by Calculated Risk on 1/08/2020 07:00:00 AM

Wednesday, January 08, 2020

MBA: Mortgage Applications Decreased Over Last Two Weeks in Latest Weekly Survey

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 1.5 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 3, 2020. The results include adjustments to account for the holidays.

... The Refinance Index decreased 8 percent from two weeks ago and was 74 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from two weeks ago. The unadjusted Purchase Index decreased 14 percent compared with two weeks ago and was 2 percent higher than the same week one year ago.

...

“Mortgage rates dropped last week, as investors sought safety in U.S. Treasury securities as a result of the events in the Middle East, with the 30-year fixed mortgage rate declining to its lowest level (3.91 percent) since early October,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Despite lower rates, refinance volume decreased these last two weeks, and we expect that it will slowly trail off in the first half of 2020 as long as mortgage rates remain in this same narrow range. Homeowners would need to see a sharp drop in rates to reinvigorate the refinance wave seen in 2019.”

Added Fratantoni, “The end of the year is the slowest time for home sales, so it is not at all surprising that activity was light. However, after a seasonal adjustment, purchase application volume was up relative to the pre-holiday period and started off 2020 ahead of last year’s pace. We expect that the strong job market will continue to support purchase activity this year, and the uptick in housing construction towards the end of last year should provide more inventory for prospective buyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.91 percent from 3.95 percent, with points increasing to 0.34 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

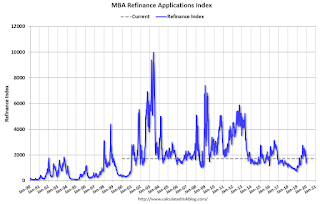

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 2% year-over-year.

Tuesday, January 07, 2020

Wednesday: ADP Employment

by Calculated Risk on 1/07/2020 08:02:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 156,000 payroll jobs added in December, up from 67,000 added in November.

Las Vegas Real Estate in December: Sales up 21% YoY, Inventory down 13% YoY

by Calculated Risk on 1/07/2020 02:27:00 PM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports year ended with higher home prices, dip in annual home sales; GLVAR housing statistics for December 2019

According to GLVAR, the total number of existing local homes, condos, townhomes and other residential properties sold in Southern Nevada during 2019 was 41,269. That’s down from 42,876 total sales in 2018 and from 45,388 in 2017.1) Overall sales were up 20.9% year-over-year to 3,214 in December 2019 from 2,658 in December 2018.

The total number of existing local homes, condos and townhomes sold during December was 3,214. Compared to one year ago, December sales were up 21.8% for homes and up 17.2% for condos and townhomes.

...

By the end of December, GLVAR reported 5,538 single-family homes listed for sale without any sort of offer. That’s down 16.3% from one year ago. For condos and townhomes, the 1,555 properties listed without offers in December represented a 1.8% increase from one year ago.

…

At the same time, the number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for 1.8% of all existing local property sales in December. That compares to 2.9% of all sales one year ago, 3.6% two years ago and 11% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 8,143 in December 2018 to 7,093 in December 2019. Note: Total inventory was down 12.9% year-over-year. This is the second consecutive month with a year-over-year decrease in inventory, and that follows 16 consecutive months with a YoY increase in inventory. And months of inventory is still low.

3) Low level of distressed sales.

CoreLogic: House Prices up 3.7% Year-over-year in November

by Calculated Risk on 1/07/2020 12:30:00 PM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: oreLogic Reports November Home Prices Increased by 3.7% Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.7% from November 2018. On a month-over-month basis, prices increased by 0.5% in November 2019. (October 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)CR Note: The YoY change in the CoreLogic index decreased over the last year, but lately the YoY change has been increasing.

...

“The latest U.S. index shows that the slowdown in home prices we saw in early 2019 ended by late summer,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Growth in the U.S. index quickened in November and posted the largest 12-month gain since February. The decline in mortgage rates, down more than one percentage point for fixed-rate loans from November 2018, has supported a rise in sales activity and home prices.”

emphasis added

Reis: Mall Vacancy Rate Increased in Q4 2019

by Calculated Risk on 1/07/2020 11:19:00 AM

Reis reported that the vacancy rate for regional malls was 9.7% in Q4 2019, up from 9.4% in Q3 2019, and up from 9.0% in Q4 2018. This is above the peak following the great recession of 9.4% in Q3 2011, and up from the cycle low of 7.8% in Q1 2016.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.2% in Q4, up from 10.1% in Q3, and unchanged from 10.2% in Q4 2018. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

Comments from Reis:

The Retail Vacancy Rate rose 0.1% in the fourth quarter as overall occupancy declined by 175,000 square feet due to the closure of 16 Kmart stores in 13 metros; Asking and Effective Rent growth was 0.1% in the quarter – the lowest since 2012.

The Mall Vacancy Rate rose 0.3% to 9.7% in the fourth quarter. Asking and Effective Rent growth was flat.

...

The fourth quarter looks like it could be the start of a declining retail market. For more than two years we had remarked how the retail statistics were defying anecdotal reports of a “retail apocalypse.” But this recent data shows that the scales may have tipped as both the retail and the Mall vacancy rate increased in the quarter. The retail rent growth was a scant 0.1% while Mall rents were flat.

...

Thus, our outlook remains cautious: if vacancies continue to rise, they should not do so at a rapid rate given how slowly the numbers have moved over the last two years. Rents should stay flat for the next few quarters. Indeed, consumers continue to buy more clothing and other goods on-line, but they are also spending more on fitness, entertainment and eating out in establishments that lease retail space. We expect these trends to continue in 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently the regional mall vacancy rates have increased significantly from an already elevated level.

Mall vacancy data courtesy of Reis

ISM Non-Manufacturing Index increased to 55.0% in December

by Calculated Risk on 1/07/2020 10:06:00 AM

The December ISM Non-manufacturing index was at 55.0%, up from 53.9% in November. The employment index decreased to 55.2%, from 55.5%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 119th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.This suggests faster expansion in December than in November.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 55 percent, which is 1.1 percentage points higher than the November reading of 53.9 percent. This represents continued growth in the non-manufacturing sector, at a slightly faster rate. The Non-Manufacturing Business Activity Index rose to 57.2 percent, a 5.6-percentage point increase compared to the November reading of 51.6 percent, reflecting growth for the 125th consecutive month. The New Orders Index registered 54.9 percent, 2.2 percentage points lower than the reading of 57.1 percent in November. The Employment Index decreased 0.3 percentage point in December to 55.2 percent from the November reading of 55.5 percent. The Prices Index reading of 58.5 percent is the same as the November figure, indicating that prices increased in December for the 31st consecutive month. According to the NMI®, 11 non-manufacturing industries reported growth. The non-manufacturing sector had an uptick in growth in December. The respondents are positive about the potential resolution on tariffs. Capacity constraints have eased a bit; however, respondents continue to have difficulty with labor resources."

emphasis added

Trade Deficit decreased to $43.1 Billion in November

by Calculated Risk on 1/07/2020 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $43.1 billion in November, down $3.9 billion from $46.9 billion in October, revised.

November exports were $208.6 billion, $1.4 billion more than October exports. November imports were $251.7 billion, $2.5 billion less than October imports.

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in November.

Exports are 26% above the pre-recession peak and unchanged compared to November 2018; imports are 8% above the pre-recession peak, and down 4% compared to November 2018.

In general, trade both imports and exports have moved more sideways or down recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that the U.S. exported a slight net positive petroleum products in September, October and November.

Oil imports averaged $51.92 per barrel in November, down from $52.00 in October, and down from $57.54 in November 2018.

The trade deficit with China decreased to $26.4 billion in November, from $37.9 billion in November 2018.

Monday, January 06, 2020

Tuesday: Trade Deficit, ISM non-Mfg

by Calculated Risk on 1/06/2020 08:35:00 PM

Tuesday:

• At 8:30 AM ET, Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $43.9 billion. The U.S. trade deficit was at $47.2 billion in October.

• At 10:00 AM, the ISM non-Manufacturing Index for December. The consensus is for an increase to 54.5 from 53.9.

• Early, Reis Q4 2019 Mall Survey of rents and vacancy rates.

Update: The Changing Mix of Light Vehicle Sales

by Calculated Risk on 1/06/2020 05:33:00 PM

SUVs to the left of me, SUVs to the right. It made me look at the changing mix of vehicle sales over time (between passenger cars and light trucks / SUVs).

The first graph below shows the mix of sales since 1976 (Blue is cars, Red is light trucks and SUVs) through December 2019.

Click on graph for larger image.

The mix has changed significantly. Back in 1976, most light vehicles were passenger cars - however car sales have trended down over time.

Note that the big dips in sales are related to economic recessions (early '80s, early '90s, and the Great Recession of 2007 through mid-2009).

Over time the mix has changed toward more and more light trucks and SUVs.

Only when oil prices are high, does the trend slow or reverse.

Recently oil prices have been somewhat steady, and the percent of light trucks and SUVs is up to 73%.

BEA: December Vehicles Sales decreased to 16.7 Million SAAR

by Calculated Risk on 1/06/2020 12:41:00 PM

The BEA released their estimate of December vehicle sales this morning. The BEA estimated light vehicle sales of 16.70 million SAAR in December 2019 (Seasonally Adjusted Annual Rate), down 2.3% from the November sales rate, and down 3.9% from December 2019.

Light vehicle sales in 2019 were 16.97 million, down 1.4% from 17.21 million in 2018.

This graph shows light vehicle sales since 2006 from the BEA (blue) and an estimate for December (red).

Note: The GM strike might have impacted sales in October.

A small decline in sales last year isn't a concern - I think sales will move mostly sideways at near record levels.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 16.70 million SAAR.

Sales have been decreasing slightly, but are still at a high level.

2019 was the 7th best year for vehicle sales following 2016 (best year), 2015, 2000, 2018, 2017 and 2001.