by Calculated Risk on 5/04/2020 12:45:00 PM

Monday, May 04, 2020

U.S. Heavy Truck Sales down 54% Year-over-year in April

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the April 2020 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 575 thousand SAAR in September 2019.

Click on graph for larger image.

However heavy truck sales started declining late last year due to lower oil prices.

And then heavy truck sales really declined at the end of March due to COVID-19 and the collapse in oil prices.

Heavy truck sales were at 259 thousand SAAR in April, down from 382 thousand SAAR in March, and down 54% from 565 thousand SAAR in April 2019.

Heavy truck sales in April were still above the Great Recession low of 180 thousand SAAR in May 2009, and still above the record low of 159 thousand SAAR in 1982.

Update: Framing Lumber Future Prices Mostly Unchanged Year-over-year

by Calculated Risk on 5/04/2020 11:27:00 AM

Here is another monthly update on framing lumber prices. Lumber prices declined sharply from the record highs in early 2018, and then increased until the COVID-19 crisis.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Apr 24, 2020 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are unchanged from a year ago, and CME futures are down less than 1% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Prices fell sharply due to COVID-19, however future prices have rebounded somewhat (Note: Construction is considered an essential activity is ongoing in many areas)

BEA: April Vehicles Sales decreased to 8.6 Million SAAR, Lowest in 50 Years

by Calculated Risk on 5/04/2020 09:32:00 AM

The BEA released their estimate of April vehicle sales this morning. The BEA estimated light vehicle sales of 8.58 million SAAR in April 2020 (Seasonally Adjusted Annual Rate), down 24.5% from the revised March sales rate, and down 47.9% from April 2019.

Sales in March were revised down slightly from 11.37 million SAAR to 11.36 million SAAR.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for April 2020 (red).

The impact of COVID-19 is significant, although April may be the worst month for vehicle sales (depending on the course of the virus).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales collapsed in the second half of March, and in April were at the lowest level in 50 years - even lower than at the depth of the Great Recession.

Black Knight Mortgage Monitor for March; Discussion of Forbearance Plans

by Calculated Risk on 5/04/2020 07:00:00 AM

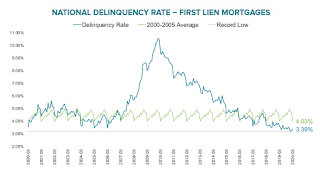

Black Knight released their Mortgage Monitor report for March today. According to Black Knight, 3.39% of mortgages were delinquent in March, down from 3.65% in March 2019. Black Knight also reported that 0.42% of mortgages were in the foreclosure process, down from 0.51% a year ago.

This gives a total of 3.81% delinquent or in foreclosure.

Press Release: Black Knight: Inflow of New COVID-19 Forbearance Plans Declines Following 15th of April; Additional Surge Likely as May Payments Approach

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. As the economic impact of COVID-19 continues, Black Knight looked this month at key indicators of mortgage performance and daily forbearance activity, as well as the effects of the pandemic on interest rates and the housing market. As Black Knight Data & Analytics President Ben Graboske explained, the rate at which American homeowners have been seeking mortgage forbearances began to slow from the middle of April forward, and Black Knight will monitor this trend to see if it continues.

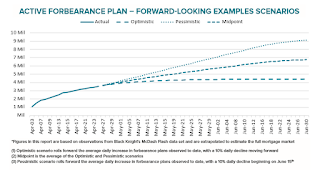

“After surging at the beginning of April and then rising again near the 15th – when most mortgages become past due and late fees are charged – the number of new forbearance requests has declined in recent weeks,” said Graboske. “While total forbearance volumes continue to mount, daily inflow has begun to taper off. Between 53,000 and 102,000 new plans have been put into place over each of the last nine days, and even the largest single-day volume was less than a quarter of what we saw at the start of April – and may see again next week. What remains an open question at this point is to what degree forbearance requests will look like at the beginning of May – when the next round of mortgage payments become due, and with nearly 30 million Americans newly unemployed in the last month. Once we have a sense for whether there is a similar spike in forbearance requests around the beginning of May, we’ll be in a much better position to more accurately forecast possible scenarios.

“As it is, in an optimistic scenario in which daily forbearance volumes continue to decline by 10% per day, the number of forbearances could peak at approximately 4.5 million in the coming months. Should current forbearance volumes hold steady through mid-June, more than 8 million homeowners could enter into forbearance plans, representing 16% or more of all mortgages. If that adverse scenario holds true, servicers would be required to advance $4 billion in monthly principal and interest (P&I) payments on GSE mortgages alone. Even under the FHFA’s recent four-month limit on P&I advances, servicers would still be bound to make $16 billion in advance payments over that time span.”

The month’s Mortgage Monitor report also looked at March prepayment activity, which surged to a near seven-year high. However, that was prior to the fallout from COVID-19 and the associated rise in unemployment and economic uncertainty. After rising in late March, 30-year interest rates fell back near record lows by mid-April. Rate lock data – a leading indicator of refinance and prepayment activity – suggests a steep decline in demand for refinancing. As of April 13, the average conventional 30-year note rate fell below 3.3% according to Black Knight’s Compass Analytics data – roughly equivalent to where it was in early March – but refinance-related rate locks saw little movement. In fact, refi locks were nearly 80% below their early-March peaks.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National Delinquency Rate.

From Black Knight:

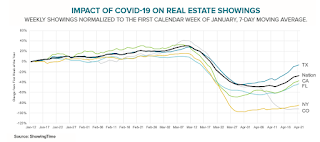

• In what’s typically the strongest month of the year for mortgage performance, March delinquencies rose by 3.33%The second graph shows the impact of COVID-19 on real estate showings:

• This the first March increase since the turn of the century – including the years of the Great Recession, and an early sign of COVID-19’s impact on the market

• In fact, March has historically seen delinquencies fall by 10% on average

• After falling as much as 63% below last year’s pace, in-person real estate showings began to pick up a bit beginning in the 3rd week of AprilThe third graph shows possible scenarios for the number of forbearance plans:

• Though a significant improvement, in-person real estate showings are still down 43% from the same time last year nationally

• In New York and Colorado – the latter of which has banned real estate showings as part of its shelter-in-place policy – in-person showings remain down 87% and 94% year-over-year respectively

• In Texas, showings are down by only 22% from the prior year, roughly half the decline being seen at the national level

• In an optimistic scenario in which daily forbearance volumes continue to decline by 10% per day, the number of forbearances could peak at approximately 4.5M in the coming monthsThere is much more in the mortgage monitor.

• Should current forbearance volumes hold steady through mid-June, more than 8M homeowners could enter into forbearance plans, representing 16% or more of all mortgages

• If that adverse scenario holds true, servicers would be required to advance $4 billion in monthly principal and interest payments on GSE mortgages alone

• Even under the FHFA’s recent four-month limit on principal and interest (P&I advances), servicers would still be bound to make $16 billion in advance payments over that time span

Sunday, May 03, 2020

Sunday Night Futures

by Calculated Risk on 5/03/2020 06:37:00 PM

Weekend:

• Schedule for Week of May 3, 2020

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 34 and DOW futures are down 275 (fair value).

Oil prices were up over the last week with WTI futures at $18.56 per barrel and Brent at $25.69 barrel. A year ago, WTI was at $62, and Brent was at $72 - so WTI oil prices are down about 70% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.76 per gallon. A year ago prices were at $2.90 per gallon, so gasoline prices are down $1.14 per gallon year-over-year.

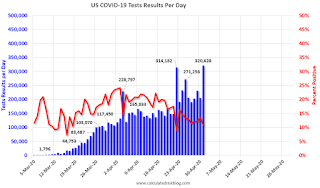

May 3 Update: US COVID-19 Test Results

by Calculated Risk on 5/03/2020 05:04:00 PM

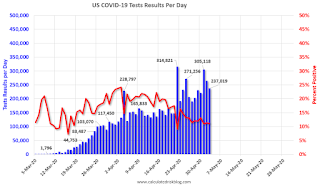

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that would probably be sufficient for test and trace.

There were 237,019 test results reported over the last 24 hours (the number of tests yesterday were revised up).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.1% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Saturday, May 02, 2020

May 2 Update: US COVID-19 Test Results

by Calculated Risk on 5/02/2020 05:26:00 PM

When I first posted this graph - in mid-March - the US was struggling to conduct much over 10,000 tests per day, while other countries - with smaller populations were testing far more than the US.

Although very late to testing - and slow to ramp up - the US has made significant progress over the last 8 weeks. The US still needs more tests, but there are also some other key hurdles to a successful test-and-trace program.

The US needs to ramp up preparedness on tracing. Some states are hiring people to do this work, but it is not organized at the national level.

The US also needs to reduce the lag time between testing and reporting. I've heard that some people are still waiting days for test results, and that makes isolating (and tracing) more difficult.

And my understanding is higher income areas are seeing more tests than lower income areas. This needs to be fixed.

The US might be able to test 400,000 to 600,000 people per day sometime in May according to Dr. Fauci - and that would probably be sufficient for test and trace.

There were 264,537 test results reported over the last 24 hours (the number of tests yesterday were revised up).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.4% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Four High Frequency Indicators for the Eventual Recovery

by Calculated Risk on 5/02/2020 01:48:00 PM

These indicators are for travel and entertainment - some of the sectors that will probably recover very slowly.

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On May 1st there were 171,563 travelers compared to 2,546,029 a year ago.

That is a decline of over 93%. There has been some increase off the bottom, but it is pretty small compared to the normal level of travel.

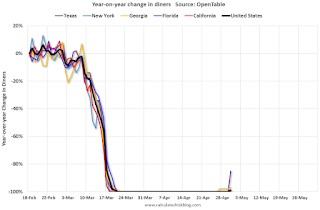

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through May 1, 2020.

The US was off 100% YoY as of March 21st.

Dining in Seattle and San Francisco declined sharply a week or two ahead of most of the country - and acting early has been shown to minimize the spread of the virus.

Some states - like Texas and Georgia - have started to open up. In Texas, diner traffic was only down 85% YoY.

Note that the data is noisy and depends on when blockbusters are released.

This data is through the week ending April 30, 2020. Movie ticket sales have been essentially at zero for six weeks.

Basically movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

STR reported hotel occupancy was off 62.2% year-over-year last week. Occupancy has increased slightly over the last couple of weeks, however STR believes it is partially "coming from essential workers, homeless housing initiatives and government-contracted guests".

Schedule for Week of May 3, 2020

by Calculated Risk on 5/02/2020 08:11:00 AM

The key report scheduled for this week is the April employment report. The report will show stunning job losses and a dramatic increase in the unemployment rate.

No major economic releases scheduled.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $44.2 billion. The U.S. trade deficit was at $39.9 Billion in February.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for a reading of 44.0, down from 52.5.

10:00 AM: Corelogic House Price index for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 20,000,000 payroll jobs lost in April, down from 27,000 lost in March.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a 3.300 million initial claims, down from 3.839 million the previous week.

3:00 PM: Consumer Credit from the Federal Reserve.

8:30 AM: Employment Report for April. The consensus is for 21,000,000 jobs lost, and for the unemployment rate to increase to 16.0%.

8:30 AM: Employment Report for April. The consensus is for 21,000,000 jobs lost, and for the unemployment rate to increase to 16.0%.There were 701,000 jobs lost in March, and the unemployment rate was at 4.4%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In March the year-over-year change was 1.504 million jobs.

Friday, May 01, 2020

May 1 Update: US COVID-19 Test Results: Progress

by Calculated Risk on 5/01/2020 05:23:00 PM

The US might be able to test 400,000 to 600,000 people per day in several weeks according to Dr. Fauci - and that would probably be sufficient for test and trace.

There were 320,628 test results reported over the last 24 hours (the number of tests yesterday were revised up).

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.8% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).