by Calculated Risk on 4/29/2020 10:04:00 AM

Wednesday, April 29, 2020

NAR: Pending Home Sales Decrease 20.8% in March

From the NAR: NAR Calls Housing Market Slump Temporary as Pending Home Sales Fall in March

Pending home sales fell in March, seeing expected declines as a result of the coronavirus outbreak, according to the National Association of Realtors®. Each of the four major regions saw drops in month-over-month contract activity and year-over-year pending home sales transactions.This was well below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May. Some of these sales will be cancelled or delayed due to COVID-19.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, decreased 20.8% to 88.2 in March. Year-over-year, contract signings declined 16.3%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI dropped 14.5% to 82.3 in March, 11.0% lower than a year ago. In the Midwest, the index decreased 22.0% to 85.6 last month, down 12.4% from March 2019.

Pending home sales in the South sank 19.5% to an index of 103.7 in March, a 17.8% drop from March 2019. The index in the West fell 26.8% in March 2020 to 71.4, down 21.5% from a year ago.

emphasis added

BEA: Real GDP decreased at 4.8% Annualized Rate in Q1

by Calculated Risk on 4/29/2020 08:37:00 AM

Note: This is the advance release. Most analysts expect downward revisions as more data become available.

From the BEA: Gross Domestic Product, 1st Quarter 2020 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 4.8 percent in the first quarter of 2020, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2019, real GDP increased 2.1 percent.The advance Q1 GDP report, at minus 4.8% annualized, was close to expectations.

...

The decrease in real GDP in the first quarter reflected negative contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and private inventory investment that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

The decrease in PCE reflected decreases in services, led by health care, and goods, led by motor vehicles and parts. The decrease in nonresidential fixed investment primarily reflected a decrease in equipment, led by transportation equipment. The decrease in exports primarily reflected a decrease in services, led by travel.

emphasis added

Personal consumption expenditures (PCE) decreased at 7.6% annualized rate in Q1, down from 1.8% increase in Q4. Residential investment (RI) increased at a 21.0% rate in Q1. Equipment investment decreased at a 15.2% annualized rate, and investment in non-residential structures decreased at a 9.7% pace.

I'll have more later ...

MBA: Mortgage Applications Decreased, Purchase Applications up 12% Week over Week

by Calculated Risk on 4/29/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 24, 2020.

... The Refinance Index decreased 7 percent from the previous week and was 218 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 12 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 20 percent lower than the same week one year ago.

...

“The news in this week’s release is that purchase applications, still recovering from a five-year low, increased 12 percent last week to the strongest level in almost a month. The ten largest states had increases in purchase activity, which is potentially a sign of the start of an upturn in the pandemic-delayed spring homebuying season, as coronavirus lockdown restrictions slowly ease in various markets,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “California and Washington continued to show increases in purchase activity, with New York seeing a significant gain after declines in five of the last six weeks.”

Added Kan, “Contributing to the uptick in purchase applications was that mortgage rates fell to another record low in MBA’s survey, with the 30-year fixed rate decreasing to 3.43 percent. However, refinance activity declined 7 percent, as rates for refinances likely remained higher than those for purchase loans. Lenders are still working through pipelines at capacity, and observed changes in credit availability for refinance loans have also in turn impacted rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.43 percent from 3.45 percent, with points increasing to 0.34 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is way up from last year (over triple last year).

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 20% year-over-year.

Purchase activity has fallen sharply, but was up 12% week over week.

Note: Red is a four-week average (blue is weekly).

Tuesday, April 28, 2020

Wednesday: GDP, FOMC Announcement, Pending Home Sales

by Calculated Risk on 4/28/2020 08:17:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2020 (Advance estimate). The consensus is that real GDP decreased 4.0% annualized in Q1, down from 2.1% in Q4.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 10.0% decrease in the index.

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

April 28 Update: US COVID-19 Test Results: Anonymous Exposure Notification coming Friday!

by Calculated Risk on 4/28/2020 05:05:00 PM

From CNBC: How a handful of Apple and Google employees came together to help health officials trace coronavirus

The software, which Apple and Google now refer to by the softer-sounding term “exposure notification” instead of “contact tracing,” is due to be released on May 1.This technology, combined with expanded testing, could drastically slow the pandemic.

…

A group of researchers from Oxford University had already seen promising results in an early study: “Our models show we can stop the epidemic if approximately 60% of the population use the app, and even with lower numbers of app users, we still estimate a reduction in the number of coronavirus cases and deaths,” noted Christophe Fraser, senior author of the latest report from Oxford University’s Nuffield Department of Medicine.

The US might be able to test 400,000 to 600,000 people per day in several weeks according to Dr. Fauci - and that would probably be sufficient for test and trace.

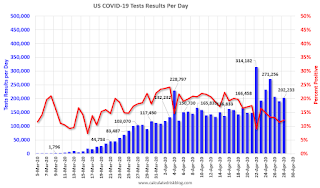

There were 202,233 test results reported over the last 24 hours (the number of tests yesterday were revised up).

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.1% (red line). The US probably needs enough tests to push the percentage positive below 5%. (probably much lower based on testing in New Zealand).

Lawler: D.R. Horton: Order Decline Not as Bad as Feared So Far in April

by Calculated Risk on 4/28/2020 03:33:00 PM

From housing economist Tom Lawler:

Below is an excerpt from D.R. Horton’s earnings press release from earlier today:

“The Company has experienced increases in sales cancellations and decreases in sales orders in late March and to date in April as compared to the same period in the prior year. Month-to-date in April 2020, the Company’s net sales orders are approximately 11% lower than the same period a year ago. This month-to-date net sales trend may not be indicative of the net sales results that may be expected for the full month of April 2020, because a significant number of sales contract cancellations typically occur in the final days of each month, which can significantly affect net sales orders for the full month. As of the date of this report, the Company’s weekly net sales order volumes in the most recent two weeks have increased as compared to the preceding four weeks.”D.R. Horton’s YOY sales decline so far in April is much smaller than some other larger builders have experienced, with the company attributing some of the “less-than-expected” drop in orders to its inventory of affordably priced homes, and especially its inventory of move-in ready “spec” homes, as well as its increased used of concessions that if often deploys during periods of weak demand.

A recording of the company’s conference call is available on its investor relations website.

| D.R. Horton YOY % Change in Net Orders | |

|---|---|

| Jan-Feb 2020 | 27.3% |

| March 2020 | 5.9% |

| YTD April 2020* | -11.0% |

Real House Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/28/2020 01:32:00 PM

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 4.2% year-over-year in February

It has been fourteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 17% above the previous bubble peak. However, in real terms, the National index (SA) is still about 6% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 13% below the bubble peak.

The year-over-year growth in prices increased to 4.2% nationally, as expected with lower mortgage rates and fewer homes for sell. This was pre-crisis data.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $291,000 today adjusted for inflation (45%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

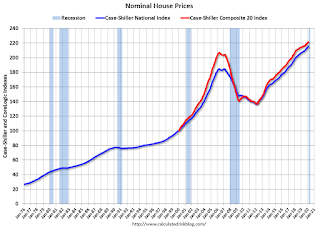

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to April 2005 levels, and the Composite 20 index is back to August 2004.

In real terms, house prices are at 2004/2005 levels.

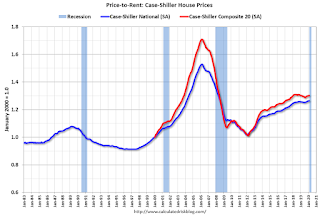

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio has been moving sideways recently.

On a price-to-rent basis, the Case-Shiller National index is back to March 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

HVS: Q1 2020 Homeownership and Vacancy Rates

by Calculated Risk on 4/28/2020 10:44:00 AM

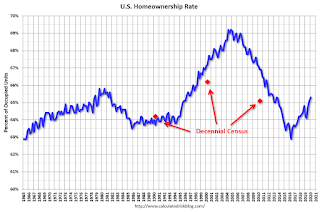

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2020. This is mostly pre-crisis.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. he Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

"National vacancy rates in the first quarter 2020 were 6.6 percent for rental housing and 1.1 percent for homeowner housing. The rental vacancy rate of 6.6 percent was 0.4 percentage points lower than the rate in the first quarter 2019 (7.0 percent), but not statistically different from the fourth quarter 2019 (6.4 percent). The homeowner vacancy rate of 1.1 percent was 0.3 percentage points lower than the rate in the first quarter 2019 (1.4 percent) and the rate in the fourth quarter 2019 (1.4 percent).

The homeownership rate of 65.3 percent was 1.1 percentage points higher than the rate in the first quarter 2019 (64.2 percent) but was not statistically different from the rate in the fourth quarter 2019 (65.1 percent)."

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 65.3% in Q1, from 65.1% in Q4.

I'd put more weight on the decennial Census numbers.

The HVS homeowner vacancy declined to 1.1%.

The HVS homeowner vacancy declined to 1.1%. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The rental vacancy rate increased to 6.6% in Q1.

The rental vacancy rate increased to 6.6% in Q1.The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, the homeownership rate has bottomed - and that the rental vacancy rate is close to the bottom for this cycle.

Richmond Fed: "Fifth District Manufacturing Activity Declined Sharply in April", Lowest Reading on Record

by Calculated Risk on 4/28/2020 10:03:00 AM

From the Richmond Fed: Manufacturing Activity Declined Sharply in April

Fifth District manufacturing activity declined sharply in April, according to the most recent survey from the Richmond Fed. The composite index plummeted from 2 in March to −53 in April, its lowest reading and largest one-month drop on record. All three components — shipments, new orders, and employment — fell, and the indexes for shipments and new orders reached record lows. Firms reported weakened local business conditions and expected conditions to remain soft in the next six months.This was the last of the regional Fed surveys for April.

Survey results reflected a deterioration in employment conditions in April. More contacts reported drops in employment and average work week, although the wage index remained flat. Manufacturers expected these conditions to persist.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

The ISM manufacturing index for April will be released on Friday, May 1st. The consensus is for the ISM to decline sharply to 36.7, down from 49.1 in March. Based on these regional surveys, the ISM manufacturing index might even be lower than the consensus in April.

Case-Shiller: National House Price Index increased 4.2% year-over-year in February

by Calculated Risk on 4/28/2020 09:11:00 AM

Note: This is for February. This is mostly pre-crisis data.

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller Index Shows Annual Home Price Gains Increased To 4.2% In February

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.2% annual gain in February, up from 3.9% in the previous month. The 10-City Composite annual increase came in at 2.9%, up from 2.6% in the previous month. The 20-City Composite posted a 3.5% year-over-year gain, up from 3.1% in the previous month.

Phoenix, Seattle, Tampa and Charlotte reported the highest year-over-year gains among the 20 cities. In February, Phoenix led the way with a 7.5% year-over-year price increase, followed by Seattle with a 6.0% increase, and Tampa and Charlotte with 5.2% increases. Seventeen of the 20 cities reported higher price increases in the year ending February 2020 versus the year ending January 2020.

...

The National Index and the 10-City Composite both posted a 0.4% month-over-month increase, while the 20-City Composite posted a 0.5% increase before seasonal adjustment in February. After seasonal adjustment, the National Index posted a month-over-month increase of 0.5%, while the 10-City and 20-City Composites both posted 0.4% increases. In February, 19 of 20 cities reported increases before seasonal adjustment while all 20 cities reported increases after seasonal adjustment.

The stable growth pattern established in the last half of 2019 continued into February,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index rose by 4.2% in February 2020, and the 10- and 20-City Composites also advanced (by 2.9% and 3.5%, respectively). Results for the month were broad-based, with gains in every city in our 20-City Composite; 17 of the 20 cities saw accelerating prices. The National, 10-City, and 20-City Composites all rose at a faster rate in February than they had in January.

“At a regional level, Phoenix retains the top spot for the ninth consecutive month, with a gain of 7.5% for February. Home prices in Seattle rose by 6.0%, with Tampa and Charlotte prices both gaining 5.2%. Prices were particularly strong in the West and Southeast, and comparatively weak in the Midwest and Northeast.

“Importantly, today’s report covers real estate transactions closed during the month of February, and shows no signs of any adverse effect from the governmental suppression of economic activity in response to the COVID-19 pandemic. As much of the U.S. economy was shuttered in March, next month’s data may begin to reflect the impact of these policies on the housing market.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 3.3% from the bubble peak, and up 0.4% in February (SA) from January.

The Composite 20 index is 7.4% above the bubble peak, and up 0.5% (SA) in February.

The National index is 17% above the bubble peak (SA), and up 0.5% (SA) in February. The National index is up 58% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 2.9% compared to February 2019. The Composite 20 SA is up 3.4% year-over-year.

The National index SA is up 4.2% year-over-year.

Note: According to the data, prices increased in 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.