by Calculated Risk on 2/11/2020 11:14:00 AM

Tuesday, February 11, 2020

NY Fed Q4 Report: "Household Debt Tops $14 Trillion as Mortgage Originations Reach Highest Volume since 2005"

From the NY Fed: Household Debt Tops $14 Trillion as Mortgage Originations Reach Highest Volume since 2005

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $193 billion (1.4%) to $14.15 trillion in the fourth quarter of 2019. This marks the 22nd consecutive quarter with an increase, and the total is now $1.5 trillion higher, in nominal terms, than the previous peak of $12.68 trillion in the third quarter of 2008. The Report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

...

Transitions into delinquency among credit card borrowers deteriorated in the fourth quarter compared to Q3 2019.

“Mortgage originations, including refinances, increased significantly in the final quarter of 2019, with auto loan originations also remaining at the brisk pace seen throughout the year,” said Wilbert Van Der Klaauw, senior vice president at the New York Fed. “The data also show that transitions into delinquency among credit card borrowers have steadily risen since 2016, notably among younger borrowers.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q4. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Mortgage balances shown on consumer credit reports on December 31 stood at $9.56 trillion, a $120 billion increase from 2019Q3. Balances on home equity lines of credit (HELOC) saw a $6 billion decline, bringing the outstanding balance to $390 billion and continuing the 10 year downward trend. Non-housing balances increased by $79 billion in the fourth quarter, with increases across the board, including $16 billion in auto loans, $46 billion in credit card balances, and $10 billion in student loans. Note that the large increase in credit card balances reflects, in part, a shifting of balances across debt types as portfolios have shifted by among lender.

New extensions of credit were strong in the fourth quarter. Auto loan originations, which include both newly opened loans and leases, at $159 billion, were about flat with the previous quarter’s high level. Mortgage originations, which we measure as appearances of new mortgage balances on consumer credit reports and which include refinances, were at $752 billion, a large increase from the $528 billion in the third quarter and the highest volume in originations since the end of 2005. Aggregate credit limits on credit cards also increased, by $96 billion, continuing a 10-year upward trend.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate was mostly unchanged in Q4. From the NY Fed:

Aggregate delinquency rates were mostly unchanged in the fourth quarter of 2019. As of December 31, 4.7% of outstanding debt was in some stage of delinquency, a 0.1 percentage point decrease from the third quarter due to a decrease in the 30 to 59 days late bucket. Of the $669 billion of debt that is delinquent, $444 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders books but upon which they continue to attempt collection).There is much more in the report.

BLS: Job Openings "Fell" to 6.4 Million in December

by Calculated Risk on 2/11/2020 10:06:00 AM

Notes: In December there were 6.423 million job openings, and, according to the December Employment report, there were 5.753 million unemployed. So, for the twenty-second consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 5 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings fell to 6.4 million (-364,000) on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.9 million and 5.7 million, respectively. Within separations, the quits rate and layoffs and discharges rate were unchanged at 2.3 percent and 1.2 percent respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in December at 3.5 million and the rate was unchanged at 2.3 percent. Quits decreased in retail trade (-111,000) and arts, entertainment, and recreation (-20,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for December, the most recent employment report was for January.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in December to 6.423 million from 6.787 million in November.

The number of job openings (yellow) are down 14% year-over-year.

Quits are up 2.9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a solid level, but have been declining - and are down 14% year-over-year. Quits are still increasing year-over-year.

Fed Chair Powell: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 2/11/2020 08:56:00 AM

From Fed Chair Jerome Powell: Semiannual Monetary Policy Report to the Congress. A few excerpts:

"Some of the uncertainties around trade have diminished recently, but risks to the outlook remain. In particular, we are closely monitoring the emergence of the coronavirus, which could lead to disruptions in China that spill over to the rest of the global economy."This suggests the Fed might cut rates if the economic impact from 2019-nCov is significant.

emphasis added

"The FOMC believes that the current stance of monetary policy will support continued economic growth, a strong labor market, and inflation returning to the Committee's symmetric 2 percent objective. As long as incoming information about the economy remains broadly consistent with this outlook, the current stance of monetary policy will likely remain appropriate. Of course, policy is not on a preset course. If developments emerge that cause a material reassessment of our outlook, we would respond accordingly. …

The current low interest rate environment also means that it would be important for fiscal policy to help support the economy if it weakens. Putting the federal budget on a sustainable path when the economy is strong would help ensure that policymakers have the space to use fiscal policy to assist in stabilizing the economy during a downturn. A more sustainable federal budget could also support the economy's growth over the long term."

Small Business Optimism Increased in January

by Calculated Risk on 2/11/2020 08:47:00 AM

Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): January 2020 Report

The small business Optimism Index started the New Year ... rising 1.6 points to 104.3 in the month of January.

..

New job creation jumped in January, with an average addition of 0.49 workers per firm, the highest level since March 2019, rebounding back into strong territory. Finding qualified workers remains the top issue for 26 percent reporting this as their number one problem, 1 point below August’s record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 104.3 in January.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, February 10, 2020

Tuesday: Job Openings, Fed Chair Powell Testimony, NY Fed Household Debt and Credit

by Calculated Risk on 2/10/2020 07:22:00 PM

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for January.

• At 10:00 AM, Job Openings and Labor Turnover Survey for December from the BLS.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

• At 11:00 AM, NY Fed: Q4 Quarterly Report on Household Debt and Credit

Payroll Employment and Seasonal Factors

by Calculated Risk on 2/10/2020 02:36:00 PM

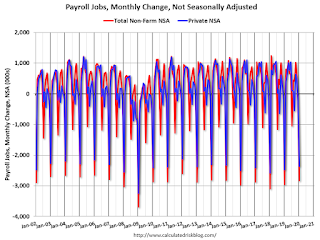

This might be a good time to review the seasonal pattern for employment.

Even in the best of years there are a significant number of jobs lost in the months of January and July. In 1994, when the economy added almost 3.9 million jobs, there were 2.25 million lost in January 1994 (not seasonally adjusted, NSA), and almost 1 million payroll jobs lost in July of that year.

This year, in January 2020, 2.83 million total jobs were lost (NSA). On a seasonally adjusted basis, the BLS reported 225 thousand jobs (SA) added in January.

A clear example of the a seasonal pattern is that teachers leave the workforce every year in July. And then those teachers return to the payrolls in September and early October. Since this happens every year, the BLS applies a seasonal adjustment before reporting the headline number.

For the private sector, there are always a large number of jobs lost in January (retailers and others cutting jobs) and in September (summer hires let go).

This graph shows the seasonal pattern since 2002 for both total nonfarm jobs and private sector only payroll jobs. Notice the large spike down every January.

Also notice the spike down in July (red) that is related to teachers leaving the labor force.

The key point is this is a series that NEEDS a seasonal adjustment. There is significant, but predictable, seasonal variation in employment.

Las Vegas: Record Convention Traffic in 2019, Visitor Traffic Increases

by Calculated Risk on 2/10/2020 11:44:00 AM

Another update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then both Las Vegas visitor and convention traffic has recovered.

Visitor traffic was up 1.0% from 2018, and about 1.0% below the record set in 2016.

Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention traffic was up 2.3% in 2019 compared to 2018, and was slightly above the previous record set in 2017.

There were many housing related conventions during the housing bubble, so it took some time for convention traffic to recover. Now there are marijuana conventions boosting traffic!

From the Las Vegas Convention and Visitors Authority:

While usually a relatively slower convention month, December 2019 bucked the trend as the destination enjoyed particularly strong convention attendance estimated at 356,100, +60.6% over last December; the YoY increase is largely due to the scheduling of Amazon Web Services (65k attendees) and Marijuana Business Conference (35k attendees) in December this year vs. November in 2018, plus the rotation of American Society of Health‐System Pharmacists (20k attendees) into the destination.

Seattle Real Estate in January: Sales up 17.2% YoY, Inventory down 32.9% YoY

by Calculated Risk on 2/10/2020 10:03:00 AM

The Northwest Multiple Listing Service reported Home buyers in Western Washington “hit the ground running” in January

“All indicators point to a vigorous spring market,” suggested broker Dean Rebhuhn when reviewing just-released statistics from Northwest Multiple Listing Service. The report covering 23 counties shows pending sales outgained new listings, record-low inventory that’s down 33% from a year ago, and double-digit price increases.The press release is for the Northwest. In King County, sales were up 5.7% year-over-year, and active inventory was down 42.6% year-over-year.

...

Northwest MLS members tallied 5,074 closed sales during January for a 4.3% increase from the year-ago total of 4,865. Median prices jumped 10.7% from a year ago.

…

At the end of January, the MLS database totaled only 7,791 active listings of single family homes and condos, well-below the year-ago figure of 11,687 (down 33.3%). A check of records dating to 2005 shows the selection is at a new low level, shrinking below the previous low of 7,921 reported for February 2018. In fact, for the 15 year span from 2005-2019 (180 months), inventory has dipped below 10,000 listings during only eight of those months.

Measured by months of supply (the ratio of active listings to closed sales), there was 1.54 months of inventory system-wide at the end of January.

emphasis added

In Seattle, sales were up 17.2% year-over-year, and inventory was down 32.9% year-over-year.. This puts the months-of-supply in Seattle at just 1.38 months.

Sunday, February 09, 2020

Sunday Night Futures

by Calculated Risk on 2/09/2020 07:52:00 PM

Weekend:

• Schedule for Week of February 9, 2020

• Weather Adjusted Employment Gains in January

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 11 and DOW futures are down 90 (fair value).

Oil prices were down over the last week with WTI futures at $49.86 per barrel and Brent at $53.98 barrel. A year ago, WTI was at $53, and Brent was at $61 - so oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.43 per gallon. A year ago prices were at $2.28 per gallon, so gasoline prices are up 15 cents per gallon year-over-year.

Hotels: Occupancy Rate Increases Year-over-year, Concerns about 2019-nCoV

by Calculated Risk on 2/09/2020 12:40:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 1 February

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 26 January through 1 February 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 27 January through 2 February 2019, the industry recorded the following:

• Occupancy: +1.7% to 57.6%

• Average daily rate (ADR): +2.2% to US$127.94

• Revenue per available room (RevPAR): +4.0% to US$73.73

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

2020 is off to a solid start, however, STR notes that the new coronavirus could have a significant negative impact on hotels:

As fears over an outbreak of the new coronavirus centered in Wuhan, China, continue to restrict travel, visits to the U.S. from China could drop by 25% in 2020, according to analysis by Tourism Economics.This analysis was based on historical data from SARS. Based on more recent data, it appears the new coronavirus will have a larger impact than SARS.

Speaking on a webinar Thursday titled “U.S. economy and hotel industry 2020 outlook: Navigating the slowdown,” Adam Sacks, president of Tourism Economics, said a 25% drop in Chinese visitors to the U.S. means a loss of 4 million hotel roomnights and $5.8 billion in visitor spending in 2020, and ultimately 7.8 million roomnights and $10.3 billion in spending through 2024.

Seasonally, the 4-week average of the occupancy rate will increase over the next several months.

Data Source: STR, Courtesy of HotelNewsNow.com