by Calculated Risk on 2/06/2020 09:52:00 AM

Thursday, February 06, 2020

Las Vegas Real Estate in January: Sales up 25% YoY, Inventory down 29% YoY

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local housing market starts 2020 with home prices, sales up from one year ago GLVAR housing statistics for January 2020

The total number of existing local homes, condos and townhomes sold during January was 2,875. Sales were down from December. But compared to the same time last year, January sales were up 25.2% for homes and up 22.8% for condos and townhomes.1) Overall sales were up 24.7% year-over-year to 2,875 in January 2020 from 2,305 in January 2019.

...

By the end of January, GLVAR reported 4,906 single-family homes listed for sale without any sort of offer. That’s down 32.4% from one year ago. For condos and townhomes, the 1,418 properties listed without offers in January represented a 16.7% drop from one year ago.

…

Meanwhile, the number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for 2.7% of all existing local property sales in January. That compares to 2.8% of all sales one year ago, 4.3% two years ago and 11% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 8,957 in January 2019 to 7,093 in January 2020. Note: Total inventory was down 29.4% year-over-year. This is the third consecutive month with a year-over-year decrease in inventory, and that follows 16 consecutive months with a YoY increase in inventory. And months of inventory is still low.

3) Low level of distressed sales.

Weekly Initial Unemployment Claims Decrease to 202,000

by Calculated Risk on 2/06/2020 08:36:00 AM

The DOL reported:

In the week ending February 1, the advance figure for seasonally adjusted initial claims was 202,000, a decrease of 15,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 216,000 to 217,000. The 4-week moving average was 211,750, a decrease of 3,000 from the previous week's revised average. The previous week's average was revised up by 250 from 214,500 to 214,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 211,750.

This was lower than the consensus forecast.

Wednesday, February 05, 2020

Revisiting Demographics and GDP

by Calculated Risk on 2/05/2020 05:04:00 PM

Five years ago I wrote Demographics and GDP: 2% is the new 4%.

I started that post with an excerpt from a WSJ opinion piece:

"The fourth quarter report means that growth for all of 2014 clocked in at 2.4%, which is the best since 2.5% in 2010. It also means another year, an astonishing ninth in a row, in which the economy did not grow by 3%."I noted that it wasn't "astonishing" if you paid attention to demographics!

The WSJ could update that piece today and note that growth for all of 2019 clocked in at 2.3%. And finish with "It also means another year, an astonishing fourteenth in a row, in which the economy did not grow by 3%."

Although it is still not "astonishing".

Off-Topic: Iraq War and Impeachment

by Calculated Risk on 2/05/2020 03:41:00 PM

Several times on this blog I've written about my experiences in the run-up to the Iraq war. I wrote earlier: "I opposed the Iraq war, and was shouted down and called names like "Saddam lover" for questioning the veracity of the information." It wasn't in my interest to speak out in early 2003, but it was the right thing to do. I never regret doing what I believe is right.

Over time, opposing the Iraq war has become a positive for politicians like Barrack Obama and Bernie Sanders. Even Donald Trump has claimed (falsely) that he opposed the Iraq war.

And now, on impeachment: There is no question Mr. Trump abused the power of his office for personal gain, and I support removing him from office.

Since the Senate will not remove him, I will work tirelessly to remove him in the November election. It is the right thing to do.

ISM Non-Manufacturing Index increased to 55.5% in January

by Calculated Risk on 2/05/2020 10:45:00 AM

The January ISM Non-manufacturing index was at 55.5%, up from 54.9% in December. The employment index decreased to 53.1%, from 54.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: January 2020 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 120th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.This suggests faster expansion in January than in December.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 55.5 percent, which is 0.6 percentage point higher than the seasonally adjusted December reading of 54.9 percent. This represents continued growth in the non-manufacturing sector, at a slightly faster rate. The Non-Manufacturing Business Activity Index increased to 60.9 percent, 3.9 percentage points higher than the seasonally adjusted December reading of 57.0 percent, reflecting growth for the 126th consecutive month. The New Orders Index registered 56.2 percent; 0.9 percentage point higher than the seasonally adjusted reading of 55.3 percent in December. The Employment Index decreased 1.7 percentage points in January to 53.1 percent from the seasonally adjusted December reading of 54.8 percent. The Prices Index of 55.5 is 3.8 percentage points lower than the seasonally adjusted December reading of 59.3 percent, indicating that prices increased in January for the 32nd consecutive month. According to the NMI®, 12 non-manufacturing industries reported growth. The non-manufacturing sector exhibited continued growth in January. The respondents remain mostly positive about business conditions and the overall economy. Respondents continue to have difficulty with labor resources.”

emphasis added

Trade Deficit increased to $48.9 Billion in December

by Calculated Risk on 2/05/2020 08:39:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $48.9 billion in December, up $5.2 billion from $43.7 billion in November, revised.

December exports were $209.6 billion, $1.6 billion more than November exports. December imports were $258.5 billion, $6.8 billion more than November imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in December.

Exports are 27% above the pre-recession peak and up 2% compared to December 2018; imports are 11% above the pre-recession peak, and down 3% compared to December 2018.

In general, trade both imports and exports have moved more sideways or down recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in recent months.

Oil imports averaged $51.48 per barrel in December, down from $51.92 in November, and up from $50.26 in December 2018.

The trade deficit with China decreased to $24.8 billion in December, from $36.8 billion in December 2018.

ADP: Private Employment increased 291,000 in January

by Calculated Risk on 2/05/2020 08:18:00 AM

Private sector employment increased by 291,000 jobs from December to January according to the January ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 159,000 private sector jobs added in the ADP report.

...

“The labor market experienced expanded payrolls in January,” said Ahu Yildirmaz, vice president and cohead of the ADP Research Institute. “Goods producers added jobs, particularly in construction and manufacturing, while service providers experienced a large gain, led by leisure and hospitality. Job creation was strong among midsized companies, though small companies enjoyed the strongest performance in the last 18 months.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Mild winter weather provided a significant boost to the January employment gain. The leisure and hospitality and construction industries in particular experienced an outsized increase in jobs. Abstracting from the vagaries of the data underlying job growth is close to 125,000 per month, which is consistent with low and stable unemployment.”

The BLS report will be released Friday, and the consensus is for 161,000 non-farm payroll jobs added in January.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 2/05/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 31, 2020. The previous week’s results included an adjustment for the Martin Luther King Jr. holiday.

... The Refinance Index increased 15 percent from the previous week – its highest level since June 2013 – and was 183 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index increased 8 percent compared with the previous week and was 11 percent higher than the same week one year ago.

...

“The 10-year Treasury yield fell around 20 basis points over the course of last week, driven mainly by growing concerns over a likely slowdown in Chinese economic growth from the spread of the coronavirus. This drove mortgage rates lower, with the 30-year fixed rate decreasing for the fifth time in six weeks to 3.71 percent, its lowest level since October 2016,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinance activity jumped as a result, with an increase in the number of applications and a spike in the average loan amount, as homeowners with jumbo loans reacted more resoundingly to lower rates.”

Added Kan, “Prospective buyers weren’t as responsive to the decline in mortgage rates – likely because of suppressed supply levels. Purchase applications took a step back, but still remained 7.7 percent higher than a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.71 percent from 3.81 percent, with points remaining unchanged at 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 11% year-over-year.

Tuesday, February 04, 2020

Wednesday: Trade Deficit, ADP Employment, ISM non-Mfg

by Calculated Risk on 2/04/2020 06:21:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 159,000 payroll jobs added in January, down from 202,000 added in December.

• At 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $48.0 billion. The U.S. trade deficit was at $43.1 billion in November.

• At 10:00 AM, the ISM non-Manufacturing Index for January.

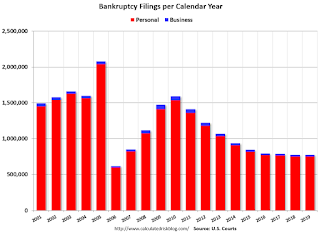

U.S. Courts: Bankruptcy Filings Increased Slightly in 2019

by Calculated Risk on 2/04/2020 04:33:00 PM

From the U.S. Courts: Bankruptcy Filings Increase Slightly

Bankruptcy filings increased slightly for the 12-month period ending Dec. 31, 2019, compared with cases for the year ending Dec. 31, 2018, according to statistics released by the Administrative Office of the U.S. Courts. It was the second straight quarter that bankruptcy filings rose, after annual declines lasting nearly a decade.

Annual bankruptcy filings totaled 774,940, compared with 773,418 cases in December 2018. That is an increase of 0.2 percent.

The level of filings is still 51 percent below the peak reached in 2010, during the aftermath of the Great Recession, 2007-2009. A national wave of bankruptcies that began in 2008 reached a peak in the year ending September 2010, when nearly 1.6 million bankruptcy cases were filed.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 2001.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation since this was more a "Lender Protection Act").

This was the first increase in filings since 2010, but the increase was very small. Bankruptcy filings have been at about the same level for the last four years.