by Calculated Risk on 5/02/2020 01:48:00 PM

Saturday, May 02, 2020

Four High Frequency Indicators for the Eventual Recovery

These indicators are for travel and entertainment - some of the sectors that will probably recover very slowly.

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On May 1st there were 171,563 travelers compared to 2,546,029 a year ago.

That is a decline of over 93%. There has been some increase off the bottom, but it is pretty small compared to the normal level of travel.

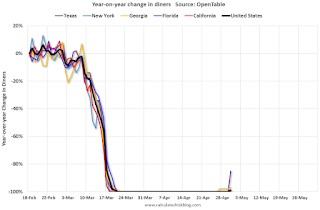

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through May 1, 2020.

The US was off 100% YoY as of March 21st.

Dining in Seattle and San Francisco declined sharply a week or two ahead of most of the country - and acting early has been shown to minimize the spread of the virus.

Some states - like Texas and Georgia - have started to open up. In Texas, diner traffic was only down 85% YoY.

Note that the data is noisy and depends on when blockbusters are released.

This data is through the week ending April 30, 2020. Movie ticket sales have been essentially at zero for six weeks.

Basically movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Note: Y-axis doesn't start at zero to better show the seasonal change.

STR reported hotel occupancy was off 62.2% year-over-year last week. Occupancy has increased slightly over the last couple of weeks, however STR believes it is partially "coming from essential workers, homeless housing initiatives and government-contracted guests".