to decline another 7% to 8% in Q2 (A much larger decline than the Great Recession).

The second graph is for monthly industrial production based on data from the Federal Reserve through Mar 2020.

The second graph is for monthly industrial production based on data from the Federal Reserve through Mar 2020.Industrial production declined much further in April (to be released this coming week).

Industrial production usually takes a long time to recover after a significant decline.

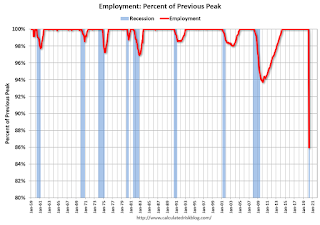

The third graph is for employment through April 2020.

The third graph is for employment through April 2020.Employment will decline much further in May.

Historically employment was a coincident indicator for the end of recessions, but that hasn't been true for the previous three recessions (1990-1991, 2001, 2007-2009).

It is likely that employment will not recover to pre-recession levels for a long time.

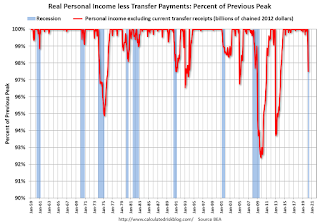

And the last graph is for real personal income excluding transfer payments through Mar 2020.

And the last graph is for real personal income excluding transfer payments through Mar 2020.Once again it will take a long time to return to pre-recession levels.

These graphs are useful in trying to identify peaks and troughs in economic activity.

My guess is that economic activity will bottom in Q2 (maybe already in April), but the pace of the recovery will depend on the course of the virus.

Schedule for Week of May 10, 2020

by Calculated Risk on 5/09/2020 08:11:00 AM

The key reports this week are April CPI and retail sales.

For manufacturing, the April Industrial Production report will be released on Friday.

Fed Chair Jerome Powell speaks on Wednesday.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for April.

8:30 AM: The Consumer Price Index for April from the BLS. The consensus is for 0.7% decrease in CPI, and a 0.2% decrease in core CPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM, Speech, Fed Chair Jerome Powell, Current Economic Issues, At the Peterson Institute for International Economics (via webcast)

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for a 2.800 million initial claims, down from 3.169 million the previous week.

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 11.6% decrease in retail sales.

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 11.6% decrease in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, decreased by 4.9% on a YoY basis in March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 11.5% decrease in Industrial Production, and for Capacity Utilization to decline to 64.0%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for May).

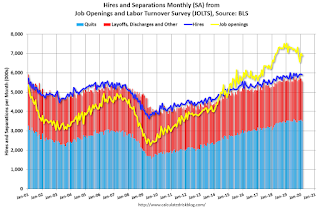

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in February to 6.882 million from 7.012 million in January.

The number of job openings (yellow) were down 2% year-over-year, and Quits were unchanged year-over-year.

Friday, May 08, 2020

Q2 GDP Forecasts: Probably Around 30% Annual Rate Decline

by Calculated Risk on 5/08/2020 08:16:00 PM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 30% Q2 decline is around 7% decline from Q1 (SA).

From Merrill Lynch:

We expect a 30% qoq saar plunge in 2Q. [SAAR May 8 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -31.2% for 2020:Q2. [May 8 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -34.9 percent on May 8, down from -17.6 percent on May 5. [May 8 estimate]

May 8 Update: US COVID-19 Test Results: States Ramping Up Tracing

by Calculated Risk on 5/08/2020 05:31:00 PM

From NPR: States Nearly Doubled Plans For Contact Tracers Since NPR Surveyed Them 10 Days Ago

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 303,275 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.2% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

AAR: April Rail Carloads down 25.2% YoY, Intermodal Down 17.2% YoY

by Calculated Risk on 5/08/2020 04:01:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Any industry that’s been around for 190 years has experienced a lot, but railroads have never faced something quite like what they’re facing now: huge swaths of their customer base shut down, with no clear idea when things will get better. It’s a good thing they’ve never experienced it before because it means bad things for rail traffic: total originated carloads on U.S. railroads fell 25.2% in April, their biggest year-over-year percentage decline since at least 1989 and probably for much longer. U.S. rail intermodal originations fell 17.2% in April 2020 from April 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

Total originated carloads on U.S. railroads averaged 196,107 per week in April 2020, easily the lowest weekly average for any month since before January 1988, when our data began. In fact, the five months from December 2019 through April 2020 are the five lowest-volume months (measured by weekly average total carloads) since before 1988. In April 2020, total carloads were down 25.2%, or 329,693 carloads, from last April. That’s the biggest year-over-year monthly percentage decline since our data began.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):U.S. intermodal originations in April 2020 were down 17.2%, or 227,165 containers and trailers, from last year. April was the 15th consecutive year-over-year decline for intermodal, but it and March 2020 (a 12.2% decline) had by far the biggest percentage declines in those 15 months. Intermodal is facing several challenges, including lower demand for most consumer goods; weaker port volumes; lots of surplus truck capacity; and lower diesel fuel prices, which helps railroads and trucks but helps trucks relatively more since they’re not as fuel efficient as railroads.