by Calculated Risk on 3/02/2020 03:01:00 PM

Monday, March 02, 2020

A Few Comments on COVID-19 Non-Medical Policies

Containment of COVID-19 has failed as was expected by most experts (but efforts delayed the onset). (examples: Washington, Oregon, California) I'll stay focused on the economic data, however, just as during the housing crisis, I will suggest some (non-medical) government policies that would probably help.

First and foremost, pay attention to the recommendations of the experts. Here is the CDC's Coronavirus Disease 2019 site. And here is the WHO's COVID-19 website.

Also pay attention to your state and local health officials.

Here is the CDC's site for Prevention & Treatment.

Note that flu activity is still high, but probably peaking. Getting a flu shot not only lowers a person's risk of getting the flu, but it lessens the burden on our healthcare professionals. There is still time to get a flu shot this year.

So what should the government do?

First, Let the experts brief the public, not politicians. In 1918, "happy talk" delayed action and cost lives. See: How the Horrific 1918 Flu Spread Across America

while influenza bled into American life, public health officials, determined to keep morale up, began to lie.And from the SacBee on another health crisis: Long before coronavirus, bubonic plague panicked California. A cover-up toppled the governor

Early in September, a Navy ship from Boston carried influenza to Philadelphia, where the disease erupted in the Navy Yard. The city’s public health director, Wilmer Krusen, declared that he would “confine this disease to its present limits, and in this we are sure to be successful. No fatalities have been recorded. No concern whatever is felt.”

The next day two sailors died of influenza. Krusen stated they died of “old-fashioned influenza or grip,” not Spanish flu. Another health official declared, “From now on the disease will decrease.”

The next day 14 sailors died—and the first civilian. Each day the disease accelerated. Each day newspapers assured readers that influenza posed no danger. Krusen assured the city he would “nip the epidemic in the bud."

When the plague came to San Francisco, business and government leaders were afraid of undermining the city’s shipping trade with Asia. Gov. Henry Tifft Gage repeatedly tried to discredit the federal government scientist who was trying to curtail the pandemic — even accusing him of starting the crisis by planting plague bacteria on cadavers. At the same time, Gage helped suppress an independent medical report confirming that bubonic plague was present in San Francisco.Second, the government should take the advice of the experts at the CDC and elsewhere and increase funding immediately as required by the health professionals.

“It was pretty crazy. There was a widespread cover-up,” said Marilyn Chase, a UC Berkeley lecturer and author of “The Barbary Plague: The Black Death in Victorian San Francisco.”

In its official history of the case, the National Institutes of Health called it “one of the most infamous chapters in U.S. public health history.”

Third, testing should be increased dramatically, and testing should be free for all in the US with any symptoms (or closely exposed to an infected person). It should be free for the uninsured, and for illegal immigrants (there should be no citizenship test). This is critical or people will not get the test.

Fourth, for those that test positive (but don't need hospitalization), the experts should determine how to isolate them. If their employers will not pay for their time off, then the government should pay. We don't want people avoiding tests because of the costs or the fear of lost income. This is a public health emergency and getting everyone to seek testing (with symptoms - or close contact with an infected person), is important. For those uninsured that need hospitalization, the government should also pay for their care (at negotiated rates - like Medicare). We don't want these people wandering around.

Fifth, the government should have a program of low interest rate (or no interest) loans for otherwise healthy companies impacted by the epidemic.

These are the kinds of programs that the government could put in place fairly quickly, in addition to what the healthcare experts suggest. In addition to the usual safety nets, these policies - well publicized - would lower the transmission rate and provide the proper stimulus to the economy (directed at exactly the right people).

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 3/02/2020 12:08:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined sharply from the record highs in early 2018, and have increased a little lately.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Feb 28, 2020 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 15% from a year ago, and CME futures are up 4% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war led to significant volatility in lumber prices in 2018. Recently prices have been picking up, but the futures fell sharply last week - probably on concerns about the impact of COVID-19.

Construction Spending Increased in January

by Calculated Risk on 3/02/2020 10:20:00 AM

From the Census Bureau reported that overall construction spending increased in January:

Construction spending during January 2020 was estimated at a seasonally adjusted annual rate of $1,369.2 billion, 1.8 percent above the revised December estimate of $1,345.5 billion. The January figure is 6.8 percent above the January 2019 estimate of $1,282.5 billion.Both private and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,022.7 billion, 1.5 percent above the revised December estimate of $1,007.6 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $346.5 billion, 2.6 percent above the revised December estimate of $337.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018. Now it is increasing again, but is still 18% below the bubble peak.

Non-residential spending is 13% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 6% above the previous peak in March 2009, and 32% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 9.0%. Non-residential spending is up 0.5% year-over-year. Public spending is up 12.6% year-over-year.

This was well above consensus expectations of a 0.7% increase in spending, construction spending for November and December were revised up.

ISM Manufacturing index Decreased to 50.1 in February

by Calculated Risk on 3/02/2020 10:04:00 AM

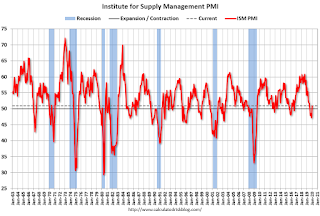

The ISM manufacturing index indicated slight expansion in February. The PMI was at 50.1% in February, down from 50.9% in January. The employment index was at 46.9%, up from 46.6% last month, and the new orders index was at 49.8%, down from 52.0%.

From the Institute for Supply Management: February 2020 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in February, and the overall economy grew for the 130th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.This was below expectations of 50.4%, and suggests manufacturing expanded slightly in February.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The February PMI® registered 50.1 percent, down 0.8 percentage point from the January reading of 50.9 percent. The New Orders Index registered 49.8 percent, a decrease of 2.2 percentage points from the January reading of 52 percent. The Production Index registered 50.3 percent, down 4 percentage points compared to the January reading of 54.3 percent. The Backlog of Orders Index registered 50.3 percent, an increase of 4.6 percentage points compared to the January reading of 45.7 percent. The Employment Index registered 46.9 percent, an increase of 0.3 percentage point from the January reading of 46.6 percent. The Supplier Deliveries Index registered 57.3 percent, up 4.4 percentage points from the January reading of 52.9 percent. The Inventories Index registered 46.5 percent, 2.3 percentage points lower than the January reading of 48.8 percent. The Prices Index registered 45.9 percent, down 7.4 percentage points as compared to the January reading of 53.3 percent. The New Export Orders Index registered 51.2 percent, a decrease of 2.1 percentage points as compared to the January reading of 53.3 percent. The Imports Index registered 42.6 percent, an 8.7-percentage point decrease from the January reading of 51.3 percent.

emphasis added

Sunday, March 01, 2020

Monday: ISM Manufacturing, Construction Spending

by Calculated Risk on 3/01/2020 08:27:00 PM

Note: As many experts expected, containment of COVID-19 has failed (but attempts at containment probably delayed the US epidemic giving policy makers crucial time to prepare).

Pay attention to the experts at the CDC about the virus (get a Flu shot, social distancing, hand washing, etc.). I'll stay focused on the economic data, and suggest some (non-medical) government policies that would help.

Weekend:

• Schedule for Week of March 1, 2020

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for January. The consensus is for the ISM to be at 50.4, down from 50.9 in January.

• At 10:00 AM, Construction Spending for December. The consensus is for a 0.7% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 34 and DOW futures are down 260 (fair value).

Oil prices were down over the last week with WTI futures at $45.14 per barrel and Brent at $50.36 barrel. A year ago, WTI was at $57, and Brent was at $65 - so oil prices are down 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.42 per gallon. A year ago prices were at $2.42 per gallon, so gasoline prices are unchanged year-over-year.

February 2020: Unofficial Problem Bank list Decreased to 63 Institutions

by Calculated Risk on 3/01/2020 01:07:00 PM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for February 2020.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for February 2020. During the month, the list declined by one to 63 banks after one removal. Aggregate assets fell to $48.5 billion from $51.3 billion a month ago with $2.6 billion of the decline coming from updated asset figures for the fourth quarter of 2019. A year ago, the list held 76 institutions with assets of $52.8 billion. Gwinnett Community Bank, Duluth, GA ($223 million) found its way off the list through a merger partner. This past week, the FDIC release industry results for the fourth quarter of 2019 and provide an update on the Official Problem Bank List, which they said had 51 institutions with assets of $48.8 billion. Earlier in the month on February 14, 2020, the Nebraska Department of Banking closed Ericson State Bank, Ericson, NE ($101 million). The FDIC estimated a 14% loss rate on the failure.The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and has steadily declined since then to well below 100 institutions.

Saturday, February 29, 2020

Schedule for Week of March 1, 2020

by Calculated Risk on 2/29/2020 08:11:00 AM

The key report scheduled for this week is the February employment report.

Other key reports scheduled for this week are the trade deficit and February vehicle sales.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 50.4, down from 50.9 in January.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 50.4, down from 50.9 in January.Here is a long term graph of the ISM manufacturing index.

The PMI was at 50.9% in January, the employment index was at 46.4%, and the new orders index was at 52.0%.

10:00 AM: Construction Spending for December. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 16.8 million SAAR in February, unchanged from 16.8 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 16.8 million SAAR in February, unchanged from 16.8 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

10:00 AM: Corelogic House Price index for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in February, down from 291,000 added in January.

10:00 AM: the ISM non-Manufacturing Index for February.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 219 thousand the previous week.

8:30 AM: Employment Report for February. The consensus is for 175,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for February. The consensus is for 175,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 225,000 jobs added in January, and the unemployment rate was at 3.6%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In January, the year-over-year change was 2.052 million jobs.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $47.7 billion. The U.S. trade deficit was at $48.9 billion in December.

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, February 28, 2020

Fannie Mae: Mortgage Serious Delinquency Rate unchanged in January

by Calculated Risk on 2/28/2020 04:27:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency was unchanged at 0.66% in January, from 0.66% in December. The serious delinquency rate is down from 0.76% in January 2019.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This matches the last two months as the lowest serious delinquency rate for Fannie Mae since June 2007.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.48% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.08% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.35% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

The Economic Impact of the COVID-19

by Calculated Risk on 2/28/2020 12:41:00 PM

Several readers have asked about the economic impact of the novel coronavirus. The answer is it depends on the severity of the epidemic.

Goldman Sachs economists wrote this morning:

Our new baseline scenario involves a continued slowdown in infections in China that allows for a slow recovery in high-frequency indicators of economic activity. However, it also includes moderate supply chain disruptions in the global goods-producing sector, as well as a hit to consumer spending and business activity from national outbreaks that go well beyond China and the other countries (such as Korea and Italy) that have been affected so far. Our analysis shows effects on quarter-on-quarter annualized global GDP growth of -5pp in Q1 and -2pp in Q2, followed by a rebound in the second half of 2020, leaving our full-year global growth forecast at about 2%. All else equal, this would imply a short-lived global contraction that stops short of an outright recession.That is a wide range of outcomes. If the epidemic slows sharply (perhaps due to seasonality), then the economy should recover quickly. However, if the epidemic continues to spread rapidly, then we could be looking at a global recession (and an enormous human tragedy).

...

We also consider two alternative scenarios. The upside scenario assumes that the global spread of the virus is brought under control quickly and supply chain disruptions remain mostly absent; if so, global GDP would rebound in Q2, risk asset markets would recover sharply, and central banks may stay on hold. The downside scenario assumes widespread supply chain disruptions as well as domestic demand weakness across the global economy. This would involve sharp sequential contraction in global GDP in Q1 and Q2—i.e., a global recession—and probably an aggressive monetary easing campaign, including a return to the near-zero funds rate of the post-crisis period.

There will be an immediate impact on travel, and not just to Asia (we are starting to see slack in the US hotel occupancy rate). And there could be an impact on US consumer spending, especially on high priced items like cars and housing (although lower interest rates are a positive). I expect areas like Las Vegas will be hit hard for the duration of the health crisis (cancelled conventions or low attendance)

We need accurate information, especially on the number of daily tests - both positive and negative results - and advice from experts on how and when to alter our behavior (social-distancing, etc). It is concerning that one of the first acts of VP Pence was to the muzzle the experts at the CDC and HHS. This is reminiscent of what happened in 1918.

In 1918, at the beginning of the crisis, government officials tried to put a positive spin on the flu epidemic. From the Smithsonian magazine:

[W]hile influenza bled into American life, public health officials, determined to keep morale up, began to lie.Right now the best data is from the CDC and the WHO. I'll write more on the possible impact as more information becomes available.

Early in September, a Navy ship from Boston carried influenza to Philadelphia, where the disease erupted in the Navy Yard. The city’s public health director, Wilmer Krusen, declared that he would “confine this disease to its present limits, and in this we are sure to be successful. No fatalities have been recorded. No concern whatever is felt.”

The next day two sailors died of influenza. Krusen stated they died of “old-fashioned influenza or grip,” not Spanish flu. Another health official declared, “From now on the disease will decrease.”

The next day 14 sailors died—and the first civilian. Each day the disease accelerated. Each day newspapers assured readers that influenza posed no danger. Krusen assured the city he would “nip the epidemic in the bud."

Q1 GDP Forecasts: 1.1% to 2.6%

by Calculated Risk on 2/28/2020 11:16:00 AM

From Merrill Lynch:

The data lifted 1Q GDP tracking by 0.4pp to 1.3% qoq saar. [Feb 28 estimate]From Goldman Sachs:

emphasis added

We lowered our Q1 GDP tracking estimate by two tenths to +1.1% (qoq ar), reflecting a larger expected drag from inventories. [Feb 27 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.1% for 2020:Q1. [Feb 28 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 2.6 percent on February 28, down from 2.7 percent on February 27. [Feb 28 estimate]CR Note: These early estimates suggest real GDP growth will be between 1.1% and 2.6% annualized in Q1.