by Calculated Risk on 12/15/2019 12:27:00 PM

Sunday, December 15, 2019

Mortgage Equity Withdrawal Positive in Q3

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released last week) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q3 2019, the Net Equity Extraction was $31 billion, or a 0.75% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been mostly positive for the last four years. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward - but nothing like during the housing bubble.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $85 billion in Q3.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Saturday, December 14, 2019

Schedule for Week of December 15, 2019

by Calculated Risk on 12/14/2019 08:11:00 AM

The key economic reports this week are November Housing Starts, Existing Home Sales, the 3rd estimate of Q3 GDP, and November Personal income and outlays.

For manufacturing, November Industrial Production, and the December New York, Philly and Kansas City Fed surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 4.0, up from 2.9.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70. Any number above 50 indicates that more builders view sales conditions as good than poor.

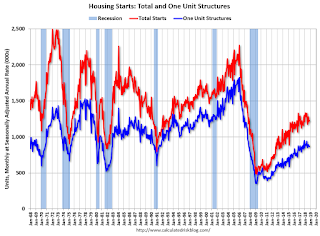

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. This graph shows single and total housing starts since 1968.

The consensus is for 1.344 million SAAR, up from 1.314 million SAAR.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.8% increase in Industrial Production, and for Capacity Utilization to increase to 77.2%.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings were at 7.024 million in September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 224,000 initial claims, down from 252,000 last week.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 8.0, down from 10.4.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, down from 5.46 million.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, down from 5.46 million.The graph shows existing home sales from 1994 through the report last month.

8:30 AM: Gross Domestic Product, 3nd quarter 2018 (Third estimate). The consensus is that real GDP increased 2.1% annualized in Q3, unchanged from the second estimate of GDP.

10:00 AM: Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for December). The consensus is for a reading of 99.2.

10:00 AM: State Employment and Unemployment (Monthly) for November 2018

11:00 AM: the Kansas City Fed manufacturing survey for December.

Friday, December 13, 2019

Hotels: Occupancy Rate Decreased Slightly Year-over-year

by Calculated Risk on 12/13/2019 03:10:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 7 December

The U.S. hotel industry reported mostly positive year-over-year results in the three key performance metrics during the week of 1-7 December 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 2-8 December 2018, the industry recorded the following:

• Occupancy: -0.2% to 60.3%

• Average daily rate (ADR): +1.6% to US$128.66

• Revenue per available room (RevPAR): +1.4% to US$77.56

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will decline into January.

Data Source: STR, Courtesy of HotelNewsNow.com

Q4 GDP Forecasts: 0.7% to 2.0%

by Calculated Risk on 12/13/2019 12:18:00 PM

From Merrill Lynch

The retail sales data nudged 3Q and 4Q GDP tracking a tenth lower to 2.1% and 1.5% qoq saar. [Dec 13 estimate]From Goldman Sachs:

emphasis added

Following today’s data, we lowered our Q4 GDP tracking estimate by one tenth to +1.8% (qoq ar). [Dec 13 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 0.7% for 2019:Q4 and 0.8% for 2020:Q1. [Dec 13 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 2.0 percent on December 13, unchanged from December 6. [Dec 13 estimate]CR Note: These estimates suggest real GDP growth will be between 0.7% and 2.0% annualized in Q4.

Retail Sales increased 0.2% in November

by Calculated Risk on 12/13/2019 09:16:00 AM

On a monthly basis, retail sales increased 0.3 percent from October to November (seasonally adjusted), and sales were up 3.3 percent from November 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for November 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $528.0 billion, an increase of 0.2 percent from the previous month, and 3.3 percent above November 2018. Total sales for the September 2019 through November 2019 period were up 3.5 percent from the same period a year ago. The September 2019 to October 2019 percent change was revised from up 0.3 percent to up 0.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.8% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.8% on a YoY basis.The increase in November was below expectations, and sales in September were revised down, and October were revised up.

Thursday, December 12, 2019

Friday: Retail sales

by Calculated Risk on 12/12/2019 07:35:00 PM

Friday:

• At 8:30 AM ET, Retail sales for November will be released. The consensus is for a 0.4% increase in retail sales.

LA area Port Traffic Down Year-over-year in November

by Calculated Risk on 12/12/2019 04:56:00 PM

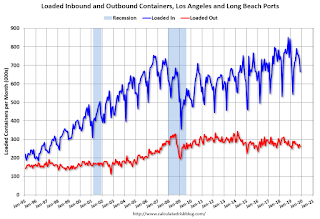

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.9% in November compared to the rolling 12 months ending in October. Outbound traffic was down 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports had been increasing (although down this year), and exports have mostly moved sideways over the last 8 years - and have also moved down recently.

Fed's Flow of Funds: Household Net Worth Increased in Q3

by Calculated Risk on 12/12/2019 02:07:00 PM

The Federal Reserve released the Q3 2019 Flow of Funds report today: Flow of Funds.

The net worth of households and nonprofits rose to $113.8 trillion during the third quarter of 2019. The value of directly and indirectly held corporate equities decreased $0.3 trillion and the value of real estate increased $0.2 trillion.

Household debt increased 3.3 percent at an annual rate in the third quarter of 2019. Consumer credit grew at an annual rate of 5.1 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 2.7 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

Net Worth as a percent of GDP decreased slightly in Q3.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2019, household percent equity (of household real estate) was at 64.0% - down from Q2.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 64.0% equity - and about 2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $85 billion in Q3.

Mortgage debt is still down from the peak during the housing bubble, and, as a percent of GDP is at 48.8% (the lowest since 2001), down from a peak of 73.5% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, decreased slightly in Q3, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

CoreLogic: 2 Million Homes with Negative Equity in Q3 2019

by Calculated Risk on 12/12/2019 10:03:00 AM

From CoreLogic: CoreLogic Reports 78,000 Single-Family Properties Regained Equity in the Third Quarter of 2019

CoreLogic® ... today released the Home Equity Report for the third quarter of 2019. The report shows that U.S. homeowners with mortgages (which account for roughly 64% of all properties) have seen their equity increase by 5.1% year over year, representing a gain of nearly $457 billion since the third quarter of 2018.

...

From the second quarter of 2019 to the third quarter of 2019, the total number of mortgaged homes in negative equity decreased by 4% to 2 million homes or 3.7% of all mortgaged properties. The number of mortgaged properties in negative equity during the third quarter of 2019 fell by 10%, or 220,000 homes, compared to the third quarter of 2018, when 2.2 million homes, or 4.1% of all mortgaged properties, were in negative equity.

...

“Ten years ago, during the depths of the Great Recession, more than 11 million homeowners had negative equity or 25% of mortgaged homes,” said Dr. Frank Nothaft, chief economist for CoreLogic. “After more than eight years of rising home prices and employment growth, underwater owners have been slashed to just 2 million, or less than 4% of mortgaged homes.”

Negative equity, often referred to as being underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in a home’s value, an increase in mortgage debt or both. Negative equity peaked at 26% of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis, which began in the third quarter of 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q3 to Q2 equity distribution by LTV. There are still quite a few properties with LTV over 125%.

On a year-over-year basis, the number of homeowners with negative equity has declined from 2.2 million to 2.0 million.

Weekly Initial Unemployment Claims increased sharply to 252,000

by Calculated Risk on 12/12/2019 08:37:00 AM

The DOL reported:

In the week ending December 7, the advance figure for seasonally adjusted initial claims was 252,000, an increase of 49,000 from the previous week's unrevised level of 203,000. This is the highest level for initial claims since September 30, 2017 when it was 257,000. The 4-week moving average was 224,000, an increase of 6,250 from the previous week's unrevised average of 217,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 224,000.

This was much higher than the consensus forecast.