by Calculated Risk on 1/08/2020 07:00:00 AM

Wednesday, January 08, 2020

MBA: Mortgage Applications Decreased Over Last Two Weeks in Latest Weekly Survey

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 1.5 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 3, 2020. The results include adjustments to account for the holidays.

... The Refinance Index decreased 8 percent from two weeks ago and was 74 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from two weeks ago. The unadjusted Purchase Index decreased 14 percent compared with two weeks ago and was 2 percent higher than the same week one year ago.

...

“Mortgage rates dropped last week, as investors sought safety in U.S. Treasury securities as a result of the events in the Middle East, with the 30-year fixed mortgage rate declining to its lowest level (3.91 percent) since early October,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Despite lower rates, refinance volume decreased these last two weeks, and we expect that it will slowly trail off in the first half of 2020 as long as mortgage rates remain in this same narrow range. Homeowners would need to see a sharp drop in rates to reinvigorate the refinance wave seen in 2019.”

Added Fratantoni, “The end of the year is the slowest time for home sales, so it is not at all surprising that activity was light. However, after a seasonal adjustment, purchase application volume was up relative to the pre-holiday period and started off 2020 ahead of last year’s pace. We expect that the strong job market will continue to support purchase activity this year, and the uptick in housing construction towards the end of last year should provide more inventory for prospective buyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.91 percent from 3.95 percent, with points increasing to 0.34 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

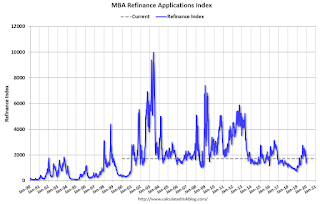

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 2% year-over-year.