by Calculated Risk on 2/29/2020 08:11:00 AM

Saturday, February 29, 2020

Schedule for Week of March 1, 2020

The key report scheduled for this week is the February employment report.

Other key reports scheduled for this week are the trade deficit and February vehicle sales.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 50.4, down from 50.9 in January.

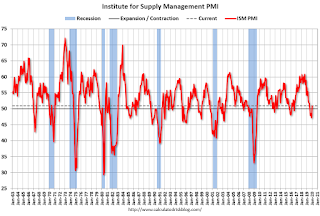

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 50.4, down from 50.9 in January.Here is a long term graph of the ISM manufacturing index.

The PMI was at 50.9% in January, the employment index was at 46.4%, and the new orders index was at 52.0%.

10:00 AM: Construction Spending for December. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 16.8 million SAAR in February, unchanged from 16.8 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 16.8 million SAAR in February, unchanged from 16.8 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

10:00 AM: Corelogic House Price index for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in February, down from 291,000 added in January.

10:00 AM: the ISM non-Manufacturing Index for February.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 219 thousand the previous week.

8:30 AM: Employment Report for February. The consensus is for 175,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for February. The consensus is for 175,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 225,000 jobs added in January, and the unemployment rate was at 3.6%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In January, the year-over-year change was 2.052 million jobs.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $47.7 billion. The U.S. trade deficit was at $48.9 billion in December.

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, February 28, 2020

Fannie Mae: Mortgage Serious Delinquency Rate unchanged in January

by Calculated Risk on 2/28/2020 04:27:00 PM

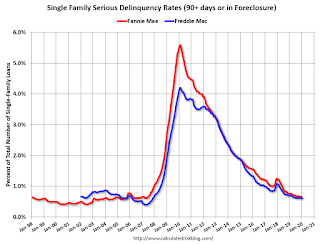

Fannie Mae reported that the Single-Family Serious Delinquency was unchanged at 0.66% in January, from 0.66% in December. The serious delinquency rate is down from 0.76% in January 2019.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This matches the last two months as the lowest serious delinquency rate for Fannie Mae since June 2007.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.48% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.08% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.35% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

The Economic Impact of the COVID-19

by Calculated Risk on 2/28/2020 12:41:00 PM

Several readers have asked about the economic impact of the novel coronavirus. The answer is it depends on the severity of the epidemic.

Goldman Sachs economists wrote this morning:

Our new baseline scenario involves a continued slowdown in infections in China that allows for a slow recovery in high-frequency indicators of economic activity. However, it also includes moderate supply chain disruptions in the global goods-producing sector, as well as a hit to consumer spending and business activity from national outbreaks that go well beyond China and the other countries (such as Korea and Italy) that have been affected so far. Our analysis shows effects on quarter-on-quarter annualized global GDP growth of -5pp in Q1 and -2pp in Q2, followed by a rebound in the second half of 2020, leaving our full-year global growth forecast at about 2%. All else equal, this would imply a short-lived global contraction that stops short of an outright recession.That is a wide range of outcomes. If the epidemic slows sharply (perhaps due to seasonality), then the economy should recover quickly. However, if the epidemic continues to spread rapidly, then we could be looking at a global recession (and an enormous human tragedy).

...

We also consider two alternative scenarios. The upside scenario assumes that the global spread of the virus is brought under control quickly and supply chain disruptions remain mostly absent; if so, global GDP would rebound in Q2, risk asset markets would recover sharply, and central banks may stay on hold. The downside scenario assumes widespread supply chain disruptions as well as domestic demand weakness across the global economy. This would involve sharp sequential contraction in global GDP in Q1 and Q2—i.e., a global recession—and probably an aggressive monetary easing campaign, including a return to the near-zero funds rate of the post-crisis period.

There will be an immediate impact on travel, and not just to Asia (we are starting to see slack in the US hotel occupancy rate). And there could be an impact on US consumer spending, especially on high priced items like cars and housing (although lower interest rates are a positive). I expect areas like Las Vegas will be hit hard for the duration of the health crisis (cancelled conventions or low attendance)

We need accurate information, especially on the number of daily tests - both positive and negative results - and advice from experts on how and when to alter our behavior (social-distancing, etc). It is concerning that one of the first acts of VP Pence was to the muzzle the experts at the CDC and HHS. This is reminiscent of what happened in 1918.

In 1918, at the beginning of the crisis, government officials tried to put a positive spin on the flu epidemic. From the Smithsonian magazine:

[W]hile influenza bled into American life, public health officials, determined to keep morale up, began to lie.Right now the best data is from the CDC and the WHO. I'll write more on the possible impact as more information becomes available.

Early in September, a Navy ship from Boston carried influenza to Philadelphia, where the disease erupted in the Navy Yard. The city’s public health director, Wilmer Krusen, declared that he would “confine this disease to its present limits, and in this we are sure to be successful. No fatalities have been recorded. No concern whatever is felt.”

The next day two sailors died of influenza. Krusen stated they died of “old-fashioned influenza or grip,” not Spanish flu. Another health official declared, “From now on the disease will decrease.”

The next day 14 sailors died—and the first civilian. Each day the disease accelerated. Each day newspapers assured readers that influenza posed no danger. Krusen assured the city he would “nip the epidemic in the bud."

Q1 GDP Forecasts: 1.1% to 2.6%

by Calculated Risk on 2/28/2020 11:16:00 AM

From Merrill Lynch:

The data lifted 1Q GDP tracking by 0.4pp to 1.3% qoq saar. [Feb 28 estimate]From Goldman Sachs:

emphasis added

We lowered our Q1 GDP tracking estimate by two tenths to +1.1% (qoq ar), reflecting a larger expected drag from inventories. [Feb 27 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.1% for 2020:Q1. [Feb 28 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2020 is 2.6 percent on February 28, down from 2.7 percent on February 27. [Feb 28 estimate]CR Note: These early estimates suggest real GDP growth will be between 1.1% and 2.6% annualized in Q1.

Hotels: Occupancy Rate Decreases Year-over-year

by Calculated Risk on 2/28/2020 09:48:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 22 February

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 16-22 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 17-23 February 2019, the industry recorded the following:

• Occupancy: -2.1% to 63.2%

• Average daily rate (ADR): +0.7% to US$130.55

• Revenue per available room (RevPAR): -1.4% to US$82.55

Of note, U.S. airport hotels reported a 4.8% decrease in occupancy for the week, which was the steepest decline among all location types tracked by STR. The decline was steeper in airport markets outside of the country’s 10 busiest.

“The obvious question is whether a dip in demand in airport hotels was directly connected to the coronavirus outbreak,” said Jan Freitag, STR’s senior VP of lodging insights. “However, one week of data is not sufficient for STR to make that correlation, especially considering last week was rather weak around the country in general—possibly due to extended vacations after Presidents’ Day.

“We’ve maintained that we do expect to see a coronavirus impact in U.S. hotel performance data, especially in gateway cities that have historically seen a large number of Chinese arrivals. We’ll continue to monitor the data each week. The next few weeks will be especially interesting considering the news to come out of the CDC on Tuesday.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 is off to a decent start, however, STR notes that the new coronavirus could have a significant negative impact on hotels.

Personal Income increased 0.6% in January, Spending increased 0.2%, Core PCE increase 0.1%

by Calculated Risk on 2/28/2020 08:35:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $116.5 billion (0.6 percent) in January according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $101.4 billion (0.6 percent) and personal consumption expenditures (PCE) increased $29.6 billion (0.2 percent).The January PCE price index increased 1.7 percent year-over-year and the January PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI increased 0.5 percent in January and Real PCE increased 0.1 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through January 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above expectations, and the increase in PCE was below expectations.

Note that core PCE inflation was below expectations.

Thursday, February 27, 2020

Friday: Personal Income & Outlays, Chicago PMI

by Calculated Risk on 2/27/2020 10:32:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for February. The consensus is for a reading of 45.8, up from 42.9 in January.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 100.9.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in January, Lowest since 2007

by Calculated Risk on 2/27/2020 04:43:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in January was 0.60%, down from 0.63% in December. Freddie's rate is down from 0.70% in January 2019.

This the lowest delinquency rate since November 2007.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for January soon.

NAR: "Pending Home Sales Ascend 5.2% in January"

by Calculated Risk on 2/27/2020 12:57:00 PM

From the NAR: Pending Home Sales Ascend 5.2% in January

Pending home sales rebounded in January, ticking up following a decline in December, according to the National Association of Realtors®. Only the West region reported a minor drop in month-over-month contract activity, while the other three major regions each saw pending home sales grow. Year-over-year pending home sales activity was up in all four regions and thus up nationally compared to one year ago.This was well above expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contract signings, grew 5.2% to 108.8 in January. Year-over-year contract signings increased 5.7%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI rose 1.3% to 92.9 in January, 1.2% higher than a year ago. In the Midwest, the index increased 7.3% to 105.3 last month, 6.5% higher than in January 2019.

Pending home sales in the South grew 8.7% to an index of 129.4 in January, a 7.1% increase from January 2019. The index in the West declined 1.1% in January 2020 to 92.6, still a jump of 5.5% from a year ago.

emphasis added

Kansas City Fed: "Tenth District Manufacturing Activity Increased Modestly" in February

by Calculated Risk on 2/27/2020 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Increased Modestly

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity increased modestly, reaching positive territory for the first time in eight months.This was the last of the regional Fed surveys for February.

“Regional factory activity finally expanded again in February,” said Wilkerson. “This was despite over 40 percent of firms reporting some negative effect from the spread of coronavirus so far in 2020.”

...

The month-over-month composite index was 5 in February, higher than -1 in January and -5 in December. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The increase in district manufacturing activity was driven by both durable and non-durable goods plants, particularly food and transportation equipment producers. Most month-over-month indexes moved into positive territory in February, with many reaching their highest levels in over a year. However, the order backlog and employment indexes continued to fall. Year-over-year factory indexes rebounded strongly, with the composite index jumping from -7 to 5. The future composite index remained solid, inching slightly higher from 14 to 16.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will increase further in February.