by Calculated Risk on 1/15/2020 08:38:00 AM

Wednesday, January 15, 2020

NY Fed: Manufacturing "Business activity grew to a small degree in New York State"

From the NY Fed: Empire State Manufacturing Survey

Business activity grew to a small degree in New York State, according to firms responding to the January 2020 Empire State Manufacturing Survey. The headline general business conditions index was little changed at 4.8.This was slightly higher than the consensus forecast.

...

The index for number of employees held steady at 9.0, indicating that employment expanded for the fifth consecutive month. The average workweek index came in at 1.3, a sign that the average workweek was essentially unchanged

…

Indexes assessing the six-month outlook suggested that optimism about future conditions remained restrained.

emphasis added

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 1/15/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 30.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 10, 2020. Last week’s results included an adjustment for the New Year’s Day holiday.

... The Refinance Index increased 43 percent from the previous week and was 109 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 16 percent from one week earlier. The unadjusted Purchase Index increased 51 percent compared with the previous week and was 8 percent higher than the same week one year ago.

...

“The mortgage market saw a strong start to 2020. Applications increased across the board, and the 30-year fixed mortgage rate hit its lowest level since September 2019,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “Refinances increased for both conventional and government loans, as lower rates provided a larger incentive for borrowers to act. It remains to be seen if this strong refinancing pace is sustainable, but even with the robust activity the last two weeks, the level is still below what occurred last fall.”

Added Kan, “Homebuyers were active the first week of the year. Purchase activity was 8 percent higher than a year ago, and the purchase index increased to its highest level since October 2009. Low rates and the solid job market continue to encourage prospective buyers to enter the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to the lowest level since September 2019, 3.87 percent, from 3.91 percent, with points decreasing to 0.32 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

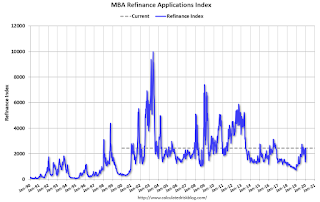

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 8% year-over-year.

Note: Holiday adjustments are difficult, and there are frequently large swings around holidays.

Tuesday, January 14, 2020

Wednesday: PPI, NY Fed Mfg Survey, Beige Book

by Calculated Risk on 1/14/2020 05:49:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 4.0, up from 3.5.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in December, Core PCE below 2%

by Calculated Risk on 1/14/2020 11:30:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in December. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for December here. Motor fuel increased at a 39.6% annualized rate in December.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.7% annualized rate) in December. The CPI less food and energy rose 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.9%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.3%. Core PCE is for November and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized and trimmed-mean CPI was at 1.8% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

Leading Index for Commercial Real Estate Increased in December

by Calculated Risk on 1/14/2020 09:01:00 AM

From Dodge Data Analytics: Dodge Momentum Index Moves Higher in December

The Dodge Momentum Index increased 1.5% in December to 156.2 (2000=100) from the revised November reading of 153.9. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Both components of the Momentum Index rose over the month – the institutional component gained 2.3%, while the commercial component rose 0.9%.

For the full year, the Momentum Index averaged 141.9, a decline of 3.7% from 2018’s average. In 2019, the commercial component was 2.3% lower than the previous year, while the institutional component dropped 5.9%. Last year’s slip in the dollar value of projects entering planning suggests that construction spending for nonresidential buildings could see a setback in the year to come. However, the Momentum Index did end the year on a high note indicating that a decline in 2020 construction is likely to be modest in nature.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 156.2 in December, up from 153.9 in November.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". After declining late 2018, this index moved mostly sideways in the first half of 2019, and increased recently. So this suggests a pickup in Commercial Real Estate in 2020.

BLS: CPI increased 0.2% in December, Core CPI increased 0.1%

by Calculated Risk on 1/14/2020 08:33:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in December on a seasonally adjusted basis after rising 0.3 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.3 percent before seasonal adjustment.Core inflation was slightly lower than expectations in December. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.1 percent in December after increasing 0.2 percent in November.

...

The all items index increased 2.3 percent for the 12 months ending December, the largest 12-month increase since the period ending October 2018. The index for all items less food and energy also rose 2.3 percent over the last 12 months, the same increase as the periods ending October and November.

emphasis added

Monday, January 13, 2020

Tuesday: CPI

by Calculated Risk on 1/13/2020 06:37:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Face More Volatility Later This Week

Mortgage rates didn't do much today, and that's good enough news considering the average lender is closer to the lower end of the rate range since early October. The only counterpoint would be that there isn't much distance between the highs and the lows during that time (not a bad thing, just a bit of context). In other words, rates are "pretty close" to the lowest levels of the past several months, but they're also not too far from the highest levels. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED 3.75%]Tuesday:

emphasis added

• At 6:00 AM, NFIB Small Business Optimism Index for December.

• At 8:30 AM, The Consumer Price Index for December from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.

Chicago Fed: Summary of 2019 Results and 2020 Forecasts

by Calculated Risk on 1/13/2020 02:53:00 PM

It is always interesting to see the consensus outlook. The Chicago Fed held an Economic Outlook Symposium in December with more than 140 economists and analysts, and they just published the 2020 Forecasts. Note that the consensus always misses turning points, but I don't expect a recession in 2020 either.

The consensus is for real GDP to increase 1.7% Q4 over Q4 in 2020 (my view is GDP growth will be a little higher than the consensus).

The consensus is the unemployment rate will be at 3.7% in Q4 2020 (my view is the unemployment rate will be lower).

The consensus is that housing starts will increase slightly to 1.28 million in 2020 (my view is starts will be somewhat higher).

Unfortunately they didn't forecast employment growth - I expect employment growth to slow further in 2020.

Paul Volcker on the "Existential test" facing America

by Calculated Risk on 1/13/2020 11:20:00 AM

Fifteen years ago, in February 2005, I excerpted from a speech by former Fed Chair Paul Volcker at Stanford. That prescient speech about housing and excessive borrowing is available on YouTube. Some of Volcker's comments were: "Altogether, the circumstances seem as dangerous and intractable as I can remember. … Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

I shared Volcker's concerns back then.

Sadly Paul Volcker passed away in December. Just a few months before his death, he wrote an "afterword to the forthcoming paperback edition of his autobiography". Here are a few excerpts (via the Financial Times):

By the late summer of 2018, it was already clear that the US and the world order it had helped establish during my lifetime were facing deep-seated political, economic, and cultural challenges.Once again I share Volcker's concerns. Although most of my writing this year will be on the economy, I will be writing about U.S. politics this year.

Nonetheless, I drew reassurance from my mother’s reminder that the US had endured a brutal civil war, two world wars, a great depression, and still emerged as the leader of the “free world”, a model for democracy, open markets, free trade, and economic growth. That was, for me, a source of both pride and hope. Today, threats facing that model have grown more ominous, and our ability to withstand them feels less certain. …

Today … Nihilistic forces ... seek to discredit the pillars of our democracy: voting rights and fair elections, the rule of law, the free press, the separation of powers, the belief in science, and the concept of truth itself.

Without them, the American example that my mother so cherished will revert to the kind of tyranny that once seemed to be on its way to extinction — though, sadly, it remains ensconced in some less fortunate parts of the world.

...

Seventy-five years ago, Americans rose to the challenge of vanquishing tyranny overseas. We joined with our allies, keenly recognising the need to defend and sustain our hard-won democratic freedoms. Today’s generation faces a different, but equally existential, test. How we respond will determine the future of our own democracy and, ultimately, of the planet itself.

emphasis added

If you aren't sure what is coming, see this post concerning the mid-term election.

Employment: December Diffusion Indexes

by Calculated Risk on 1/13/2020 09:59:00 AM

I haven't posted this in a few months.

The BLS diffusion index for total private employment was at 57.0 in December, down from 65.7 in November.

For manufacturing, the diffusion index was at 44.7, down from 65.8 in November.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Overall both total private and manufacturing job growth were not widespread in December.

Overall both total private and manufacturing job growth were not widespread in December.Both indexes generally trended down in 2019 - except for a spike up in November - indicating job growth was becoming less widespread across industries (especially manufacturing).