by Calculated Risk on 3/11/2020 09:13:00 AM

Wednesday, March 11, 2020

LA area Port Traffic Down Year-over-year in February

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.6% in February compared to the rolling 12 months ending in January. Outbound traffic was up 0.4% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Because of the timing of the New Year, we would have expected traffic to decline in February without an impact from COVID-19.

In general imports both imports and exports have turned down recently - and will probably be negatively impacted by COVID-19 over the next several months.

BLS: CPI increased 0.1% in February, Core CPI increased 0.2%

by Calculated Risk on 3/11/2020 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in February on a seasonally adjusted basis, the same increase as in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.3 percent before seasonal adjustment.Overall inflation was close to expectations in February. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.2 percent in February, the same increase as in January.

...

The all items index increased 2.3 percent for the 12 months ending February, a smaller increase than the 2.5-percent figure for the period ending January. The index for all items less food and energy rose 2.4 percent over the last 12 months.

emphasis added

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

by Calculated Risk on 3/11/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 55.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 6, 2020.

In response to the current interest rate environment, MBA now forecasts total mortgage originations to come in around $2.61 trillion this year – a 20.3 percent gain from 2019’s volume ($2.17 trillion). Refinance originations are expected to double earlier MBA projections, jumping 36.7 percent to around $1.23 trillion. Purchase originations are now forecasted to rise 8.3 percent to $1.38 trillion.

... The Refinance Index increased 79 percent from the previous week to the highest level since April 2009, and was 479 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

“Market uncertainty around the coronavirus led to a considerable drop in U.S. Treasury rates last week, causing the 30-year fixed rate to fall and match its December 2012 survey low of 3.47 percent. Homeowners rushed in, with refinance applications jumping 79 percent – the largest weekly increase since November 2008,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “With last week’s increase, the refinance index hit its highest level since April 2009. The purchase market also had a solid week, with activity nearly 12 percent higher than a year ago. Prospective buyers continue to be encouraged by improving housing inventory levels in some markets and very low rates.”

Added Kan, “Taking into the account the current economic situation and how much rates have fallen, MBA is nearly doubling its 2020 refinance originations forecast to $1.2 trillion, a 37 percent increase from 2019 and the strongest refinance volume since 2012. As lenders handle the wave in applications and manage capacity, mortgage rates will likely stabilize but remain low for now. This in turn will support borrowers looking to refinance or purchase a home this spring.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to the lowest level since December 2012, equaling the lowest level in survey history at 3.47 percent, from 3.57 percent with points increasing to 0.27 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With record lower rates, we saw a huge increase in refinance activity in the survey this week.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 12% year-over-year.

A key question is will low mortgage rates bring in more buyers, or will people hold off buying a home during the health crisis (as happened in China). So far people are still buying according to this survey.

Tuesday, March 10, 2020

Me on NPR The Indicator from Planet Money with Cardiff Garcia

by Calculated Risk on 3/10/2020 06:08:00 PM

Cardiff Garcia interviewed me yesterday at NPR The Indicator from Planet Money: Tracking The Impact Of Coronavirus In Real Time. Thanks to Cardiff for having me on!

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for February from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

Employment: February Diffusion Indexes

by Calculated Risk on 3/10/2020 04:29:00 PM

I haven't posted this in a few months.

The BLS diffusion index for total private employment was at 58.7 in February, up from 57.0 in January.

For manufacturing, the diffusion index was at 54.6, up from 47.4 in January.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Overall both total private and manufacturing job growth were somewhat widespread in February.

Overall both total private and manufacturing job growth were somewhat widespread in February.Both indexes generally trended down in 2019 - except for a spike up in November - indicating job growth was becoming less widespread across industries (especially manufacturing).

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 3/10/2020 12:44:00 PM

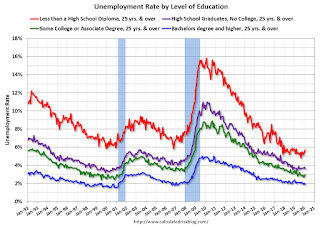

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through Feb 2020. Note: This is an update to a post from a few years ago.

Unfortunately this data only goes back to 1992 and includes only two recessions (the stock / tech bust in 2001, and the housing bust/financial crisis). Clearly education matters with regards to the unemployment rate - and all four groups are generally trending down.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

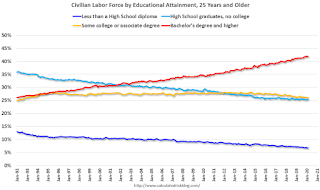

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

Here is some data on the U.S. labor force by educational attainment since 1992.

This is the only category trending up. "Some college" has been steady, and both "high school" and "less than high school" have been trending down.

Based on current trends, probably more than half the labor force will have at least a bachelor's degree at the end of this decade (2020s).

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, this is probably a factor in pushing down the overall unemployment rate over time.

Also, I'd guess more education would mean less labor turnover, and that education is a factor in fewer weekly claims (I haven't seen data on unemployment claims by education).

A more educated labor force is a positive for the future.

On COVID-19 Seasonality

by Calculated Risk on 3/10/2020 09:55:00 AM

The Flu is seasonal. There are research papers on why this happens, and it is very possible that COVID-19 will be seasonal too.

Here is an optimistic paper that suggests seasonality: Temperature and Latitude Analysis to Predict Potential Spread and Seasonality for COVID-19

A significant number of infectious diseases display seasonal patterns in their incidence, including human coronaviruses. We hypothesize that SARS-CoV-2 does as well. To date, Coronavirus Disease 2019 (COVID-19), caused by SARS-CoV-2, has established significant community spread in cities and regions only along a narrow east west distribution roughly along the 30-50 N” corridor at consistently similar weather patterns (5-11OC and 47-79% humidity). ...

Click on graph for larger image.

Click on graph for larger image.Because of geographical proximity and significant travel connections, epidemiological modeling of the epicenter predicted that regions in Southeast Asia, and specifically Bangkok would follow Wuhan, and China in the epidemic.7 However, the establishment of community transmission has occurred in a consistent east and west pattern. The new epicenters of virus were all roughly along the 30-50o N” zone; to South Korea, Japan, Iran, and Northern Italy. After the unexpected emergence of a large outbreak in Iran, we first made this map in late February. Since then new areas with significant community transmission include the Northwestern United States and France. Notably, during the same time, COVID-19 failed to spread significantly to countries immediately south of China. The number of patients and reported deaths in Southeast Asia is much less when compared to more temperate regions noted above.This suggests temperature and humidity may be factors in the spread of COVID-19. If this is the case, then the spread of the disease might slow sharply in May.

This is a possibility, but not a certainty. If there is seasonality, we need to prepare for a resurgence of the disease in the Fall.

Small Business Optimism Increased Slightly in February

by Calculated Risk on 3/10/2020 08:46:00 AM

Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): February 2020 Report

Small business owners expressed slightly higher levels of optimism in February with the NFIB Optimism Index moving up 0.2 points to 104.5 ...

..

Strong job creation continued in February, with an average addition of 0.43 workers per firm, adding to a strong 1st quarter of 2020. Finding qualified workers remains the top issue with 25 percent reporting this as their number one problem.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 104.5 in February.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, March 09, 2020

Seattle Real Estate in February: Sales up 5.2% YoY, Inventory down 32.5% YoY

by Calculated Risk on 3/09/2020 04:47:00 PM

The Northwest Multiple Listing Service reported NWMLS brokers report brisk activity, noting “too early to tell” if coronavirus will soften sales

“It’s still too early to tell if the broadening effects of the coronavirus will sideline buyers,” said Matthew Gardner, chief economist at Windermere Real Estate. “What we do know is that news of the virus led equity markets sharply lower and this caused mortgage rates to drop significantly. Therefore, the question is whether buyers will put their search on hold until the virus has abated, or if they will decide to move forward so they don’t miss out on near historic low mortgage rates,” he added.There were 5,265 sales in February 2020, up 2.3% from 5,145 sales in February 2019.

...

Inventory remained tight. At month end, there were 7,655 active listings in the 23 counties included in the MLS report. That was a 32% drop from the year ago total of 11,275. All but two counties (San Juan and Douglas) reported declines. Thurston County had the largest year-over-year drop, at 45.7%, followed by Snohomish (down 42%) and King (down 40.7%).

There is only 1.45 months of supply area-wide, according to Northwest MLS data.

emphasis added

The press release is for the Northwest. In King County, sales were up 5.4% year-over-year, and active inventory was down 40.7% year-over-year.

In Seattle, sales were up 5.2% year-over-year, and inventory was down 32.5% year-over-year.. This puts the months-of-supply in Seattle at just 1.3 months.

Black Knight Mortgage Monitor for January; "Cash-out lending hit a more than 10-year high at the end of 2019"

by Calculated Risk on 3/09/2020 01:43:00 PM

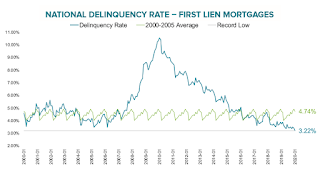

Black Knight released their Mortgage Monitor report for January last week. According to Black Knight, 3.22% of mortgages were delinquent in January, down from 3.75% in January 2019. Black Knight also reported that 0.46% of mortgages were in the foreclosure process, down from 0.51% a year ago.

This gives a total of 3.73% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: Despite 6.5-Year High in Refinance Lending, Servicers Struggle to Retain and Recapture Borrowers; 80% of Refinance Borrower Business Lost

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, in light of a marked increase in refinance activity in Q4 2019, Black Knight looked into servicers’ retention of refinancing borrowers. As Black Knight Data & Analytics President Ben Graboske explained, despite refinance lending hitting a 6.5-year high, servicers are facing challenges in retaining the business of refinancing borrowers.

“Despite a surge in refinance lending driven by low rates, servicers continue to struggle in their efforts to recapture refinancing borrowers, with only one in five being retained by servicers in Q4 2019,” said Graboske. “Retention rates rose along with refinance volumes early last year, hitting an 18-month high in Q2 2019, but retention rates have since fallen in each of the past two quarters. Fewer than one in four borrowers refinancing to lower their rate or term – business which has been historically easier to retain – stayed with their servicer post-refinance in Q4 2019. A large driver has been a recent failure to retain 2018 vintage mortgages, which goes to show just how quickly lender/borrower relationships can evaporate without the right data and tools for servicers to early on identify clients in their portfolios with sufficient tappable equity, and act to retain them. Borrowers who left for ‘greener pastures’ received an average 0.08% lower interest rate than those who stayed, strengthening the need for tools to ensure rate pricing is competitive. Retention challenges are even more pronounced among cash-out refinances, for which retention rates fell from 19% in Q3 2019 to just 17% in Q4 2019, the lowest in more than four years. At the same time, cash-out lending hit a more than 10-year high at the end of 2019, with some 600,000 borrowers pulling an estimated $41B in equity from their homes, the largest quarterly volume since 2007.

“Lenders and servicers should take note – there are currently 44.7 million homeowners with equity available to tap via cash-out refinance or HELOC, with the average homeowner having $119K in equity. At $6.2 trillion, total tappable equity – the amount available to homeowners with mortgages to borrow against while still retaining at least 20% equity in their homes – hit its highest year-end total on record. What’s more, the same falling interest rates that have reheated the housing market have also increased the rate of equity growth for the third consecutive quarter. Tappable equity grew 9.0% year-over-year in Q4 2019, the highest such growth rate since Q3 2018. Refinance lending is up 250% year-over-year, cash-out lending is at a 10-year high and 75% of homeowners with tappable equity have first lien interest rates at or above today’s prevailing rate. Taking all of this into account, improving the retention and recapture of this business is of critical importance. Data-driven portfolio retention strategies that help determine borrowers’ motivations for refinancing can go a long way in this regard.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National Delinquency Rate.

From Black Knight:

• Mortgage delinquencies fell by 5.4% month-over month to the lowest level on record since Black Knight began reporting the metric in 2000The second graph shows Black Knight's estimate of equity withdrawn (cash-out):

• At 3.22%, the national delinquency rate is down 14% from the same time last year

• With annual declines picking up in recent months and tax refund season on the horizon, we could see delinquencies push downward even further

• Approximately 600K homeowners pulled $41 billion in equity via cash-outs in Q4, the largest such volume since mid-2009There is much more in the mortgage monitor.

• With rates falling below 3.5% in early 2020, cash-out refinance activity is likely to remain strong in coming months

• Cash-out origination volumes have increased in each of the past three quarters

• However, outsized growth in rate/term lending has suppressed the cash-out share of refinance lending, which edged below 50% in Q4 2019 for the first time in three years