by Calculated Risk on 5/10/2020 05:32:00 PM

Sunday, May 10, 2020

May 10 Update: US COVID-19 Test Results

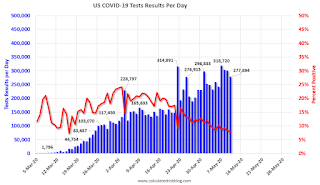

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 277,897 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.8% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Employment: April Diffusion Indexes Decline to Record Lows

by Calculated Risk on 5/10/2020 11:34:00 AM

The BLS diffusion index for total private employment was at a record low 4.8 in April, down from 28.5 in March.

For manufacturing, the diffusion index was at a record low 2.6, down from 26.3 in March.

Think of this as a measure of how widespread job gains or losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Click on graph for larger image.

Click on graph for larger image.Both indexes generally trended down in 2019 indicating job growth was becoming less widespread across industries (especially manufacturing).

Then both indexes declined sharply in March 2020, and collapsed to new record lows in April, due to the impact from COVID-19.

Saturday, May 09, 2020

May 9 Update: US COVID-19 Test Results: Third Consecutive Day Over 300K

by Calculated Risk on 5/09/2020 04:51:00 PM

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 300,842 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.4% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Recession Measures and NBER

by Calculated Risk on 5/09/2020 12:58:00 PM

Calling the beginning or end of a recession takes time. The National Bureau of Economic Research (NBER) waits until the data is revised, and if the recovery is sluggish, this process can take from 18 months to two years or longer.

In addition, if the economy slides into recession again, the committee will only consider it a new recession if most major indicators were close to or above their previous highs. Otherwise it will just be considered a continuation of the previous recession.

A good example of the NBER calling two separate recessions was in the early '80s, from the NBER memo:

"The period following July 1980 will appear in the NBER chronology as an expansion. An important factor influencing that decision is that most major indicators, including real GNP, are already close to or above their previous highs."It will take some time for most major indicators to be above their previous high after the current recession because of the severe contraction as the graphs below show.

emphasis added

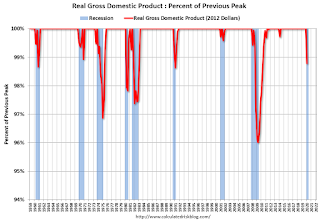

GDP is the key measure, as the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.

Click on graph for larger image.

Click on graph for larger image.This graph is for real GDP through Q1 2020. Real GDP returned to the pre-recession peak in Q3 2011, and has been at new post recession highs for almost a decade.

This is the key measure, and the NBER will probably use GDP and GDI to determine the trough of the recession.

Real GDP is only 1.2% below the pre-recession peak - however real GDP is expected to decline another 7% to 8% in Q2 (A much larger decline than the Great Recession).

The second graph is for monthly industrial production based on data from the Federal Reserve through Mar 2020.

The second graph is for monthly industrial production based on data from the Federal Reserve through Mar 2020.Industrial production declined much further in April (to be released this coming week).

Industrial production usually takes a long time to recover after a significant decline.

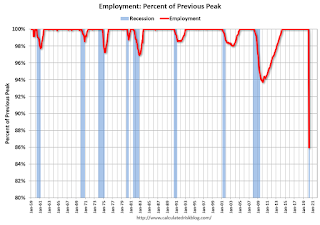

The third graph is for employment through April 2020.

The third graph is for employment through April 2020.Employment will decline much further in May.

Historically employment was a coincident indicator for the end of recessions, but that hasn't been true for the previous three recessions (1990-1991, 2001, 2007-2009).

It is likely that employment will not recover to pre-recession levels for a long time.

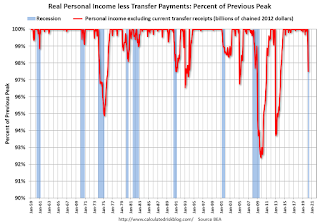

And the last graph is for real personal income excluding transfer payments through Mar 2020.

And the last graph is for real personal income excluding transfer payments through Mar 2020.Once again it will take a long time to return to pre-recession levels.

These graphs are useful in trying to identify peaks and troughs in economic activity.

My guess is that economic activity will bottom in Q2 (maybe already in April), but the pace of the recovery will depend on the course of the virus.

Schedule for Week of May 10, 2020

by Calculated Risk on 5/09/2020 08:11:00 AM

The key reports this week are April CPI and retail sales.

For manufacturing, the April Industrial Production report will be released on Friday.

Fed Chair Jerome Powell speaks on Wednesday.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for April.

8:30 AM: The Consumer Price Index for April from the BLS. The consensus is for 0.7% decrease in CPI, and a 0.2% decrease in core CPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM, Speech, Fed Chair Jerome Powell, Current Economic Issues, At the Peterson Institute for International Economics (via webcast)

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for a 2.800 million initial claims, down from 3.169 million the previous week.

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 11.6% decrease in retail sales.

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 11.6% decrease in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, decreased by 4.9% on a YoY basis in March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 11.5% decrease in Industrial Production, and for Capacity Utilization to decline to 64.0%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for May).

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS.

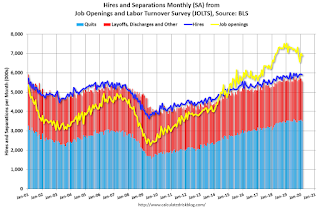

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in February to 6.882 million from 7.012 million in January.

The number of job openings (yellow) were down 2% year-over-year, and Quits were unchanged year-over-year.

Friday, May 08, 2020

Q2 GDP Forecasts: Probably Around 30% Annual Rate Decline

by Calculated Risk on 5/08/2020 08:16:00 PM

Important: GDP is reported at a seasonally adjusted annual rate (SAAR). So a 30% Q2 decline is around 7% decline from Q1 (SA).

From Merrill Lynch:

We expect a 30% qoq saar plunge in 2Q. [SAAR May 8 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at -31.2% for 2020:Q2. [May 8 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2020 is -34.9 percent on May 8, down from -17.6 percent on May 5. [May 8 estimate]

May 8 Update: US COVID-19 Test Results: States Ramping Up Tracing

by Calculated Risk on 5/08/2020 05:31:00 PM

From NPR: States Nearly Doubled Plans For Contact Tracers Since NPR Surveyed Them 10 Days Ago

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that might be enough for test and trace.

However, the US might need more than 900,000 tests per day according to Dr. Jha of Harvard's Global Health Institute.

There were 303,275 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.2% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

AAR: April Rail Carloads down 25.2% YoY, Intermodal Down 17.2% YoY

by Calculated Risk on 5/08/2020 04:01:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Any industry that’s been around for 190 years has experienced a lot, but railroads have never faced something quite like what they’re facing now: huge swaths of their customer base shut down, with no clear idea when things will get better. It’s a good thing they’ve never experienced it before because it means bad things for rail traffic: total originated carloads on U.S. railroads fell 25.2% in April, their biggest year-over-year percentage decline since at least 1989 and probably for much longer. U.S. rail intermodal originations fell 17.2% in April 2020 from April 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

Total originated carloads on U.S. railroads averaged 196,107 per week in April 2020, easily the lowest weekly average for any month since before January 1988, when our data began. In fact, the five months from December 2019 through April 2020 are the five lowest-volume months (measured by weekly average total carloads) since before 1988. In April 2020, total carloads were down 25.2%, or 329,693 carloads, from last April. That’s the biggest year-over-year monthly percentage decline since our data began.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):U.S. intermodal originations in April 2020 were down 17.2%, or 227,165 containers and trailers, from last year. April was the 15th consecutive year-over-year decline for intermodal, but it and March 2020 (a 12.2% decline) had by far the biggest percentage declines in those 15 months. Intermodal is facing several challenges, including lower demand for most consumer goods; weaker port volumes; lots of surplus truck capacity; and lower diesel fuel prices, which helps railroads and trucks but helps trucks relatively more since they’re not as fuel efficient as railroads.

NMHC: Rent Payment Tracker Finds 80.2 Percent of Apartment Households Paid Rent as of May 6

by Calculated Risk on 5/08/2020 01:33:00 PM

CR Note: People are still paying their rent. In an email, NMHC analysts note that the rent "payment level represents a payment rate of 98.1 percent compared to May 1-6, 2019"

From the NMHC: NMHC Rent Payment Tracker Finds 80.2 Percent of Apartment Households Paid Rent as of May 6

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 80.2 percent of apartment households made a full or partial rent payment by May 6 in its survey of 11.4 million units of professionally managed apartment units across the country.

This is a 1.5-percentage point decrease in the share who paid rent through May 6, 2019 and compares to 78.0 percent that had paid by April 6, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“Despite the fact that over twenty million people lost their jobs in April, for the second month in a row, we are seeing evidence that apartment renters who can pay rent are stepping up and doing so,” said Doug Bibby, NMHC President. “We expect May to largely mirror April, when the payment rate increased throughout the month as financial assistance worked its way to people’s bank accounts.”

“However, we are in uncharted waters and will be watching this closely over the course of the month as millions of households will not be able to access unemployment benefits, and those who have may find that they are not enough to cover rent plus all the other financial pressures caused by this crisis,” said Bibby.

emphasis added

Comments on April Employment Report

by Calculated Risk on 5/08/2020 10:35:00 AM

The April report was the worst monthly report ever in terms of job losses and the increase in the unemployment rate. The headline number for April was 20,500,000 jobs lost, and the previous two months were revised down 214 thousand, combined. The unemployment rate increased to 14.7%.

The BLS noted that the actual unemployment rate was probably close to 20%:

"If the workers who were recorded as employed but absent from work due to "other reasons" (over and above the number absent for other reasons in a typical April) had been classified as unemployed on temporary layoff, the overall unemployment rate would have been almost 5 percentage points higher than reported (on a not seasonally adjusted basis)."In addition, the job losses are ongoing. There will be millions more job losses in May, and when the PPP ends - after eight weeks - many of those workers will also become unemployed. It is very likely that the unemployment rate at the peak will exceed the worst of the Great Depression (25%). The key will be how well the virus is suppressed, and that will determine how quickly the economy recovers.

Earlier: April Employment Report: 20,500,000 Jobs Lost, 14.7% Unemployment Rate

In April, the year-over-year employment change was minus 19.42 million jobs.

One of the keys to follow will be the number of workers on temporary layoff. This increased from 801 thousand in February, to 1.848 million in March, and to 18.063 million in April. If these temporary layoffs become permanent, then that will be worse for the eventual job recovery.

Prime (25 to 54 Years Old) Participation

Click on graph for larger image.

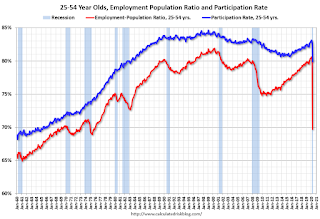

Click on graph for larger image.Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The prime working age will be key in the eventual recovery.

The 25 to 54 participation rate decreased in April to 79.9%, and the 25 to 54 employment population ratio decreased to 69.7%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons at work part time for economic reasons nearly doubled over the month to 10.9 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased sharply in April to 10.730 million from 5.681 million in March.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 22.8% in April. This is the record high for this measure (since 1994). The previous peak was 17.2% during the Great Recession.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 939 thousand workers who have been unemployed for more than 26 weeks and still want a job. This was the lowest level since 2001, probably because many long term unemployed just gave up looking in April. This will increase sharply in 5 or 6 months, and will be a key measure to follow during the eventual recovery.

Summary:

The headline monthly jobs number was the worst ever, and the previous two months were revised down. The headline unemployment rate increased to 14.7% (probably closer to 20%). These are horrible numbers, and there is more bad news to come.