by Calculated Risk on 4/03/2020 05:02:00 PM

Friday, April 03, 2020

April 3 Update: US COVID-19 Test Results per Day; More Testing Needed

Germany is conducting 50,000 tests per day, and scientists are advising Germany to increase testing to 200,000 per day.

The population of Germany is 83 million, about one-fourth of the US. To match Germany's current testing level, the US needs 200,000 tests per day, and the US needs four times that many based on the advice of some scientists.

The US testing shortfall continues. We need someone in charge resolving any bottleneck issues - PPE, manpower, swabs, reagents - whatever the issue, someone needs to be fixing it.

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve.

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

Also, I'm no longer including pending tests. So this is just test results reported daily.

There were 139,613 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 24% (red line). The US needs enough tests to push the percentage below 5%.

Test. Test. Test. Protect healthcare workers first!

AAR: March Rail Carloads down 6.0% YoY, Intermodal Down 12.2% YoY

by Calculated Risk on 4/03/2020 03:31:00 PM

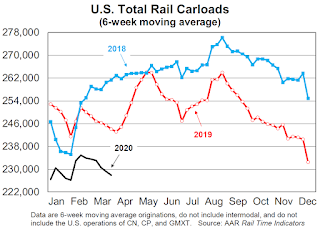

Note: The graphs are six week averages, and the economy was very different at the end of March - so next month we will see a sharp decline in traffic due to COVID-19.

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

A confluence of factors caused weekly average U.S. rail carloads in March 2020 to fall to their lowest level since sometime before January 1988, when our data begin. Total U.S. carloads in March 2020 were down 6.0% from March 2019 and down 3.0% from February 2020. Meanwhile, U.S. intermodal volume in March 2020 was down 12.2% from March 2019 (its biggest year-over-year percentage decline since September 2009) and down 6.3% from February 2020.

The clearest example so far of the impact of the coronavirus on rail volumes involves autos and auto parts: combined U.S., Canadian, and Mexican carloads were 25,518 in the third week of March, but only 9,745 carloads — a 62% decline — the following week, thanks to widespread auto plant shutdowns. Intermodal also suffered from fewer containers of auto parts.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2018, 2019 and 2020:

The U.S. economy in the last week of March was very different from what it was in the first week of March. It’s the same with some rail commodities.

Total originated carloads on U.S. railroads in March 2020 were 57,148 carloads, or 6.0%, lower than in March 2019. That’s their 14th consecutive year-overyear decline. Total carloads averaged 224,918 per week in March 2020, supplanting February 2020 as the lowest-volume month since sometime prior to January 1988, when our data begin.

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):

The second graph shows the six week average of U.S. intermodal in 2018, 2019 and 2020: (using intermodal or shipping containers):U.S. intermodal originations fell 12.2% in March 2020 from March 2019, their biggest year-over- year percentage decline since September 2009. Weekly average intermodal volume in March 2020 (233,845 units) was the lowest for March since 2013. What happens at Western ports will have a big impact on intermodal. Some say China is returning to normal, removing a supply shock that reduced sailings to the U.S and related intermodal shipments. However, some analysts fear that a demand shock is coming as U.S. importers cancel shipments because they don’t think they’ll be able to sell them. The only sure thing is that nobody knows for sure what’s going to happen.

CDC: Seasonal Flu Activity Decreased Sharply, Now "Low"

by Calculated Risk on 4/03/2020 02:10:00 PM

Seasonal flu activity has slowed sharply, and is now low, and that will help with the rapidly increasing COVID-19 pandemic.

From the CDC: Weekly U.S. Influenza Surveillance Report

Laboratory confirmed flu activity as reported by clinical laboratories continues to decrease sharply and is now low. Influenza-like illness activity, while lower than last week, is still elevated..Note that ILI (influenza-like illness) activity is elevated due to COVID-19.

…

Nationally, the percent of laboratory specimens testing positive for influenza at clinical laboratories continued to decrease and is now low. … Recent changes in healthcare seeking behavior, including increasing use of telemedicine and recommendations to limit emergency department (ED) visits to severe illness, as well as increasing levels of social distancing, are affecting the number of persons with ILI and their reasons for seeking care in outpatient and ED settings.

Click on graph for larger image.

Click on graph for larger image.This graph from the CDC shows the number of positive specimens, and the percent of tests positive.

If we look back at previous reports (for week 13), activity slowed faster this year than in most previous years.

Influenza is seasonal, but social distancing has helped lower flu activity too.

And fewer patients with the flu is a positive for healthcare workers.

Comments on March Employment Report

by Calculated Risk on 4/03/2020 11:11:00 AM

The March report was much worse than expected (due to uncertainty about the timing of layoffs), but the report is already "stale". The April report will be much worse with job losses in the millions (The April report will show the most job losses ever).

The headline number for March was 701 thousand jobs lost, and the previous two months were revised down 57 thousand, combined. The unemployment rate increased to 4.4%. The BLS noted many issues with the employment report this month (see Frequently asked questions: The impact of the coronavirus (COVID-19) pandemic on The Employment Situation for March 2020) and it appears the unemployment rate might be a percentage point higher (but that will seem like a small error next month).

Earlier: March Employment Report: 701,000 Jobs Lost (718,000 Lost ex-Census), 4.4% Unemployment Rate

In March, the year-over-year employment change was 1.504 million jobs including Census hires. The year-over-year change will turn negative next month.

"Scariest Job Chart Ever"

During the Great Recession, I posted a graph each month comparing the percentage job losses to previous recessions. This became known as the "scariest job chart".

Here is an updated version of the scariest chart. The 2020 Sudden Stop is in Red (just one month) - next month will be stunning.

The Great Recession is in blue. What made the 2007 recession so scary, was both the depth and duration of the job losses.

The 2020 recession will have the sharpest decline in jobs, but we don't know about the duration of the losses. Duration will depend on the battle against the virus.

Average Hourly Earnings

Wage growth was at expectations. From the BLS:

"In March, average hourly earnings for all employees on private nonfarm payrolls increased by 11 cents to $28.62. Over the past 12 months, average hourly earnings have increased by 3.1 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.1% YoY in March.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in March to 82.6%, and the 25 to 54 employment population ratio decreased to 79.6%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 5.8 million, increased by 1.4 million in March. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased sharply in March to 5.765 million from 4.318 million in February.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 8.7% in March.

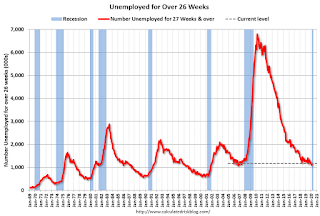

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.164 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 1.102 million in February.

Summary:

The headline jobs number was well below expectations, and the previous two months were revised down. The headline unemployment rate increased to 4.4%. These are horrible numbers, but the report for April will be much worse.

ISM Non-Manufacturing Index decreased to 52.5% in March

by Calculated Risk on 4/03/2020 10:05:00 AM

The March ISM Non-manufacturing index was at 52.5%, down from 57.3% in February. The employment index decreased to 47.0%, from 55.6%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2020 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 122nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business.®This is just the beginning of the down turn. The numbers will be much worse in the April report.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 52.5 percent, 4.8 percentage points lower than the February reading of 57.3 percent. This represents continued growth in the non-manufacturing sector, at a slower rate. The Non-Manufacturing Business Activity Index decreased to 48 percent, 9.8 percentage points lower than the February reading of 57.8 percent, reflecting contraction for the first time since July 2009, when the index registered 47.2 percent. The New Orders Index registered 52.9 percent, 10.2 percentage points below the reading of 63.1 percent in February. The Employment Index decreased 8.6 percentage points to 47 percent from the February reading of 55.6 percent.

emphasis added

March Employment Report: 701,000 Jobs Lost (718,000 Lost ex-Census), 4.4% Unemployment Rate

by Calculated Risk on 4/03/2020 08:44:00 AM

From the BLS:

Total nonfarm payroll employment fell by 701,000 in March, and the unemployment rate rose to 4.4 percent, the U.S. Bureau of Labor Statistics reported today. The changes in these measures reflect the effects of the coronavirus (COVID-19) and efforts to contain it. Employment in leisure and hospitality fell by 459,000, mainly in food services and drinking places. Notable declines also occurred in health care and social assistance, professional and business services, retail trade, and construction.

...

Federal government employment rose by 18,000 in March, reflecting the hiring of 17,000 workers for the 2020 Census.

...

The change in total nonfarm payroll employment for January was revised down by 59,000 from +273,000 to +214,000, and the change for February was revised up by 2,000 from +273,000 to +275,000. With these revisions, employment gains in January and February combined were 57,000 lower than previously reported.

...

In March, average hourly earnings for all employees on private nonfarm payrolls increased by 11 cents to $28.62. Over the past 12 months, average hourly earnings have increased by 3.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls decreased by 718 thousand in March ex-Census (private payrolls decreased 713 thousand).

Payrolls for January and February were revised down 57 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In March, the year-over-year change was 1.504 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was decreased to 62.7% in March. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was decreased to 62.7% in March. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio decreased to 60.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in March to 4.4%.

This was well below consensus expectations of 100,000 jobs lost, and January and February were revised down by 57,000 combined.

This was a horrible employment report, and the report for April will be much worse. I'll have much more later ...

Thursday, April 02, 2020

Friday: Employment Report

by Calculated Risk on 4/02/2020 10:25:00 PM

Friday:

My March Employment Preview.

Goldman's March Payrolls preview.

Friday:

• At 8:30 AM ET, Employment Report for March. The consensus is for 100,000 jobs lost, and for the unemployment rate to increase to 3.9%.

• At 10:00 AM, the ISM non-Manufacturing Index for March. The consensus is for a reading of 48.1, down from 57.3.

April 2 Update: US COVID-19 Test Results per Day; More Testing Needed

by Calculated Risk on 4/02/2020 05:37:00 PM

The testing shortfall continues. We need someone in charge resolving any bottleneck issues - PPE, manpower, swabs, reagents - whatever the issue, someone needs to be fixing it.

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve.

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

Also, I'm no longer including pending tests. So this is just test results reported daily.

There were 103,940 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 26% (red line - going the wrong way).

Test. Test. Test. Protect healthcare workers first!

Goldman: March Payrolls Preview

by Calculated Risk on 4/02/2020 04:45:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls declined 180k in March, below consensus of -100k.

...

We estimate the unemployment rate rose three tenths to 3.8%, with risks skewed towards a larger increase (consensus 3.8%).

…

While we look for a weaker-than-consensus report tomorrow, the March employment numbers are already fairly stale and insignificant in our view, because the April report will likely show job losses in the millions.

emphasis added

March Employment Preview

by Calculated Risk on 4/02/2020 12:22:00 PM

Important Notes:

1. The BLS reference week includes the 12th of the month. Massive COVID-19 layoffs started after the reference week (although there was a pickup in layoffs during the reference week).

2. Watch for Special Notes in the release. There could be some important announcements on how the BLS will be handling unemployment numbers and seasonal adjustments.

3. The 2020 Decennial Census was expected to increase hiring in March. This is unclear now - some of the hiring will be delayed.

On Friday at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for a decrease of 100,000 non-farm payroll jobs, and for the unemployment rate to increase to 3.9%.

Last month, the BLS reported 273,000 jobs added in February (266,000 ex-Census).

Here is a summary of recent data:

• The ADP employment report showed a decrease of 27,000 private sector payroll jobs in March. This was above consensus expectations of 154,000 private sector payroll jobs lost. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index decreased in March to 43.8%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased around 55,000 in March. The ADP report indicated manufacturing jobs increased 6,000 in March.

The ISM non-manufacturing employment index has not been released yet.

• Initial weekly unemployment claims averaged 2.6 million in March, way up from 213,000 in February. For the BLS reference week (includes the 12th of the month), initial claims were at 282,000, up from 211,000 during the reference week the previous month.

This suggests more layoffs (during the reference week) in March than in February.

• The final March University of Michigan consumer sentiment index decreased to 89.1 from the February reading of 101.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics. The decline this month was related to the pandemic.

• The BofA job tracker decreased in March to 103,000, down from 144,000 in February, suggesting fewer jobs added in March. However, according to the BofA, this data is "stale".

• Weather: The weather was favorable in both January and February. It is likely some expected hiring for March was pulled forward to the previous two months, suggesting some payback in the March report. So there was some chance that the March report would have been weaker than many expected without COVID-19.

• Conclusion: If we look back at 2005, when weekly claims for the reference week jumped following hurricane Katrina (similar to what happened in March), the economy lost 35 thousand jobs. It is possible that job losses will be that small in the March report - it is also possible that losses could be well over 100K. One thing is clear, job losses in the April report will be off the chart.