by Calculated Risk on 3/18/2020 07:00:00 AM

Wednesday, March 18, 2020

MBA: Mortgage Applications Decreased in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 8.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 13, 2020.

... The Refinance Index decreased 10 percent from the previous week and was 402 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index remained unchanged compared with the previous week and was 11 percent higher than the same week one year ago.

...

“The ongoing situation around the coronavirus led to further stress in the financial markets late last week, with unprecedented volatility and widening spreads. This drove mortgage rates back up to their highest levels since mid-February and led to a 10 percent decrease in refinance applications. However, refinance activity remains very high. Excluding the spike two weeks ago, the index remained at its highest level since October 2012, and refinancing accounted for almost 75 percent of all applications,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The Federal Reserve’s rate cut and other monetary policy measures to help the economy should help to bring down mortgage rates in the coming weeks, spurring more refinancing. Amidst these challenging times, the savings that households can gain from refinancing will help bolster their own financial circumstances and support the broader economy.”

Added Kan, “Purchase activity was flat but remained over 10 percent higher than a year ago. The purchase market was on firm footing to start the year and has so far held steady through the current uncertainty. Looking ahead, a gloomier outlook may cause some prospective homebuyers to delay their home search, even with these lower mortgage rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.74 percent from 3.47 percent, with points increasing to 0.37 from 0.27 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With record lower rates, we saw a huge increase in refinance activity in the survey over the last two weeks.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 11% year-over-year.

A key question is will low mortgage rates bring in more buyers, or will people hold off buying a home during the health crisis (as happened in China). So far people are still buying according to this survey.

Tuesday, March 17, 2020

Wednesday: Housing Starts

by Calculated Risk on 3/17/2020 07:45:00 PM

Housing Starts is for February (pre-crisis), but the MBA purchase index is for last week - and might indicate if people have stopped buying.

Tuesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for February. The consensus is for 1.500 million SAAR, down from 1.567 million SAAR.

• During the day, The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

COVID-19 Tests per Day

by Calculated Risk on 3/17/2020 05:38:00 PM

Tests per day is a key number to track (along with actual cases and, sadly, deaths). But total tests were a key for South Korea slowing the spread of COVID-19. South Korea has been conducting 15,000 tests per day with about one-fifth of the US population, so the US needs to test 70,000 to 100,000 per day.

The last two days, the US has average 13,000 tests per day. Those are still rookie numbers, and the US needs the ability to conduct about 5 times as many tests.

This data is from the COVID Tracking Project.

Testing it getting better, but is still far too low.

Test. Test. Test.

Stay Healthy!

BLS: Job Openings increased to 7.0 Million in January

by Calculated Risk on 3/17/2020 10:19:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings rose to 7.0 million (+411,000) on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.8 million and 5.6 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in January at 3.5 million and the rate was unchanged at 2.3 percent. The quits level was little changed for total private but fell for government (-18,000). Quits decreased in other services (-46,000), state and local government education (-12,000), and federal government (-5,000). The quits level increased in real estate and rental and leasing (+14,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 6.963 million from 6.552 million in December.

The number of job openings (yellow) are down 7% year-over-year.

Quits are up slightly year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a solid level, but have been declining - and are down 7% year-over-year. Quits are still increasing year-over-year. However this was for January - the picture will change sharply in March and April.

NAHB: Builder Confidence Decreased to 72 in March

by Calculated Risk on 3/17/2020 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 72, down from 74 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Declines But Remains Solid Amid Rising Risks

Builder confidence in the market for newly-built single-family homes fell two points to 72 in March, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. Sentiment levels have held in a firm range in the low- to mid-70s for the past six months.

“Builder confidence remains solid, although sales expectations for the next six months dropped four points on economic uncertainty stemming from the coronavirus,” said NAHB Chairman Dean Mon. “Interest rates remain low, and a lack of inventory creates market opportunities for single-family builders.”

“It is important to note that half of the builder responses in the March HMI were collected prior to March 4, so the recent stock market declines and the rising economic impact of the coronavirus will be reflected more in next month’s report,” said NAHB Chief Economist Robert Dietz. “Overall, 21% of builders in the survey report some disruption in supply due to virus concerns in other countries such as China. However, the incidence is higher (33%) among builders who responded to the survey after March 6, indicating that this is an emerging issue.”

...

The HMI index gauging current sales conditions fell two points to 79, the component measuring sales expectations in the next six months dropped four points to 75 and the gauge charting traffic of prospective buyers also decreased one point to 56.

Looking at the three-month moving averages for regional HMI scores, the Midwest fell two points to 66, the South moved one point lower to 77 and the West posted a one-point decline to 82. The Northeast rose two points to 64.

emphasis added

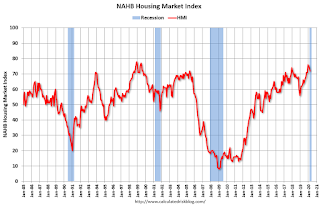

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was slightly below the consensus forecast, but still another very strong reading. However, this survey was largely prior to the impact of COVID-19.

Note: The graph shows the 2020 recession starting in March 2020.

Industrial Production Increased in February

by Calculated Risk on 3/17/2020 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.6 percent in February after falling 0.5 percent in January. Manufacturing output edged up 0.1 percent in February; excluding a large gain for motor vehicles and parts and a large drop for civilian aircraft, factory output was unchanged. The index for mining declined 1.5 percent, but the index for utilities jumped 7.1 percent, as temperatures returned to more typical levels following an unseasonably warm January. At 109.6 percent of its 2012 average, the level of total industrial production in February was unchanged from a year earlier. Capacity utilization for the industrial sector increased 0.4 percentage point in February to 77.0 percent, a rate that is 2.8 percentage points below its long-run (1972–2019) average.

emphasis added

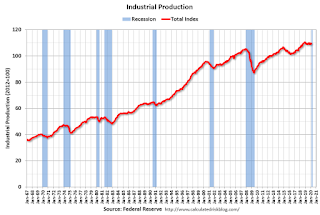

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.0% is 2.8% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in February to 109.6. This is 25.9% above the recession low, and 4.0% above the pre-recession peak.

The change in industrial production was above consensus expectations.

Note: The graphs show the 2020 recession starting in March 2020.

Retail Sales decreased 0.5% in February

by Calculated Risk on 3/17/2020 08:36:00 AM

On a monthly basis, retail sales decreased 0.5 percent from January to February (seasonally adjusted), and sales were up 4.3 percent from February 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $528.1 billion, a decrease of 0.5 percent from the previous month, but 4.3 percent above February 2019.

emphasis added

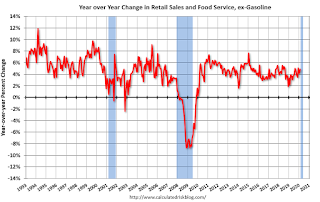

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.3% in February.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.The decrease in February was well below expectations, however sales in December and January were revised up, combined.

Note: The graphs show the 2020 recession starting in March 2020.

Monday, March 16, 2020

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey, Job Openings

by Calculated Risk on 3/16/2020 06:59:00 PM

The retail sales and industrial production data is for February (pre-crisis), but the homebuilder survey was taken in March - and might show a sharp decline.

Tuesday:

• At 8:30 AM ET, Retail sales for February is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 77.0%.

• At 10:00 AM, The March NAHB homebuilder survey. The consensus is for a reading of 74, unchanged from 74. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS.

Thanks to All the Heroes!

by Calculated Risk on 3/16/2020 04:57:00 PM

Let's thank all the heroes in this fight. Especially the healthcare workers that are at serious risk (two ER doctors are in critical condition) and the first responders.

Let's also thank all the people working at the grocery stores and pharmacies - and working in the supply chain to keep us fed and bring us goods.

And all the people working at the restaurants (it will probably be just pickup and delivery soon) and delivery people bringing other goods.

And all the people going to work practicing safe distancing (please keep making toilet paper!).

And for the utility workers keeping the power on and the internet working.

And all the people working from home.

And all the people staying at home are heroes too.

Thank you!

Update: Decline in Restaurant Traffic

by Calculated Risk on 3/16/2020 01:24:00 PM

There are some sectors that will be hit hard over the next several months: hotels, airlines, restaurants, movie theaters, sporting events, and convention centers. People will probably avoid these places as part of social distancing.

Here is some restaurant data from OpenTable:

This data shows the year-over-year change in diners as tabulated by OpenTable for the US, the states of Washington and New York, and a few impacted cities (Seattle, San Francisco, and Boston).

This data is updated through March 15, 2020.

Seattle and San Francisco saw a dramatic decline starting at the beginning of March. Starting a few days ago, restaurant traffic is declining sharply just about everywhere.

As of yesterday, San Francisco was off 72% YoY, Boston was off 70% YoY, and Seattle was off 62%. Going forward, restaurants are closing in many states (or going to half occupancy).

Clearly the US will need to help the employees (and owners) of these impacted sectors.