by Calculated Risk on 3/27/2020 11:47:00 AM

Friday, March 27, 2020

Kansas City Fed: "Tenth District Services Activity Decreased Significantly"

Usually I don't cover the service surveys, but the regional surveys are timely and are showing the sharp decline in activity.

From the Kansas City Fed: Tenth District Services Activity Decreased Significantly

The Federal Reserve Bank of Kansas City released the March Services Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District services activity decreased significantly in March to the lowest level in survey history (since 2014), and firms expected business activity to drop further in the future.A few survey comments:

“We saw a significant decrease in regional services activity as businesses were negatively affected by COVID-19, and firms expected more activity to drop off moving forward,” said Wilkerson. “Over 54 percent of firms expected lower levels of employment for 2020 due to COVID-19 and recent market volatility, and nearly 63 percent of contacts were concerned about cash availability.”

…

The month-over-month services composite index was -16 in March, the lowest posting since the survey started in 2014, and down significantly from 6 in February and 14 in January … Expectations for future services activity decreased sharply, and the expected composite index posted the worst change from a month ago in survey history, dropping from 23 to -30.

“Currently closed to public, thus no business, which is tolerable in the short-term, but would be problematic long-term.”

“With customers staying at home we have no sales. This may force us to shut down temporarily.”

“We need access to cash fast… business has dropped 95% in the last 4 days.”

“(Business activity) has dropped to basically zero. Until schools reopen we are going to greatly suffer. We have tremendous uncertainty - how long will this last - 1 month - 2 months - 6 months - it will bankrupt us eventually if it is prolonged.”

BLS: February Unemployment rates at New Series Lows in Six States

by Calculated Risk on 3/27/2020 10:14:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in February in 8 states, higher in 1 state, and stable in 41 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eleven states had jobless rate decreases from a year earlier, 1 state had an increase, and 38 states and the District had little or no change. The national unemployment rate, 3.5 percent, was little changed over the month but was 0.3 percentage point lower than in February 2019.

...

North Dakota had the lowest unemployment rate in February, 2.2 percent, while Alaska had the highest rate, 5.8 percent. The rates in Alaska (5.8 percent), Idaho (2.7 percent), Illinois (3.4 percent), New York (3.7 percent), North Dakota (2.2 percent), and Washington (3.8 percent) set new series lows. (All state series begin in 1976.)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently no has an unemployment rate at or above 6% (dark blue). Note that this is the first time since the series started in 1976 that Alaska has been below 6%. Three states and the D.C. have unemployment rates above 5%; Alaska, Louisiana, and Mississippi.

A total of fifteen states are at a series low: Alabama, Alaska, Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Maryland, Nevada, New York, North Dakota, Oregon, and Washington.

Personal Income increased 0.6% in February, Spending increased 0.2%, Core PCE increase 0.2%

by Calculated Risk on 3/27/2020 09:09:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $106.8 billion (0.6 percent) in February according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $88.7 billion (0.5 percent) and personal consumption expenditures (PCE) increased $27.7 billion (0.2 percent).The February PCE price index increased 1.8 percent year-over-year and the February PCE price index, excluding food and energy, increased 1.8 percent year-over-year.

Real DPI inincreased 0.4 percent in February and Real PCE increased 0.1 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent

The increase in personal income was above expectations, and the increase in PCE was below expectations.

Note that core PCE inflation was at expectations.

This was prior to the COVID-19 crisis.

Thursday, March 26, 2020

Friday: Personal Income & Outlays

by Calculated Risk on 3/26/2020 07:50:00 PM

If you want to track the cases (and tests) in your state over time, check out COVID-19 Case Statistics by State. Just click on the state of interest.

Consumer sentiment might be interesting tomorrow. (something I don't watch closely). Personal income & outlays is for February (pre-crisis).

Friday:

• At 8:30 AM ET, Personal Income and Outlays, February. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 94.0.

• At 10:00 AM, State Employment and Unemployment (Monthly), February 2020

March 26 Update: US COVID-19 Tests per Day #TestAndTrace

by Calculated Risk on 3/26/2020 05:35:00 PM

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 to 20,000 tests per day with a 51 million population, so the US needs to test around 130,000 per day.

The US reported 146,044 tests in the last 24 hours. Some of these were probably late reports.

Note: About 12% of tests were positive in the most recent report (some are still pending). However in some states, private labs aren't reporting the number of negative results, so this percentage may be high.

It would be helpful if there was a national reporting system for total tests and positive and negative results. Apparently, new legislation includes this reporting.

This data is from the COVID Tracking Project.

States are improving their reporting.

If testing can be maintained at this level, then that might be sufficient for test-and-trace.

Test. Test. Test. But protect our healthcare workers first!

Freddie Mac: Mortgage Serious Delinquency Rate Unchanged in February

by Calculated Risk on 3/26/2020 05:15:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in February was 0.60%, unchanged from 0.60% in January. Freddie's rate is down from 0.69% in February 2019.

This matches January as the lowest delinquency rate since November 2007.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This is close to a cycle bottom. However, with COVID-19, this rate will probably increase in a few months (it takes time since these are mortgage three months or more past due).

Note: Fannie Mae will report for February soon.

Hotels: Occupancy Rate Declined 56% Year-over-year to All Time Record Low

by Calculated Risk on 3/26/2020 11:16:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 21 March

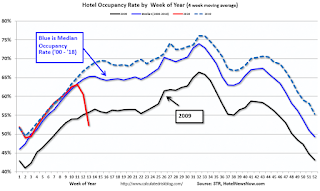

Showing further effects of the COVID-19 pandemic, the U.S. hotel industry reported significant year-over-year declines in the three key performance metrics during the week of 15-21 March 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 17-23 March 2019, the industry recorded the following:

• Occupancy: -56.4% to 30.3%

• Average daily rate (ADR): -30.2% to US$93.41

• Revenue per available room (RevPAR): -69.5% to US$28.32

“RevPAR decreases are at unprecedented levels—worse than those seen during 9/11 and the financial crisis,” said Jan Freitag, STR’s senior VP of lodging insights. “Seven of 10 rooms were empty around the country. That average is staggering on its own, but it’s tougher to process when you consider that occupancy will likely fall further. With most events cancelled around the nation, group occupancy was down to one percent with a year-over-year RevPAR decline of 96.6%. The industry is no doubt facing a situation that will take a concerted effort by brands, owners and the government to overcome.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

This is the lowest weekly occupancy on record, even considering seasonality, and STR expects occupancy rates to fall further. Note the graph is a 4-week average.

Kansas City Fed: "Tenth District Manufacturing Activity Declined Sharply" in March

by Calculated Risk on 3/26/2020 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined Sharply

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined sharply from a month ago, and expectations for future activity fell to levels last seen in early 2009.The last of the regional surveys for March will be released on Monday (Dallas Fed), and I expect the Texas region will be hit hard.

“Regional factory activity contracted sharply in March as firms were negatively impacted by COVID-19,” said Wilkerson. “Many firms indicated overall demand and sales have slowed dramatically, with capital investments being put on hold. Around 60 percent of manufacturers faced delayed payments from customers and 54 percent had concerns about cash availability.”

...

The month-over-month composite index was -17 in March, the lowest composite reading since April 2009, and down considerably from 5 in February and -1 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes.

emphasis added

Third Estimate Q4 GDP: Remains at 2.1% Annual Rate

by Calculated Risk on 3/26/2020 08:47:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Year 2019 (Third Estimate); Corporate Profits, Fourth Quarter and Year 2019

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the fourth quarter of 2019, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP also increased 2.1 percent.PCE growth was revised up to 1.8% from 1.7% in the second estimate. Residential investment was revised up to 6.5% from 6.2%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was also 2.1 percent. In the third estimate, an upward revision to personal consumption expenditures (PCE) was largely offset by downward revisions to federal government spending and nonresidential fixed investment.

emphasis added

Here is a Comparison of Third and Second Estimates.

Weekly Initial Unemployment Claims Increase to 3,283,000

by Calculated Risk on 3/26/2020 08:35:00 AM

The DOL reported:

In the week ending March 21, the advance figure for seasonally adjusted initial claims was 3,283,000, an increase of 3,001,000 from the previous week's revised level. This marks the highest level of seasonally adjusted initial claims in the history of the seasonally adjusted series. The previous high was 695,000 in October of 1982. The previous week's level was revised up by 1,000 from 281,000 to 282,000. The 4-week moving average was 998,250, an increase of 765,750 from the previous week's revised average. The previous week's average was revised up by 250 from 232,250 to 232,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 998,250.

This was much higher than the consensus forecast.

This week initial claims skyrocketed, and next week continued claims will follow.

The second graph shows seasonally adjust continued claims since 1967.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Over the next few weeks, continued claims will increase rapidly to a new record high, and then will likely stay at that high level until the crisis abates.