by Calculated Risk on 3/23/2020 08:07:00 PM

Monday, March 23, 2020

Tuesday: New Home Sale, Richmond Fed Mfg

The new home sales data is for February (pre-crisis), but the Richmond Fed manufacturing survey was taken in March and will likely show a sharp decline.

Note that the Philadelphia Fed Non-Manufacturing Survey will be released tomorrow morning. I usually don't cover this, but I'll post on it tomorrow.

Tuesday:

• At 10:00 AM ET, New Home Sales for February from the Census Bureau. The consensus is for 750 thousand SAAR, down from 764 thousand in January.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for March.

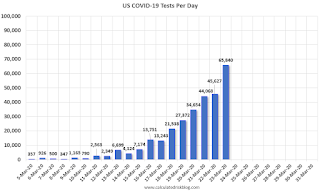

March 23 Update: US COVID-19 Tests per Day #TestAndTrace

by Calculated Risk on 3/23/2020 05:24:00 PM

Note: Test-and-trace is one of the keys to getting the economy back on track.

1. First, we need to provide our healthcare workers with whatever they need (masks, gowns, ventilators, beds, etc). This should be a national priority.

2. We need a national shelter-in-place order with a national disaster declaration. The sooner as many people as possible stay home, the less the spread. For those that work - thank you! - we need social distancing.

3. We need test-and-trace ready to go once we have adequate testing capacity.

4. We need to fund and fast track both vaccines and treatment medications.

5. We need swift action on both monetary and fiscal policy (The Fed has delivered "Whatever it takes", but we are still waiting on fiscal policy).

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 tests per day with a 51 million population, so the US needs to test around 100,000 per day.

Note: NYC and LA have stopped testing mild cases due to resource constraints. Hopefully testing will continue to improve, and we can test more people - this is important for test-and-trace.

The US conducted 65,840 tests in the last 24 hours.

Note: About 15% of tests were positive in the most recent report (some are still pending). The high percentage of positives indicates limited testing.

This data is from the COVID Tracking Project. Some states could do a better job of reporting the number of tests - so this is probably low.

Testing is improving, but needs to double from here to be sufficient for test-and-trace.

Test. Test. Test. But protect our healthcare workers first!

Black Knight's First Look: National Mortgage Delinquency Rate Increased slightly in February

by Calculated Risk on 3/23/2020 11:05:00 AM

From Black Knight: Black Knight’s First Look: Foreclosure Starts Hit Lowest Level on Record; Mortgage Delinquencies Edge Slightly Upward from January’s Record Low

• Foreclosure starts fell 25% from January 2020, and 20% from the year prior, hitting their lowest level on record since Black Knight began publicly reporting the metric in January 2000According to Black Knight's First Look report for February, the percent of loans delinquent increased 2.0% in February compared to January, and decreased 15.6% year-over-year.

• The national foreclosure rate also ticked lower in February, falling to 0.45%; the lowest it’s been since 2005, and within one basis point of an all-time low

• Delinquencies were up slightly from January, but remain more than 15% below last year’s levels

• Prepayment activity rose by nearly 8% month-over-month as early 2020 rate declines have begun to impact refinance activity

The percent of loans in the foreclosure process decreased 2.5% in February, and were down 11.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.28% in February, up from 3.22% in January.

The percent of loans in the foreclosure process was decreased to 0.456% from 0.46% in January.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2020 | Jan 2020 | Feb 2019 | Feb 2018 | |

| Delinquent | 3.28% | 3.22% | 3.89% | 4.30% |

| In Foreclosure | 0.45% | 0.46% | 0.51% | 0.65% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,737,000 | 1,705,000 | 2,019,000 | 2,198,000 |

| Number of properties in foreclosure pre-sale inventory: | 239,000 | 246,000 | 264,000 | 331,000 |

| Total Properties Delinquent or in foreclosure | 1,976,000 | 1,951,000 | 2,284,000 | 2,528,000 |

Fed: Whatever it Takes Announcement

by Calculated Risk on 3/23/2020 09:19:00 AM

From the Federal Reserve: Federal Reserve announces extensive new measures to support the economy. There are several actions in the announcement including:

The Federal Open Market Committee (FOMC) will purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.This is especially important for the mortgage market. The Fed will buy whatever it takes to stabilize MBS.

emphasis added

There is much more in the announcement (including supporting large and small businesses). This is a "whatever it takes" moment for the Fed.

"Chicago Fed National Activity Index Index Suggests Economic Growth Picked Up in February"

by Calculated Risk on 3/23/2020 09:04:00 AM

From the Chicago Fed: Chicago Fed National Activity Index Index Suggests Economic Growth Picked Up in February

The data through February were unlikely to have been affected much by the COVID-19 outbreak. Economic data for March will be incorporated in the next CFNAI released on April 20, 2020.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.16 in February from –0.33 in January. Two of the four broad categories of indicators that make up the index increased from January, and three of the four categories made positive contributions to the index in February. The index’s three-month moving average, CFNAI-MA3, decreased to –0.21 in February from –0.11 in January.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in February (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, March 22, 2020

Sunday Night Futures: Limit Down

by Calculated Risk on 3/22/2020 07:39:00 PM

Weekend:

• Schedule for Week of March 22, 2020

• A few Comments on Weekly and Continued Unemployment Claims

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures are limit down: S&P 500 are down 119 and DOW futures are down 962 (fair value).

Oil prices were down over the last week with WTI futures at $21.31 per barrel and Brent at $25.12 barrel. A year ago, WTI was at $59, and Brent was at $66 - so oil prices are down more than 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.08 per gallon. A year ago prices were at $2.60 per gallon, so gasoline prices are down 52 cents per gallon year-over-year.

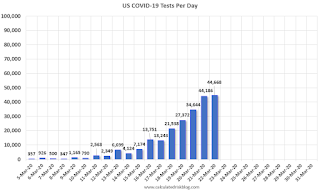

March 22 Update: US COVID-19 Tests per Day #TestAndTrace

by Calculated Risk on 3/22/2020 05:16:00 PM

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 tests per day with a 51 million population, so the US needs to test around 100,000 per day.

Note: NYC and LA have stopped testing mild cases due to resource constraints. Hopefully testing will continue to improve, and we can test more people - this is important for test-and-trace.

The US conducted 44,668 tests in the last 24 hours.

Note: About 19% of tests were positive in the most recent report (some are still pending). The high percentage of positives indicates limited testing.

This data is from the COVID Tracking Project. Some states could do a better job of reporting the number of tests - so this is probably low.

Testing is improving, but needs to more than double from here (maybe three times this much to be sufficient for test-and-trace).

Test. Test. Test. But protect our healthcare workers first!

A few Comments on Weekly and Continued Unemployment Claims

by Calculated Risk on 3/22/2020 11:56:00 AM

On Thursday, the Department of Labor will release Unemployment Insurance Weekly Claims. The consensus is initial claims will increase to 750,000, but that is way too low.

Based on early reporting from various states, initial weekly claims will probably be several million this week.

The all time high for initial weekly unemployment claims, Seasonally Adjusted, was 695,000 in Oct 82. The high during the great recession was 665,000 in Mar 09.

The previous record will be obliterated this week due to the sudden economic stop.

The extremely high level of claims will probably continue for several weeks. But it will be important to track Continued Claims too - since many of these people won't be returning to work for some time.

Here is a graph of continued claims since 1967.

If we look at Hurricane Katrina in 2005, weekly claims jumped up immediately, and then declined fairly quickly back to normal levels - but continued claims stayed high for a few months (since it took some time for people in New Orleans and along the Gulf coast to return to work).

This pandemic sudden stop is like Hurricane Katrina for unemployment claims, but all across the country.

This week initial claims will skyrocket, and the following week continued claims will follow.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined. Over the next few weeks, continued claims will increase rapidly, and then will likely stay at that high level until the crisis abates.

Saturday, March 21, 2020

March 21 Update: US COVID-19 Tests per Day

by Calculated Risk on 3/21/2020 04:43:00 PM

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 tests per day with a 51 million population, so the US needs to test around 100,000 per day.

Note: NYC and LA have stopped testing mild cases due to resource constraints. Hopefully testing will continue to improve, and we can test more people - this is important for test-and-trace.

The US conducted 44,186 tests in the last 24 hours. That is progress.

Note: About 14% of tests were positive in the most recent report (some are still pending).

This data is from the COVID Tracking Project. Some states could do a better job of reporting the number of tests - so this is probably low.

Testing is improving, but needs to more than double from here (maybe three times this much to be sufficient for test-and-trace).

Test. Test. Test. But protect our healthcare workers first!

Schedule for Week of March 22, 2020

by Calculated Risk on 3/21/2020 08:11:00 AM

The key reports this week are the third estimate of Q4 GDP, February New Home Sales and February Personal Income and Outlays.

For manufacturing, the March Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 750 thousand SAAR, down from 764 thousand in January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.9% decrease in durable goods orders.

9:00 AM: FHFA House Price Index for January. This was originally a GSE only repeat sales, however there is also an expanded index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a huge number of initial claims, up from 281 thousand the previous week.

8:30 AM: Gross Domestic Product, 4th quarter 2019 (Third estimate). The consensus is that real GDP increased 2.1% annualized in Q4, the same as the second estimate of 2.1%.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM ET: Personal Income and Outlays, February. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 94.0.

10:00 AM: State Employment and Unemployment (Monthly), February 2020